Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 18, 2021

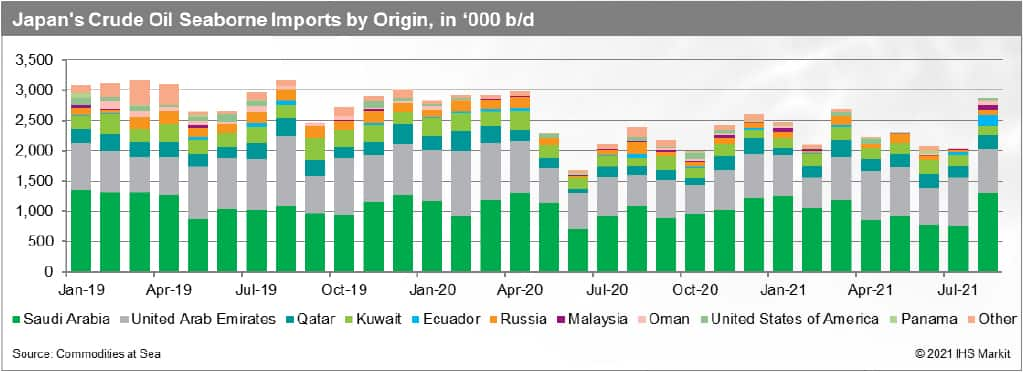

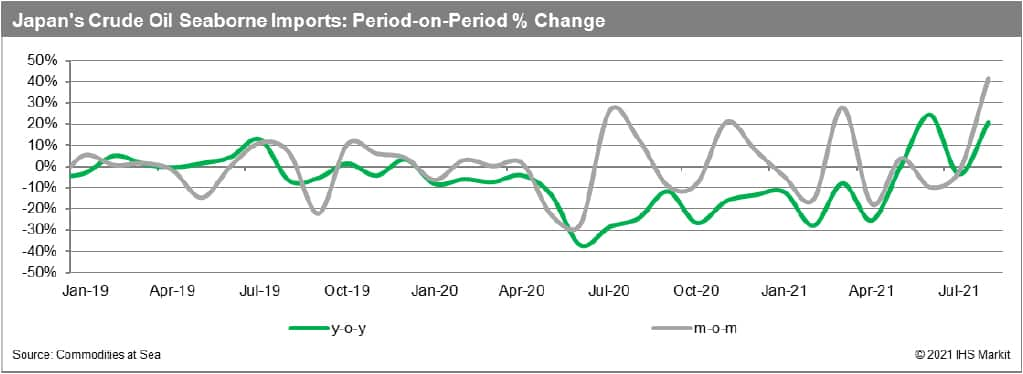

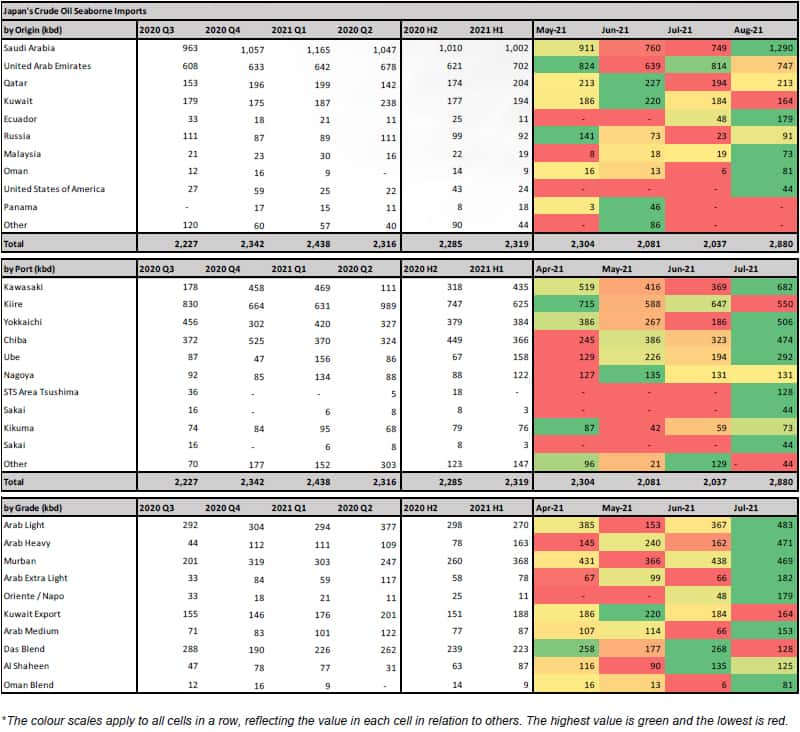

Japan's crude oil imports are recovering impressively in August and are on track to hit 2.9 million b/d, up from 2.04 million b/d in July and surging 21% year on year.

The July volumes had fallen 2% on month.

Flows from Saudi Arabia alone are set to reach 1.3 million b/d in August, from 750,000 b/d in July and up 19% year on year, according to latest data by IHS Markit Commodities at Sea, up 19% on year. This month's flows from Saudi Arabia to Japan are set to hit a record high since May 2020.

Saudi Arabia's market share of Japanese crude imports fell to just 37% in July, compared to 48% in the first quarter, but could surpass 45% in August. Arab Light remains the major grade imported into Japan, with flows of 483,000 b/d observed so far in August, compared to 367,000 b/d in July and 153,000 b/d in June. Meanwhile, Arab Heavy is expected to reach 470,000 b/d as well, from just 162,000 b/d in July.

Crude imports from the UAE are marginally down in the first half of August, to 747,000 b/d from 814,000 b/d in July. However, Murban flows are up, near 470,000 b/d so far this month, vs 438,000 b/d in July. Imports from Kuwait are down 20,000 b/d over last month, at 164,000 b/d.

Imports from Qatar are up 10% over last month, having surpassed 210,000 b/d so far in August, versus 137,000 b/d a year ago.

OPEC's agreement to further ease production cuts has increased global supply, allowing Japan to take advantage of the shorter haul from the Mideast Gulf, primarily Saudi Arabia, and avoid cargoes from the Atlantic Basin in favour of Middle Eastern grades. There has been only one U.S. cargo, of Eagle Ford Condensate, discharged in Sakai on 6th August, after a long break since late April.

However, Japan's appetite for crude oil from Ecuador has strengthened further in August, with total flows currently standing near 180,000 b/d.

Imports from Russia have recovered, having surpassed 90,000 b/d so far in August, from 23,000 b/d in July, but stand much lower than a year ago.

Japan's economy has been recovering since early Q2 2021, even though Covid-19 measures still remain in place, with the state of emergency having recently been expanded yet again across major areas during the summer holidays. New Covid-19 infections have been increasing, having recently reached 20,000 cases per day.

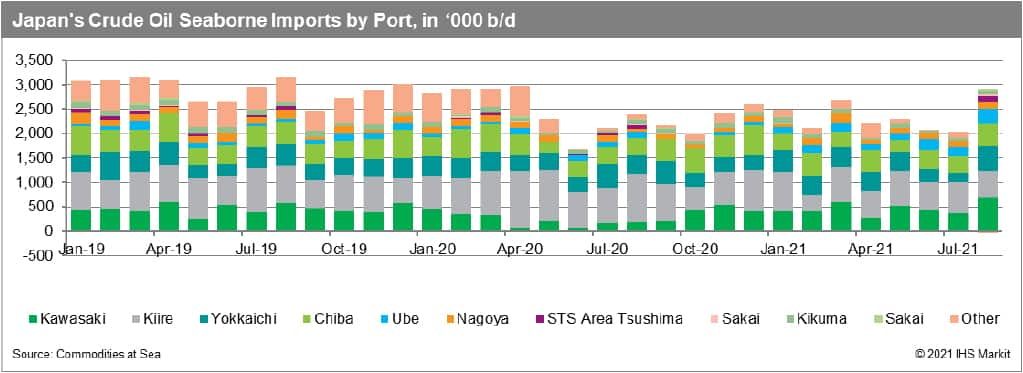

Crude processing rates at Japanese refineries surpassed 70% in late July, from 60.3% in mid-July. However, gasoline and jet fuel demand remain under pressure, with Japan's major airlines All Nippon Airways (ANA) and Japan Airlines (JAL) maintaining most domestic flight cuts into September.

Japan's refinery runs were drastically affected by Covid-19, with total crude imports averaging below 2.3 million b/d since May 2020, compared to levels near 3 million b/d prior to the pandemic.

On the positive side, Japan's Eneos recommenced operations at its Oita refinery of 136,000 b/d on 14th August. The refinery, on Kyushu island in southern Japan, was forced to halt operations following a fire in May 2020, which took place at a crude distillation unit during a turnaround. Eneos' operation rates were lowered to 61-69% since April 2020, compared with 82-92% before the pandemic.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 18 August 2021 by Fotios Katsoulas, Associate Director, Lead Analyst Tanker Shipping & Alternative Fuels, S&P Global Commodity Insights

How can our products help you?