Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 03, 2023

Business prospects for the year ahead rose in January to the highest since comparable data were first available in 2012, as looser COVID-19 restrictions in mainland China fuelled expectations of faster economic growth. Current output growth also accelerated, buoyed by resurgent demand from the mainland.

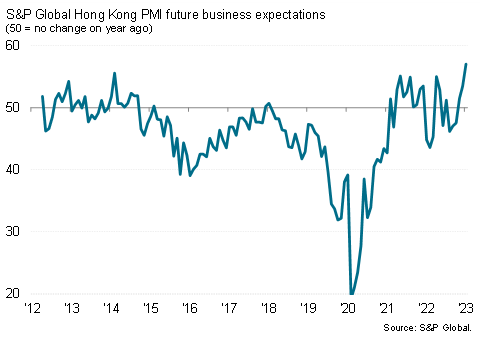

January saw business confidence hit an all-time high. S&P Global's Purchasing Managers' Index (PMI) surveys generally track actual changes in business metrics such as output, employment and prices. But the surveys also include a question on how companies expect their output to fare over the coming year, adding a subjective perspective to the survey findings. Not only did January's survey see the number of optimists about the coming year exceed pessimists for the third month in a row, but the overall degree of optimism hit the highest since comparable data for Hong Kong SAR were first available in 2012.

Hong Kong SAR output expectations

Driving the upturn in sentiment was an expectation that business conditions will improve in Hong Kong on the back of the recent relaxation of COVID-19 restrictions in mainland China. Indeed, the impact of the reopening was already evident in January. Business output rose at the start of the year at the sharpest rate since last July, building on a marginal return to growth recorded in December.

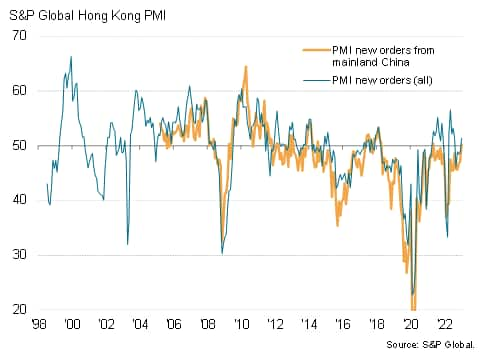

Higher activity levels were buoyed by the first increase in new orders since last August. This improvement in demand was in turn driven by a steadying in new business received from the Chinese mainland, which rose marginally in January. While such a marginal improvement may not sound overly encouraging, business from the mainland has been in decline over much of the past decade, according to the PMI respondents. In fact, new business from the mainland has risen only once before since April 2018 (in May 2021), underscoring how unusual the January rise in business has been by recent historical standards.

Hong Kong SAR orders from mainland China

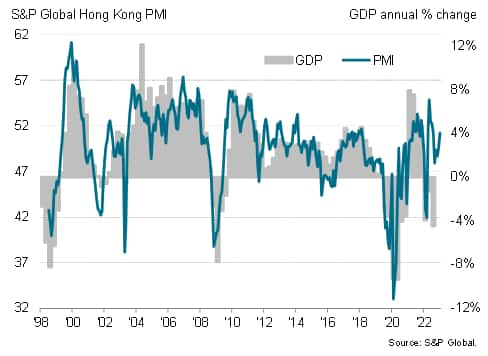

The latest PMI data therefore point to the economy recovering at the start of 2023 after the damaging impact of the Omicron COVID-19 wave late last year. Since the PMI was first compiled for Hong Kong in 1998, it has exhibited a correlation of 83% in the two decades leading up to the pandemic, with the PMI leading changes in GDP growth by two months, while also being published several months ahead of the GDP data.

The latest rise in the headline PMI, from 49.6 in December to a five-month high of 51.2 in January, is broadly commensurate with GDP growing at an annual rate of 4%, with the forward-looking business expectations and new orders indices boding well for this recovery to gain steam in the months ahead.

Hong Kong SAR economic growth

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.