Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 02, 2021

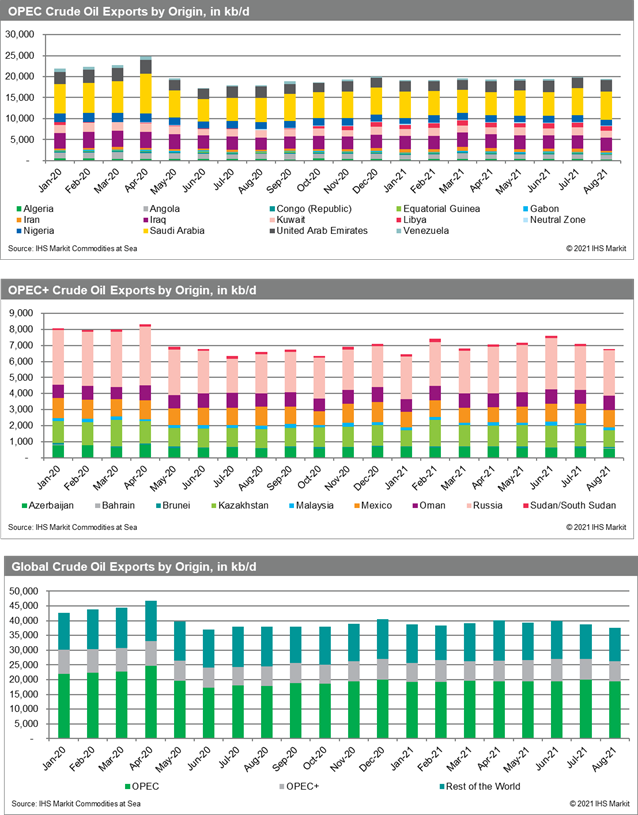

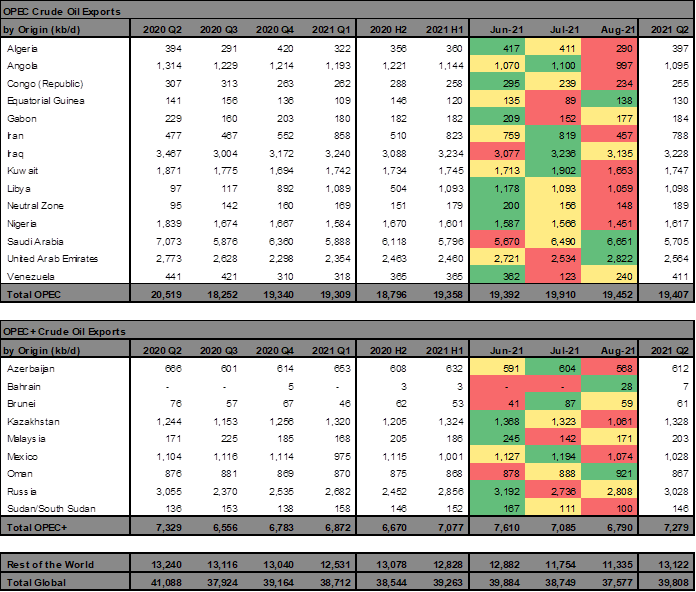

OPEC seaborne crude oil exports dropped to 26.24 million b/d in August, from 27 million b/d in July. This is the first month total volumes fell below 26.3 million b/d since January 2021, led by declines from Kuwait, Angola and Nigeria.

