Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 23, 2021

By Sara Johnson

Global economic growth will continue, albeit at a moderating pace over the next three years. The COVID-19 virus remains a source of disruption for regional economies, but its economic impact will diminish with further progress on vaccinations and treatments. As supply conditions improve, downstream inflation rates will start to ease in the first half of 2022. A measured tightening of monetary policies will help to restrain inflation expectations and actual inflation.

The global economic expansion is unevenly progressing.

The ebbs and flows vary across regions with each wave of the COVID-19 pandemic. The dampening effects of regional outbreaks on economic activity are then transmitted globally through trading relationships. With expansionary fiscal and monetary policies supporting demand, the implications are widespread supply shortages and escalating prices.

World real GDP growth slowed from a 4.6% annual rate quarter on quarter (q/q) in the second quarter to a 2.2% rate in the third quarter, as outbreaks of the Delta variant of COVID-19 curtailed production in Asia Pacific and slowed consumer spending in the United States. Global growth should pick up to a 3.8% annual pace q/q in the fourth quarter, as resilience in Asia Pacific and North America outweighs a pronounced slowdown in Europe, where COVID-19 virus infections are now rising.

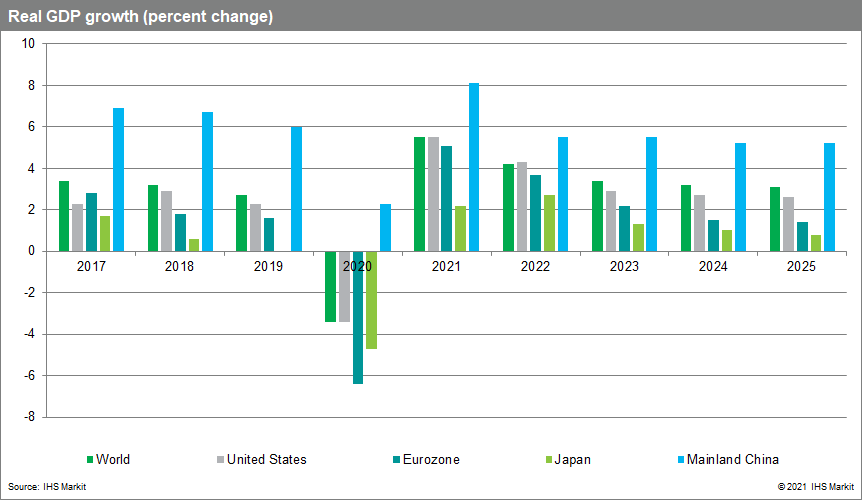

After a 3.4% decline in 2020, world real GDP is projected to increase 5.5% in 2021 and 4.2% in 2022.

Pandemic-related constraints on growth will ease in response to rising vaccination rates, more effective treatments, business adaptations, and a rebalancing of consumer spending from goods to services. IHS Markit PMI surveys are signaling an acceleration in service sectors that should continue into 2022, along with further recovery in travel and tourism. Global growth will settle to 3.4% in 2023 and 3.2% in 2024 as pent-up demand is satisfied, employment recoveries are completed, and fiscal and monetary policies tighten.

With some critical supply shortages and shipping bottlenecks persisting into 2022 and beyond, inflation pressures will subside only gradually.

IHS Markit manufacturing PMI data show supplier delivery times lengthening to the greatest extent on record in October, leading to sharp accelerations in input costs and output prices. Input costs are being passed along to customers at unprecedented rates, suggesting little buyer resistance. Semiconductor shortages are driving rising prices of vehicles, industrial electronics, communications equipment, and computers. Electrical steel, a niche product used in transformers, motors, and generators, should be in short supply through 2023 because of the surge in battery-electric vehicle (BEV) production. These shortages will constrain the production of electrical machinery and appliances while holding back the expansion of wind towers, electricity generation, and power transmission. Other supply-side risks stem from the highly concentrated production of key metals such as magnesium, aluminum, copper, cobalt, lithium, and nickel.

On the positive side, a broad price correction appears to be underway in commodity markets.

The IHS Markit Materials Price Index fell 14% in the four weeks that ended 11 November, and it stands 20% below its mid-May peak. Shipping rates and prices of lumber, ferrous metals, and coal are retreating from exceptional highs. With normal lags, the declines in raw material prices should bring some relief to finished goods markets in the first half of 2022. However, natural gas prices are expected to stay elevated through the northern hemisphere's winter and then decline as depleted storage facilities are refilled.

Global consumer price inflation is projected to pick up from 2.2% in 2020 to 3.7% in 2021, its highest rate since a 5.0% advance in 2008. As agricultural and industrial commodity prices retreat, consumer price inflation will ease to 3.5% in 2022 and 2.7% in 2023 and 2024

The US economy is proving its resilience with robust gains in consumer spending and industrial production in the final quarter of 2021.

Households enjoy healthy balance sheets and supportive financial conditions, while labor income continues to rise at a solid pace. High inflation is dampening consumer sentiment, but with little impact to date on spending behavior. Thus, real GDP growth is projected to pick up from an annual rate of 2.0% q/q in the third quarter to 4.4% in the fourth quarter. Improving COVID-19 trends, the partial resolutions of supply disruptions and labor shortages, and inventory restocking will support growth moving through 2022. Among major economies, the US business cycle most closely aligns with the global economy. After a 3.4% contraction in 2020, US real GDP should increase 5.5% in 2021 and 4.3% in 2022. As the economy reaches full employment and interest rates rise, growth will settle to 2.9% in 2023. The US unemployment rate will likely fall from 4.6% in October to a low of 3.5% in late 2022 and 2023, putting upward pressure on wage rates.

After a mid-2021 growth spurt, eurozone growth prospects are deteriorating.

With the easing of pandemic-related restrictions, eurozone real GDP surged at annual rates of over 8.0% q/q rate in the second and third quarter, led by a rebound in consumer spending. As 2021 ends, however, growth is slowing abruptly in response to record-high energy costs, supply chain disruptions, and a new wave of COVID-19 cases. After a 6.4% decline in 2020, eurozone real GDP should increase 5.1% in 2021, 3.7% in 2022, and 2.2% in 2023. While Emerging Europe's medium-term growth prospects are stronger, the pandemic is taking a heavy toll: in mid-November, the region had 17 of the top 20 countries globally in per capita COVID-19 death rates.

Mainland China's economy is resuming a long-term deceleration.

Real GDP grew to 4.9% year on year (y/y) in the third quarter. A further slowdown is expected in the fourth quarter, as the government's deleveraging campaign deflates real estate and construction activity. Other headwinds include a declining working-age population, diminishing productivity growth as regulations increase, and sourcing diversification by multinational companies. The worst of mainland China's power crunch appears to be over, as the government has mobilized state energy companies to increase coal production and imports. Mainland China's real GDP growth is projected to slow from 8.1% in 2021 to 5.5% in both 2022 and 2023.

Asia Pacific economies are rebounding from third-quarter setbacks as factories reopen.

With the Delta variant wave of COVID-19 subsiding, manufacturing production in Asia Pacific is rebounding, led by accelerations in Indonesia, Thailand, and India. The regional recovery in manufacturing output is helping to gradually ease global supply-chain disruptions. After a 3.8% decline in 2020, real GDP in Asia Pacific, excluding mainland China and Japan, is projected to increase 4.5% in 2021 and 4.7% in 2022.