Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 24, 2022

By Jingyi Pan

APAC economies Japan and Australia slipped into contraction at the start of 2022 as new waves of COVID-19 infections disrupted business activity. The service sectors were especially hard hit, and manufacturing in Australia was also badly affected. That said, selling price pressures eased according to the IHS Markit flash PMI data, heralding a positive development in terms of the recent rise of inflation.

The latest IHS Markit flash PMI data revealed that APAC economies Japan and Australia both saw their private sector activity contract at the start of 2022. This marked a sharp downturn from December 2021, when the PMI data showed growth momentum merely easing from the initial recovery boost post the COVID-19 Delta wave. The deteriorating picture primarily reflects the detriments of the COVID-19 Omicron wave.

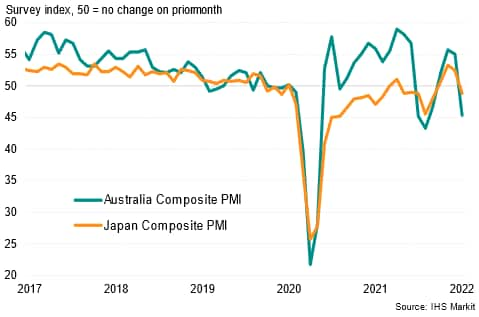

Specifically, Australia's Composite PMI slumped to 45.3 in January while Japan fell to 48.8, both the lowest in at least four months and in both cases indicating a third spell of economic contraction due to the pandemic.

IHS Markit Flash Composite PMI

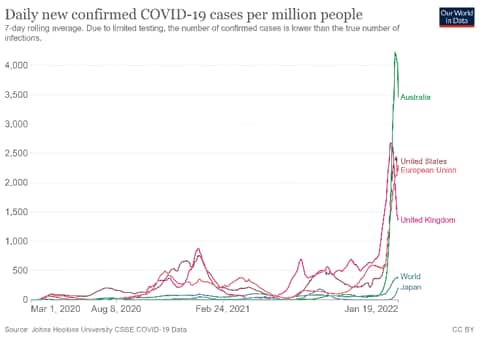

In both countries, service sector performances had been especially badly affected by the latest COVID-19 Omicron wave, despite no new restrictions having been imposed across, thus solely reflecting the impact of the surge in cases.

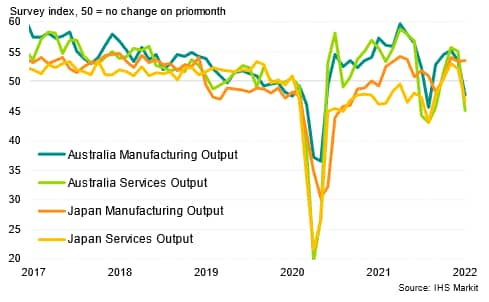

Manufacturing and services output

Manufacturing output also contracted in Australia, though the service sector output index fell almost twice as fast as its manufacturing counterpart. Not only was demand weighed by the latest pandemic developments, with consumers holding back their consumption of services as COVID-19 cases raced to a record high, widespread supply and labour disruptions were also reported, contributing to the sharp downturn in the service sector. Manufacturing output in Australia had similarly been affected, even as demand growth persisted in January, seeing production efforts hampered by the spate of supply disruptions, including the lengthening of lead times at a more severe rate, and employee absenteeism.

On the other hand, Japan's manufacturing output expanded at a stronger rate, though arguably COVID-19 cases remain on the climb in Japan, suggesting that it is still early days for the 'sixth wave' of infections. Service sector output meanwhile demonstrated a clear decline alongside demand.

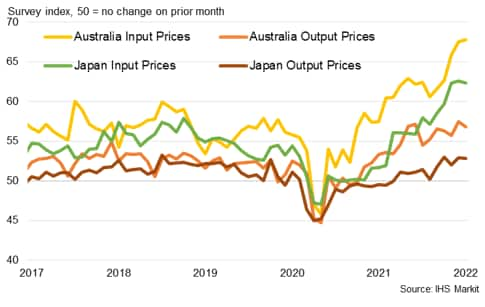

One positive sign gleaned had been the easing of selling price pressures across both APAC countries in January despite the COVID-19 disruptions. That said, the effects may well be demand-driven following the fall in new orders.

Specifically for Australia, selling price inflation eased from the record rate in December 2021 but input price inflation continued the climb to a fresh survey record. Anecdotal evidence suggested that the surge in COVID-19 infections aggravated input costs for firms, although weaker demand conditions limited firms' ability to pass on some of these costs to their clients.

In comparison, Japan - which appears to be in the early part of the new COVID-19 wave - had seen the easing of price pressures across both input costs and output charges. Further developments on the COVID-19 front will continue to be closely scrutinised for the effect on Japanese prices moving forward.

Separately, risks of price pressure renewals should also not be ruled out given precedents of previous waves. The unleashing of pent-up demand following the easing of each COVID-19 wave had also previously aggravated price pressures and may similarly pose a threat to prices when COVID-19 conditions improve.

Input and output price indices

Business confidence across both Japan and Australia was seen reacting immediately to the latest developments on the COVID-19 front. Future output expectation indices, while reflecting sustained optimism, plunged to the lowest readings seen since April 2020 and January 2021 for Australia and Japan respectively.

IHS Markit continues to expect the transition from a global COVID-19 pandemic to endemic status in 2022, and Australia has so far shown a lack of intention for the tightening of restrictions even as cases rose to a record. This is likely to eliminate the threat of imposed restrictions upon economic activity, though voluntary restrictions remain prevalent amid heightened risk aversion in these countries due to the elevated COVID-19 cases. As it is, Australia had seen new COVID-19 cases peaking into end-January, offering hopes for recovery in the months ahead.

Meanwhile Japan was seen bringing back virus restrictions on the back of the Omicron surge. Some effects on the economy may be felt even as the restrictions were regarded to be less strict than prior lockdowns. Any quicker turnaround in the 'sixth wave' with these restrictions would nevertheless bode well for Japan.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.