Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 May, 2018 | 08:00

Metals & Mining

By Nick Wright

Highlights

Q1 2018 activity index was still the second-highest since Q1 2013, and was a 17% improvement over Q1 2017.

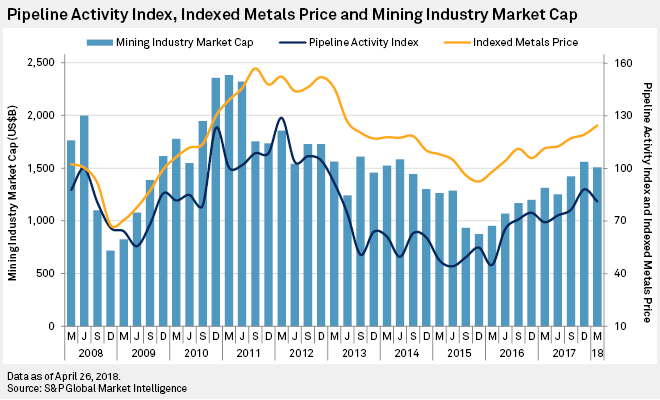

With the notable exception of initial resource announcements, all components of S&P Global Market Intelligence's Pipeline Activity Index (PAI) fell in the March quarter, lowering the PAI to 81 from 88 in the final quarter of 2017. However, the March quarter activity index was still the second-highest since the March 2013 quarter and was a 17% improvement over the year-ago quarter.

Pipeline Activity Index

The two PAI indexes most closely related to exploration activity — announcements of significant drill results and financings — fell 9% and 28%, respectively, quarter-over-quarter. Among the more indirect measures — announcements of initial resources and positive project milestones — new initial resources almost doubled to 23 from 12 in the December 2017 quarter, and milestones retreated to 10 from 16.

Exploration

The decline in the number of significant drill results was offset somewhat by the fact that the total number of projects reporting drill results declined only 2% quarter-over-quarter to 554 from 567.

Initial Resources

Initial resource announcements nearly doubled in the March quarter to 23 from 12 in the December quarter, with new gold resources jumping to 17 from nine and base/other metals resources doubling from three to six. The increase likely reflects the near doubling of projects reporting drill results over the past two years, from 289 in the March 2016 quarter to 554 in the first quarter of 2018.

Exploration Finance

In an indication of continuing investor interest, the lower number of financings was mitigated by a 24% increase in funds raised to US$1.89 billion from US$1.53 billion in the previous quarter. Gold projects accounted for almost all of the increase, rising 46% to US$1.10 billion, from US$753.5 million in the previous quarter.

Project Milestones

The number of positive project milestones continued to fall in the March quarter, sliding to 10 from a one-year high of 19 in the September 2017 quarter; there were two negative milestones. New mine startups fell the most, to five from 11. Mines entering preproduction fell by one and projects entering feasibility studies for new mines rose by one.

Request a demo to gain essential insights into global exploration trends update with our Metals & Mining service.