Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 26, 2021

By Rajiv Biswas

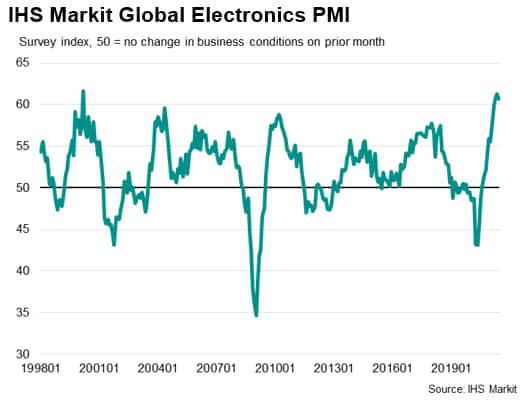

The latest IHS Markit Global Electronics Purchasing Managers' Index (PMI) for June was strongly expansionary, boosted by buoyant demand in key markets. Rebounding consumer spending and industrial production in key economies, notably the US, China, EU and UK, is helping to drive demand for a wide range of electronics products.

However, the strength of global electronics demand is continuing to exacerbate semiconductors shortages for some manufacturing industries, notably the global automotive sector. Supply chain disruptions to semiconductors production have also impacted on the situation. The new COVID-19 waves in East Asian electronics manufacturing hubs such as South Korea, Taiwan, Malaysia and Vietnam have further increased risks of potential supply chain disruptions at electronics plants due to escalating domestic pandemics. Meanwhile the latest IHS Markit Global Electronics PMI survey shows evidence of sharp increases in electronics industry input prices as well as output prices, mainly due to shortages of essential raw materials.

Global electronics industry continues to strengthen

The strong rebound in world consumer markets, notably in the US, China and Western Europe, is continuing to drive growth in demand for electronics. This is resulting in buoyant growth in household spending on electronics products as well as products that are intensive users of electronics, notably autos.

The headline seasonally adjusted IHS Markit Global Electronics PMI registered 60.7 in June, continuing to show strong operating conditions, albeit edging down from 61.2 in May. Sharp growth was once again seen across output and new orders, driving another strong rise in employment.

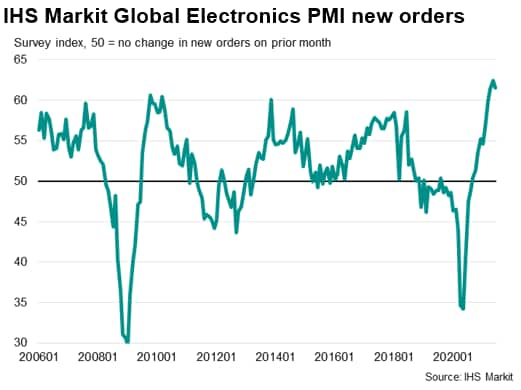

The IHS Markit Global Electronics PMI new orders index meanwhile rose from a low of 35.0 in May 2020 to a level of 61.5 in June 2021. The rate at which demand improved during June was strong, despite easing slightly from the 17-year high recorded in the previous month.

The electronics sector rebound is making an important contribution to the recovery of manufacturing exports and industrial production in many East Asian industrial economies. The electronics manufacturing industry is an important part of the manufacturing export sector for many Asian economies, including South Korea, China, Japan, Malaysia, Singapore, Philippines, Taiwan, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies in East Asia.

Global electronics demand has risen strongly due to the global shift to remote working and online shopping. This has resulted in surging demand for consumer electronics products such as laptops, mobile phones and wearables.

China's exports for June 2021 continued to show strong growth, rising by 32.2% y/y according to trade data from China's General Administration of Customs. This reflected continued strong global demand for electronics and PPE equipment as well as the impact of base year effects due to global lockdowns a year earlier. China's exports of LCD panels in value terms were up 56% y/y in the first six months of 2021, while exports of integrated circuits were up 32% y/y. Exports of mobile phones rose by 33.5% y/y in the same period.

South Korea's exports of information and communications technology (ICT) goods have also shown strong growth in the first half of 2021 and increased by 29% y/y in June. South Korean semiconductor exports rose by 34% y/y, with exports of memory chips up 31% while exports of system chips rose by 47% y/y. Exports of displays rose by 30% y/y. Electronics exports to key markets showed large increases, with exports to the US up 32% y/y, while exports to the EU were up 51% y/y. Exports to Vietnam, which is a key manufacturing hub for South Korean electronics firms, also showed rapid growth of 25% y/y.

Japanese exports of electronics have also performed strongly, with semiconductors exports up 25% y/y in June, while exports of integrated circuits rose by 14% y/y.

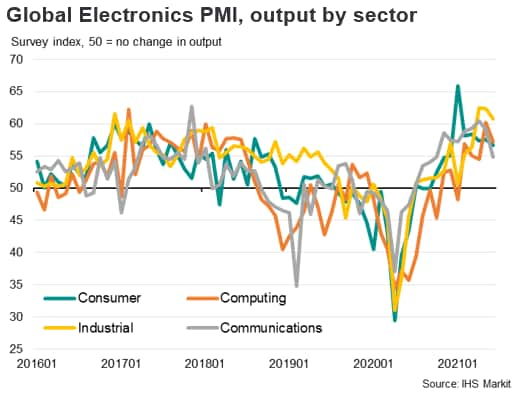

All four monitored sub-sectors of the global electronics industry continued to show robust expansion in June, according to the IHS Markit Global Electronics survey, with very strong growth in the industrial and computing segments.

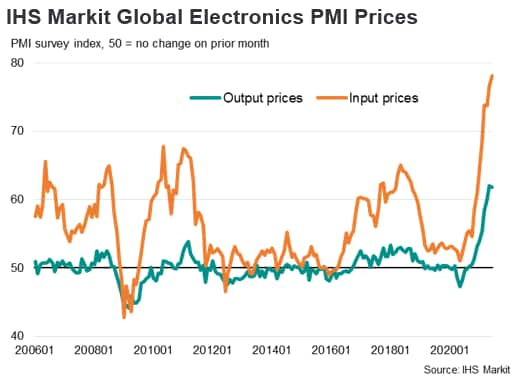

Sharply rising electronics input pricing pressures

The rapid rise in electronics production has also triggered a sharp upturn in raw materials input prices for electronics firms during the first half of 2021. The IHS Markit Global Electronics PMI Input Prices Index has continued to rise rapidly during the second quarter of 2021, increasing from 72.8 in April to 77.8 in May and 78.1 in June. Notably, the rate of input price inflation is the quickest since the PMI series began in January 1998. Companies that were surveyed overwhelmingly linked raw material shortages to rising prices.

Reflecting the sharp increases in input prices, the IHS Markit Global Electronics PMI Output Price Index continued to signal strong pricing pressures, at 61.8 in June.

The near-term pricing outlook for the remainder of 2021 according to IHS Markit Pricing & Purchasing analysis for semiconductors and components generally is that supply shortages are likely to continue to translate into price escalation. Printed circuit board assemblies are the most severely affected, but semiconductors, bare printed circuit boards, resistors, capacitors, and connectors are all expected to see price pressures. Escalation generally over the second half of the year will be greater than 10%. (See "Prices: Pricing Analysis - Semiconductors", by IHS Markit Pricing & Purchasing, 1st July 2021.)

In 2022 and 2023, capacity expansion will bring supply and demand closer to balance and lead to stabilizing prices. According to IHS Markit Pricing & Purchasing, moderating demand for electronic components and improving semiconductors production is expected to bring supply and demand closer to balance and lead to some price relief. Specific categories will show some resilience in pricing given the changing demand landscape. For example, the expansion of electronics in light vehicles will keep pressure on certain commodity electronic components.

With significant shortages of semiconductors having become evident globally during the first half of 2021, this is expected to further boost South Korean semiconductors exports during 2021.

Electronics supply chain disruptions

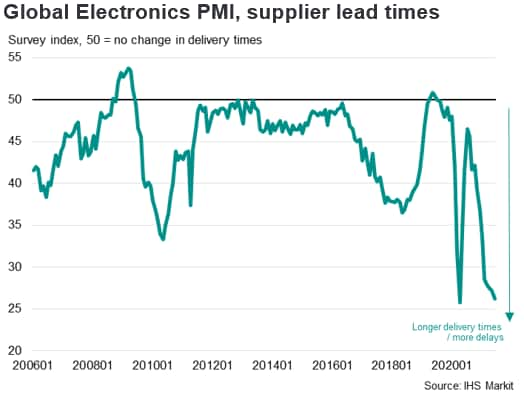

In the electronics industry, the strength of global electronics demand is continuing to exacerbate semiconductors shortages for some manufacturing industries, notably the global automotive sector. Supply chain disruptions to semiconductors production have also impacted on the situation. Semiconductors and electronic components are in very short supply. According to analysis by IHS Markit Pricing & Purchasing, sporadic electronics production outages because of COVID-19 continue, and while many or most facilities are operating at or near full capacity, the supply chain for electronic components is highly sensitive to disruptions.

Meanwhile the latest IHS Markit Global Electronics PMI survey shows evidence of sharp increases in electronics industry input prices as well as output prices, mainly due to shortages of essential raw materials.

Global auto manufacturers as well as smartphone producers are among the industry segments that have been impacted by semiconductors shortages. According to IHS Markit Automotive research, vehicle manufacturers have faced increased disruption to the supply of systems using semiconductors in the first half of 2021. Many automakers worldwide have reported disruptions to production due to shortages of semiconductors, including Ford, VW Group, GM, Honda and Mazda.

According to IHS Markit Automotive research, reports of disruption within the supply chain of semiconductors to the automotive sector began in late 2020 and have continued in the first half of 2021, with further disruption expected during the third quarter of 2021. These disruptions of supply of important electronic components have resulted in significant disruption of global auto production during the first half of 2021, amounting to auto production being reduced by around 4 million units during that period. (see IHS Markit Automotive, 20th July 2021, "Semiconductor Supply Issue: Light Vehicle Production Tracker").

The extent of the shortages of critical electronics components became so severe that high level consultations were held involving key industry bodies as well as government officials from major industrial economies including the US and Germany. Technology companies including semiconductors manufacturing firms participated in the White House Summit on 12th April on semiconductors shortages and supply chain vulnerabilities.

Global semiconductors shortages have also been impacted by temporary supply disruptions to semiconductors production in Texas due to power outages in February as a result of severe weather, as well as production disruptions in Japan due to a fire in a Renesas Electronics semiconductors plant in mid-March.

Chip stockpiling during 2020 due to US government sanctions on certain Chinese technology companies have also contributed to the shortages. Global auto manufacturers as well as smartphone producers are among the industry segments that have been impacted by these shortages. The US Department of Commerce added seven Chinese supercomputing firms to its entity list in early April 2021.

Risks from new Covid waves in East Asia

Since April, a number of East Asian economies with large electronics manufacturing industries have been hit by escalating COVID-19 Delta waves.

Due to the new COVID-19 outbreak that has occurred in Taiwan during May and June, electronics production has faced some impact effects. The King Yuan Electronics Co (KYEC) chip-testing plant shut down temporarily in early June due to a Covid cluster among workers on its factory floor, although operations resumed within days, using other staff. Another chip-testing firm, Greatek Electronics, has also been impacted by a Covid cluster in its facility. However, with daily new COVID-19 cases having fallen sharply in recent weeks, the situation has been gradually improving.

In Southeast Asia, Malaysia, Thailand and Vietnam, which are significant electronics manufacturing hubs, are all currently experiencing significant Covid waves that have triggered lockdowns and are creating significant disruption to economic activity.

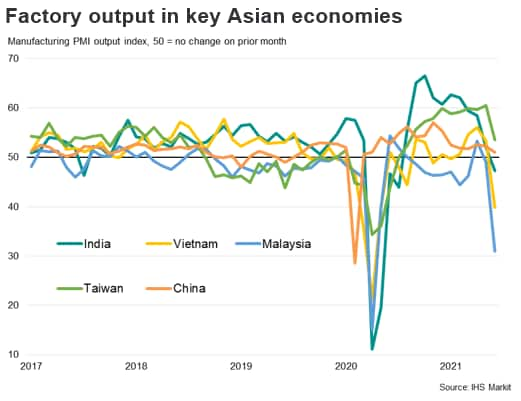

The latest IHS Markit Manufacturing PMI surveys for Southeast Asia have reflected the impact of these new lockdown measures, which have disrupted industrial production and consumption spending.

In Malaysia, the headline IHS Markit Malaysia Manufacturing Purchasing Managers' Index (PMI) fell sharply in June, to 39.9 compared with 51.3 in May. This pointed to a severe decline in business conditions in the Malaysian manufacturing sector.

Vietnam's economy has also been hit by the impact of the latest Covid wave, after its economy showed considerable resilience during 2020 as the domestic pandemic was successfully contained. The latest wave of COVID-19 cases in Vietnam led to a sharp decline in business conditions for manufacturers during June. The IHS Markit Vietnam PMI dropped sharply to 44.1 in June from 53.1 in May, pointing to the most rapid deterioration in business conditions for over a year and ending a six-month period of growth.

With reported daily new cases having risen sharply in recent weeks in many Southeast Asian nations, there is still significant uncertainty about how protracted and severe the current Covid waves will be, posing continuing risks to electronics supply chains in the region.

APAC electronics sector outlook

During the first half of 2021, global electronics demand has shown a strong rebound from the lows of the first half of 2020, when lockdowns disrupted production and consumer spending. With improving economic recovery underway in the US and EU as COVID-19 vaccines are progressively rolled out, demand for electronics products is expected to remain strong during the remainder of 2021.

The impact of the pandemic has accelerated the pace of digital transformation due to the global shift to working remotely, which has boosted demand for electronic devices such as computers, printers and mobile phones. The easing of lockdowns in many countries has also triggered a rebound in consumer spending, helping to boost demand for a wide range of consumer electronics. Spending on consumer electronics has also been boosted by fiscal stimulus measures in many OECD countries that have provided significant pandemic relief payments to support households in many large economies, including the US, UK, Japan and Australia. Meanwhile global auto demand has also shown a rebound after slumping during the first half of 2020, which is boosting demand for auto electronics, albeit contributing to intensifying supply-side problems related to semiconductors shortages.

The medium-term economic outlook is also supportive for the electronics industry, with sustained strong world economic growth forecast over 2022-2024.

With shortages of semiconductors disrupting manufacturing supply chains in early 2021, the importance of having domestic electronics production capacity for critical electronics components has become a national priority for major industrial nations, including the US, EU and China. For the US and EU, reducing reliance on Asian semiconductors production has become a key strategic priority over the next decade.

A key risk is excessive global vulnerability to semiconductors supply from South Korea and Taiwan, which are major electronics production hubs but also potential geopolitical flashpoints in the Asia-Pacific region. Military tensions in the Taiwan Strait and South China Sea have escalated during the first half of 2021, highlighting these vulnerabilities.

The outlook for electronics demand is also supported by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

Competition amongst leading technology nations in strategic electronics production has also intensified. Consequently strategic global competition amongst the world's leading high-technology nations is also likely to play a greater role in reshaping the global electronics industry landscape over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location