Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 22 2025

By Kaushal Chaurasia and Alfia Shaikh

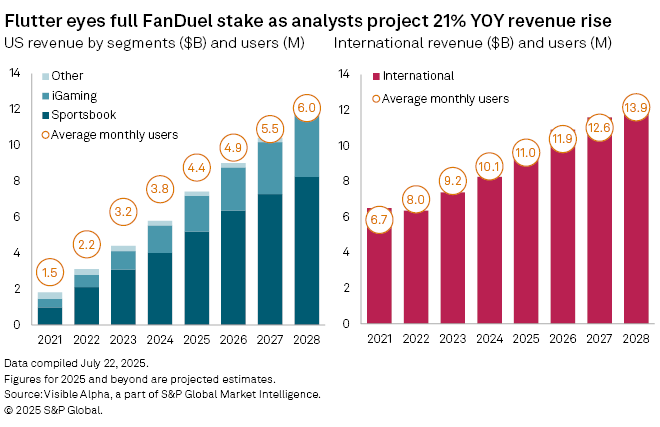

Flutter Entertainment PLC (NYSE: FLUT) is poised for a +21% rise in revenue to $17 billion in 2025, alongside a sharp increase in net income to $844 million—up from just $43 million last year—as it doubles down on its US expansion strategy.

The company plans to acquire the remaining 5% stake in FanDuel from Boyd Gaming Corp. (NYSE: BYD) for $1.76 billion, securing full ownership of its top-earning US sportsbook. The deal, pending regulatory approval, is expected to close in the third quarter of 2025.

FanDuel is Flutter’s largest growth engine in the US at an estimated $5.2 million in revenue in 2025. Overall, analysts forecast US revenue to climb +28% in 2025 to $7.4 billion, supported by a rise in average monthly active users to 4.4 million. International markets are also gaining traction, with revenue expected to grow +17% to $9.7 billion. Flutter recently completed acquisitions of Italy’s Snaitech and Brazil’s NSX Group to strengthen its global footprint, with international monthly users projected to hit 11 million.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment