Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 16, 2022

Effective performance attribution provides critical insights that can lead to greater comprehension of the top-down and bottom-up drivers of investment returns. However, the complexities and building block allocation approach of multi-asset class portfolios can make garnering useful information a challenge, particularly at scale.

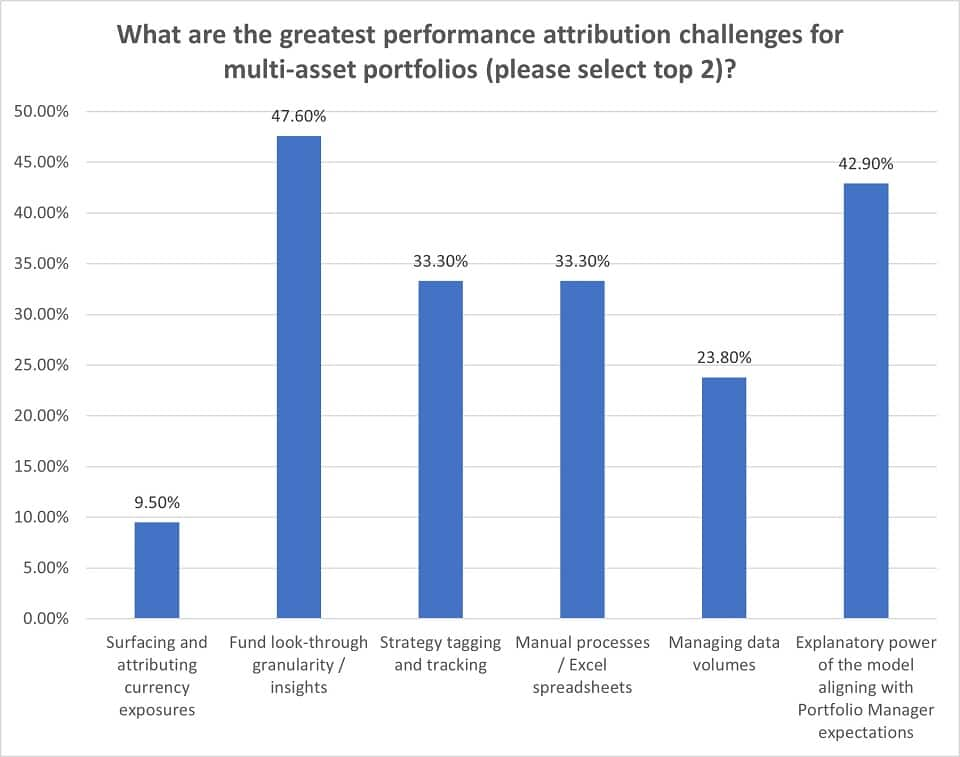

A recent survey of investment managers illustrates the long list of issues. Nearly half of respondents said they struggle to source the level of fund look-through granularity and insights they require for performance attribution. A large proportion (42.9%) also flagged challenges in their models' ability to provide adequate explanations for performance attribution across the respective return generation levers.

The poll results, gathered during a webinar we hosted with our partners CloudAttribution, echo what we hear from our industry contacts every day.

Multi-asset portfolio managers need a pulse on the aggregate fund level picture, but they also want the capability to drill down at a very granular level — beyond NAV and basic return data — to gain a better understanding of performance contributors, both absolute and relative to benchmark. Importantly, performance attribution involves much more than assessing returns by asset type. While capturing the impact of top-down allocation decisions is one key dimension, firms and their institutional clients also need to discern how much of the return is attributable to their respective fund managers' skill in security selection.

Few solutions can adequately perform attributions across the entire mix of securities that multi-asset portfolios hold, leaving portfolio managers to lean on labor-intensive and error-prone manual processes.

As Peter Simmons, co-founder of CloudAttribution, notes, "Most systems tend to focus on either equities or fixed income, not both. As a result, multi-asset portfolios get stuck in between, and managers must either shoehorn everything into an equity-focused system or manually process it in spreadsheets." The rigidity of such systems also creates problems when reconciling attribution across portfolio operations.

