Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 09, 2022

By David Owen

New S&P Global PMI™ Comment Trackers provide unique insights into the key macroeconomic trends shaping the global economy. The trackers are derived from qualitative evidence provided by PMI survey panellists around the world, including the perceived impact of changing supply chain conditions, price and demand drivers and recession risk.

Alongside the standard response data to S&P Global's monthly Purchasing Managers' Index™ (PMI) business surveys, companies are invited to provide additional qualitative information on the reasons as to why these variables (such as output, new orders and employment) have changed from the previous month. A panel comments tool tracks the frequency of words or phrases mentioned in these qualitative replies.

Every index is calculated as a multiple of its long run average, which is set equal to a value of 1.0. A reading of 5.0, for example, therefore suggest that the issue being tracked is being mentioned by survey participants five times more than average.

One important use of the Global PMI Comment Trackers has been the gaining of additional insights into supply chain conditions, which have been heavily affected over the last two years by the COVID-19 pandemic.

Repeated lockdowns and stoppages of factory lines led to unprecedented shortages of raw materials and components, while staff absences and lower participation rates have left many countries with limited labour availability, both of which have often constrained production at manufacturers.

Chart 1 looks at our new Input Shortages trackers, which calculate the frequency of comments from global manufacturing survey panellists that mention a reduction in output or a rise in backlogs due to shortage of inputs, including materials, staff, utilities and more. The 'All Inputs' index peaked at approximately 4.51 in November 2021, signalling that global shortages were roughly 4.5 times the normal amount at their peak following repeated global lockdowns. In August 2022, the index fell to 2.22, suggesting that, whilst overall shortages were still well above normal, they had roughly halved since their peak.

Similar findings were seen for both material and staff shortages. The Material Shortages index peaked at 5.48 in October last year, before dropping to a 15-month low of 2.96 in July, with an intervening spike due to the onset of the Russia-Ukraine war. Although rising to 3.44 in August, the index suggests that relaxed COVID-19 restrictions and improved factory output helped to loosen a tight commodities market.

Staff shortages have also eased from their peak in January 2022, when rapid COVID-19 infections due to the Omicron strain led to widespread absences and re-tightened government stringency measures. Since hitting 4.08 at the start of the year, the index dropped to a 15-month low of 1.85 in July, and 2.04 in August, signalling that labour availability had improved but remained stretched compared to historical trends.

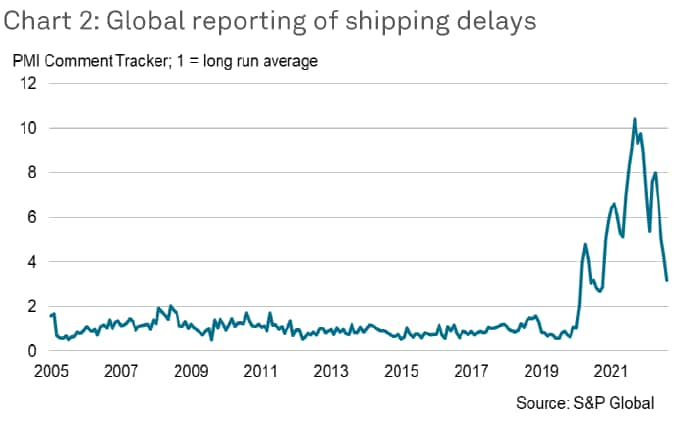

The Global PMI Comment Tracker dataset can also help to understand the extent to which manufacturers are facing delays on shipping as a lingering result of the pandemic. While PMI manufacturing surveys look at suppliers' delivery times in general, these new data dig deeper into the contributing factors and give a leading indication about the state of shipment congestion.

Looking at chart 2, the Shipping Delays index suggests that global freight was most heavily congested in the second half of 2021, with examples seen in Europe and the west coast of the USA as backlogs of cargo ships at large ports reached all-time highs. Since then, with the gradual roll-back of COVID-19 measures (barring China's continued zero-COVID policy), the index has fallen sharply, reaching a near two-year low of 3.18 in August. While still marked, the indicated degree of shipping congestion has improved dramatically this year to offer encouraging signs for companies that supply chains are improving, which is also helping to stem material and freight price inflation.

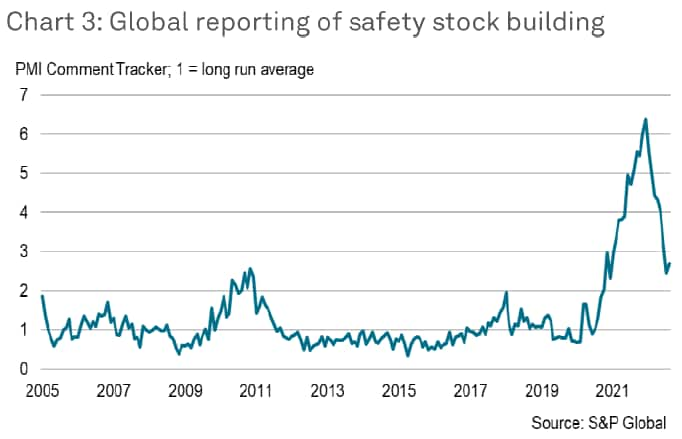

As well as tracking supply chain conditions, the PMI Comment Tracker dataset can also be used to discover how firms' inventory strategies have changed as a result of these conditions.

One element recorded throughout the pandemic was a gradual build-up of input purchasing in order to acquire safety stocks in case of shortages, shutdowns and supplier constraints. Chart 3 shows how manufacturers' survey responses increasingly mentioned 'safety stock building' in 2021 - the index rose steeply throughout the year to reach a peak of 6.37 last December. In 2022, the reverse has been true, with the index dropping to 2.68 in August, as improving material supply and reduced shipping congestion have alleviated firms' concerns about future goods availability.

That said, companies also highlighted that concerns about weak demand in recent months have led to destocking, a factor that could also be influencing the rapid decrease of safety stock building. Chart 4 shows that inventories of both pre-production and finished goods at manufacturers have been increasingly depleted due to demand softening - mentions on the stocks of purchased goods survey question reached the highest since April 2009 in July at 2.56 times the long-run average.

The PMI Comment Trackers analysed in this note form only a small part of the overall dataset, which includes additional indices tracking the impact of demand shortfalls on global companies, as well as further indicators on supply shortages, inventories, inflation and capacity expansion. As well as detailing the impact of the pandemic over the last two years, these indicators will provide unique insights into the emerging trends of inflation and recession in 2022 and beyond.

This dataset is released later in September and will be available only via subscription. Please contact economics@spglobal.com for further information.

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

david.owen@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.