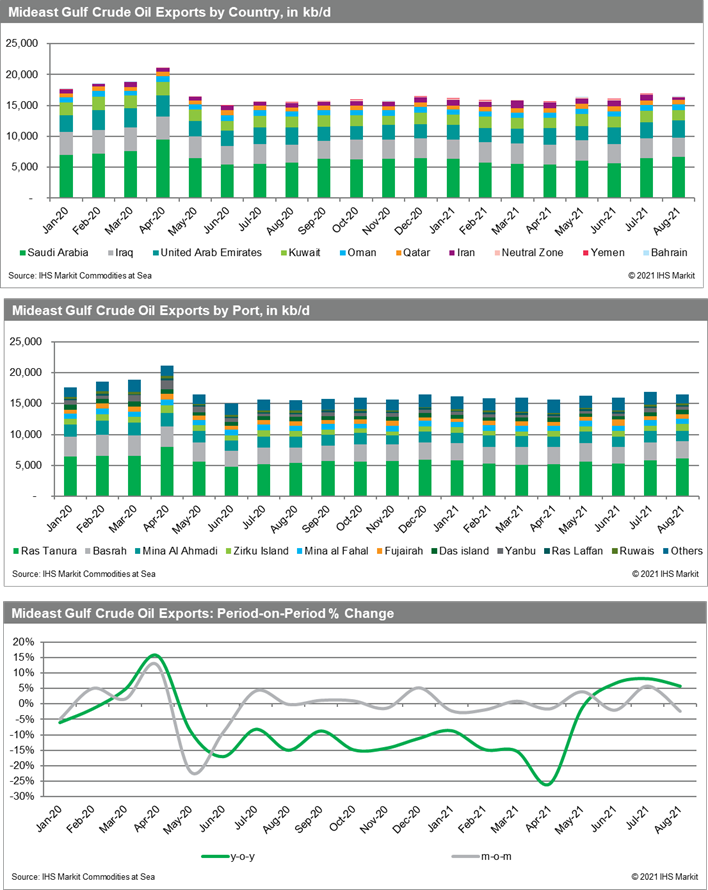

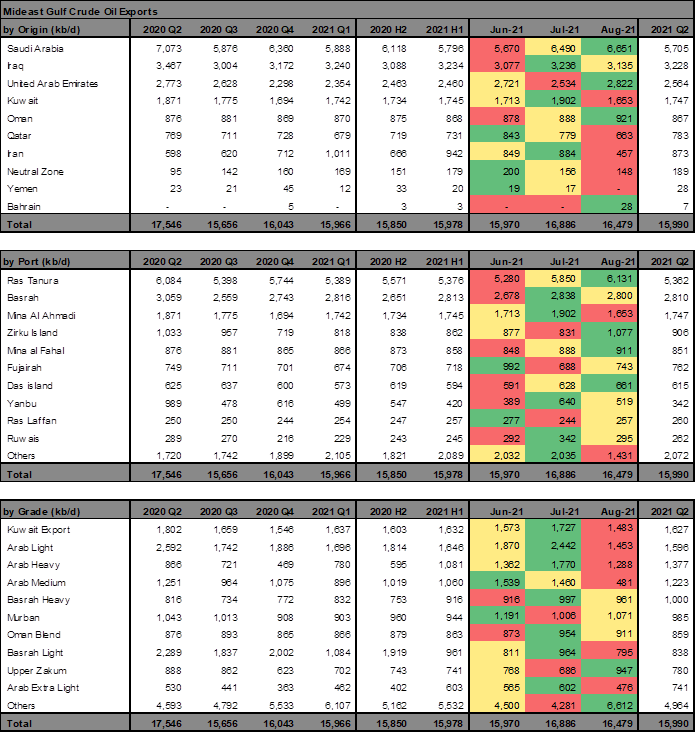

Saudi Arabia's outflows rose to 6.65 million b/d, up 2.5% and 15.1% over last month and last year respectively. The Middle Eastern producer last export higher volumes in April 2020.

Arab Light crude comprised 1.5 million b/d in August, compared with 1.75 million b/d a year ago, while Arab Heavy amounted to 1.3 million b/d. Saudi Arabia's export volumes exclude loadings from the Neutral Zone, which averaged 148,000 b/d in August, vs 156,000 b/d in July.

Saudi cargoes loaded in August and bound for Asia are estimated at 4.9 million b/d, a decline from 5.2 million b/d in July. Shipments headed to China are estimated at 1.9 million b/d, rising by around 100,000 b/d from July.

