Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 Jun, 2021

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn

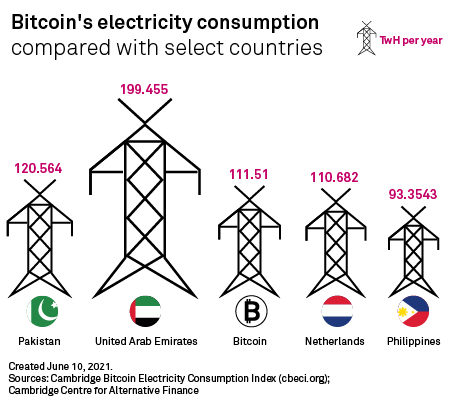

In this edition, we take a closer look at environmental concerns weighing on tariff talks and cryptocurrency investments. As U.S. and EU officials work to resolve differences on steel and aluminum duties, the Biden administration is facing pressure to keep measures in place to stem global excess capacity and resolve alleged market inequities. But with steel producers moving to build new assets that produce low- or zero-carbon steel, the industry trend toward green technology will mitigate any desire voiced by U.S. steel companies to stop new capacity from coming online abroad. Investment in bitcoin creates a similar dilemma for ESG-conscious investors, given that the bitcoin network's energy consumption is roughly the same as that of the Netherlands and a large portion of it is powered by coal. Some industry experts argue that there is a greener way to power the network, but not everyone is convinced.

The Biden administration's proposal to raise the capital gains tax is accelerating timelines for some banks. Since capital gains taxes are levied if a stock is sold, the higher tax rate could discourage all-cash deals. Deal advisers note that some sellers could demand higher prices to compensate for the higher tax bill and some bankers appear to be speeding up their timing to beat the tax change.

COVID-19 helped create a perfect storm of conditions that left U.S. hospitals and health systems distracted and more vulnerable to cyberattacks. Although hospitals are looking to invest more in cybersecurity after attacks rose during the pandemic, tight budgets and a shortage of IT professionals may slow those efforts.

Environmental concerns in Focus

Biden faces climate change conundrum in EU steel tariff talks

Resolving a dispute over steel import tariffs by the end of 2021 will be a "tall order," said American Iron and Steel Institute President and CEO Kevin Dempsey. The trade group is "skeptical" that a different trade measure sufficiently addressing overcapacity could be drafted by that deadline.

Read the full article from S&P Global Market Intelligence

Energy-hungry bitcoin poses questions for ESG-conscious institutions

Institutional investors have increasingly dipped their toes in the waters of cryptocurrency over the past year, but concerns have been raised about the environmental impact of mining bitcoin, which is heavily reliant on energy generated from coal.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Short sellers back off bets against financial sector stocks

Short interest in the financial sector dropped by nearly half from January 2020 to May 2021, according to the latest S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

Banks look to stress tests for green light on stock buybacks

This year's results will give another read on banks' relative vulnerability to another downturn, but regulators have said they expect most will be clear to make capital distributions at their discretion starting in the third quarter.

Read the full article from S&P Global Market Intelligence

Biden's proposed capital gains hike accelerating bank M&A timelines

Deal advisers say higher capital gains taxes could force sellers to elevate prices and may encourage more all-stock transactions rather than all-cash or cash-and-stock deals.

Read the full article from S&P Global Market Intelligence

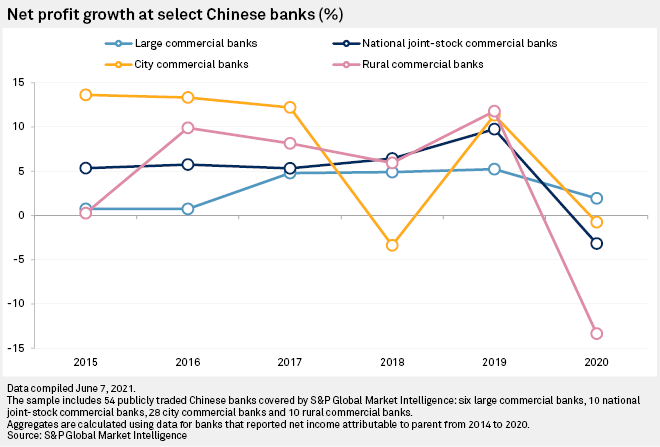

Chinese rural banks under growing pressure to consolidate amid sluggish earnings

Rural commercial banks in China took the strongest hit with a profit decrease of 14.17% in 2020, the steepest slump for the group in five years and the worst among the 54 listed Chinese banks tracked by S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

