Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 09, 2025

By Sean DeCoff

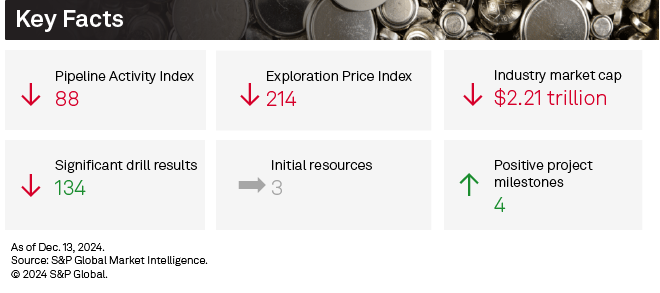

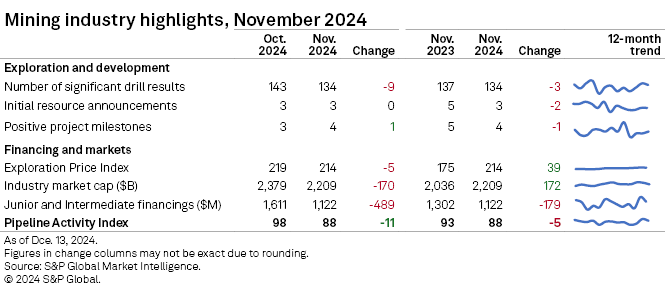

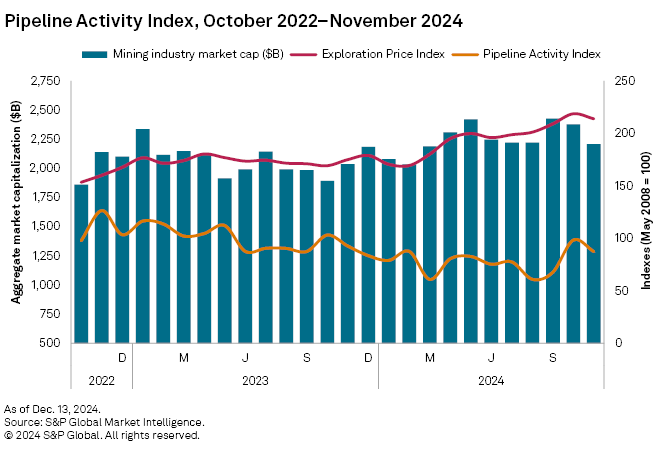

The S&P Global Market Intelligence Pipeline Activity Index (PAI) pulled back in November, decreasing 11% to 88 from 98 in October. The gold PAI declined 11% to 118 from 133, while the base/other PAI was down 11% to 63, compared to 71 in October.

The metrics used to calculate the PAI were again mostly negative in November. Significant drill results and financings decreased, while positive milestones increased and initial resources remained flat month over month. The Exploration Price Index (EPI) pulled back slightly from the record high. The precious and base/other metal sell-off in the month impacted mining equities, which equated in the aggregate industry market cap declining 7%.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel databook.

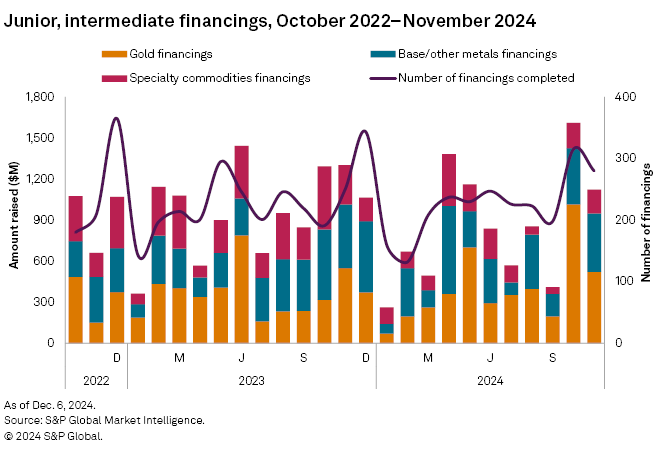

November financings retreat but still above $1B

Fundraisings by junior and intermediate companies fell 30% to $1.12 billion in November, following a peak in transactions and high-value financings in October, when total funds raised reached its highest level since March 2022. Despite this month-over-month decline, November financings exceeded those of the previous quarter, as junior companies continued to secure funds for their winter programs.

The total number of transactions decreased to 280 from 315 in October, while the number of significant financings — transactions valued at more than US$2 million — fell to 75 from 97. There were four transactions valued at over US$50 million, down from five in October.

Gold financings experienced the largest decline among the three commodity groups, dropping 49% to $522 million in November, after peaking at $1.02 billion in October. The number of funds raised fell to 137 from 177, and the number of significant financings decreased to 36 from 59. Two transactions were valued at more than $50 million, the same as in October.

Funds raised for the base/other metals group rose for the second consecutive month, up 4% to $428 million — the group's highest total in seven months. This growth was fueled by a 50% increase in silver financings to $111 million, alongside higher nickel financings, which effectively offset an 18% decline in copper financings. The number of transactions rose to 78 from 70, and there were two transactions valued at more than $50 million, unchanged from October.

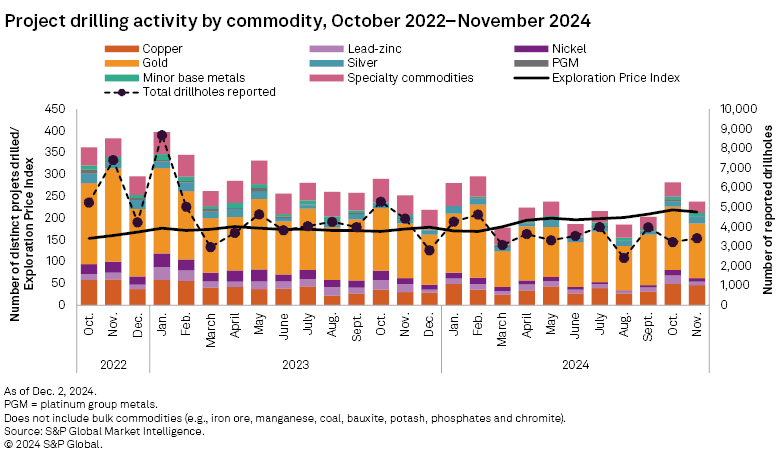

Drilling metrics decline overall amid jump in drillholes

Drilling metrics went down in November, driven by the total projects drilled decreasing across all commodities. The total number of holes drilled, however, was up 6% due to increases in gold, silver and specialty metals. The total number of companies reporting also dropped 12% to 223. Drilling decreased across all stages: early-stage projects declined 8% to 90 projects drilled, late-stage projects were down 14% to 116 and minesite projects fell 35% to 32.

November's top result came from Australian Securities Exchange-listed Contango Ore Inc.'s Johnson Tract advanced-stage gold project in Alaska. The company reported an intersect of 223.5 meters grading at 8.89 grams of gold per metric ton, 6.06 g/t silver, 0.45% copper, 4.42% zinc and 0.88% lead. The company has announced that it is planning its programs for 2025, with a focus on advancing the Johnson Tract project toward feasibility and mine development.

