Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Nov, 2017 | 11:15

Highlights

Our 2017 U.S. Mobile Banking Landscape includes regional mobile banking survey insights and details on dozens of U.S. bank apps.

Banks across the U.S. are adopting a mobile-first strategy for their digital offerings, and the Midwest is no exception.

U.S. consumers value their mobile bank apps more than ever, and expectations for these products are growing increasingly sophisticated. Once-novel mobile features such as photo check deposit and bill pay are now table stakes, and banks seeking to offer a competitive digital experience have to evaluate an ever-evolving range of services.

S&P Global Market Intelligence's 2017 U.S. Mobile Banking Landscape includes regional insights from our 2017 mobile banking survey and details on the features available in the apps of dozens of U.S. financial institutions, including more than two dozen large banks and 45 companies with less than $50 billion in assets. The latter group consists of five smaller regional and community banks from each of the nine U.S. census divisions. This article focuses on the Midwest, which includes the East North Central and West North Central census divisions.

Already a client? Click here to read the full report.

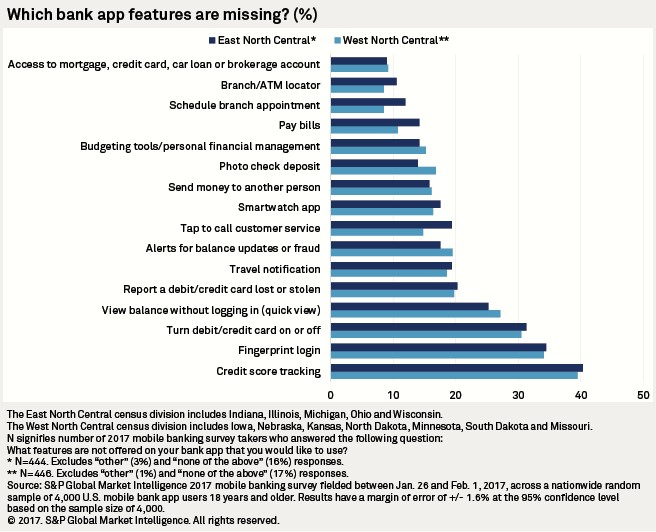

Our survey found that Midwestern mobile banking customers are most interested in seeing credit score information added to their apps. Consumers' preoccupation with their credit files is only likely to intensify in the wake of the Equifax data breach. Few of the regional bank apps from around the country that we recently reviewed provide access to this information, although First National Bank of Omaha makes it available to consumer credit card customers.

Another highly valued feature for bank app users is fingerprint login, which many Midwestern banks offer. But with the rollout of Apple's new iPhone X and other evolutions in mobile technology, banks across the country are increasingly having to pay attention to alternative forms of biometric authentication, including face ID. Banks are responding to their customers' desire for even more convenient access to account information by allowing them to view their balances without logging in to the app.

Customers also want access to certain card controls via their bank apps, including the ability to temporarily switch cards on or off, and to report them lost or stolen. Jefferson City, Mo.-based Central Banco. Inc. and Sioux Falls, S.D.-based Great Western Bancorp Inc. are among the institutions planning to roll out such features in the near future, while Saint Paul, Minn.-based Bremer Financial Corp. makes certain card controls and account alert management available through a separate, third-party app.

The availability of certain features is just one way to assess the quality of a mobile offering. Customers who provide app store reviews clearly value speed, reliability, and an intuitive layout, and they seem to prefer having all features available on one platform.

Central Bank is redesigning its whole app for release next year, with the goal of providing a more user-friendly experience by streamlining navigation and better surfacing popular features such as person-to-person payments. The bank is taking the mobile-first approach seriously, as mobile logins have overtaken desktop logins, and about 65% of the company's digital traffic is coming through phones.

Great Western Bank, whose deposits are primarily spread across Nebraska, Iowa, South Dakota, and Colorado, also hears from customers that they want improved core functionality, for example, faster transaction alerts. Great Western uses a niche digital vendor for its mobile channel and believes this is more advantageous than using a standard package from core systems providers.

The Midwest is home to some of the nation's few mobile-ready ATMs. Chicago-area Wintrust Financial Corp. is a relatively early adopter of Cardless Cash, which lets the customer scan a QR code with their smartphone instead of using a debit card to withdraw money. In a competitive banking environment, and especially in heavily banked areas, financial institutions are keeping an eye on customer attrition and looking for an edge. This sometimes means making investments in new ATM hardware or services like mobile P2P payments that do not necessarily add revenue but that have become part of what customers expect from their banks.

It is difficult to quantify the value of a high-quality mobile banking experience, but our survey results give an idea of how important it is to consumers. Despite being generally fee-averse, more than 40% of survey respondents from the Midwest indicated that they would be willing to pay $1 per month to use their bank apps, while more than 20% said they would pay $3 per month. Respondents from the East North Central census division, which includes Indiana, Illinois, Michigan, Ohio and Wisconsin, were more willing to pay a fee. Although banks are unlikely to start charging for their digital services, satisfied mobile banking users could prove stickier deposit customers even as rates continue to rise and other institutions tempt them with promotional offerings.

When it comes to delivering products and services, banks of all sizes have a high bar to meet. Large, deep-pocketed institutions are constantly innovating with their digital channels, and it is not easy for their smaller peers to keep up. But many regional and community banks boast sophisticated mobile apps with desirable features that are not yet ubiquitous among the nation's largest banks. In a banking landscape populated by fewer branches and with visits to those locations by tech-savvy customers on the decline, the combination of a strong local brand and robust digital experience could give smaller banks a competitive edge.

Methodology

The 2017 mobile banking survey was fielded online between January 26 and February 1 across a nationwide random sample of 4,000 U.S. mobile bank app users 18 years and older. Results have a margin of error of +/- 1.6% at the 95% confidence level based on the sample size of 4,000.

S&P Global Market Intelligence researched mobile apps in June 2017 for more than two dozen financial institutions, including the biggest retail banking franchises in the U.S. and various large regional and branchless banks. Between September 18 and November 10, S&P Global Market Intelligence researched mobile apps for 45 smaller regional players and large community banks. The latter analysis focused, for the most part, on the top five retail deposit market share leaders with under $50 billion in assets in each of the nine U.S. census divisions.

This research is based on product descriptions available on bank websites and in app stores, as well as company-provided information. Some companies may have subsequently updated their apps or may offer additional features and services. Our analysis does not necessarily reflect functionality or services available through text banking, mobile browsers or secure messaging.