'If not us, who?' Cheniere leans into cleaning up natural gas supply chain

The efforts of the biggest U.S. LNG exporter to meet customer demand for greener LNG could be an important driver of the gas industry's path in the energy transition. The first challenge: measuring supply chain emissions.

Read the full article from S&P Global Market Intelligence

Canadian carbon-capture provider sees opportunity in smokestacks as levies climb

Delta CleanTech has seen a surge of interest in its carbon-capture and purification systems due to increased carbon levies.

Read the full article from S&P Global Market Intelligence

Healthcare

US hospitals scramble to bolster security as attacks increase amid pandemic

Cybersecurity attacks on U.S. hospitals and health systems rose dramatically during the pandemic, but tight budgets and a shortage of IT professionals are slowing efforts to invest more in prevention and response.

Read the full article from S&P Global Market Intelligence

ESG

ESG financing takes flight in North American oil, gas pipeline sector

"Midstream doesn't want to be left out in the cold like coal," S&P Global Ratings' Michael Grande said in an interview. "Equity markets are already closed for the most part, and the bond markets are not."

Read the full article from S&P Global Market Intelligence

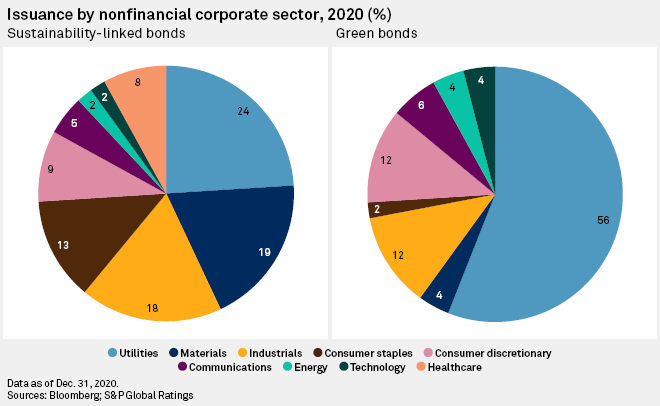

Sustainability-linked bonds in 'rapid growth' as more firms tap ESG debt market

The issuance of sustainability-linked bonds is expected to grow sixfold in 2021 as companies in a diverse range of sectors look to tap into the sustainable debt market.

Read the full article from S&P Global Market Intelligence

Insurance

Lloyd's insurer Inigo targeting up to $1.5B in premium for 1st phase

New Lloyd's of London insurer Inigo, which opened for business at the start of 2021, is aiming to write a gross written premium of between $1 billion and $1.5 billion in the first stage of its development, according to co-founder and CEO Richard Watson.

Read the full article from S&P Global Market Intelligence

Fintech

Wise's LSE float proposal bodes well for London's future as listing destination

Financial technology unicorn Wise's plans to float on the main market of the London Stock Exchange has sparked a debate among industry experts about the pros and cons of a dual-class share structure and whether direct listings could catch on in the U.K.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Prezi CEO expects video communication platforms to thrive beyond COVID-19

The explosive growth that video communication and collaboration platforms saw during the pandemic will not decline after schools and offices reopen, Prezi CEO Jim Szafranski predicted in an interview with S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

The Week in M&A

2 of North Carolina's largest community banks announce deals

Fintech M&A 2021 deal tracker: Full steam ahead for payments consolidation

Columbia Banking System will use deal as launch point for growth through M&A

The Big Number

Trending

Read the full article from S&P Global Market Intelligence and follow @seanlongoria on Twitter

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.