Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 14, 2023

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

The global economic expansion resumed in November. Stabilisation of new order inflows supported a mild growth in output while inflation rates remained little-changed. Employment growth came close to stalling, however, affected primarily by manufacturing job losses.

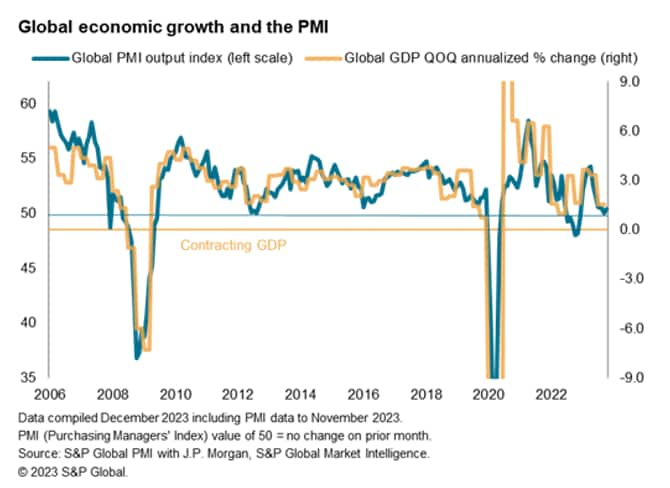

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - rose to 50.4 in November, up from 50.0 in October to signal a renewal of output growth, albeit only marginally. The current PMI reading remains well below the survey's long-run average of 53.2 and is therefore consistent with an annualized quarterly global GDP growth of approximately 1%, which pales in comparison with the pre-pandemic ten-year average of 3.0%. Growth in activity remained exclusive to the service sector as manufacturing output remained in contraction territory for a sixth consecutive month.

A lack of recovery in demand for goods following the post-pandemic shift in spending from goods to services coupled with destocking efforts at clients continued to underpin the global manufacturing sector downturn into the end of 2023. That said, there were some early indications of the inventory cycle turning observed via PMI data, which will be more supportive to growth. Meanwhile services activity growth was modest, with the pace of expansion little changed from the nine-month low in October. Overall conditions in the service sector have largely stalled of late, contrary to the strong revival of demand for services earlier in the year.

The latest developments on the activity front continued to trend in line with policy guidance as central bankers previously tightened financial conditions to help cool inflation. As far as global PMI selling price index alluded to, price pressures are expected to further ease in the coming months. Notably, however, employment growth has nearly stalled. Although this is supportive of wage pressures easing, further deterioration in employment conditions may add to the demand dearth and will be worth watching for the trend from here. The next release of flash December PMI will be on December 15.

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location