Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 27, 2021

Calendar Week of 09/27/2021

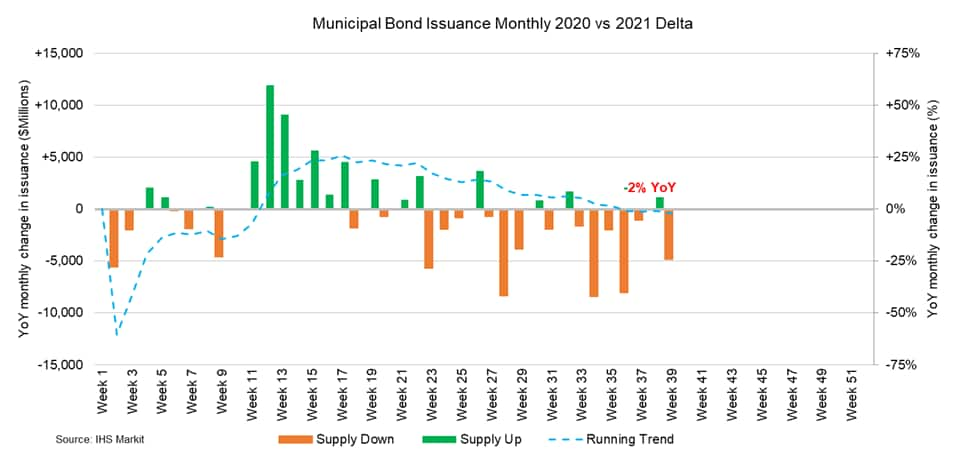

New issue volume activity is slated to hit higher levels despite last week’s market sell off triggered by Evergrande debt concerns, pushing US treasuries higher across the board with muni benchmarks following suit widening 3-5bps on the week, with the greatest cuts noted on the long end of the curve. As the market navigates the beginning of fall, participants remain highly focused on macro government policy, which has been a driving force behind new issue activity across the muni arena. After months of deliberation, the House is preparing to finalize a vote on a national infrastructure package, followed by a hefty multi-trillion social spending package, drawing further concerns over the magnitude of perpetual government spending. A final vote projected this week marks a highly welcomed inflection point in the muni market, as a portion of funding derived from the package would be appropriated towards state and local governments across the nation, funding a myriad of projects spanning roadways and bridges to electric vehicle charging stations. As participants prepare for a final vote on an infrastructure package, attention towards the national debt ceiling continues to mount as bipartisan conversations remain polarized given the scope of peaking national debt levels in conjunction with ongoing economic concerns stemming from the nation-wide valiant battle to return to pre-pandemic operating levels. As the market dials-in on economic indicators, recent volatility across interest rates continue to highlight opportunity for issuers seeking to lower debt service expenses, as new money issuance floats to the surface given larger scale issuers stepping up to the plate and pricing muni debt in an effort to settle financing activities prior to year-end. Given the noteworthy presence of double-digit weekly calendar supply in recent weeks institutional accounts continue to take advantage of higher volumes, strategically placing cash to work across various credits as demand for new issue paper runs strong, attributed to greater macro volatility witnessed in global markets. Given the current trajectory of market activity participants will continue to monitor rapidly evolving government policy updates as state and local issuers maintain stability across financing operations amidst heightened uncertainty behind national economic conditions.

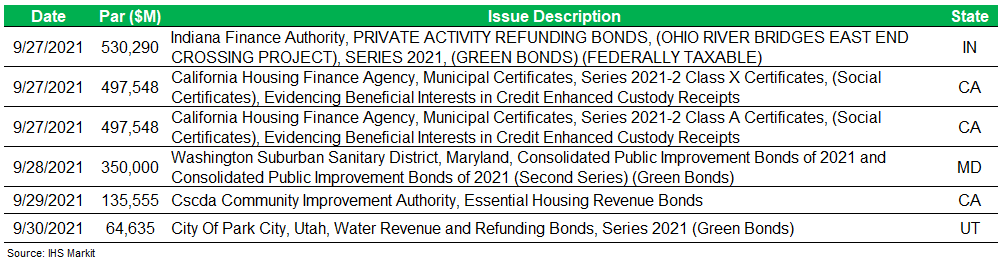

Primary issuance will remain on solid ground, after last week’s calendar supplied $10.8Bn, with the majority of deal flow supporting infrastructure projects, including the MTA of New York as well as the Orange County Transportation Authority of California. The Triborough Bridge and Tunnel Authority (-/AA+/AA+/AA+) led last week’s calendar supplying $854mm of bridge and tunnel bonds with the majority of par size offered in the 30-year tranche. Demand for the offering was substantial, with bumps of 1-7bps noted across the various series and the greatest bump registered in the 2033 maturity, falling +53bps off the interpolated MAC curve. The New Jersey Health Care Facilities Financing Authority also came to market, pricing $752mm of revenue bonds with maturities spanning 07/2022-07/2051 with the majority of investor interest noted in the front end of the scale, with bumps of 3-7bps reflected within a 20-year maturity duration. This week’s calendar is anticipated to reach higher ground, with $12.8Bn spanning 210 new issues with a large presence of upcoming ESG offerings, representing a total aggregate of $2Bn across various states and credits. The State of Hawaii (Aa2/AA+/AA/-) will lead this week’s negotiated calendar, supplying $1.9Bn of taxable general obligation bonds across seven series. The Golden State Tobacco Securitization Corporation will also tap into the primary arena in effort to finance $1.8Bn of tobacco settlement bonds spanning 06/2022-06/2046 with the majority of par size housed in the intermediate range of the curve, senior managed by Jefferies. This week’s competitive calendar will span 99 new issues for a total of $2.4Bn led by the Washington Suburban Sanitary District auctioning $350mm of public improvement bonds with a green bond designation status.

Negotiated ESG Offerings Week of 09/27/2021

Posted 27 September 2021 by Matthew Gerstenfeld, Municipal Bond Business Development Specialist, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.