Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 09, 2021

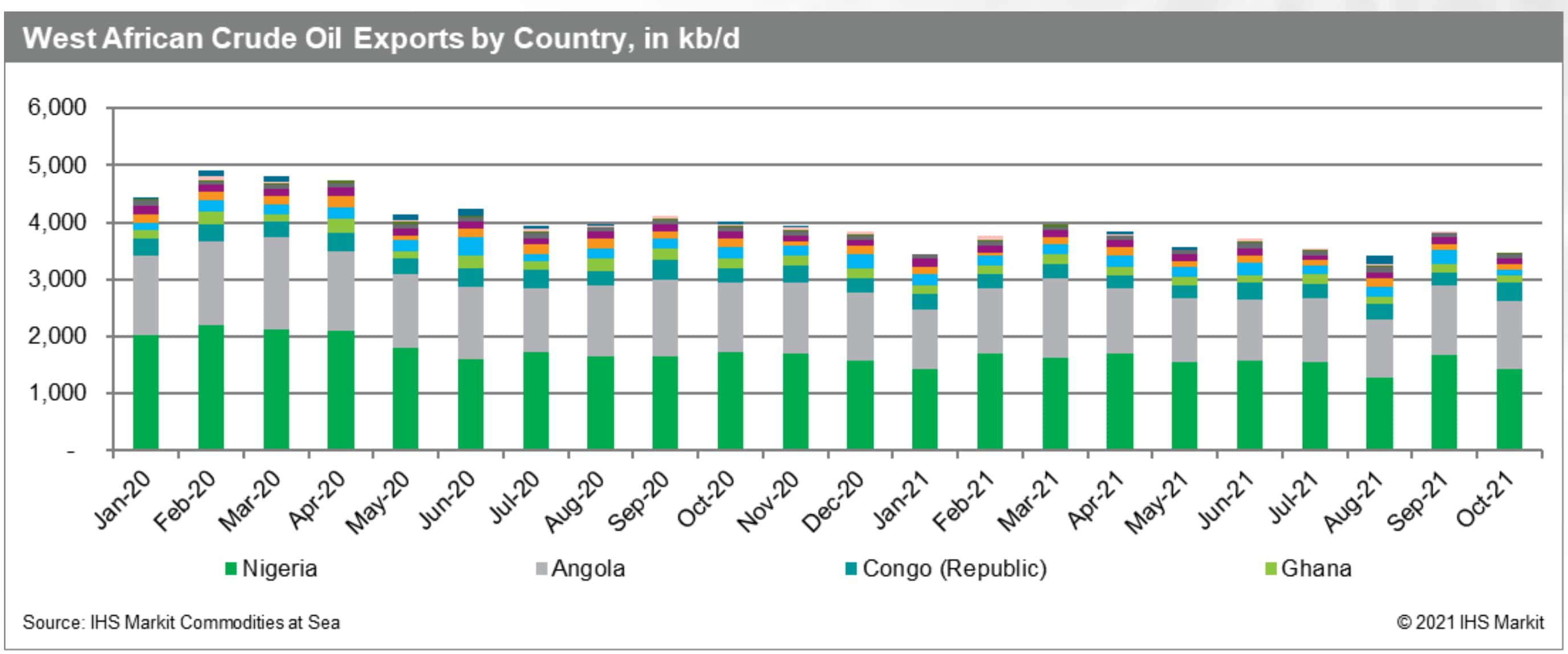

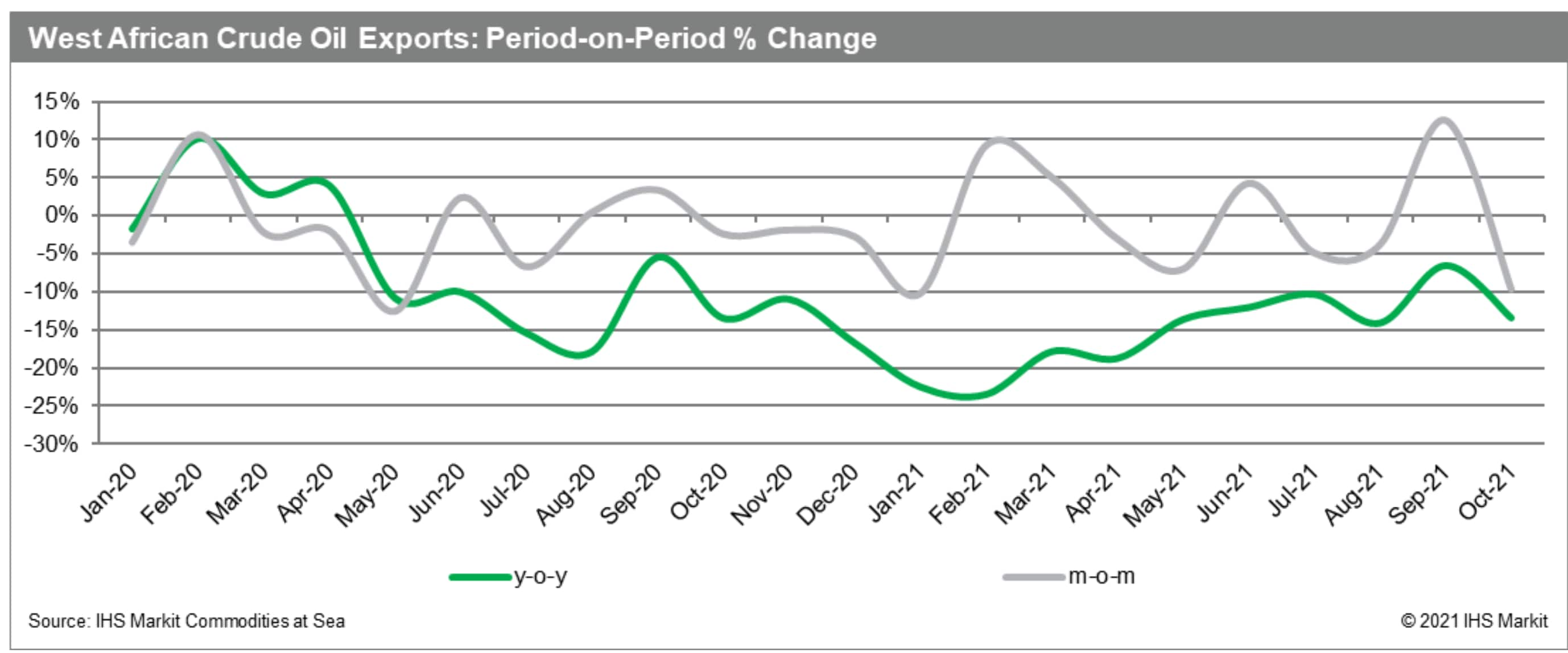

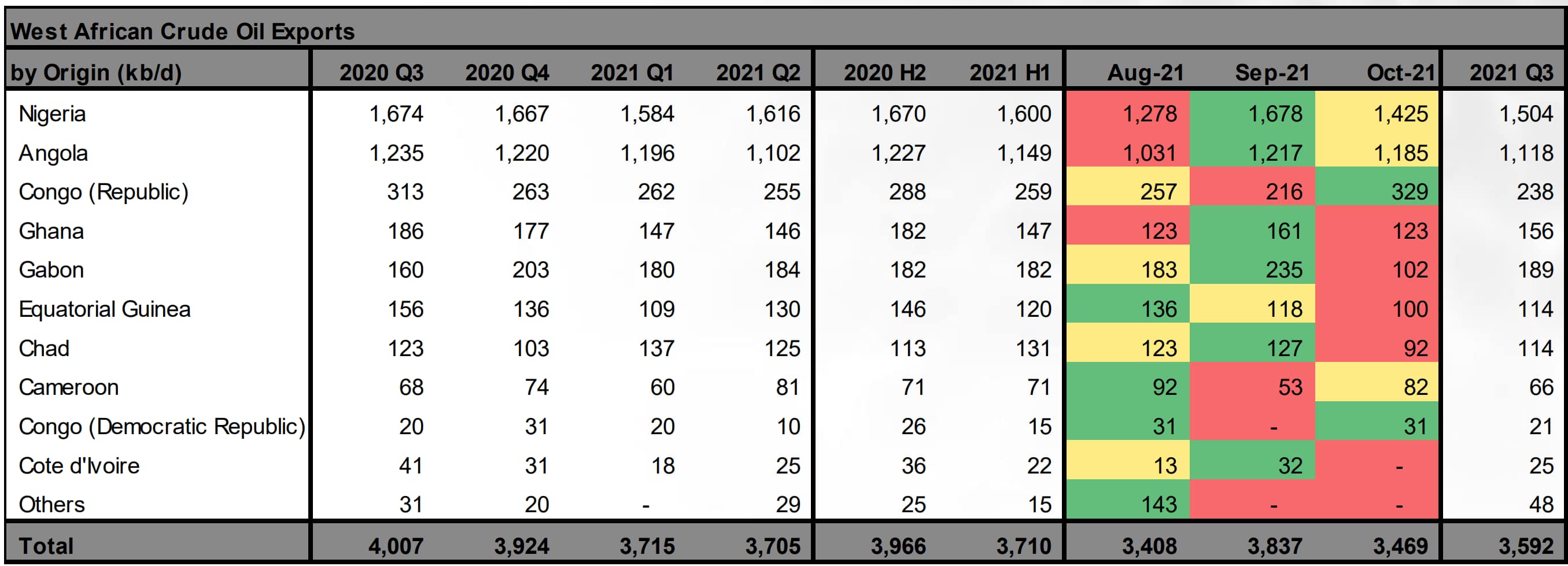

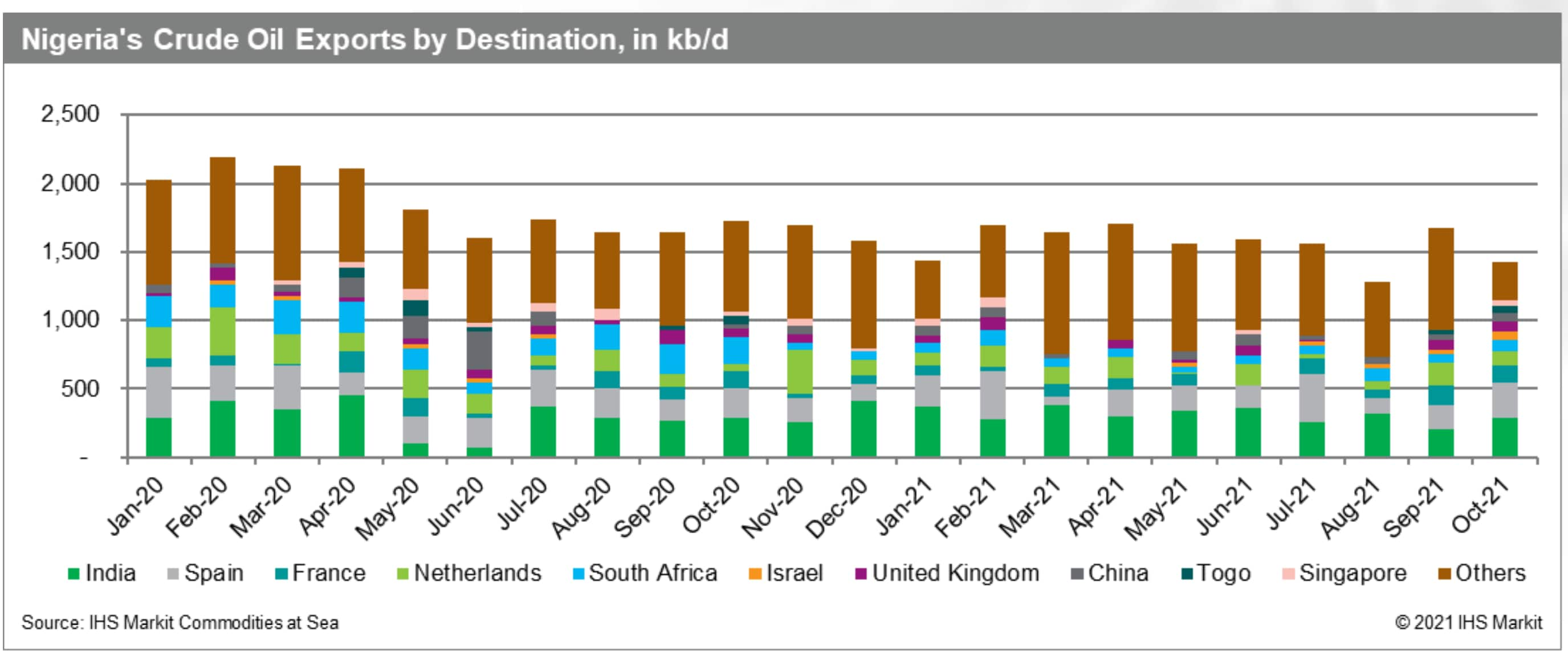

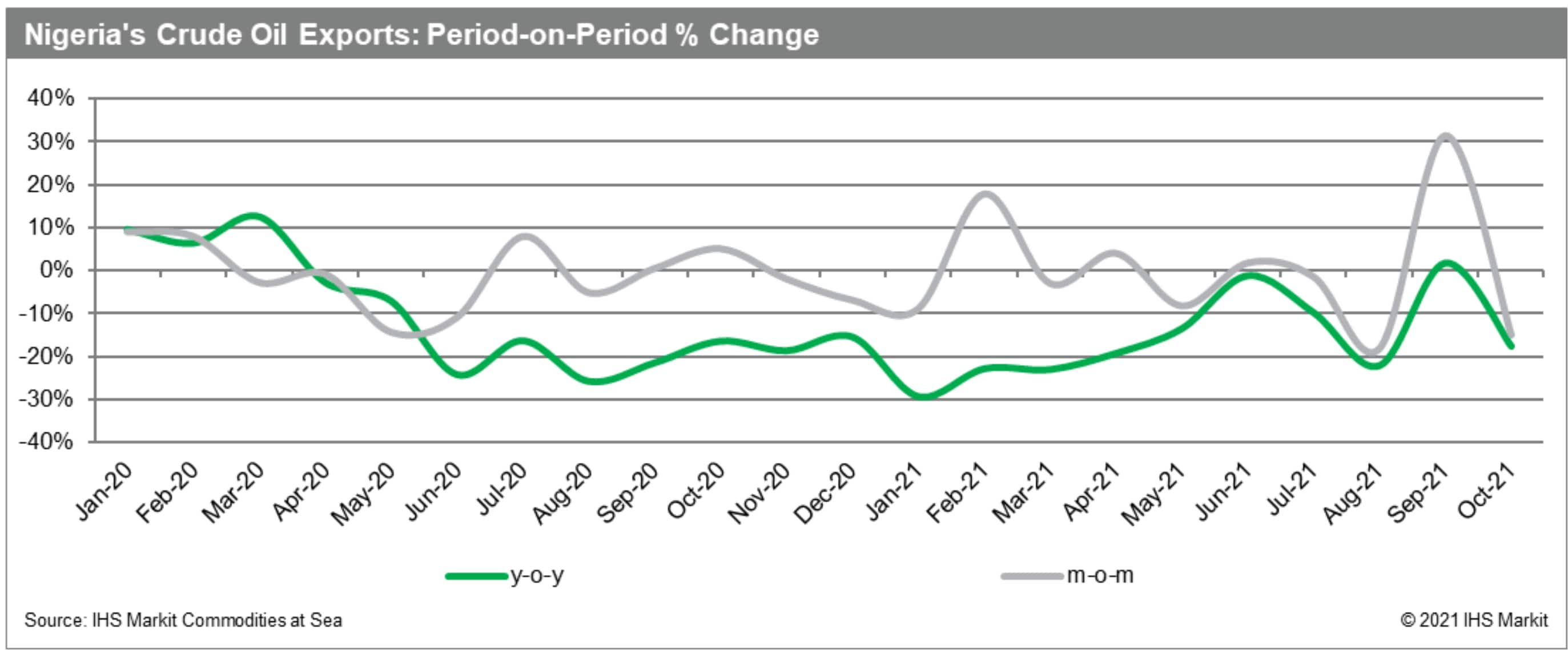

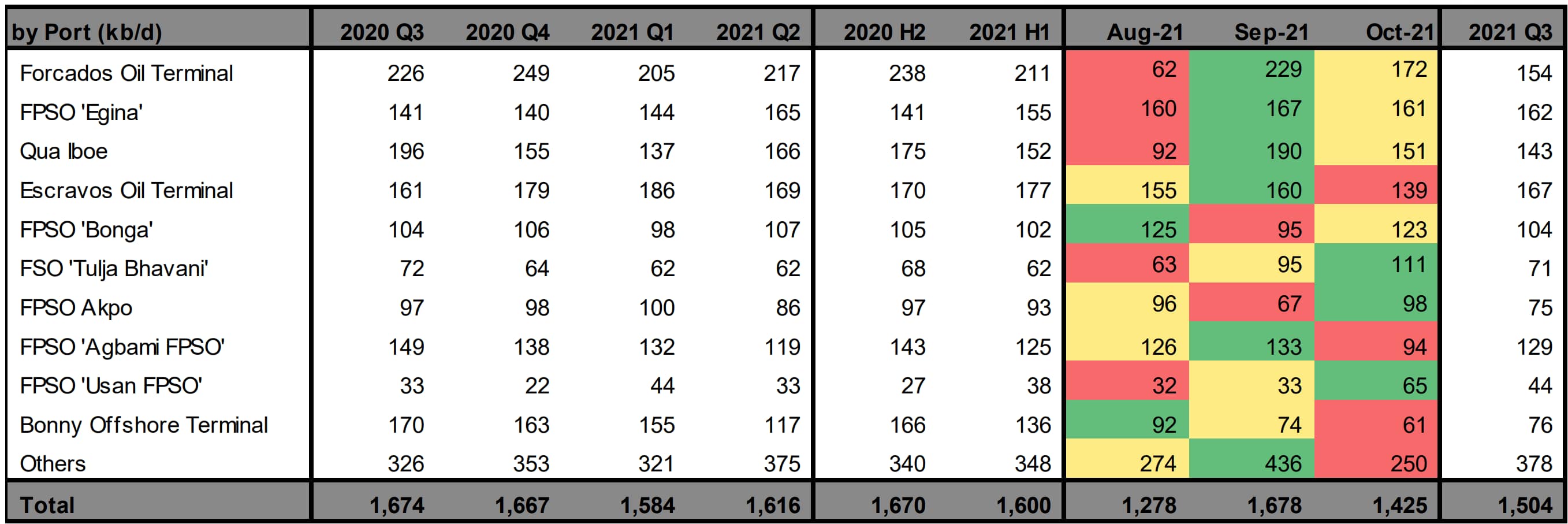

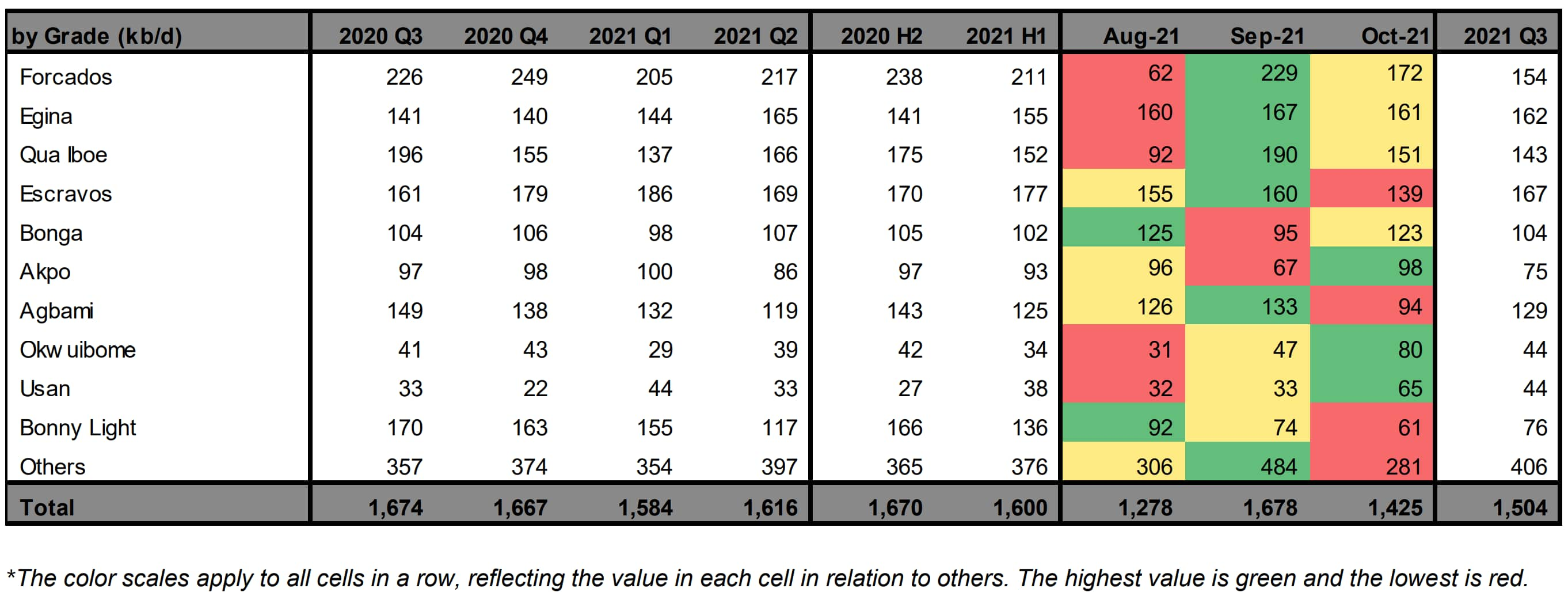

West Africa's total seaborne crude oil exports fell below 3.5 million b/d in October, down from 3.84 million b/d in September. The continent's major producer, Nigeria, has struggled to increase its crude oil output and exports, primarily due to local disruptions after attacks against oil infrastructure.

The country witnessed the sharpest crude oil production decline among all OPEC members in October 2021. The fall observed in Nigeria's crude oil output, estimated to have surpassed 70,000 b/d, followed a force majeure declared by Shell, which halted loadings of Bonny Light crude after a pipeline shut down.

