Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 27, 2025

By Jim O'Reilly

Economic uncertainties and the need to attract investment capital have spurred electric utilities to seek higher transmission returns on equity and risk-reducing transmission incentives in a series of proceedings at the Federal Energy Regulatory Commission.

➤ A transmission-only (transco) subsidiary of NextEra Energy Inc. in the California ISO asked FERC for authorization to increase the return on equity (ROE) in the company's formula transmission rate by more than 200 basis points. The NextEra transco joined at least three other companies seeking significant ROE increases in their transmission formula rates at the commission.

➤ The commission is also considering a settlement filed by a second NextEra transco that would establish a base ROE of 10.27% in the company's transmission formula rate in the PJM Interconnection LLC, an increase from the transco's currently authorized ROE of 9.60%. The company initially asked the commission to approve an increase in its ROE to 11.00%.

➤ A third NextEra transco asked FERC to authorize transmission incentives for its investment in a planned $2.6 billion transmission project in the Midcontinent ISO. The company argued, among other things, that the incentives are warranted due to supply chain uncertainty resulting from the recent imposition of tariffs on imported goods. The company also argued that the investment will result in significant negative cash flows and the potential to adversely impact the company's credit ratings.

➤ Three Fortis Inc. transcos in MISO have asked FERC to authorize transmission incentives for the companies' investments in six new high-voltage transmission projects with a total estimated cost of approximately $3 billion. The companies argued the incentives are warranted in part because of the regulatory and environmental risks and challenges of developing the projects, as well as high construction costs, supply chain issues and labor shortages.

A more detailed discussion of these developments that Regulatory Research Associates is following is provided below.

The commission

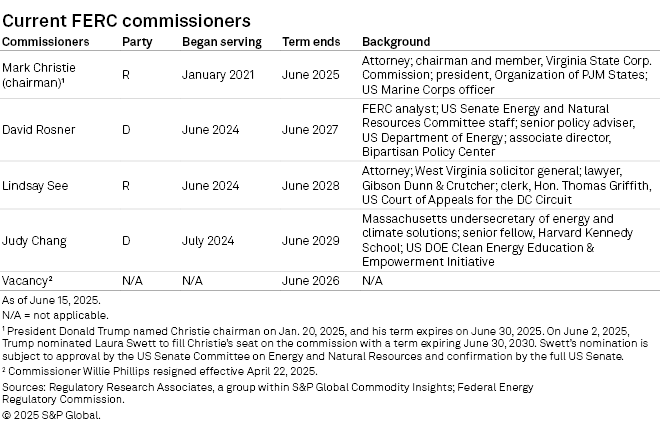

FERC's membership continued to undergo change when the White House nominated a Washington, DC, lawyer to the seat on the commission held by Chairman Mark Christie: Trump nominates industry lawyer Laura Swett to fill Christie's spot at FERC. Swett's nomination was submitted to the US Senate on June 2, 2025, and referred to the Committee on Energy and Natural Resources. Swett's nomination is subject to the committee's approval and confirmation by the full Senate.

Christie's term is scheduled to expire on June 30, 2025, and his imminent departure follows quickly on the heels of the departure of Commissioner Willie Phillips, who resigned on April 22, 2025: Former FERC Chairman Willie Phillips to step down as commissioner early. Phillips' term was scheduled to expire on June 30, 2026.

Earlier this month, FERC held a much-anticipated two-day technical conference to discuss resource adequacy issues in the six regional transmission organizations and independent system operators (RTOs/ISOs) in the US. The first day featured a panel of representatives from all six RTOs/ISOs and the North American Electric Reliability Corp.'s president and CEO: US grid operators stress reliability challenges amid retirements, high demand.

The conference also included panels that focused specifically on PJM, MISO, the New York ISO and ISO New England. See PJM stakeholders debate need for state intervention to solve resource concerns, Stakeholders debate whether MISO faces an imminent threat to system reliability and Northeast grid operators discuss offshore wind challenges at FERC conference.

Transmission ROEs and formula rates – Horizon West

On May 30, 2025, NextEra subsidiary Horizon West Transmission LLC asked the commission to approve an increase to the base ROE in the company's transmission formula rate from 9.70% to 11.98%. The proposed base ROE, when combined with Horizon West's authorized 50-basis-point adder for participation in an RTO/ISO (RTO adder), would result in a total ROE for the company of 12.48%. Horizon West was formed in 2014 to develop and own electric transmission facilities in the CAISO region.

