Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 Nov, 2021

By Jasim Zahid

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

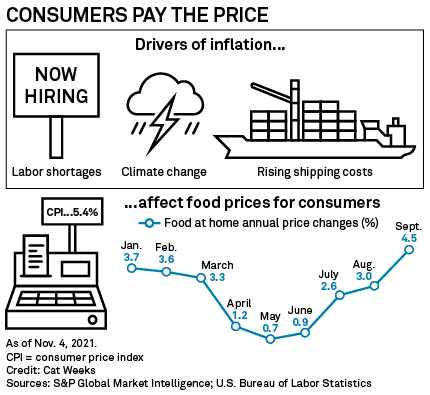

In this edition, we take a close look at the rising food prices in the U.S. with analysts not anticipating a peak until well into 2023 at least. The food at home segment of the consumer price index, which represents what consumers pay for groceries, jumped 4.5% year-over-year in September, the highest increase since August 2020. Several factors are contributing to the run-up in grocery bills, including labor shortages as millions of Americans remain reluctant to return to work with no significant changes foreseen anytime soon.

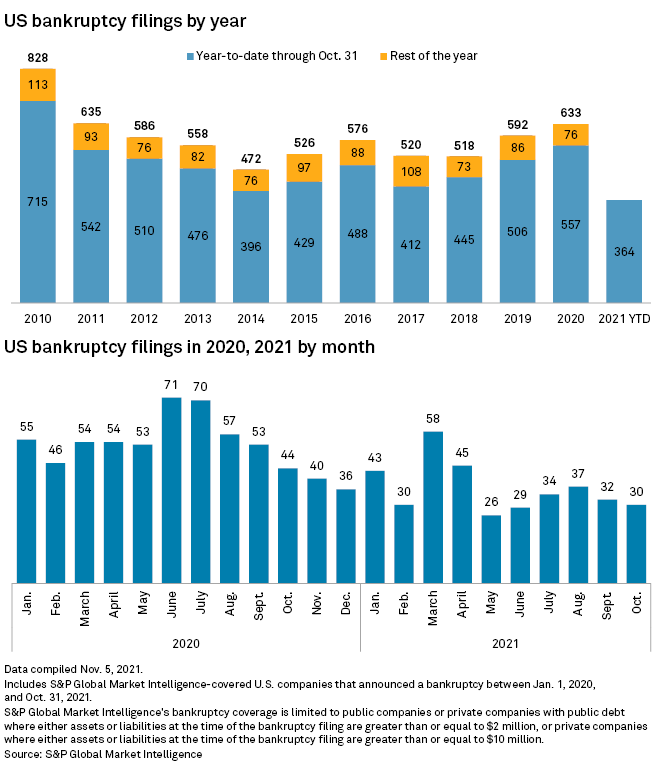

Corporate bankruptcies have fallen to historic lows this year, thanks to open capital markets and a flood of liquidity keeping businesses afloat through the pandemic. A total of 364 cases were filed in the first 10 months of 2021, lower than any of the prior 11 years and a drastic fall from the Great Recession era, when thousands of companies sought court protection each year.

Lemonade Inc.'s purchase of Metromile Inc. could accelerate merger activity in the U.S. insurtech space, given a string of lackluster stock performances from newly public startups. Another potential M&A catalyst is that still-private insurtech startups might want to sell rather than go public, fearing a tepid reception from public market investors.

Despite hot job market, millions reluctant to return to workforce

The U.S. unemployment rate fell to 4.6% in October, its lowest point since March 2020, but the labor participation rate — how many workers in the population are in the job market — remained at 61.6%.

— Read the full article from S&P Global Market Intelligence

US food prices soar with no end in sight

Grocery prices are on track to rise between 2.5% and 3.5% this year, largely driven so far by surging beef and veal prices, according to the U.S. Department of Agriculture's Economic Research Service. The agency forecasts prices will rise in 2022 by up to 2.5%.

— Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

18 US bank stocks traded at least 20% below analyst price targets in October

Meanwhile, eight U.S. banks and thrifts are already trading above analysts' consensus one-year price targets, as of Oct. 29, the last trading day of the month.

— Read the full article from S&P Global Market Intelligence

US banks taper securities buys in Q3 as some wait for higher rates

Cash built up at roughly twice the pace of securities in the third quarter among big U.S. banks as a slump in rates during the period kept many on the sidelines.

— Read the full article from S&P Global Market Intelligence

Several US banks continued to cut restaurant exposure in Q3

The majority of banks with outstanding exposure to restaurants of more than $100 million as of Sept. 30 recorded quarter-over-quarter decreases in their exposure, according to S&P Global Market Intelligence data.

— Read the full article from S&P Global Market Intelligence

Credit union-bank M&A wave stokes community bankers' animus

The growing friction between banks and credit unions presents a dilemma for selling banks: accept what could be the highest bid or take a principled stand against credit union offers.

