Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 02, 2023

By Rajiv Biswas

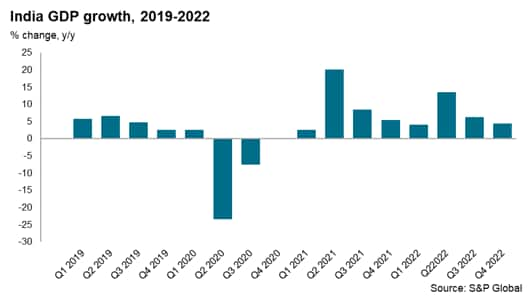

The Indian economy has shown sustained economic expansion in the 2022 calendar year, with real GDP growth for the Fiscal Year (FY) 2022-23 estimated at 7.0% by India's National Statistics Office. India's GDP growth rate moderated to a pace of 4.4% year-on-year (y/y) in the October to December quarter of 2022, compared with a growth of 6.3% y/y in the July to September quarter.

India has become an increasingly attractive location for multinationals across a wide range of industries, with foreign direct investment inflows (FDI) reached a new record high of USD 85 billion in the 2021-22 fiscal year. Foreign direct investment inflows into the manufacturing sector rose by 76% y/y in 2021-22, reaching level of over USD 21 billion.

According to the Second Advance Estimates of National Income for 2022-23 released by India's National Statistics Office, the GDP growth rate for the fiscal year (FY) 2022-23 is estimated at 7.0% compared with 9.1% in FY2021-22.

Compared with the previous quarter, GDP grew by 3.5% quarter-on-quarter (q/q) in the October to December quarter, boosted by strong growth of private consumption. Private final consumption expenditure grew by 7.3% q/q in the October to December quarter of 2022, albeit up only 2.1% y/y, reflecting high base year effects from the traditional Diwali festival season boost to consumption spending.

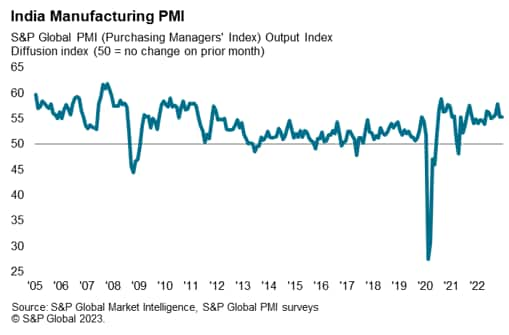

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers' Index was at 55.3 in February 2023, little-changed from 55.4 in January and signalling continued strong expansion in the manufacturing sector. The headline figure was also above its long-run average of 53.7.

Latest data on key economic indicators continue to show strong momentum in many sectors of the economy. Steel consumption rose by 13.5% y/y in the October to December quarter and was up 11.9% y/y in the first nine months of FY2022-23. Similarly, production of cement rose by 9.9% y/y in the October-December quarter, and was up by 10.6% y/y in the first nine months of FY2022-23. Sales of commercial vehicles increased by 16.6% y/y in the October-December quarter and was sharply higher for the first nine months of FY2022-23, rising by 46.4% y/y.

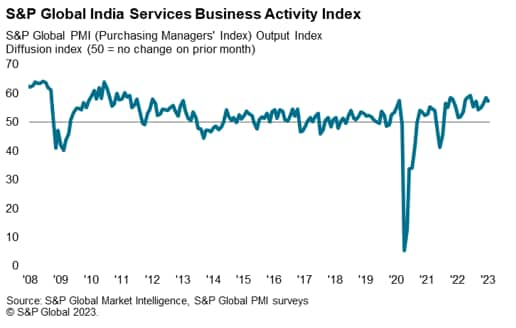

Posting 57.2 in January, the seasonally adjusted S&P Global India Services PMI Business Activity Index signalled an eighteenth successive monthly rise in output. Despite easing from 58.5 in December 2022, the latest figure remained above its long-run average (53.5) and indicated a strong rate of economic expansion. The upturn was associated with favourable demand conditions and ongoing increases in new work.

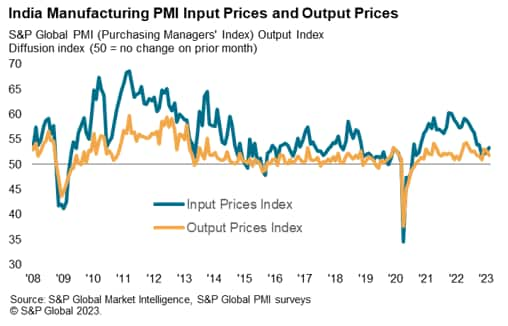

Input costs in the manufacturing industry continued to rise in February according to the latest S&P Global Manufacturing PMI survey, with firms mentioning higher prices for electronic components, energy, foodstuff, metals and textiles. Despite quickening to a four-month high, the rate of input price inflation was below its long-run average and among the most moderate pace of increases in over two years. Some firms opted to pass cost increases through to clients by lifting their selling prices, while the vast majority (94%) left their fees unchanged in attempts to boost sales. Overall, factory gate charges rose at a modest pace that was the slowest in three months and below the long-run series average.

Services companies noted a further increase in their input costs during January 2023, which they attributed to higher costs for a wide range of materials, food and wages. Whilst remaining above its long-run average, the rate of manufacturing input price inflation softened to a two-year low. Similarly, prices charged for the provision of services rose at a softer pace in January. The latest rise was the slowest since March 2022 and below the average seen since the survey started in December 2005.

Latest statistics on India's Consumer Price Index showed that the headline CPI inflation rate rebounded in January 2023 to a pace of 6.5% y/y, after having eased to 5.7% y/y in December 2022, which was the lowest since December 2021.

A key factor contributing to the upturn in the CPI inflation rate was the Food and Beverages CPI sub-index, which rose at a pace of 6.2% y/y in January 2023, compared with 4.6% y/y in December 2022. High energy prices have continued to contribute to India's CPI inflation pressures, with the fuel and light sub-index showing an increase of 10.8% y/y in January 2023.

The Monetary Policy Committee (MPC) of the Reserve Bank of India decided to raise the policy repo rate by 25 basis points to 6.50 per cent at its meeting on 8th February, following an earlier rate hike of 35bps at its meeting on 7th December. The January 2023 CPI inflation reading has pushed headline CPI inflation slightly above the upper end of RBI's medium-term target range for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent. Looking ahead, the MPC had also decided at its February meeting to remain focused on further withdrawal of monetary policy accommodation to ensure that inflation remains within the target going forward, while supporting growth. The latest upturn in CPI inflation has increased the probability of a further rate hike by the RBI.

The RBI in its February Monetary Policy Statement projected CPI inflation for the current fiscal year 2022-23 at 6.5% y/y, assuming an average crude oil price of US$ 95 per barrel. CPI inflation is projected to moderate to 5.3 per cent for the fiscal year 2023-24. The near-term trajectory of CPI inflation was projected in the RBI Monetary Policy Statement at 5.7 per cent in the January-March quarter of 2023. CPI inflation for the April to June quarter of 2023-24 is projected at 5.0 per cent and at 5.4 per cent for the July-September quarter, based on the assumption of a normal monsoon.

Net new foreign direct investment into India has risen very rapidly in recent years, with FDI reaching a new record level of USD 85 billion in the 2021-22 fiscal year, after inflows of USD 82 billion in the 2020-21 fiscal year. This compares with FDI inflows of just USD 4 billion in the 2003-04 fiscal year. Rapid growth in FDI inflows has been evident over the past decade, with technology-related FDI having become an important source of investment. The Computer Software and Hardware sector was the largest recipient of foreign direct investment equity inflows in the 2021-22 fiscal year, at around 25% of the total inflows.

US technology firms have been a key source of recent FDI inflows into India. In 2020, Google established the "Google for India Digitization Fund", through which it announced plans to invest USD 10 billion into India over seven years through a mix of equity investments, partnerships, and operational, infrastructure and ecosystem investments. Also in 2020, Facebook announced an investment of USD 5.7 billion in Jio Platforms, owned by Reliance Industries Limited.

Infrastructure investments have also been an important sector for FDI inflows. A large FDI deal in 2020 was the USD 3.7 billion investment by Singapore's GIC and Canada's Brookfield Asset Management in the acquisition of Tower Infrastructure Trust, which owns Indian telecom towers assets.

In the 2020-21 fiscal year, FDI from Saudi Arabia also rose sharply, reaching USD 2.8 billion. Saudi Arabia's Public Investment Fund acquired a USD 1.5 billion stake in Jio Platforms and a USD 1.3 billion stake in Reliance Retail in 2020.

Reliance Retail also received investment from other foreign firms in 2020, with Singapore's GIC and TPG Private Capital having invested a combined amount of USD 1 billion, while US private equity firm Silver Lake Partners also invested USD 1 billion.

