Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 23 Nov, 2021

By Jasim Zahid

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

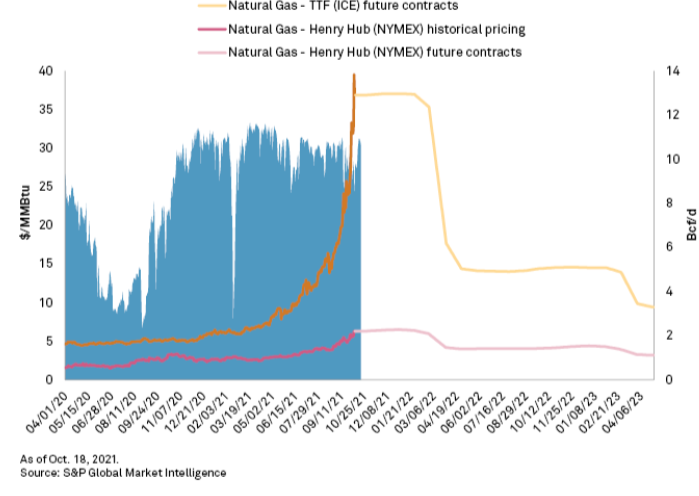

In this edition, we take a close look at the surge in U.S. LNG exports that has sent natural gas prices to their highest level in years amid a global energy crisis. World buyers are desperate to find available LNG cargoes, while natural gas experts say the U.S. may have reached an inflection point in its rise as an LNG producer. The increase in LNG contract activity has bolstered the prospects of export projects getting commercially sanctioned over the coming year, according to a Goldman Sachs forecast.

While inflation has surged to levels not seen in more than three decades, the government bond market seems to be buying the Federal Reserve's argument that inflation will not stick around. The Consumer Price Index, the market's preferred inflation metric, jumped 6.2% in October, the highest year-over-year increase since November 1990.

Venture capital investments in the U.S. financial technology space hit $9.33 billion in the third quarter, representing a 122% jump from the year-ago period, with banking technology and payment startups that derive revenues from interchange fees a big draw among investors.

High gas prices boost chances of US LNG projects getting built – Goldman Sachs

Analysts pointed to Cheniere and Venture Global projects as likely to advance. Both developers have benefited from an increase in LNG contracting activity amid a global gas crunch.

Read the full article from S&P Global Market Intelligence

Surging US LNG exports hike domestic gas prices amid global supply crunch

U.S. LNG shipments to world buyers are soaring amid a global natural gas shortage, but the impact on domestic U.S. prices has raised fresh questions about the role of gas exports.

Read the full article from S&P Global Market Intelligence

In-depth features looking at the impact of major news developments in key industries.

Banks reckon with potential deposit outflows as inflation heats up

Deposits have continued to grow rapidly, but a pivot by the Fed and a red-hot inflation report has the industry thinking about a reversal.

Read the full article from S&P Global Market Intelligence

High-yield savings products fall back in fintech-bank battle for market share

Large banks have been retreating from the battlefield of high-yield savings as competition for core retail customers has shifted toward prioritizing a full suite of products.

Read the full article from S&P Global Market Intelligence

As BNP Paribas explores sale of US unit, some raise doubts on Canadian buyers

The French bank is looking to sell Bank of the West, according to a media report that named Canadian banks among the potential suitors. But some analysts are skeptical the Canadian giants would be a good fit.

Read the full article from S&P Global Market Intelligence

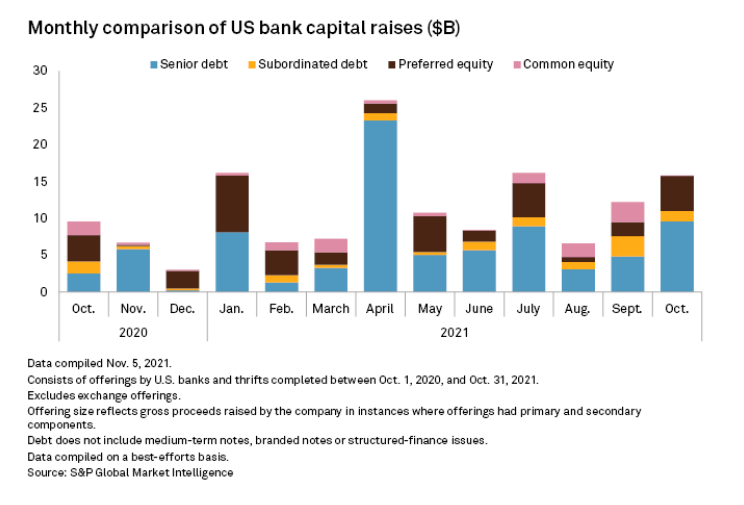

US banks' capital raises grew 29.4% in October

Capital raising by publicly traded U.S. banks was 65.4% higher in October than a year earlier, according to S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

Auto weakness apparent in historically large State Farm Q3 underwriting loss

State Farm's third-quarter combined ratio spiked to its highest point in a decade amid elevated losses in both the homeowners and auto business. While the former was not unexpected after Hurricane Ida made landfall, the latter is cause for concern.