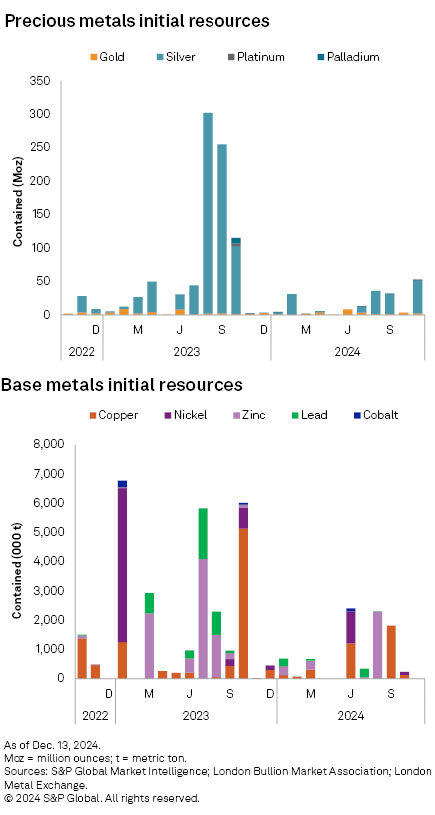

Initial resource announcements flat

Three initial resource announcements were made in November, comprising two for gold-focused projects and one for a copper-nickel project.

Fredonia Mining Inc. announced an initial mineral resource estimate for its El Dorado Monserrat gold project in Argentina. The total measured and indicated resource estimate shows 81.35 million metric tons, grading 0.61 g/t Au and 18.76 g/t Ag, bringing the total contained gold to 1.593 million ounces and 49.1 Moz silver.

The second gold-focused announcement came from Far East Gold Ltd. for its Idenburg gold project in Indonesia. The company reported an inferred resource estimate of 540,000 ounces of gold at 4.1 g/t Au and 468,000 ounces of silver at 3.6 g/t Ag at the project.

The copper-nickel announcement came Premium Resources Ltd., which announced an inferred Mineral Resource Estimate for its Selkirk project in Botswana. The estimate totaled 44.2 MMt at 0.30% Cu and 0.24% Ni for a contained total of 132,000 metric tons of copper and 108,000 metric tons of nickel.

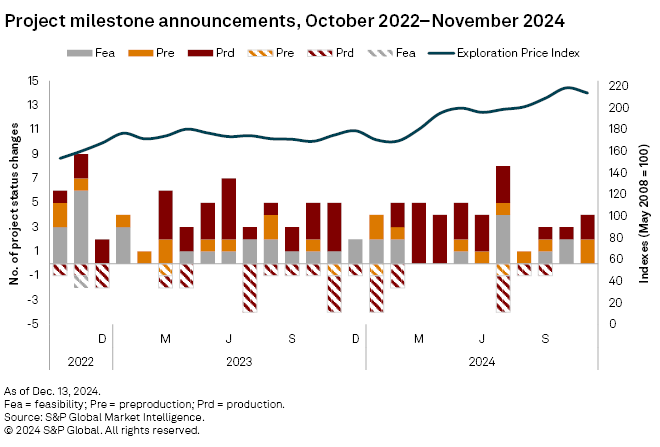

Positive milestones increase by 1

Four positive milestones were registered in November — three for gold-related and one for silver-related projects — one more than in October. Three project milestones were production-related, and one was pre-production-related. There were no negative milestones recorded in November.

The first milestone came from Equinox Gold Corp., which announced that its Greenstone gold mine in Ontario reached commercial production. Aya Gold & Silver Inc. also announced a production milestone, with ore processing commencing at its Zgounder silver mine plant in Morocco. The third production milestone came from Amaroq Minerals Ltd., which announced the first pour at its Nalunaq gold mine in Greenland.

The pre-production milestone came from Patagonia Gold Corp., which announced it received a full and final permit to begin construction at its Calcatreu gold-silver project in Argentina.

Exploration Price Index pulls back slightly

S&P Global Market Intelligence's EPI lost steam in November, coming in at 214, slightly below the record 219 in October. The gold average was down 1.4% month over month, while other precious metals experienced more significant declines, with silver down 3.9% and platinum down 3.6%. Base metals also posted sizable declines — down 6.1% for nickel, 4.7% for copper, 3.2% for zinc and 0.7% for molybdenum — while cobalt was flat month over month.

The EPI measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Equity values sold off

The broad range price pullback directly impacted mining equities valuation. Market Intelligence's aggregate market capitalization of the 2,673 listed mining companies decreased 7.1% to $2.21 trillion from $2.38 trillion in October.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.