Nigeria's unstable production could become one of the biggest obstacles for OPEC+ efforts to increase supply by the end of this year. The country's production capacity stands above 2.2 million b/d of crude and condensate, with a plan to reach 1.75 million b/d by early 2022, from an average of around 1.62 million b/d in H1 2021.

Nigeria is still far from recovering to its full potential. The country, which produces sweet crude oil, mostly with light to medium grades, is expected to face difficulties in maintaining its production levels in the coming years given the mature profile of several fields. Grades such as Bonga, Egina, and Qua Iboe will face the most pressure as the government struggles to attract new investment in the upstream.

New field developments are expected to only add up to 35,000 b/d in 2022, while fields currently in the ramp-up phase could add another 70,000 b/d.

Nigeria's government introduced the Petroleum Industry Act (PIA), in August, targeting to drive an increase of its crude oil output close to 4 million b/d.

However, a potential increase in the country's crude oil production in coming years should not necessarily translate into more exports, as Nigeria targets to refine more locally to supply increasing domestic demand for refined products. The 650,000 b/d Dangote refinery is on track to be operational from early 2022, despite some delays sufferedd due to the coronavirus pandemic. This will be Africa's largest refinery.

State-owned Nigerian National Petroleum Corp (NNPC) plans to supply 300,000 b/d of crude to the refinery. The producer has been in talks to acquire a 20% stake in the project, located near Lagos. Nigeria has been importing more than 1 million mt of gasoline a month, as all its refineries, with a combined capacity of 445,000 b/d, remain shut down.

The Dangote refinery's slate will include at least three Nigerian crude grades - Escravos, Bonny Light and Forcados.

