Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 29, 2023

By David Owen and Paul Smith, Ph.D.

In this research paper, we build on our previous nowcasting work with Purchasing Managers' Index (PMI) data by introducing a new model to provide early estimates of gross domestic product in South Africa. The nowcast model draws on both PMI and non-PMI data sources, taking advantage of the timely release of PMI survey data to provide GDP nowcasts well in advance of official numbers.

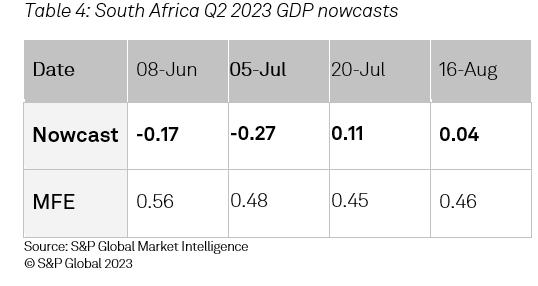

The model was first run in March 2023, and thereafter on a regular basis, to nowcast quarterly GDP growth. The late-cycle nowcast of Q1 GDP on 18th May provided an estimate of 0.41%, compared to an official figure of 0.42% released on 6th June, nearly three weeks later. The latest Q2 GDP nowcast signals marginal growth of just 0.04%.

Furthermore, our nowcast model allows for deeper insight into economic drivers by comparing individual GDP estimates from each variable that we use to derive our overall growth nowcast. Grouping these individual estimates also allows us to compare the impact of broad areas of the economy such as production, services and trade.

Nowcasting is a process of measuring what's happening in the economy today, or in the near past or future, and has become increasingly popular within the economics community during recent years. This is largely due to the long lead times associated with the release of official government statistics, especially GDP.

Keen to understand the performance of the economy closer to real-time, economists, investors and policymakers understandably seek to exploit these time gaps seen in official data publication by utilising an array of more timely and higher frequency data sources.

Official GDP estimates in South Africa have a particularly lengthy lag time in their publication, generally releasing over two months after the reference period. This makes alternative data sources and nowcasting models even more valuable compared to other countries and regions with timelier official data releases.

At the same time, South Africa has a wide array of economic and survey data, more so than any other African country, which makes it an ideal candidate for sourcing indicators that are useful for predicting macroeconomic variables such as GDP.

Previously, we have found that our own Purchasing Managers' Index (PMI) dataset fits the bill as an ideal candidate for use within nowcasting models. The PMI dataset provides monthly information on a variety of business metrics such as output, new orders, employment, prices and inventories, and is typically released just after the end of the survey month.

The South Africa PMI is derived from survey responses from around 300 private sector businesses within the country each month, covering sectors such as manufacturing, services, construction and retail. Results from the survey are released on the third working day of the month following the reference period, making it a far timelier indicator of economic conditions than GDP or other official data.

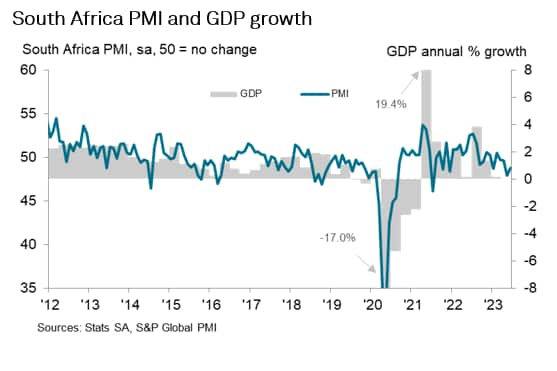

Furthermore, historical PMI data has demonstrated a strong relationship with GDP. Since the survey was first conducted in mid-2011, the headline monthly PMI series holds a 66% correlation with annual GDP growth figures published on a quarterly basis.

