Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 13, 2021

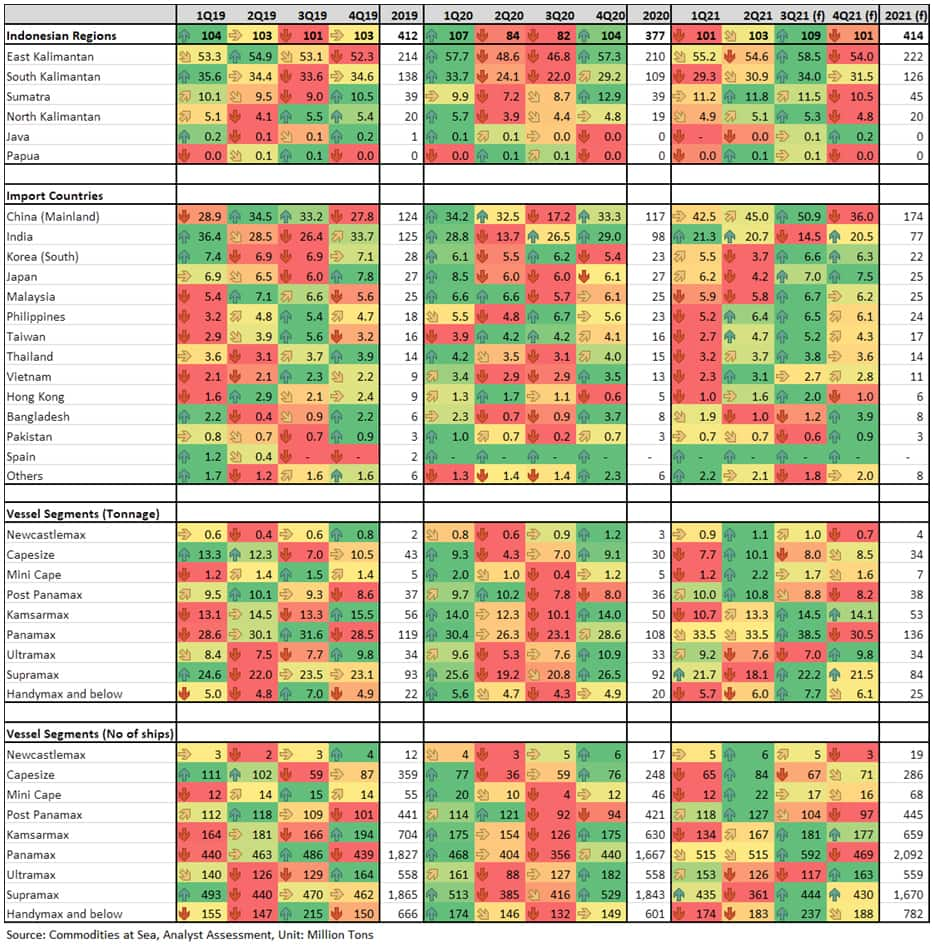

As per the IHS Markit's Commodities at Sea, Indonesian coal shipments during June 2021 stood at 35.3mt (up 25 percent y/y). In terms of regions, shipments from East Kalimantan, South Kalimantan, and Sumatra stood at 18.9mt (up 9 percent y/y), 11.0mt (up 56 percent), and 3.7mt (up 61 percent), respectively.

Renewed COVID-19 outbreaks are slowing the economic recovery in the country and putting pressure on fiscal shortfalls. However, there is an increase in taxes from coal exports due to an increase in international demand in addition to the surge in coal prices. As per the Ministry of Energy and Mineral Resources of Indonesia, the monthly benchmark coal price (HBA) basis, 6300 GAR surged further in July 2021 and announced at $115.35/t (highest since November 2011), up 15 percent m/m and 121 percent y/y. HBA prices after bottoming out in September 2020 have been on an upward trajectory driven by strong demand from China (Mainland) and lately from Japan and South Korea.

Indonesian coal shipments during June 2021, to Mainland China, which accounts for 53 percent of total Indonesian coal export, stood at 18.6mt (up 15 percent m/m, and 70 percent y/y). While shipments to India stood at 4.5mt (down 25 percent m/m and 14 percent y/y). Shipments to South Korea, Japan, Malaysia, and Taiwan stood at 1.5mt (up 20 percent m/m, but still down 13 percent y/y), 1.1mt (down 21 percent m/m, and 39 percent y/y), 2.2mt (up 22 percent m/m, and 31 percent y/y), and 1.9mt (down 13 percent m/m, and 7 percent y/y), respectively.