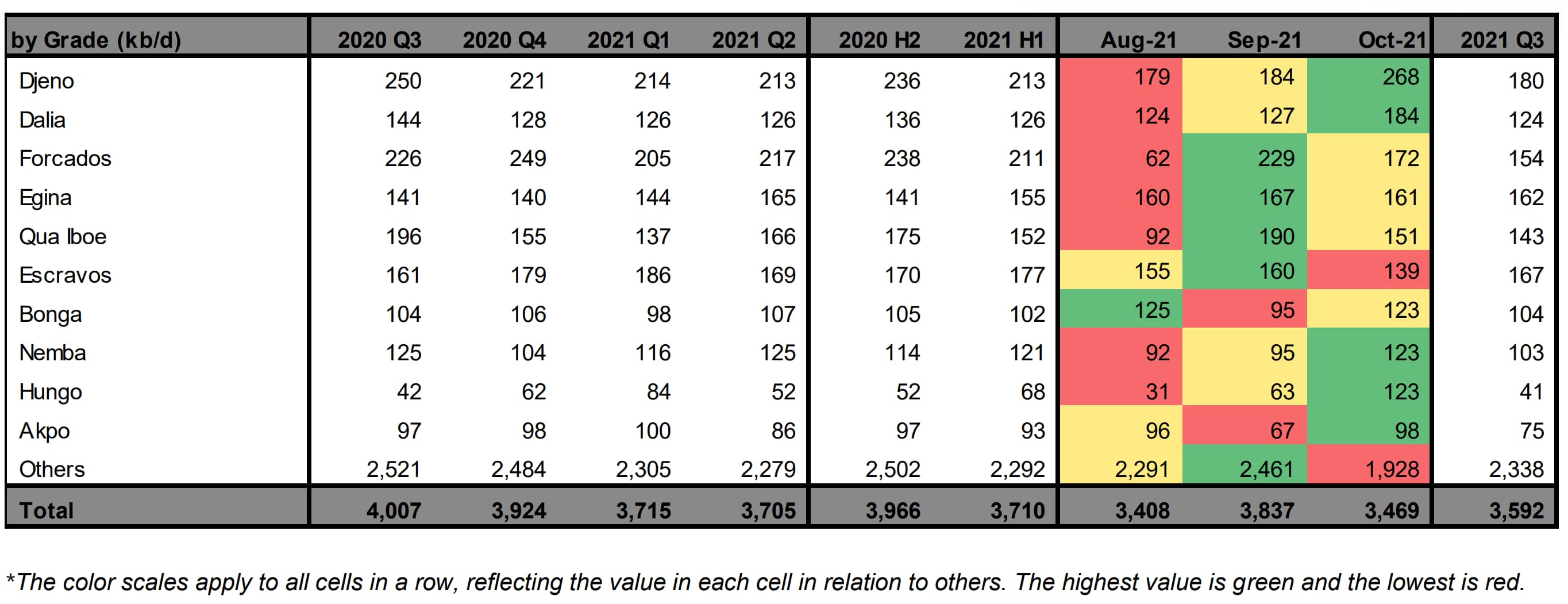

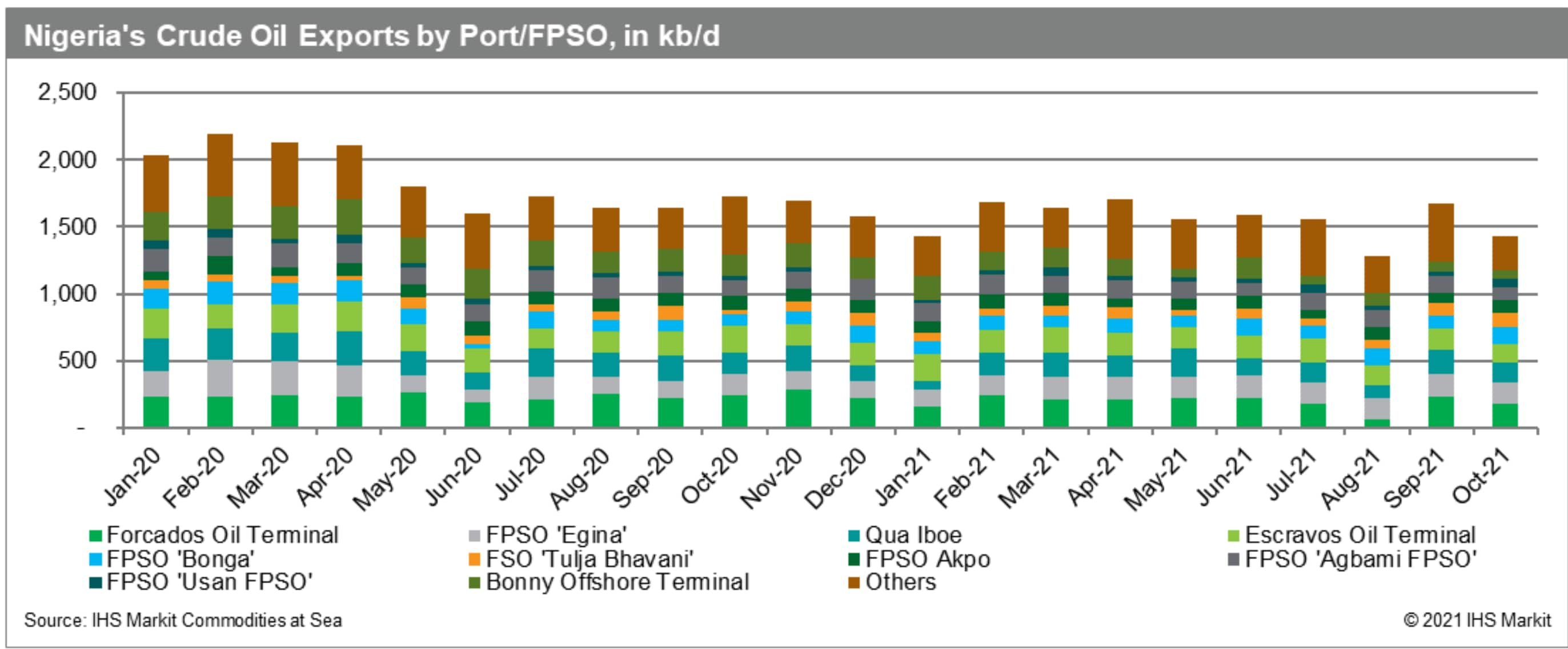

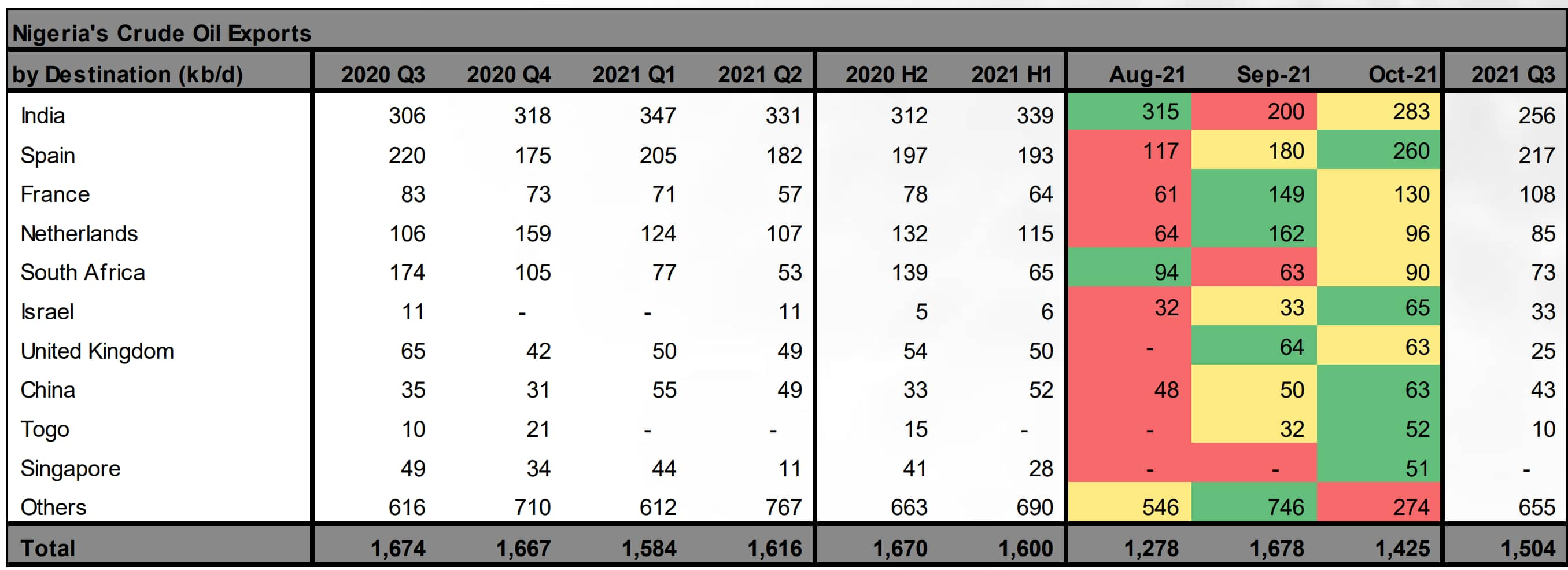

Shipments of Forcados fell to 172,000 b/d in October, according to IHS Markit Commodities at Sea, from 229,000 b/d in September. This is one of Nigeria's two largest grades exported, with average loadings exceeding 210,000 b/d in H1 2021.

This gasoil-rich sweet crude blend has a full capacity near 250,000 b/d, heavily relying on oil pipelines which have suffered multiple coordinated attacks by militants in the restive Niger Delta, since early 2021.

Among other key crude grades of Nigeria, October's exports of Egina reached 161,000 b/d, versus 167,000 b/d in September. Escravos and Qua Iboe stood at 139,000 b/d and 151,000 b/d respectively, down 13% and 20% over month.

Bonny Light loadings have fallen to 61,000 b/d in October, versus 74,000 b/d in September. A year ago, activity typically surpassed 160,000 b/d.

Nigerian loadings heading for Mediterranean importers fell marginally to 454,000 b/d in August, from 458,000 b/d in September. Flows shipped to Spain strengthened to 260,000 b/d in October, from 180,000 b/d in September. Flows to NW Europe fell sharply, to 254,000 b/d in October, compared with 388,000 b/d in September. Loadings heading for the Netherlands collapsed to levels near 96,000 b/d in October, compared to 162,000 b/d in September.

Shipments from Nigeria to India recovered in October, standing at 283,000 b/d, versus 200,000 b/d in September. Most flows refer to grades such as Agbami, Akpo, Bonny Light and Bonga.