The rapid growth in numbers of Indian unicorns (start-ups that have achieved a valuation of over USD 1 billion) over the past five years has also become a major focus for foreign direct investment inflows into India. By September 2022, there were 107 Indian unicorns, with 44 of these having reached unicorn status within the 2021 year and 22 in the 2022 year-to-date, according to Invest India, the National Investment Promotion & Facilitation Agency. The 2023 Budget has proposed new fiscal measures to assist startups, by extending the period that startups can carry forward and set off losses over the first ten years of incorporation.

Indian start-up firms have attracted large-scale foreign direct investment from global venture capital and private equity firms such as Blackstone and Sequoia Capital. Japan's SoftBank has been a leading global investor in Indian tech start-ups, having invested over USD 14 billion into Indian firms over the past decade, with an estimated USD 3 billion of new FDI in calendar 2021.

Electronics sector investment

As in many other auto manufacturing hubs worldwide, global semiconductors shortages caused significant disruption to Indian auto production in 2021-22, constraining new auto output and sales. With India still highly reliant on imported chips, the Indian government announced a large new incentive package of USD 10 billion in December 2021, to try to encourage the development of semiconductors and display manufacturing in India. The new incentive scheme will provide 50% financial support for the cost of establishing new semiconductors fabrication and packaging plants as well as display plants in India. Many major international electronics firms have commenced initial discussions about establishing production facilities in India. India already has strong capabilities in semiconductor design, with an estimated 24,000 design engineers working in India. The federal government will work with state governments in order to establish high-tech clusters for semiconductor fabs and display fabs.

India has already made considerable progress in developing its domestic electronics manufacturing industry over the past decade, with total electronics manufacturing estimated to have risen from USD 30 billion in 2014-15 to USD 75 billion in 2019-20. The growth in electronics exports has been helped by rapid growth in exports of mobile phones as major global electronics firms have rapidly expanded their production of mobile phones in India. India's mobile phone exports rose from USD 0.2 billion in the fiscal year 2017-18 to USD 3.2 billion in the 2020-2021 fiscal year, rising further to USD 5.5 billion in the 2021-22 fiscal year.

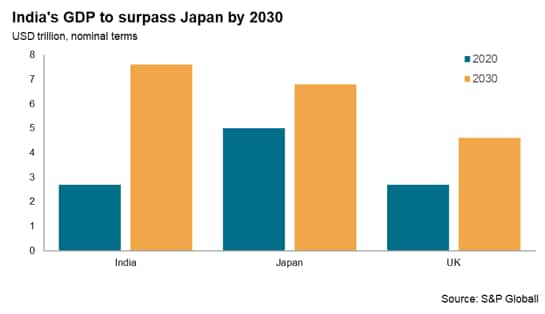

The acceleration of foreign direct investment inflows into India over the past decade reflects the strong long-term growth outlook for the Indian economy. India's nominal GDP measured in USD terms is forecast to rise from USD 3.2 trillion in 2021 to USD 7.6 trillion by 2030. This rapid pace of economic expansion would result in the size of the Indian GDP exceeding Japanese GDP by 2030, making India the second largest economy in the Asia-Pacific region. By 2030, the Indian economy would also be larger in size than the largest Western European economies, notably Germany, France and the United Kingdom.

The long-term outlook for the Indian economy is supported by a number of key growth drivers. An important positive factor for India is its large and fast-growing middle class, which is helping to drive consumer spending. The rapidly growing Indian domestic consumer market as well as its large industrial sector have made India an increasingly important investment destination for a wide range of multinationals in many sectors, including manufacturing, infrastructure and services.

The digital transformation of India that is currently underway is expected to accelerate the growth of e-commerce, changing the retail consumer market landscape over the next decade. This is attracting leading global multinationals in technology and e-commerce to the Indian market.

By 2030, 1.1 billion Indians will have internet access, more than doubling from the estimated 500 million internet users in 2020. The rapid growth of e-commerce and the shift to 4G and 5G smartphone technology will boost home-grown unicorns like online e-commerce platform Mensa Brands, logistics startup Delhivery and the fast-growing online grocer BigBasket, whose e-sales have surged during the pandemic.

The large FDI inflows to India that have been evident over the past decade have continued with strong momentum during 2021 and 2022. This is being boosted by large inflows of investments from global technology MNCs such as Google and Facebook that are attracted to India's large domestic consumer market, as well as a strong upturn in foreign direct investment inflows from manufacturing firms.

Overall, India is expected to continue to be one of the world's fastest growing economies over the next decade. This will make India one of the most important long-term growth markets for multinationals in a wide range of industries, including manufacturing industries such as autos, electronics and chemicals to services industries such as banking, insurance, asset management, health care and information technology.

Access the full press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.