The surge in Indonesian coal shipments to Mainland China is an attempt by the utilities in the Mainland to build stocks ahead of peak season coupled with an ongoing informal ban on imports of Australian coal. Shipments to India declined as buyers increased their reliance on Australian thermal coal.

In terms of vessel demand, during June 2021, there were increased loadings on Newcastlemax (0.6mt, versus no shipment a year ago), Capesize (2.3mt, up 99 percent y/y), Mini Cape (0.8mt, up 717 percent), Kamsarmax (5.2mt, up 14 percent), Panamax (12.6mt, up 30 percent), and Supramax (6.7mt, up 12 percent). Shipments declined on Post Panamax (2.9mt, down 7 percent y/y) and Ultramax (1.8mt, down 5 percent).

Overall, during the first six months of 2021, Indonesian coal shipments stood at 203.2mt (up 6 percent y/y). In terms of regions, shipments from East Kalimantan, South Kalimantan, and Sumatra stood at 109.9mt (up 3 percent y/y), 60.2mt (up 4 percent), and 23.0mt (up 35 percent), respectively.

In terms of major destinations, during 1H2021, there was an increase in shipments only to Mainland China (87.5mt, up 31 percent y/y) and Taiwan (11.6mt, up 12 percent); while declined to Japan (10.5mt, down 28 percent), South Korea (9.1mt, down 21 percent) and Malaysia (11.7mt, down 11 percent). Shipments to India were mostly flat and at almost previous year levels of 42.0mt.

In terms of vessel segment, during the first half of 2021, there was a surge in loadings on Panamax (67mt, up 18 percent), and Capesize (17.8mt, up 31 percent). Indonesian coal shipments declined on Kamsarmax and Supramax, which stood at 24.1mt (down 8 percent y/y) and 39.8mt (down 11 percent), respectively.

Short-Medium term outlook

For the first 10 days of July 2021, Indonesian coal shipments stood at 17.6mt (52.9mt on a 30-Day basis, up 93 percent y/y). In terms of exporting regions, on a 30-day basis, East Kalimantan, South Kalimantan, and Sumatra stood at 30.4mt (up 92 percent y/y), 15.8mt (up 116 percent), and 4.6mt (up 69 percent), respectively. The calculated PACE is quite high and is expected to slow down in the remaining days of the month.

Indonesian coal shipments for July 2021 are forecast at 38.4mt, with shipments to Mainland China, India, South Korea, and Japan are calculated at 19.5mt, 4.5mt, 2mt, and 2.2mt, respectively. Indonesian coal shipments to Mainland China have remained quite strong as domestic supply is reported to be below levels as the country enters the peak summer season. Lately, there are reports of strong electricity demand in Mainland China due to high temperatures.

For 3Q21 and full 2021, Indonesian coal exports are forecast at 109mt (up 33 percent y/y) and 414mt (up 10 percent y/y), respectively. In terms of imports countries during 3Q21 and 2021, shipments to Mainland China, India, South Korea, and Japan are forecast at 50.9mt/174mt, 14.5mt/77mt, 6.6mt/22mt, and 7mt/25mt, respectively.

Minister of Finance Sri Mulyani Indrawati on 28 June 2021 presented to parliament major amendments to Indonesia's main tax law to increase government revenue and reduce greenhouse gas emissions. The government's amendments to the General Principles of Taxation bill proposed an increase to the rate and scope of value-added tax (VAT), a new carbon tax, an increase to the top-rate of personal income tax, and the introduction of another round of the tax amnesty program.

The bill proposes a minimum carbon tax rate of IDR75 (USD0.0052) per kg of CO2 equivalent of emissions. The bill only stipulates that a carbon tax shall apply to goods that contain carbon or activities that produce carbon emissions. The sectors to be taxed and the rate that will be imposed on specific goods and industries will be elaborated in government regulation on carbon pricing that is currently being drafted and through further ministerial-level regulations. Associations representing coal, petrochemical, and cement industries are opposed to the carbon tax. Although they are unlikely to be able to stop its imposition on their sectors, they will probably seek a lower rate and exemptions or delay its implementation at least until the COVID-19 pandemic is better controlled.

Indonesia coal shipments - Quarterly Forecast

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 13 July 2021 by Pranay Shukla, Research and Analysis Director, Refining Chemicals And Resources Solutions, S&P Global Commodity Insights

How can our products help you?