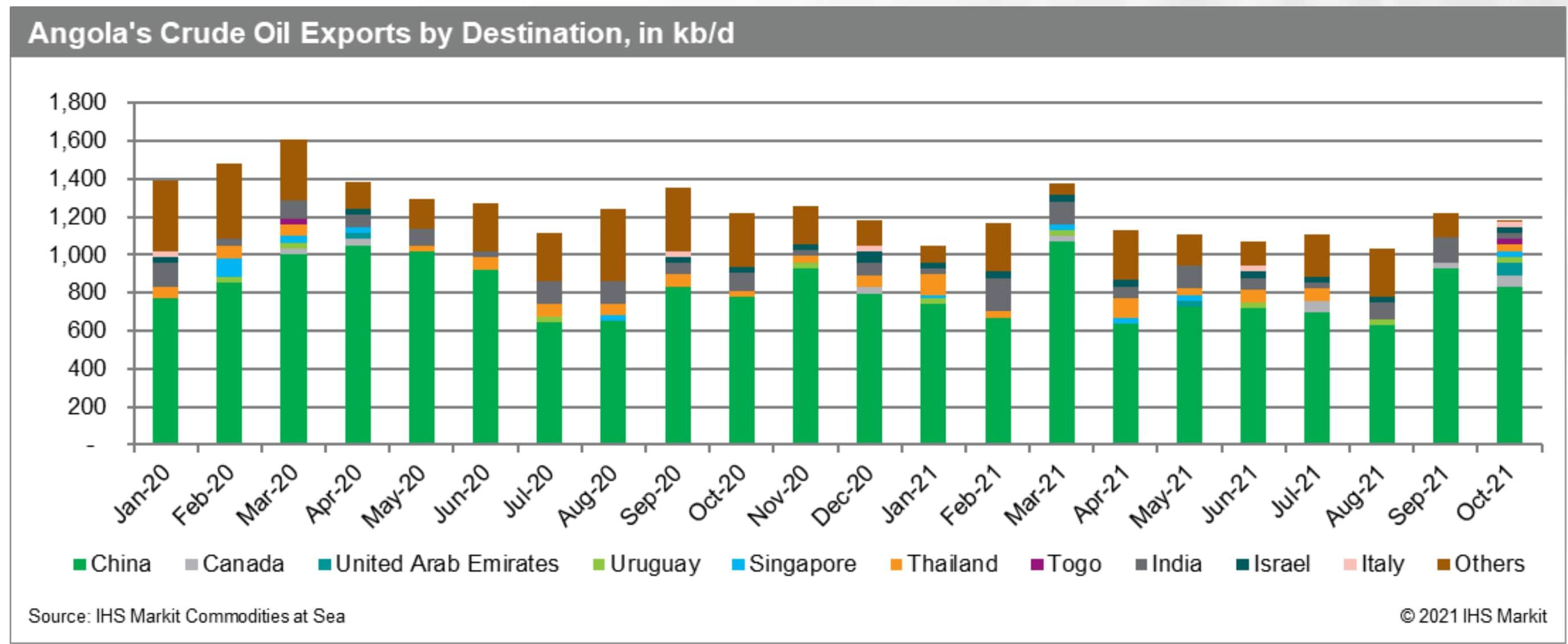

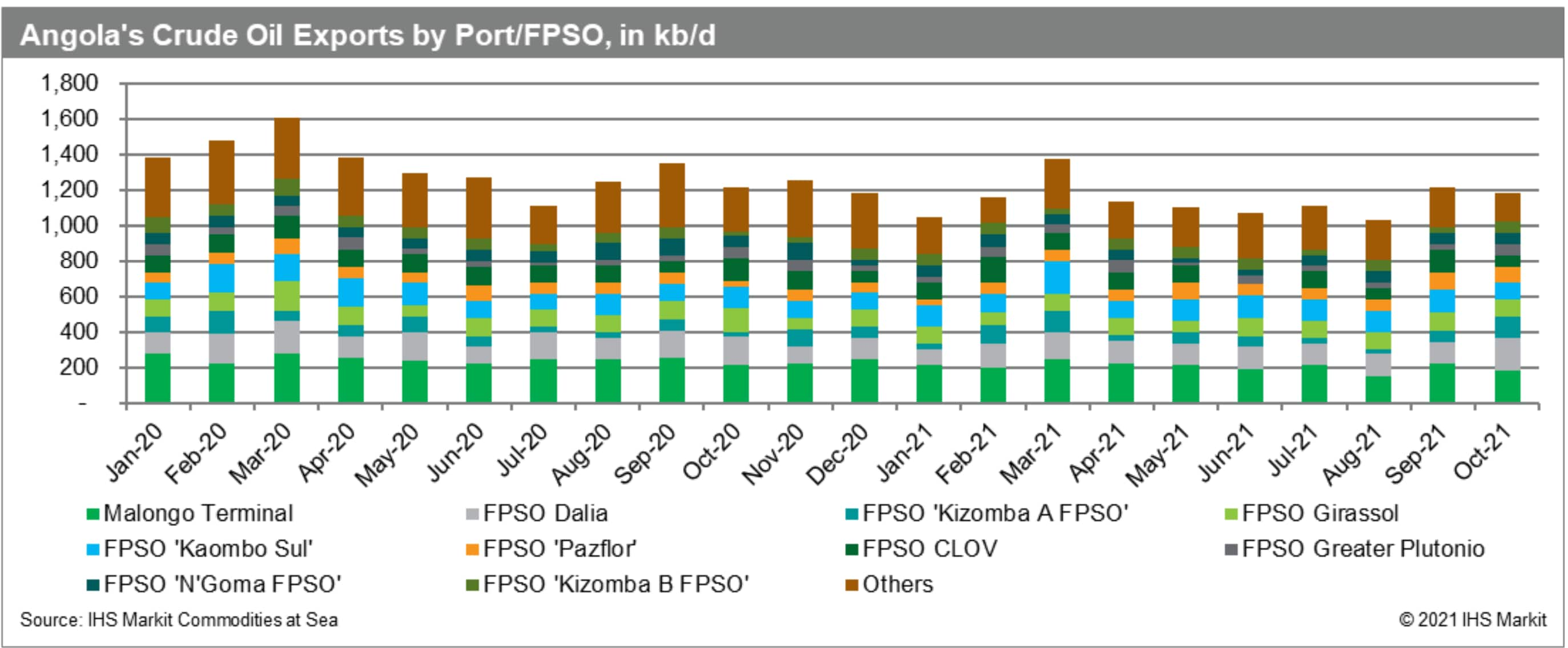

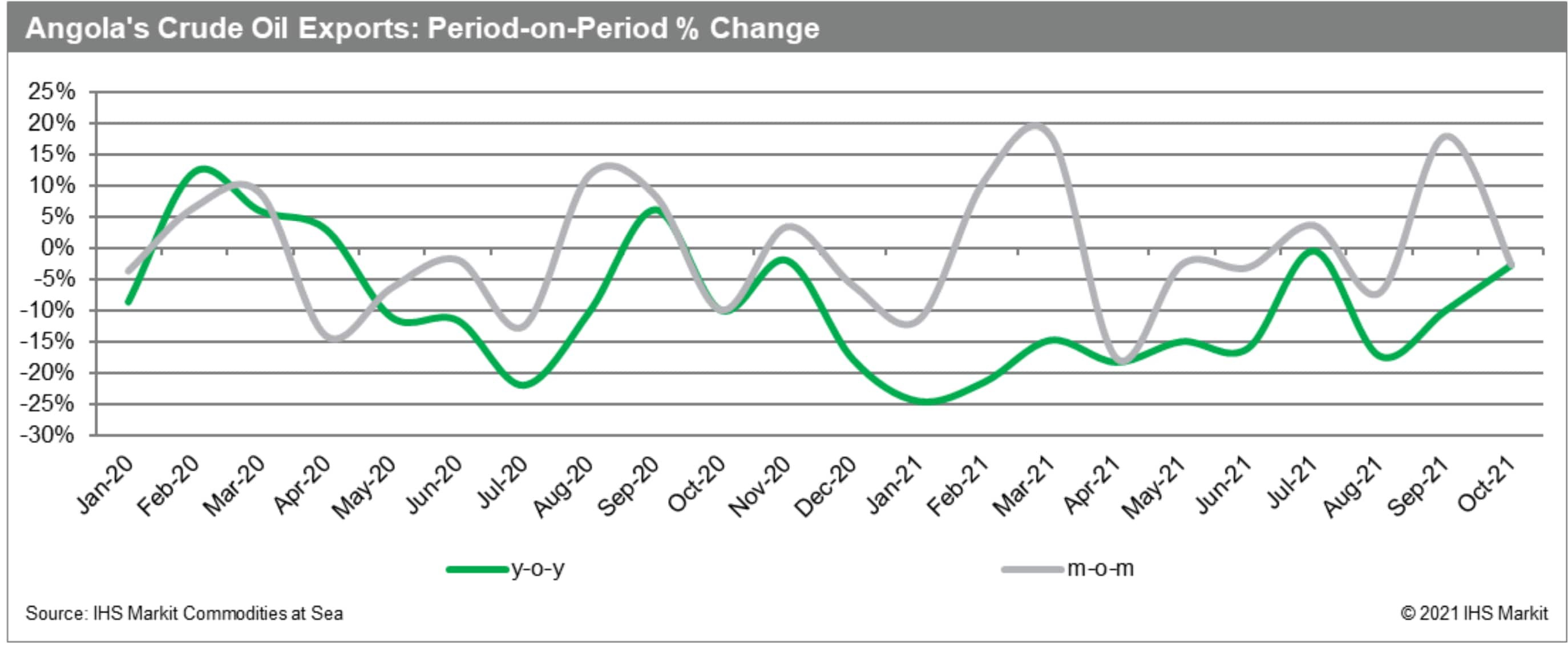

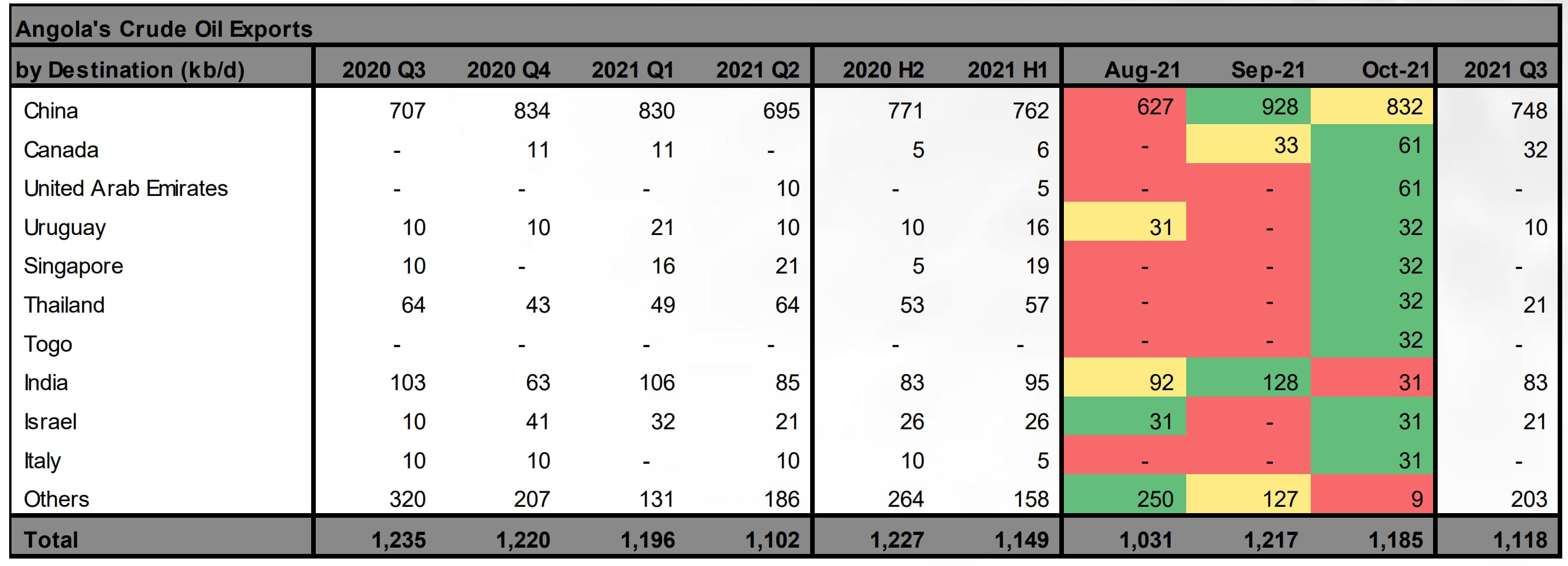

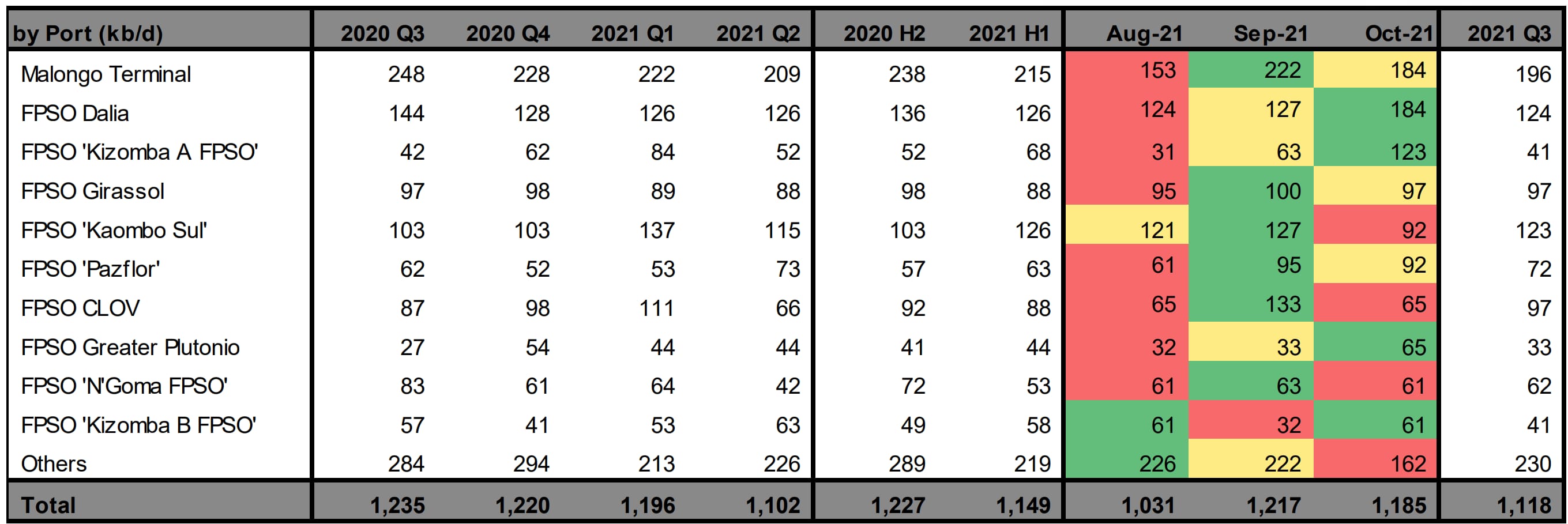

Angola's exports in August inched down 32,000 b/d to 1.19 million b/d, standing 2.6% lower than a year ago. Flows to China declined to 832,000 b/d in October, versus 928,000 b/d in September.

China's crude imports from Angola and West Africa overall have fallen to 1.26 million b/d in October, from 1.37 million b/d in September, as competition from Middle Eastern suppliers increases.

Shipments to India collapsed to just 31,000 b/d in October, from 128,000 b/d in September.

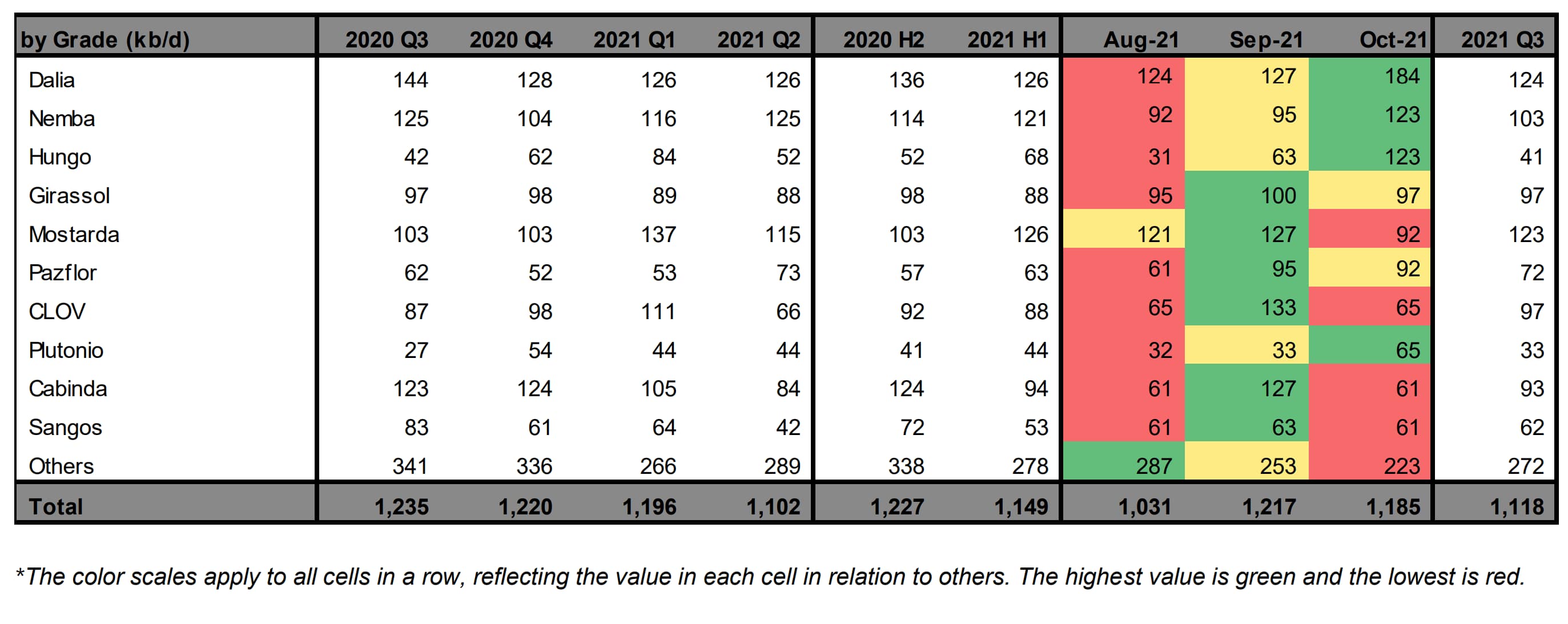

Among Angolan crude oil grades, Dalia remains the largest, with significant gains observed in October, with total exports at 184,000 b/d, the highest since March 2020. Growth on month was rather impressive, at 45%.

Shipments of Nemba reached 123,000 b/d in October, from 95,000 b/d in September.

