Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 25, 2024

The flash PMI data released for March brought further signs that economic growth trajectories have improved since late last year, with growth across the four largest developed economies (the 'G4') hitting a nine-month high in March. Business confidence data were even more encouraging, rising to the highest level in two years. At the same time, price pressures remained elevated by pre-pandemic standards, notably in the service sector but now also in some cases in manufacturing. These price gauges will need to be monitored in the coming months, given their leading-indicator properties for consumer price inflation.

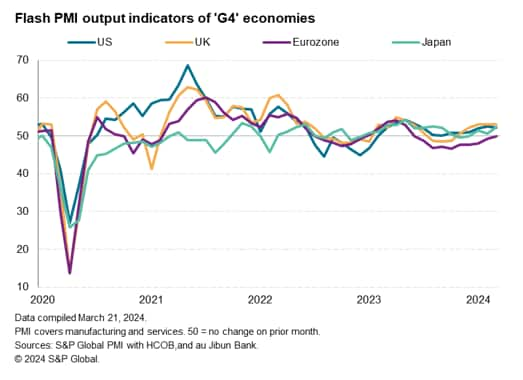

Looking at economic growth trajectories in the major economies, the flash PMI data continued to quash recession worries. The US and UK flash PMIs signalled solid ends to the first quarter in terms of business activity, the composite PMIs both dipping slightly since February but - at 52.2 and 52.9 respectively - continued to signal reasonable growth. The US survey is broadly indicative of a 0.4-0.5% quarterly GDP expansion in the first quarter and the UK survey is broadly consistent with a 0.25% gain, according to historical relationships. The equivalent eurozone PMI meanwhile came close to stabilising, edging up to 49.9.

The UK and Eurozone data thereby hint that both economies are pulling out of downturns, while the US continued to register a sustained expansion.

The flash PMI data for Japan were also encouraging, signalling the fastest growth since last August.

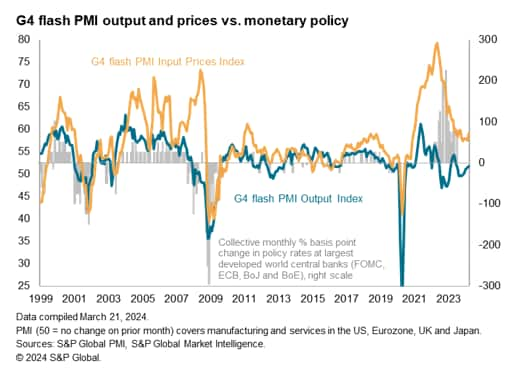

Output growth measured across these four large economies consequently accelerated in March to its fastest since last June. The rush to loosen monetary policy to stave off recession, which seemed all-pervasive at the end of last year, has therefore calmed.

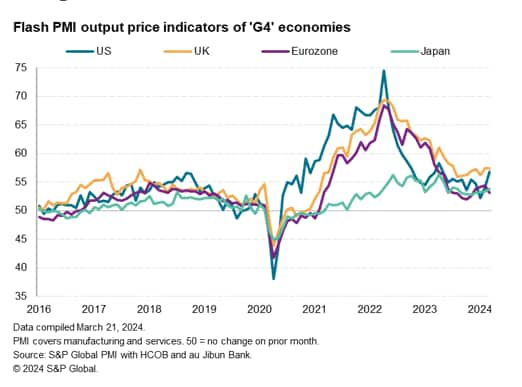

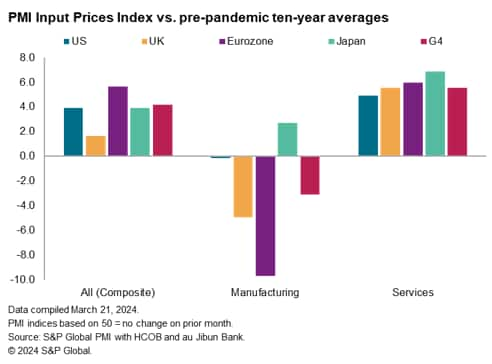

Price pressures - both in terms of input costs and selling prices across goods and services - meanwhile remained elevated by pre-pandemic standards across the board, and even intensified in the US. Stubborn inflation was often linked to upward wage pressures amid tight labour markets, exacerbated by recent energy price hikes.

The steepest growth of selling prices for goods and services was seen in the UK, followed by the US, where rates of inflation accelerated in March for a second month running. Selling price inflation in Japan also accelerated to a seven-month high. