Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 13, 2021

No one would have been able to say that "today, we are better than where we were a year ago." As the not-very-distant memory of 2020 lingers in our minds, savings were obliterated, no vaccine in sight, cities under lockdown and schools canceled, an uncertain economic future, and no clear direction from the governments around the world. But with the acceleration of vaccine rollout, as well as the policy support from governments and central banks, people are starting to get a sense of increased security for both the overall economic environment as well as their personal health conditions.

As the global economy recovers, inflationary pressures are building, and price increases are moving downstream. In several markets, strengthening demand is causing more stress on pandemic-constrained supply and driving up prices. Our Materials Price Index (MPI) has surged 40% since mid-November 2020, reaching its highest level since early 2014. The inflation pressures are coming from all sides, including the disruption in the supply chain, resilience in consumer demand, and most importantly, support from governments and central banks.

First, suppliers have been playing catch up to the urgency of demand while navigating supply shortages and port congestions around the world. Global supply chains have remained disrupted in the second year of the pandemic.

Second, governments are rolling out massive fiscal support while central banks are pumping liquidity into the markets through zero interest rates and asset purchases. All these policy efforts could lead to overheating.

Third, household savings have surged in the past year, as consumers have been accumulating greater savings from governments' stimulus payment, tightening their belts in response to economic uncertainty, but also due to the simple fact that social isolation also meant isolating our wallets. As the pandemic subsides and pent-up demand for services is released, these savings, as well as substantial gains in equity and housing asset values, could drive a faster resurgence in consumer demand, therefore inflation, than forecast.

Here we provide two possible outlooks in our scenario analysis.