Horizon West noted it was recently selected by CAISO to construct and own two major new 500-kV transmission projects in Arizona and California with an estimated total cost of $2.6 billion. The approximately 80-mile North Gila-Imperial Valley Project is designed to improve access to renewable resources for customers in Southern California. Horizon West stated the second project, the approximately 140-mile Imperial Valley-North of San Onofre Nuclear Generating Station and 500/230-kV Substation Project, "was identified as necessary to meet the future needs of the region's electric grid."

In support of the proposed ROE, Horizon West argued "[r]ecent upward movement in interest rates suggests that long-term capital costs, inclusive of the cost of equity, have increased significantly in recent years." Further, Horizon West argued that "[f]ailing to provide investors with the opportunity to earn a rate of return that is commensurate with Horizon West's risks will weaken its financial integrity and undermine its ability to attract necessary capital."

Horizon West's request joins at least three other pending requests at FERC seeking significantly higher transmission ROEs. The three requests are currently in settlement judge procedures, while a fourth similar request, filed by another NextEra transco, is the subject of a pending settlement and is described further below.

The three requests in settlement judge procedures include a proposal filed on Oct. 24, 2024, by the New York Power Authority (NYPA) asking FERC to approve a base ROE of 10.98% in NYPA's transmission formula rate, an increase of more than 200 basis points from NYPA's currently authorized base ROE of 8.95%. NYPA's current base ROE is the result of a 2016 settlement that initiated NYPA's formula transmission rate.

In addition, on Oct. 30, 2024, Sempra subsidiary San Diego Gas & Electric Co. (SDG&E) filed a proposed new transmission formula rate and asked FERC to authorize the company a base ROE of 11.75%, an increase from the utility's currently authorized base ROE of 10.10%. SDG&E argued that it is an above-average risk utility due to the combination of higher wildfire exposure in California and California's inverse condemnation law "that makes a utility responsible for any utility-caused wildfire, regardless of fault, which increases the frequency and amount of property subject to liability."

Finally, on Jan. 9, 2025, New York Transco LLC filed a proposal to modify the company's formula transmission rate and establish a base ROE of 10.90% for all New York Transco's transmission investments except the $2.8 billion Propel NY Energy Project. Under New York Transco's existing formula rate, the company has a project-specific base ROE for each project that it develops and owns. In accordance with the terms of a FERC-approved settlement in 2024, a base ROE of 10.30% applies for the Propel NY Energy Project. A stay-out provision in that settlement prohibits New York Transco from making any filings that would modify the base ROE for the project prior to May 31, 2030.

New York Transco's proposal would increase the ROEs that currently apply to the company's projects known as the Transmission Owner Transmission Solutions, which have a current base ROE of 9.50%, and certain segments of the AC Transmission Projects, which have a current base ROE of 9.65%. New York Transco is owned by affiliates of the major investor-owned utilities in the state, including Consolidated Edison Transmission, LLC, Grid NY LLC, Avangrid Networks New York TransCo LLC, and Central Hudson Electric Transmission LLC.

Transmission ROE and formula rates – NEET MidAtlantic

On May 28, 2025, NextEra subsidiary NextEra Energy Transmission MidAtlantic LLC (NEET MidAtlantic) filed a proposed settlement of the company's request to increase the authorized ROE in its transmission formula rate from 9.60% to 11.00%. The 9.60% base ROE for the company was established in 2018 when FERC approved a settlement in an earlier proceeding.

The proposed settlement filed on May 28 provides that NEET MidAtlantic's base ROE will be set at 10.27%, nearly splitting the difference between the company's current and requested ROE. The base ROE proposed in the settlement, when combined with NEET MidAtlantic's previously authorized 50-basis-point RTO adder, would result in a total ROE for the company of 10.77%.

The proceeding was initiated on June 12, 2024, when NEET MidAtlantic filed proposed revisions to increase the base ROE in its formula rate, asserting that "recent macroeconomic trends and indicators point to a higher cost of equity for electric utilities than during the pre-pandemic period," when the company's 9.60% base ROE settlement was negotiated. NEET MidAtlantic also described the risks faced by the company as a transmission-only entity and the critical role the company's allowed ROE will have in access to investment capital to support new transmission infrastructure investments.

