Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 24, 2025

By Disha Mandavia

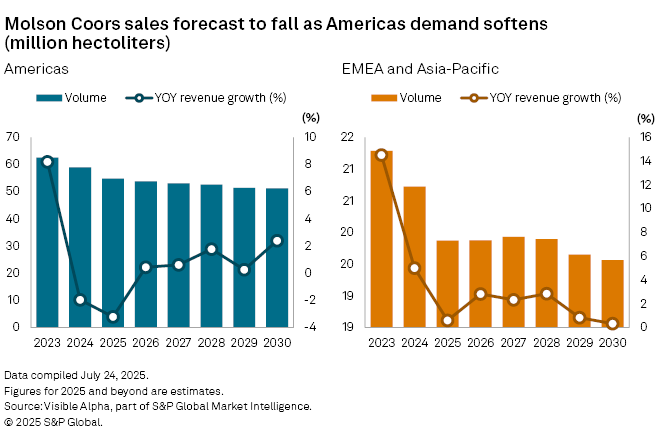

Molson Coors Beverage Co. (NYSE: TAP) is expected to post a -2.3% year-on-year decline in net sales to $11.4 billion in 2025, according to Visible Alpha consensus estimates, extending a downward trend that began in 2024. The anticipated dip follows a -1% fall last year and comes after a +9% jump in 2023, when the brewer benefited from a post-pandemic recovery and gained market share from rivals.

The company’s largest market, the Americas, is set to remain under pressure. Sales in the region are forecast to drop -3.2% to $8.9 billion in 2025, as volumes decline -7% to 54.8 million hectoliters. Analysts attribute the weakness to macroeconomic headwinds, waning consumer demand, and the expiration of a brewing partnership with Pabst Brewing.

In the EMEA and APAC markets, volumes are projected to decline -4.1% to 19.9 million hectoliters. However, net sales growth in these regions is expected to be broadly flat, rising +0.6% in 2025.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment