Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 05, 2021

By Jingyi Pan

The IHS Markit Global Sector PMI™ signalled sustained strong recovery for the global economy, led by the consumer services sector. Less congruent with financial markets had been the weakness of basic materials output in July, with the wedge underpinned by supply constraints.

Global Sector PMI™ indicates consumer services lead sector growth again in July

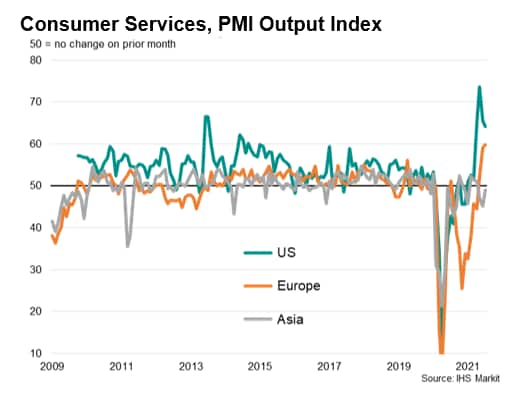

Global Sector PMI™, compiled by IHS Markit, revealed that all 21 sectors and eight sector groups sustained in growth in the latest July update. Tourism & Recreation was the fastest growing sector, with Consumer Services the fastest growing among the broader sector groups. This indicates a continuation of the global economic recovery, led by strong services output, particularly across the US and Europe.

That said, Tourism & Recreation, as with all bar the Consumer Goods sector, experienced an easing of growth momentum according to the July survey. While the spread of the Delta variant across the Asia Pacific region had a key part to play, moderation of the growth pace from historically elevated rates during the second quarter, such as in the US, also contributed to the slowdowns. The overall growth speed, however, remained strong by historical standards, with Consumer Services still the flag bearer in July.

Basic materials sector performance diverges with asset prices

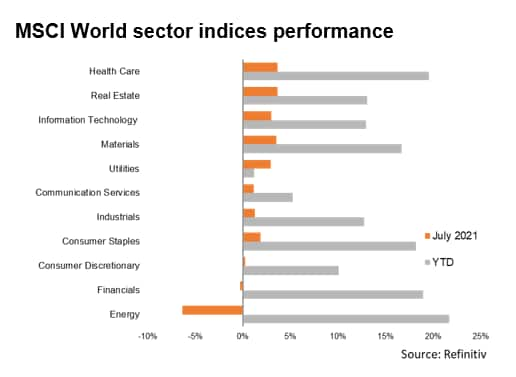

Assessing the sector group performance against the MSCI World sector indices' performance in July, one finds the price action for most sectors not deviating too far from actual output conditions. This is with exception of the Basic Materials sector group.

Basic Materials sector output growth eased for a second straight month to land in the last position of the eight sector groups we track in the global sector survey. In contrast, the MSCI World Materials Sector Price Index rose 3.0% in July, contributing to the 13% year-to-date (YTD) gains, and was amongst the top performers in the month.

The divergence may be best explained by the supply constraints surrounding the Basic Materials sector, allotting the companies with considerable pricing power amid sustained global economic recovery expectations. All of which had been well illuminated by the various PMI sub-indices.

While the Basic Materials output growth momentum eased into July, pricing power was sustained at elevated levels as shown by the output price sub-index. This is as Basic Materials firms experienced severe lengthening of input delivery delays, a global phenomenon well captured by the Suppliers' Delivery Times Index. Concurrently, optimism in the Basic Materials sector remained strong as seen by the Future Output Index reading that posted well above the survey average in July, although nothing of the extent that Consumer Services appear to be enjoying.

As shown in the case studies for US, Japan and Europe, sector PMI data were used to formulate active investment strategies, exhibiting their ability to provide signals for investments into financial markets. While we have yet to formalise the same for global sectors, it is nevertheless worth considering the potential impact here for materials sector asset pricing moving forward, particularly with output growth slowing, the question lies with when will the other shoe drop.

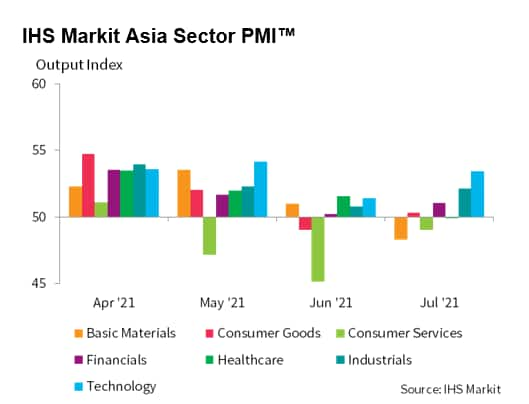

Asia Sector PMI™ tells a different story of consumer services under pressure amid COVID-19 wave

Separately, prior to the release of the global sector data, Asia Sector PMI™ had also continued to tell the story of the Delta wave impact in July with the Consumer Services sector group in contraction as opposed to the global trend.

The good news is that the contraction of sector output eased from June, though it may be hard to call a turning point a trend yet.

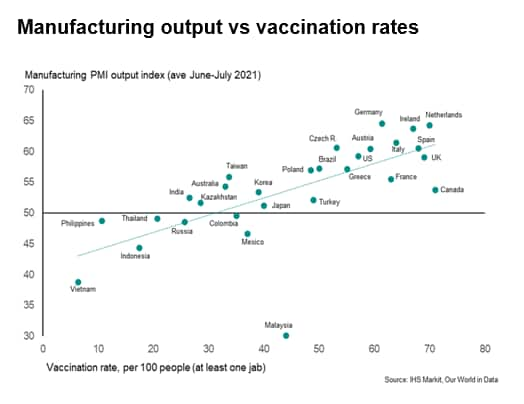

Once again, the issue of divergence boils down to vaccination rates as displayed by the chart on manufacturing output and vaccination rates, which clearly shows the positive corelation. Many Asian economies continued to lag counterparts in Europe and North America in July in terms of their vaccination rates, and one can imagine this divergence in sector performance to likewise only sustain if the gap is not narrowed.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location