Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Jun, 2021

Highlights

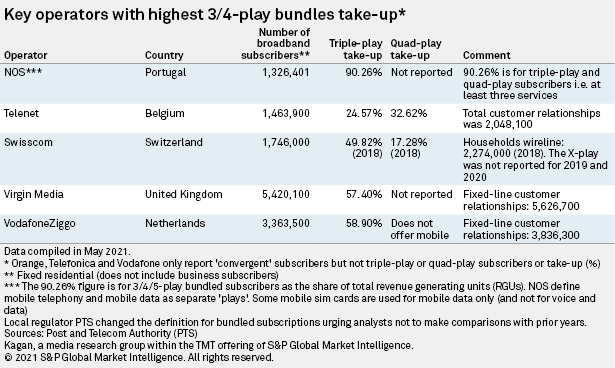

Out of operators in our analysis that report take-up of triple-play and quad-play bundles, NOS in Portugal came out on top in Western Europe, with over 90.0% of unique subscribers opting for a triple-play or a quad-play bundle.

Telenet in Belgium came second with 32.6% opting for a quad-play bundle and 24.6% for a triple-play bundle.

Bundling has been at the heart of operator's strategies to increase average revenue per user and reduce churn for over 20 years. Out of operators in our analysis that report take-up of triple-play and quad-play bundles, NOS in Portugal came out on top in Western Europe, with over 90.0% of unique subscribers opting for a triple-play or a quad-play bundle. Quad-play bundles are typically defined as subscriptions that include TV, fixed broadband, fixed telephony and a mobile contract at a discounted price versus the cost of purchase of the stand-alone versions. Triple-play combines any three of these four services.

Over the last five years, NOS has been changing its stand-alone and multiplay offers while increasing the take-up of bundles every year. As of May 2021, NOS offered 30 key triple-play and quad-play bundles.

Swiss incumbent telco Swisscom AG offers its "InOne Configurator" on the bundles section of its website. Swisscom is one of the most advanced operators in Europe and has been offering a very large selection of bundles for over 10 years. As of May 2021, the operator offered over 80 bundles.

At the end of 2020, Virgin Media had 15.3 million homes passed, 5.4 million of which subscribed to broadband, 3.5 million subscribed to TV and 4.5 million fixed telephony subscribers. Virgin Media is the only cable operator in the U.K. and Ireland, and its advertised top download speeds are higher than those of rival DSL competitors, Comcast's Sky, BT, TalkTalk and Vodafone. The operator heavily promotes its premium quad-play bundles that include BT Sport and Sky packages to increase ARPU and reduce churn. None of the operators in the U.K. or Ireland offer more than one SIM card in a contract bundled with fixed services, which is a popular strategy in other countries in Western Europe, especially in Spain and Portugal.

Blog

BLOG

Location

Segment