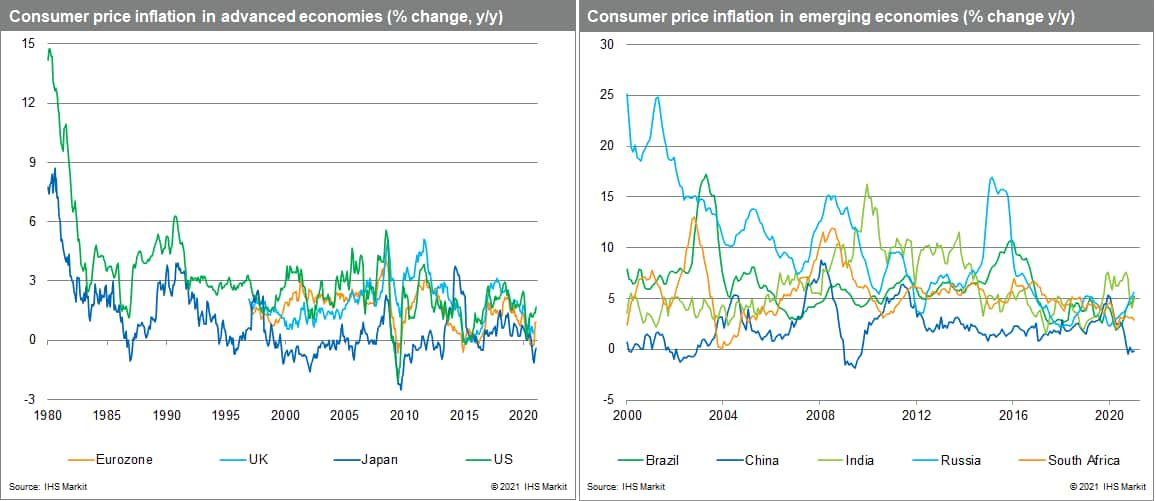

Baseline outlook: Moderate global growth and inflation with regional variations

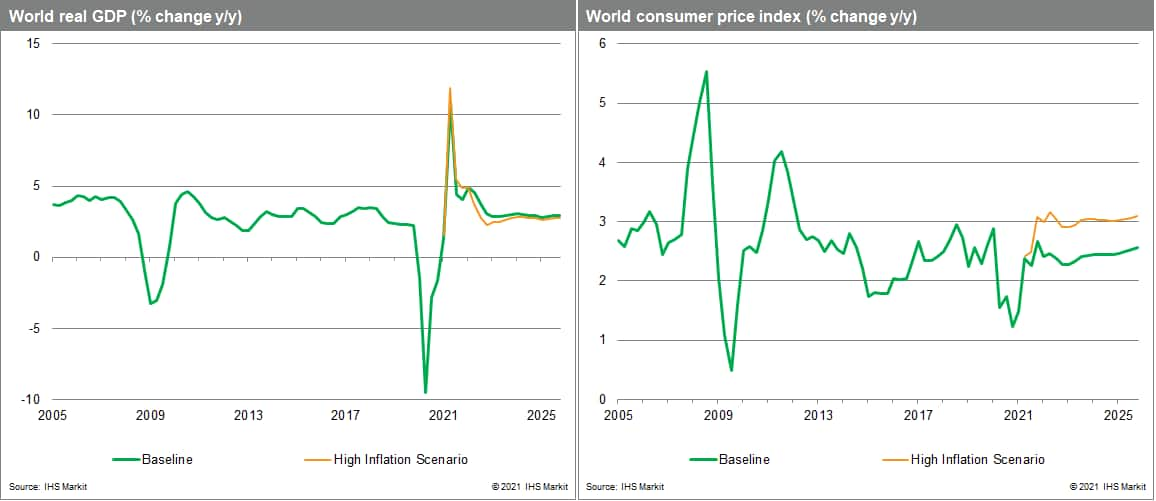

World real GDP is projected to advance 5.1% in 2021 and 4.3% in 2022 before settling to a more sustainable 3.1% growth pace in 2023-25. The United States and mainland China are leading the global expansion, while Europe and Latin America are lagging as countries struggle to contain the COVID-19 virus. As the global economic expansion gains momentum, year-on-year (y/y) price inflation will pick up, and increased commodity prices will be passed downstream through supply chains. Global producer prices will shift from a 1.0% decrease in 2020 to a 4.5% increase in 2021, while global consumer price inflation picks up from 2.1% in 2020 to 2.8% in 2021.

As supply conditions improve, pressures should ease in shipping rates and prices of lumber, iron ore, steel sheet, copper, and basic chemicals. Our MPI, which soared 58% y/y in Q1 of 2021, is projected to decrease 16% through Q1 of 2022. Crude oil prices will settle in the USD 60-65/barrel range as OPEC+ nations increase production to defend market share. The semiconductor market will remain tight into 2022 with significant upside potential for prices of commodity-grade chips. In most industries, however, available global capacity looks sufficient to meet projected demand in 2021 and 2022 if operating rates improve.

Agricultural commodity prices should follow a trajectory similar to the MPI, as US farmers plant record acreage of corn and soybeans in 2021 to replenish stocks and hence drive prices down. After a 26% y/y increase in Q1 of 2021, our Soft Commodity Price Index is projected to fall 12% in the next four quarters. With prices of industrial and agricultural commodities retreating from current levels, global consumer price inflation will ease to 2.4% in 2022.

The United States will lead a gradual acceleration in global prices in 2023-26. The unemployment rate will reach a low of 3.5% in mid-2023, triggering accelerations in wages and prices. Consumer price inflation will move above 2.0% in 2024 and reach 2.5% in 2026. On the other hand, inflation risks will remain low in both China and Europe. In China, consumer price inflation is projected at 1.5% in 2021. A rebuilding of pork supplies— depleted in 2020 by African swine flu— will restrain food prices. In Europe, core inflation should remain relatively low due to sluggish recoveries, slack labor markets, and subdued inflation expectations.

A "higher inflation" scenario

Using our Global Link Model, we developed an alternative scenario in which more resilient consumer demand and prolonged supply bottlenecks lead to a sharper acceleration in wages and prices than in the baseline forecast. This will inevitably lead to a more aggressive tightening of monetary policy by major central banks, thus cool down global economic growth in the long run.

In this scenario, global consumer price inflation averages 0.6% above the baseline inflation rate in 2022-25, and 0.5% higher in 2026-30. The new norm of inflation will become 3.0-3.5%, rather than 2.5-3.0%. By 2030, the global price level is 5.6% above its baseline path. While North America and Europe generally follow the global pattern, Latin America should experience more effects of inflation (8% above their baseline level in 2030), and Asia-Pacific less (only 4% above the baseline).

Global real GDP growth is nearly 6% in 2021, or 0.8% above the baseline forecast because of a quicker rebound in consumer spending. The trend is reversed in 2022, however, and growth becomes slower than in the baseline forecast through 2030. By the end of the decade, global real GDP is 1.0% below the baseline forecast.

The rise in consumer prices is a steady drain on household purchasing power. After an initial spurt in 2021, growth in real private consumption trails the baseline pace. The level of real consumer spending falls below its baseline path in 2024 and is 0.9% below the baseline forecast by 2030. US consumers are able to maintain their spending thanks to accumulated savings and gains in household net worth during the pandemic. In contrast, real spending by European households is 2.3% below the baseline forecast by 2030.

Conclusion

We believe that as the global economy recovers, inflation will pick up at a moderate pace. This is especially true as global competition, supply responses, and well-anchored long-term inflation expectations should limit the magnitude and duration of the price increase. But this does not mean we should not consider the economic implications if the inflation were higher than expected. It will entail a quicker economic rebound, which burns out faster due to central banks tightening monetary policy at a faster pace.

Posted 13 April 2021 by Derek Liu, Director of Economist Solutions, Economics & Country Risk, S&P Global Market Intelligence and

Jonathan Ablett, Executive Director, Global Economic Modelling Economics & Country Risk, S&P Global Market Intelligence