NEET MidAtlantic noted PJM recently selected it from among other transmission owners in the region to develop and construct the $1 billion MidAtlantic Resiliency Link Project, a new 129-mile, 500-kV transmission line crossing through four states — Virginia, West Virginia, Maryland and Pennsylvania — and a new 500/138-kV substation located in Virginia.

The company argued, among other things, that "expected ROE is the key economic signal that allocates finite capital among competing opportunities" and "allowed ROE and a reasonable opportunity to earn it are key to ensuring the flow of investment capital for new utility facilities." The company also argued that "[u]tilities and their investors must commit huge sums to expand the transmission grid with new and upgraded facilities and additional funding will be provided only if investors anticipate an opportunity to earn a return that is sufficient to compensate for the associated risks."

Transmission incentives – GridLiance Heartland

On May 30, 2025, NextEra subsidiary GridLiance Heartland LLC asked FERC to approve two incentives for the company's $354 million investment in a new 139-mile, 765-kV transmission line project in Minnesota and Wisconsin that it will co-develop with Dairyland Power Cooperative. Specifically, GridLiance asked the commission for authorization to recover 100% of prudently incurred transmission-related costs if the project is abandoned or canceled for reasons beyond GridLiance's control (abandoned plant incentive) and include in rate base 100% of prudently incurred construction work in progress (CWIP incentive).

GridLiance stated the project is the middle segment of a larger 273-mile North Rochester-Columbia 765-kV transmission line that also involves interconnected projects by Xcel Energy Inc., American Transmission Co. LLC and a developer that will be selected through MISO's competitive transmission development process.

GridLiance argued the project "represents a significant transmission investment from both a construction and cost perspective," noting that its $345 million portion of the project is a "level of investment that exceeds [the company's] current net transmission plant of approximately $32 million." GridLiance added that given the size of its existing rate base, "the magnitude of these investments over the short term will result in significant negative cash flows and the potential to adversely impact credit ratings absent approval of the requested incentives."

GridLiance also argued that the project "will pose engineering and construction challenges as it is a first-of-its-kind project where a 765-kV circuit will be co-located with a 161-kV circuit on the same structures." GridLiance asserted that "there is considerable supply chain uncertainty resulting from the recent imposition of tariffs on imported goods, and tight labor conditions should not be overlooked." The company added it is "ultimately competing for goods and services both regionally and nationally. These industry conditions generally contribute to the risks and challenges, and further the potential for the project to be cancelled for reasons beyond [the company's] control."

Transmission incentives – Fortis companies

On June 4, 2025, two Fortis subsidiaries sought FERC authorization for the abandoned plant incentive for their investment in five proposed transmission projects in MISO. On June 6, a third Fortis subsidiary asked FERC to authorize the abandoned plant and CWIP incentives for the company's investment in another transmission project in MISO with an estimated cost of $1.5 billion.

The first Fortis subsidiary, International Transmission Co. d/b/a ITC Transmission (ITCT), asked FERC to approve the abandoned plant incentive for the company's investment in a 138-mile, 765-kV transmission line from a substation owned by ITCT in Michigan to a substation in Indiana owned by American Electric Power Co. Inc. ITCT would construct 68 miles of the line to the Michigan-Indiana state border, and the company's investment in the project is estimated to be $535 million.

The second Fortis subsidiary, ITC Midwest LLC, asked FERC to approve the abandoned plant incentive for the company's investment in four planned transmission projects in Minnesota. ITC Midwest's share of the projects includes 135 miles of new 765-kV transmission lines, 17 miles of new 345-kV transmission lines and a new 765-kV substation. ITC Midwest's investment in the four projects will total approximately $972 million.

The third Fortis subsidiary, Michigan Electric Transmission Co. LLC (METC), asked FERC to approve the abandoned plant and CWIP incentives for the company's investment in the Denver Project in Michigan, which includes a 159-mile, 345-kV transmission line, a 40-mile, 345-kV line and a 55-mile, 345-kV line. METC's investment in the project is estimated to be $1.5 billion.

The three Fortis companies argued that the incentives are warranted because "development of the projects presents regulatory and environmental risks and challenges, particularly with respect to the federal, state, and local regulatory approvals and authorizations that are required for the development and construction of large-scale transmission assets like the [projects]." The companies also argued that costs for construction materials, specialized skilled labor, and specialized equipment "remain high and fluctuate significantly due to supply chain issues and labor shortages."

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location

Products & Offerings

Segment