Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

PUBLICATION — Jan 05, 2021

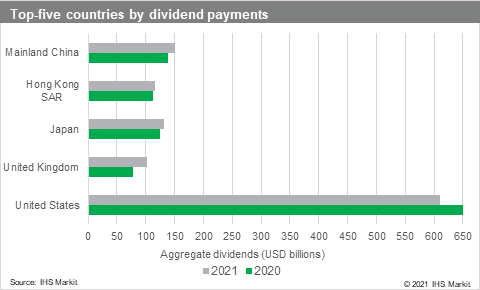

Global dividends in 2021 should grow by 6.5% year over year, putting the overall payout in 2021 just under the pre-COVID-19 levels of 2019. This growth will be driven by continued lifting of restrictions, accelerated growth as the vaccine becomes more widely available, and clearer visibility for businesses as they make capital allocation plans. The Asia Pacific (APAC) region will lead the dividend growth and surpass the dividend levels of 2019 by USD21 billion—an increase of 6.8% year over year. While dividends in the Europe, Middle East, and Africa (EMEA) region should grow in the upcoming year, the growth will fail to reach the levels of 2019.

The travel and leisure, automobile and parts, and oil and gas sectors are expected to continue lagging in 2021. A quick recovery for travel and leisure in 2021 is unlikely, as both travel restrictions and structural issues continue to weigh on the sector. In automotive, the Americas (AMER) and APAC regions will decrease their aggregate payouts only slightly over 2020; however, the French and Italian majors should be unable to resume dividends in 2021, leading to an almost 30% drop for the EMEA region's dividends in this sector. The majors in biotechnology, pharmaceuticals, and medical technology have had well-performing businesses, which have offset the lower-performing healthcare services and medical center segments of the healthcare sector. Overall, the technology sector has benefitted from the move to working from home (WFH) in 2020, as well as, increased gaming and streaming— both of which have highlighted the importance of improving digital infrastructure. The sector should continue growing in 2021, albeit at a slightly more modest pace than in 2020.

In a league of their own, US dividends have remained resilient in 2020, but are expected to drop slightly in 2021. The decrease in dividends is interesting, given that IHS Markit forecasts the US GDP to increase in 2021; however, the decline is largely due to the expected fall of two of the country's largest paying sectors—banks and the oil and gas sector—in 2021. For the banks, this contraction is overwhelmingly due to the WellsFargo dividend cut; even if the bank does increase its dividend in 2021, it will be unable to return to previous levels owing to the Fed's dividend cap. The new stimulus bill, having been passed, will help stabilize the economy, indicated by the steady and growing GDP levels forecast for 2021.

IHS Markit has forecast the mainland China GDP to grow in the majority of 2021 and 2022, which coincides with the expected growth of dividends in 2021. Mainland China has experienced broad recovery, especially in the second half of 2020, providing stronger ground going into 2021. The government rushed to restore the industrial sector and production, which, along with increased demand, has boosted the economy. Additionally, the stimulus measures in the western world increased the demand for mainland Chinese products and have helped the recovery gain ground. Furthermore, insurance companies, financial services, and the megabanks all increased dividends in 2020 and should remain resilient in 2021.

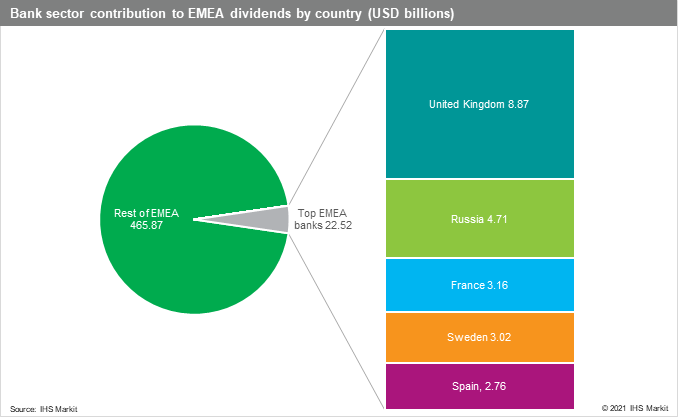

Banks are not only key players in the economy, and therefore highly regulated, but also key dividend payers in their respective regions. More than any other sector, dividends are linked to regulatory approvals and the conditions of their respective economies. In EMEA, The UK Prudential Regulation Authority (PRA) has announced that "an extension of the exceptional and precautionary action taken in March is not necessary and that there is scope for banks to recommence some distributions should their boards choose to do so." The appropriate level of any distribution is a decision for the board of each bank, but the PRA requests that FY 2020 distributions to shareholders do not exceed the higher of: 20 basis points of risk-weighted assets as of the year-end or 25% of cumulative eight-quarter profits covering 2019 and 2020 after deducting prior shareholder distributions over that period.

Currently, the PRA is content for UK banks to accrue, but not pay, prudent dividends for 2021. An update regarding 2021 distributions will be provided in advance of the half-year results from large UK banks. Consequently HSBC or Lloyds are unlikely to make payments to shareholders for the first quarter. Any first quarter dividends accrued should be included in their FY 2021 second quarter distributions, subject to PRA approvals.

At its December policy meeting, the ECB expanded programs offering support to banks and the real economy. The ECB said it was maintaining the eurozone deposit rate at -0.50%, the refinancing rate at 0%, and the marginal lending facility rate at 0.25%. It also updated its recommendation stating that banks should "exercise extreme prudence on dividends and share buy-backs. To this end, the ECB asked all banks to consider not distributing any cash dividends or conducting share buy-backs, or to limit such distributions, until 30 September 2021." Given the persisting uncertainty over the economic impact of the COVID-19 pandemic, the ECB expects dividends and share buybacks to remain below 15% of the cumulated profit for 2019-20 and not higher than 20 basis points of the Common Equity Tier 1 (CET1) ratio, whichever is lower. For banks that have already distributed dividends or conducted share buybacks to remunerate shareholders with regard to financial year 2019, the basis for the definition is the profit attributable to owners of the parent for the 2020 financial year based on the prudential scope of consolidation; this is the case for BBVA,Banco Santander, and ING.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.