— Read the full article from S&P Global Market Intelligence

US corporate bankruptcies reach new low in 2021

Low borrowing costs are helping companies avoid restructuring, but rising inflation could present challenges moving forward.

— Read the full article from S&P Global Market Intelligence

Insurance

Proposed roof rules could help Progressive stem rapid Florida homeowners growth

The insurer is seeking to reduce the share of residential property premiums it obtains from catastrophe-prone states like Florida and Texas after the business generated a 125.1% combined ratio through the first three quarters of 2021.

— Read the full article from S&P Global Market Intelligence

Credit and Markets

Fed's taper plan hammers odds of near-term interest-rate hike

The market has placed higher odds on a rate hike in summer 2022. The central bank, meanwhile, will be patient, Chairman Jerome Powell said.

— Read the full article from S&P Global Market Intelligence

US may be spared worst of global economic slowdown

Inflation, supply chain bottlenecks and the delta wave of the coronavirus have restrained global economic growth, but strong consumption means the U.S. is better positioned to rebound than others.

— Read the full article from S&P Global Market Intelligence

US House passes infrastructure package, sending bill to Biden's desk

The legislation, which the U.S. House of Representatives passed late Nov. 5, could ease permitting of major transmission projects and contains billions of dollars for grid infrastructure, electric vehicle deployment and hydrogen hubs.

— Read the full article from S&P Global Market Intelligence

Analysts and investors welcome GE breakup, see upside for energy spinoff

"This business possesses a unique offering with the world's most powerful wind turbines and most efficient gas turbines, as well as technology to modernize and digitize the grid," CEO Larry Culp said about the energy spinoff scheduled for 2024.

— Read the full article from S&P Global Market Intelligence

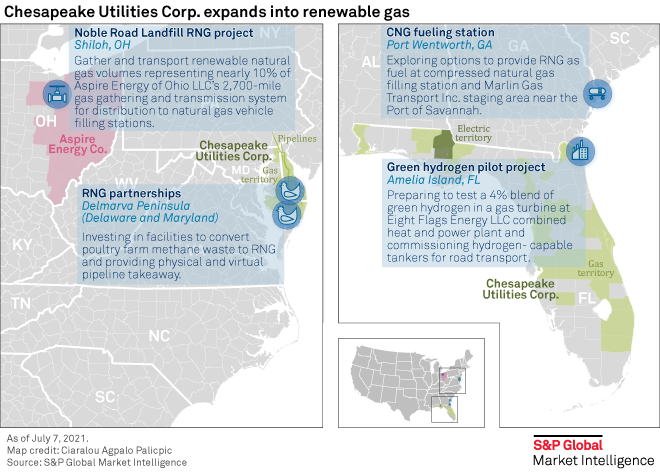

Gas utilities expand renewable natural gas project investments in Q3

U.S. gas distribution executives provided updates on existing renewable natural gas projects, announced new investments, and explained how they planned to enter the growing market for pipeline-quality biogas processed from methane waste.

— Read the full article from S&P Global Market Intelligence

Fintech

20 US fintech stocks traded at least 50% below analyst price targets in October

EverQuote Inc. had the greatest implied upside in the industry at 201.5% as of Oct. 29, the last trading day of the month.

— Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Solving labor, last-mile delivery key to Amazon's 1-day shipping ambitions

The company must finish building out last-mile capacity closer to customers' homes and attract workers to deliver goods within a one-day window.

— Read the full article from S&P Global Market Intelligence

Metals and Mining

EU's steel supply chain to face extra scrutiny under new US trade rules

A melt-and-pour policy in a recent U.S.-EU trade agreement over steel imports will be a crucial new requirement for steel products to achieve tariff-free status.

— Read the full article from S&P Global Market Intelligence

Lithium, nickel, uranium hits propel top Q3'21 small cap share price gains

The share price moves came amid strong base and energy metals markets, with prices for industrial metals on the climb in recent months.

— Read the full article from S&P Global Market Intelligence

The Week in M&A

Bank M&A 2021 Deal Tracker: 2 October megadeals send 2021 deal value above $58B

Read full article

Allegiance Bancshares, CBTX highlight benefits of scale in MOE; stocks pop

Read full article

Umpqua, Columbia deal could require divestitures in 9 counties

Read full article

Royal Bafokeng Platinum in deal with Northam as Impala's takeover collapses

Read full article

McAfee's going-private deal 'reasonable valued' in hot security M&A landscape

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @zackhale on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

The Big Picture.

Summarizing the key themes impacting companies and industries, around the world, in 2022.

[Reports] 2022 Outlook Reports - A look ahead to the key strategic trends and opportunities expected through 2022 and beyond.

[Webinar] The Big Picture: Outlook & Predictions for 2022

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.