Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Mar 03, 2022

Research Signals - February 2022

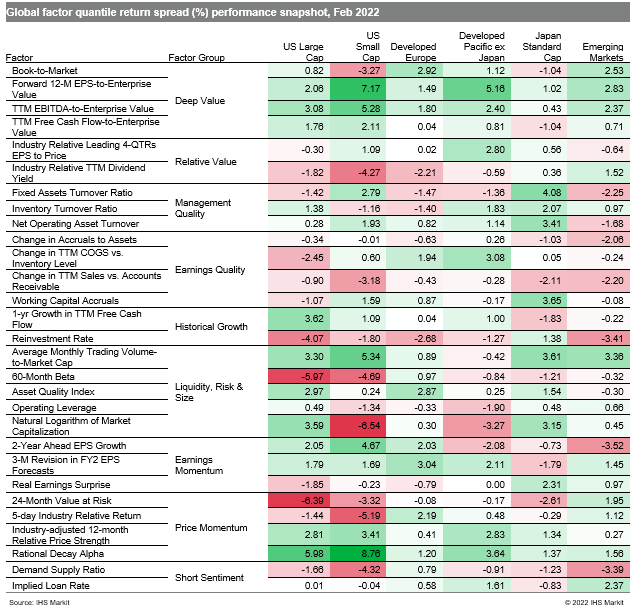

Most regional equity markets extended their losses into February as concerns over higher inflation and ensuing central bank interest rate hikes and monetary tightening were exacerbated by the escalation in the Russia-Ukraine conflict. However, high momentum and risk shares outperformed in several regional markets (Table 1), suggesting investors saw some glimmer of optimism, including that suggested by a mild upturn in the J.P.Morgan Global Manufacturing PMI led by Europe and the US, though a darkening geopolitical backdrop may pose significant risk to demand.

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.