Similarly impressive growth has been observed in exports of Hungo, which doubled to 123,000 b/d in October, from 63,000 b/d in September.

Girassol and Pazflor remained almost unchanged on month, at 97,000 b/d and 92,000 b/d respectively.

Mostarda and CLOV suffered deep losses, having fallen to 92,000 b/d and 65,000 b/d in October, from 127,000 b/d and 133,000 b/d in September.

Like Nigeria, Angola's oil sector is facing structural challenges in the last five years - lack of new investments in exploration and a failure to maintain production levels at mature oil fields. New upstream projects could add up to 90,000 b/d in 2022, which may not be enough to raise output substantially.

Among Angola's mostly sweet crude grades, most pressure will be felt by Nemba, Dalia, Mostarda, Gindungo, Girassol, and Kissanje in coming years.

Meanwhile, involuntary outages across smaller producers in West Africa pushed the region's supplies further down. Congo, Cameroon and DR Congo have been the only exporters in the region to report some small gains in October 2021, adding 173,000 b/d in total over month. Exports of Djeno reached 268,000 b/d.

Ghana's crude oil exports stood at 123,000 b/d in October, according to Commodities at Sea. This is 24% down from September's shipments of 161,000 b/d. Activity typically averages near 150,000 b/d. Crude loadings of the West African country have been scheduled at 153,000 b/d in December, marginally down from 158,000 b/d planned for November. Exports of Jubilee should rise to 92,000 b/d in December, from 63,000 b/d in November, according to loading schedules. Activity stood at 61,000 b/d in October, according to Commodities at Sea, down from 97,000 b/d in September.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 09 November 2021 by Fotios Katsoulas, Associate Director, Lead Analyst Tanker Shipping & Alternative Fuels, S&P Global Commodity Insights and

Mark F. Esposito, Senior Principal Research Analyst, Commodities at Sea, S&P Global Commodity Insights

How can our products help you?