Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Jun, 2016 | 08:30

Despite the gradual recovery of global gold prices so far this year, during the first quarter of 2016 most gold producers continued their efforts to reduce all-in sustaining costs (AISC). The major producers of gold gained an added advantage due to strengthening of the U.S. dollar against local currencies and lower global fuel prices.

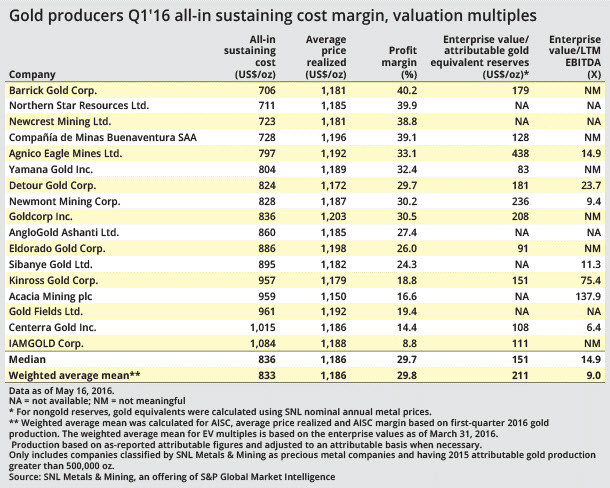

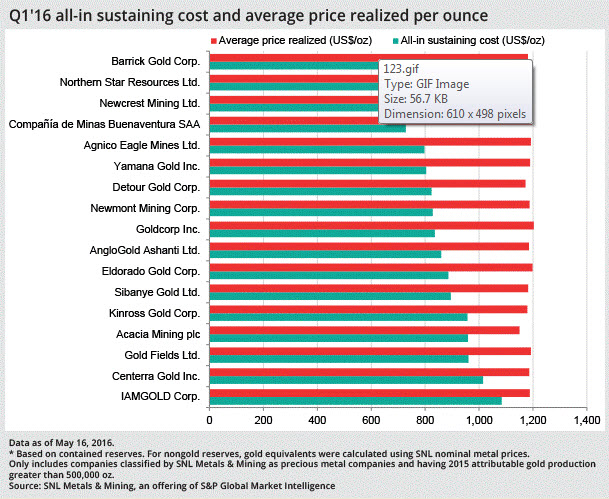

The top 17 publicly listed gold companies that reported AISC produced gold at a weighted-average cost of US$833 per ounce in the first quarter, according to data from SNL Metals & Mining, an offering of S&P Global Market Intelligence.

NYSE-listed Barrick Gold Corp. had the quarter's lowest AISC at US$706 per ounce of gold produced, US$130 per ounce less than the group median of US$836 per ounce. Barrick primarily benefited from operating and capital-cost control initiatives, and from lower fuel prices andforeign exchange gains.

Northern Star Resources Ltd. was next lowest with an AISC of US$711 per ounce. The March quarter AISC was a 5% decline from the previous quarter and a 30% drop from the year-ago quarter, mainly attributable to lower contracting, labor and supply rates that became effective Jan. 1, 2016.

Newcrest Mining Ltd. achieved the third-lowest AISC at US$723 per ounce sold on a consolidated weighted basis. The quarter's low cost was attributed to high production at the Cadia Hill mine and a significant decrease in AISC at the Hidden Valley mine. At the end of the first quarter, Newcrest revised its AISC guidance range for fiscal 2016 to US$1.88 billion to US$1.98 billion from US$1.90 billion to US$2.05 billion previously.

At the other end of the scale, Canada-based IAMGOLD Corp. reported the highest AISC compared with its peers, at US$1,084 per ounce of gold sold. Although the company's March quarter AISC was 3% lower than the year-ago quarter, it was high compared with its peers due to an increase in sustaining capital and lower sales.

Other companies with high AISC were Centerra Gold Inc. and Gold Fields Ltd., with AISC of US$1,015 per ounce and US$961 per ounce respectively.

Comparing gold producers based on first-quarter profit margin, Barrick Gold again led the pack with a margin of 40.2%, well above the group's weighted average of 29.8%. Northern Star Resources Ltd. and Compania de Minas Buenaventura SAA also stood out with a margin of 39.9% and 39.1% respectively.

Again at the bottom of the scale, IAMGOLD had by far the lowest profit margin at 8.8%, or US$104 per ounce. Centerra Gold and Acacia Mining plc recorded the second- and third-lowest profit margins compared with the group at 14.4% and 16.6%, respectively.

Comparing companies based on the ratio of enterprise value-to-gold equivalent reserves, the group traded at a weighted average of US$211 per ounce in the first quarter. Yamana Gold Inc. traded at US$83 per ounce, well below the group average, while Newmont Mining Corp. traded at US$236 per ounce and Agnico Eagle Mines Ltd. traded at US$438 per ounce, more than twice the group average.

The group shows a great deal of variance in terms of enterprise value compared with the last 12 months' EBITDA multiple. Acacia traded at the highest premium in the group at 137.9x, substantially above the group median of 14.9x. At the other end of the valuation scale, Centerra Gold and Newmont recorded low EV/LTM EBITDA multiples of 6.4x and 9.4x respectively.