Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2017 | 14:00

By Kwame Campos

The following post comes from Kagan, a media research group within S&P Global Market Intelligence. To learn more about this research, please request a call

Discounts and promotions can fail in the long term, so Latin American pay TV operators talked about focusing on value-add strategies June 20-22 at TEPAL's Congreso 27 in Panama.

Cable operators have been working on their infrastructure and service offerings for pay TV customers looking to access data-intensive content when and where they want it. An increasing number of vendors, such as TiVo Corp., Minerva Networks Inc., Toolbox, and ActiveVideo Networks Inc. are providing TV Everywhere, or TVE, services for cable operators in the region. At the trade show, Cable Onda SA announced its new TVE platform, Cable Onda Go, developed in conjunction with TiVo. It will offer 35 live channels and 5,000 titles on demand.Latin American operators are developing strategies to compete with streaming providers. Cablevisión Argentina COO Gonzalo Hita said the company's TVE platform, Flow, reached more than 300,000 active users in the second quarter. The company invested more than $100 million in the project with the objective of reaching more than three million active users. Hita mentioned that services like Netflix are complementary to pay TV, thus operators should aspire to become "Smart Pipes," where subscribers can have access to their favorite content, regardless of the platform with a single sign-on. He said subscribers should be able to search for content across different providers from a Cablevision platform.

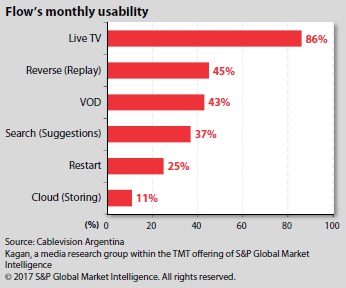

Cablevision Argentina seeks to leverage local content and streaming rights to provide value to its customers. Flow is available for free for HD customers, while SD customers have to pay a fee. As of the second quarter, 92% of the users of the platform were HD customers, and 8% were SD customers. Flow usability statistics reveal live TV is the principal use of the platform followed by replay and on-demand content. According to Hita, news and sports are the most highly demanded types of content.

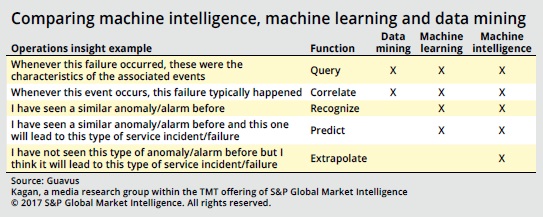

Machine intelligence was another of the technologies discussed in the conference. This technology goes one step beyond machine learning due to its capacity to understand features it was not originally programmed to handle. Some of the applications of this technology are customer service, capacity planning, predictive maintenance, and marketing.An example of the application of this technology is planning maintenance truck rolls during storms. Guavus claims its platform can help reduce maintenance tickets by 33% and truck rolls to attend to outages by 31% because the platform helps predict spots with the highest probability to suffer outages due to the storm.

On the infrastructure front, Jorge Salinger, vice president of access architecture at Comcast Corp. subsidiary Comcast Cable Communications LLC, presented DOCSIS 3.1 as an efficient alternative to fiber to the home. Comcast's goal is to complete the deployment of this technology by 2018 in the U.S., and the company expects to reach 2 Gbps and 3 Gbps speeds with this platform in the near future. The advantage of DOCSIS 3.1 versus fiber are lower cost and lower deployment time. Comcast expects to achieve symmetrical upstream/downstream data services. Latin American cable operators, such as Cablevision Argentina, are deploying DOCSIS 3.1 in their networks and prioritizing cities with the highest data consumption.