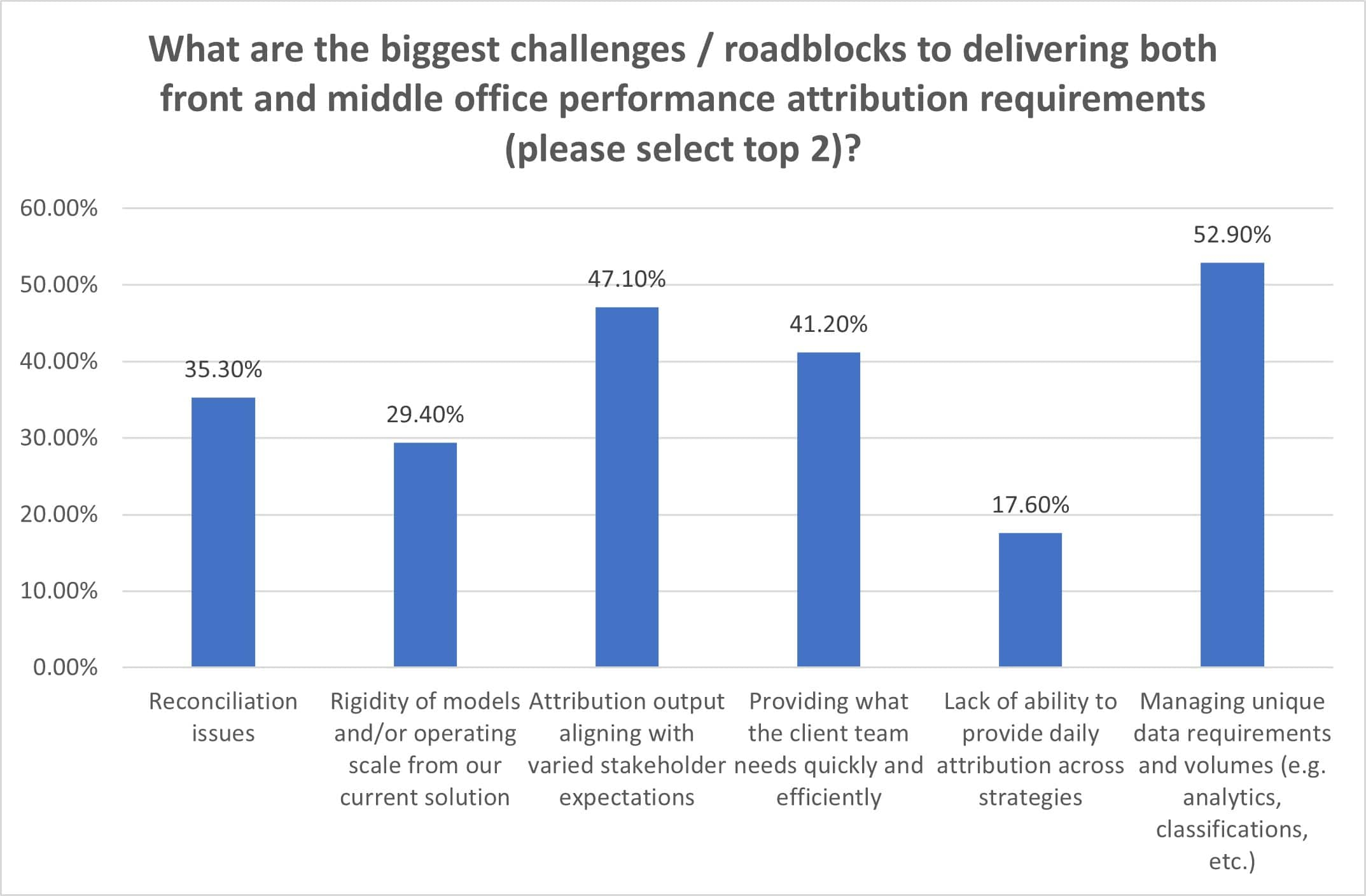

A separate poll question from the webinar showed that multi-asset managers struggle with several roadblocks when delivering both front- and middle-office performance attribution. The challenges include: managing unique data requirements and volumes (52.9%), aligning attribution output with varied stakeholder expectations (47.1%), and providing what the client team needs quickly and efficiently (41.2%).

We regularly hear from performance teams and front-office stakeholders about the issues they face trying to bring these two segments of the organization together. Much of the challenge revolves around matching up and reconciling their data and calculations, and then having a flexible framework that presents the output in a way that cohesively aligns with the investment process. These are the sorts of issues that are time-consuming and create barriers to the broader use of any single platform to suit the needs of the enterprise.

A unique solution for multi-asset portfolios

Through our partnership with CloudAttribution, we have created a solution to address these and many other challenges that fixed income and multi-asset portfolio managers face.

By integrating CloudAttribution's best-in-class performance attribution capabilities and our thinkFolio investment management platform, we are enabling multi-asset managers to simplify the required data inputs while maintaining the same focus on quality, consistency, and the necessary explanatory outputs. The result is a flexible, insightful suite of models that empower portfolio managers and performance teams to understand their results in greater depth and detail.

The integrated thinkFolio/CloudAttribution solution provides managers with a robust attribution modelling and reporting suite that can capture and reflect their management style and which is based on depth offered through consistent, granular look-through information. It also removes the alignment and operational hurdles that regularly persist between the front-office and middle-office functions so that they can quickly and confidently provide the client teams with what they need for downstream communication and reporting. In this way, we are helping portfolio managers and performance teams achieve both the breadth and depth of attribution they require.

Learn more about the partnership between thinkFolio and CloudAttribution

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.