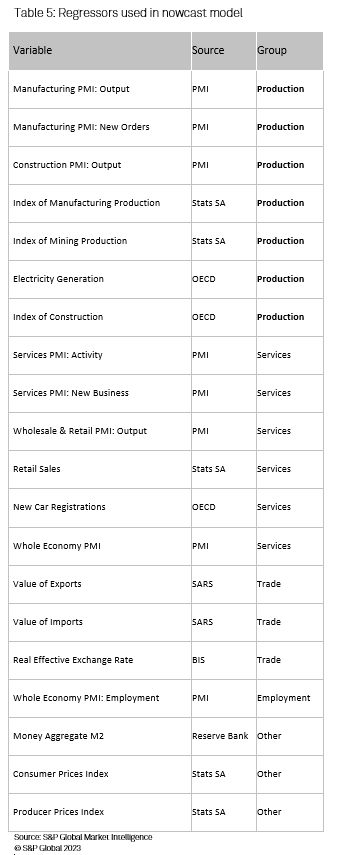

Our South Africa nowcast model has been constructed in a similar way to our previous models on the UK and eurozone, utilising PMI survey data with official metrics covering topics such as manufacturing output, current account, retail sales and electricity generation. All data incorporated in the model are monthly series and have generally been transformed into a 3-month on 3-month growth rate. A list of regressors used in the model is given in table 5.

To straddle the gap between monthly regressors and a quarterly dependent variable (GDP), we employ a Mixed Data Sampling (MIDAS) technique which allows us to add the individual components of the higher-frequency variables as independent regressors. For simplicity, we include the last three data points of each series, but technically a greater number of lagged data points can be included if they are determined to have a significant impact on GDP. For example, if we are measuring Q1 GDP and have manufacturing production data available to February, we include December, January and February data to estimate Q1 GDP growth.

As such, nowcasts typically improve in their accuracy as data availability increases over a quarterly cycle. In early February, we would likely only have January PMI numbers as a direct measure of Q1 economic performance. By March, we would also have February PMI numbers and a handful of official data points such as industrial production and price indices. The nowcast will therefore be likely to be at its most accurate just before the release of GDP figures.

Instead of combining all the variables into one standard ordinary least squares (OLS) regression, we have regressed each variable against GDP to provide a set of independent estimates for quarterly economic growth. From here we use a dynamic weighting scheme to create our 'model of models' estimate of GDP growth, i.e., individual growth estimates are combined based on their historical accuracy in predicting quarterly GDP, and these weights are allowed to change during a typical nowcasting cycle in line with the data news flow [1].

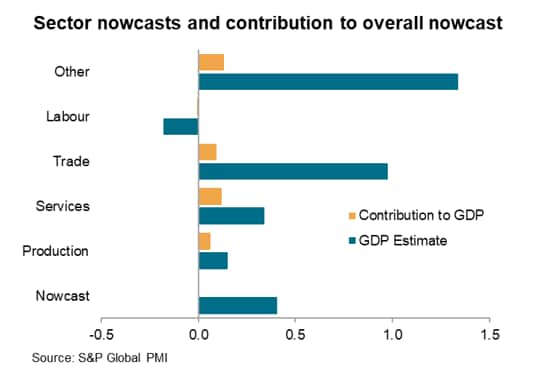

Combining the individual growth estimates into broad sectors also allows for the possibility of gaining deeper insights into which areas of the economy are driving GDP in each quarter (e.g. trade, production).

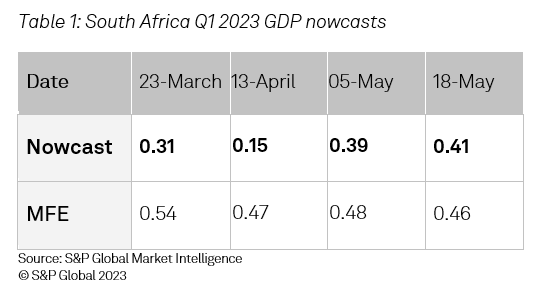

The table below provides a summary of the nowcast performance in Q1 2023. The gauge of the nowcast performance is the Mean Forecast Error (MFE) which shows the nowcast's accuracy in predicting past GDP figures using the data available. As the quarter progresses, the MFE tends to decrease as more data becomes available and better aligns with the period in question.

