Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 03, 2022

Calendar Week of 1/03/2022

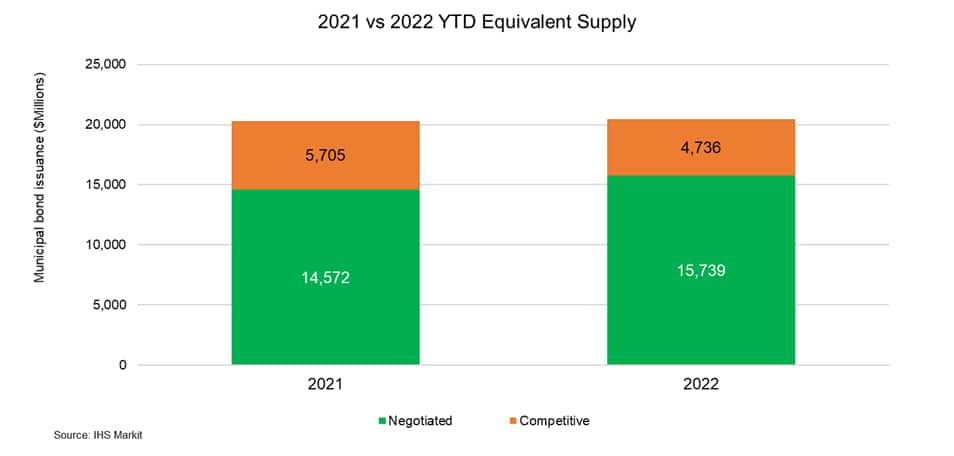

Munis showcased exceptional strength throughout the course of 2021, settling -2% YoY with $487.5Bn (excluding corporate cusips) of new issue volume spanning across 12,825 deals, marking the second largest primary issuance recorded in the past decade after state and local governments valiantly battled ongoing pandemic complications. Market appetite for new issue paper remained firm throughout the course of the past year, with supply generally lacking robust demand witnessed from both institutional and retail investors who sought to deploy capital across a myriad of state and local credits. Primary issuance over the course of last month of 2021 was noteworthy, with $40Bn+ of new issue deals priced, outpacing November 2020 levels by +83% as state and local governments took advantage of surging investor demand for tax-exempt yields. Performance over the final months of 2021 was noteworthy, with the majority of weekly volume registering 25%+ gains as compared to levels registered during 2020, with December closing out +26% greater than 2020 activity. The market effortlessly digested numerous large scale deals over the past year with The Golden State Tobacco Securitization Corp marking the largest negotiated bond deal, supplying $2.8Bn of taxable interest bonds paired with the Commonwealth of Pennsylvania representing the largest competitive deal after auctioning $1Bn of unlimited tax general obligation bonds. Nominal movement in municipal benchmarks played a contributing factor in last year's successful volume activity, after issuers persistently tapped into the primary arena to reduce borrowing expenditures and take advantage of stable and historically low benchmark rates. As market participants adjusted to another year of remote work operations and pandemic-induced economic setbacks, financing activity noted within the primary arena was impressive, highlighting issuers core reliance to the municipal capital markets to fund operations and maintain adequate financial health despite the plethora of federal stimulus available. Market players also navigated complex and rapidly evolving political developments throughout 2021 with ephemeral government-led funding dedicated to municipalities across the year coupled with monetary policy fluctuations as a result of rapidly rising inflation figures and lackluster employment participation nationwide.

Looking ahead, ongoing bi-partisan discussions surrounding the Build Back Better package remains a focus across the market as concerted government-driven financing activities evolve to foster greater economic engagement, with the market forecasting a successful approval of the social and climate oriented package this month. Following the most recent FOMC meeting, participants are preparing for several rate hikes throughout the year, with the market forecasting an uptick in primary financing activity in the first quarter as issuers eagerly finance debt amidst opportunistic interest rates currently available. Primary volume projections for 2022 are expected to remain in line with the market consensus over recent years as participants weigh increased government participation coupled with unpredictable pandemic-related economic impacts in addition to evolving federal monetary policy decisions positioned to effectively curb historic levels of inflation. Despite the cross-currents throughout the macro markets and beyond, municipal bonds continue to remain a superior safe haven investment, supported by surging investor demand and linear new issue volume growth demonstrated across the past decade. This week's primary calendar is slated to remain subdued as participants return from the Holidays with $1.6Bn offered across 75 new issues with The Department of Airports (Los Angeles International Airport) leading this week's negotiated calendar selling $503mm of subordinate revenue bonds spanning 05/2026-05/2049, pricing on Thursday and senior managed by Ramirez. This week's competitive calendar will span across 40 new issues for a total of $.39Bn, led by the Town of Greenwich, CT auctioning $75mm of general obligation bond anticipation notes, selling on Wednesday 01/05.

Posted 03 January 2022 by Matthew Gerstenfeld, Municipal Bond Business Development Specialist, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.