Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Mar, 2017 | 08:45

By Nick Wright

Highlights

S&P Global Market Intelligence's Mined Supply: Gold quarterly report reviews and analyses activity in the gold mining sector, from exploration through to production. Highlights from the latest edition are below.

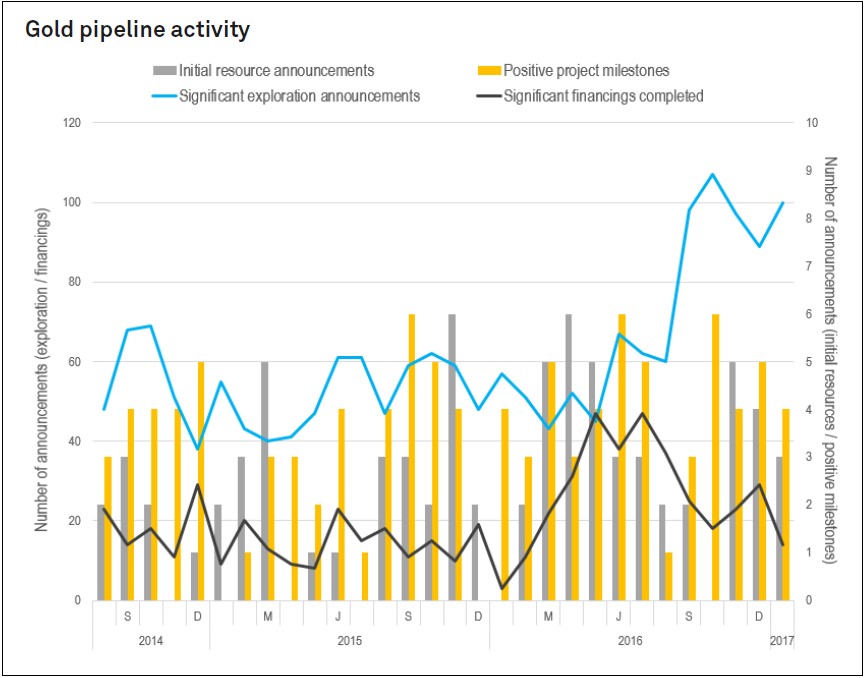

The past year was one of guarded optimism for the gold market, with a strong first half tempered by a volatile last few months. Despite the turmoil, preliminary production results for the December quarter supported relatively stable quarterly mine supply year-over-year (up 1%). We estimate that gold production in the fourth quarter of 2016 was roughly 24 Moz. This was about 2% less than the previous quarter (25 Moz).

In 2016, many major gold producers started to reap the rewards of their persistent efforts to reshape their companies. Higher ore throughput, higher-grade ore and a rebounding gold price were all positive factors for gold producers. As a result, many returned to profitability in the year, or at least narrowed their losses significantly.

Stay on course with our insights:

Download the snapshot by completing the form, or learn more about our global metals and mining solution.