The actual GDP quarterly growth figure for Q1 2023 released on 6th June was 0.42%, which was only fractionally above the nowcast conducted nearly three weeks prior. Moreover, the nowcast on 5th May was just 0.03% away from the official figure.

One advantage of how the model is set up is that we can delve deeper into the nowcasts given from the individual regressors, as well as grouping these into different sectors and types of sources. This allows us to monitor the impact of production sectors versus services for example, as well as the effect of trade, prices or labour conditions. We can also compare the nowcasts given purely by PMI survey data against non-PMI data.

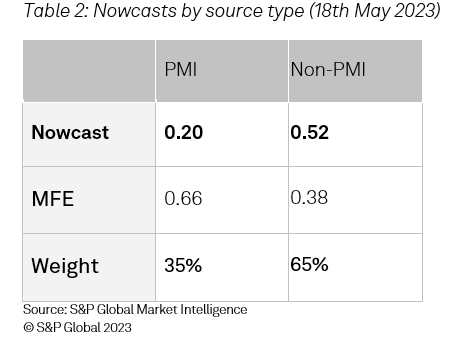

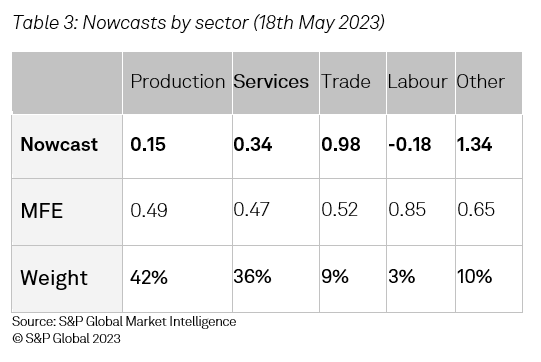

Tables 2 and 3 outline the results given by these categories in our nowcast conducted on the 18th May, including the weighting of each category in the overall nowcast. For instance, PMI data series have a 35% weighting in the nowcast compared to 65% for non-PMI series. Production (including mining, manufacturing and construction) and services data series account for the majority of the model's weighting, while smaller weightings are applied to Trade, Labour and Other (which contains price indices and money supply data).

The findings show that non-PMI data tended to signal a stronger quarterly performance of the South African economy than PMI data. Production sectors appeared to perform weakly in Q1, signalling 0.15% growth, whereas services sectors performed better and indicated 0.34% growth. Other was the best-performing area in Q1, mostly due to a ramp up of M2 money supply, while Trade also signalled underlying strength.

The nowcast has subsequently been ran to estimate GDP growth in the second quarter of 2023. Early nowcasts suggested a modest decline in GDP in line with PMI data indicating a contraction in economic output. More positive signals later in the cycle point to an upturn, albeit only a slight one. The latest nowcast on 16th August indicates approximately 0.04% growth in Q2. According to sector results, strength in manufacturing was greatly offset by weak performances in services and trade.

Official figures are released on 6th September 2023.

In this research paper we introduced a nowcasting model to track economic growth across South Africa, drawing on both PMI and non-PMI data sources to give reliable indicators of growth well in advance of official data releases. The model's use is particularly pertinent at present, as energy supply issues and inflationary pressures meant that the South African economy has garnered significant attention from economists around the world.

The nowcasting model is currently being used as a guide for S&P Global Market Intelligence's estimates of growth in South Africa. Going forward, the model will continue to be used as both an accurate indicator and a tool for garnering deeper insight into economic drivers such as services, trade and prices. The model's continued success could provide impetus for developing nowcasts in other countries where official data releases have a particularly lengthy lag time and would benefit from PMI-led models.

[1] Individual weights are determined by Root Mean Square Forecasting Error (RMSFE).

Please click here for the full report

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

david.owen@spglobal.com

Paul Smith, Economics Director, IHS Markit

Tel: +44 1491 461 038

Email: paul.smith@ihsmarkit.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.