Iranian crude exports in August averaged 457,000 b/d, a 48% decline month on month. The majority of these volumes loaded on so-called dark vessels, and it is not clear which grades have been exported. Year-to-date, Iran's crude oil exports have averaged 873,000 b/d, according to Commodities at Sea.

Among tankers having recently lifted Iranian barrels, the NITC-owned "ARTAVIL" loaded 657,000 barrels of light sour crude oil from Bandar Jask on 9th August and discharged in Bandar Abbas on 27th.

In August Iraq exported 3.1 million b/d, with a decline of 3% month on month to report, including volumes from the Kurdistan region. Exports from Kuwait slumped 13.1% on month and 4.5% on year to 1.65 million b/d while UAE loadings increased 11.4% from July to 2.82 million b/d. Murban cargoes increased 6.6% on month to 1,071,000 b/d while Upper Zakum shipments reached 947,000 b/d.

OPEC+ are expected to affirm a prior deal to further increase production quotas by a collective 400,000 b/d for October during their meeting on 1st September. The alliance plans to unwind up to 4.5 million b/d of production cuts by the end of next year, as long as market fundamentals are in line with their strategy.

But demand has been recently slowing, with September expected to run a 1.1 MMb/d global supply deficit. There could be more tightness on the horizon, allowing futures prices to move up, as has happened over the past week.

An additional 2 MMb/d of upstream production is now suspended globally, including 1.7 MMb/d that came offline in the US Gulf from Hurricane Ida, together with roughly 300,000 b/d that remain offline from Pemex's offshore platform fire in the Ku-Maloob-Zaap complex last week.

Meanwhile, Libyan supply is at risk of being curtailed due to funding issues experienced by state-owned NOC subsidiary Agoco, threatening 300,000 b/d of crude output.

With stronger demand in summer, global crude stocks have been unwound, reflected by the market currently in backwardation. But with the pandemic staging a resurgence in the US and parts of Asia, OPEC+ is maintaining cautious optimism. Incremental barrels coming back from the group will comprise medium and heavy sour crude grades, mostly from producers across the Middle East and Russia.

This will pit them against US Gulf Coast output, which is set to accelerate going into 2022, the current outage from Hurricane Ida notwithstanding. Moreover, the scenario of Iran's return in first half of 2022 could change market fundamentals drastically.

In the immediate term, competition is rising with medium sour US Gulf Coast crude Mars offered at cheaper prices relative to Dubai, opening up an arbitrage to Asia given low freight rates. This has been also supported by a planned sale of crude from the US SPR totalling 20 MMbbl between October and December.

Asian consumers are already reacting, this month requesting lower volumes from their nominal contractual offtake from Saudi Arabia following a hike in OSP differentials.

Apart from the Middle East, West Africa's major producers, Nigeria and Algeria, are also expected to negotiate a higher production baseline for quota calculations, following UAE's example.

This could lead to an additional 1.6 MMb/d in production starting April 2022. Nigeria has been producing well under its current quota at roughly 1.3 MMb/d compared to a July target of 1.5 MMb/d.

In contrast to rising Saudi cargoes, Russia's exports of crude have remained close to 2.8 million b/d in both July and August, compared to 3.2 million b/d in June.

This resulted in total OPEC+ seaborne crude oil exports this month declining 2.8% from July to 26.24 million b/d.

Aside from Russia, Kazakhstan's seaborne exports of light sweet CPC Blend crude fell 19.8% to 1.06 million b/d, the lowest since January. Loadings will likely remain constrained in the next few months due to a major maintenance program scheduled at the Tengiz field.

Azeri crude oil exports also declined 5.9% on month to 568,000 b/d while Malaysia's crude oil exports increased to 171,000 b/d.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 02 September 2021 by Fotios Katsoulas, Associate Director, Lead Analyst Tanker Shipping & Alternative Fuels, S&P Global Commodity Insights

How can our products help you?