Read the full article from S&P Global Market Intelligence

Reinsurers hit hard by catastrophes in Q3, look ahead to higher rates in 2022

Select global reinsurers posted revenue beats, but three of the biggest companies logged EPS misses, according to an S&P Global Market Intelligence analysis.

Read the full article from S&P Global Market Intelligence

New Fed trading restrictions raise enforcement doubts

The Federal Reserve is developing systemwide constraints on securities transactions, including restricting active trading, as observers question how they will be enforced.

Read the full article from S&P Global Market Intelligence

Bond investors unfazed, so far, by alarming inflation numbers

Consumer price index hits highest point since 1990, but long-term bond yields fall.

Read the full article from S&P Global Market Intelligence

Inflation to play role in Biden's Fed chair selection, analysts say

The ongoing rise in inflation may give Federal Reserve Chairman Jerome Powell a slight edge over other candidates as President Joe Biden mulls who he will pick to lead the central bank, analysts say.

Read the full article from S&P Global Market Intelligence

FERC hears support for transmission rule targeting renewable energy-rich zones

As part of its sweeping electric transmission rulemaking, the Federal Energy Regulatory Commission staff heard cautious support for a potential requirement that would lead to the identification of renewable energy zones throughout the U.S.

Read the full article from S&P Global Market Intelligence

New DOE office could help bridge 'valley of death' for clean energy technologies

The soon-to-be-enacted infrastructure bill from Congress will create a new Office of Clean Energy Demonstrations that could deploy hydrogen production and other cutting-edge technologies.

Read the full article from S&P Global Market Intelligence

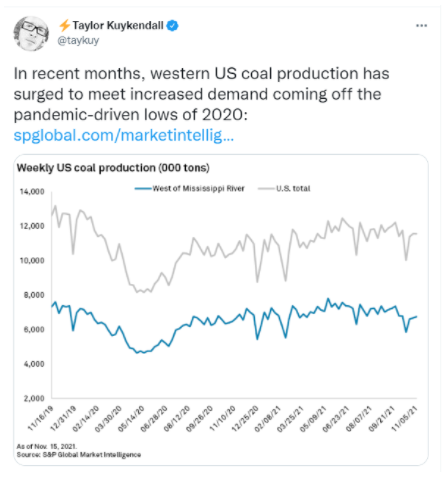

COP26 deal reached: Nations target coal, pledge more climate action in 2022

The Glasgow Climate Pact adds pressure on nations to quickly ramp up efforts to keep global temperatures from rising past 1.5 degrees Celsius from preindustrial levels, but it falls short on climate finance.

Read the full article from S&P Global Market Intelligence

Streaming adds heat to studio real estate market as ViacomCBS sheds assets

Competition for content production is driving up spending, and private real estate investment firms are finding a way to put money in the game.

Read the full article from S&P Global Market Intelligence

FTC nominee signals support for privacy rules, Big Tech regulations

If confirmed, Alvaro Bedoya is considered a key vote on pending enforcement action related to Big Tech mergers as well as privacy rulemaking.

Read the full article from S&P Global Market Intelligence

Algonquin could sell assets to fund Kentucky Power, transmission acquisition

Glencore's strategy shift opens door for Evolution's acquisition of Ernest Henry

European financial services M&A activity dips in October

—Read more on S&P Global Market Intelligence and follow @taykuy on Twitter.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Summarizing the key themes impacting companies and industries, around the world, in 2022.

[Reports] 2022 Outlook Reports - A look ahead to the key strategic trends and opportunities expected through 2022 and beyond.

Next in Tech | Episode 40: Tech goes to Space

Rahiel Nasir and Craig Matsumoto join host Eric Hanselman to look at how capabilities in space-borne technology are going beyond communications. Real time analysis of imaging data can help with everything from natural disaster response to freight logistics.

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.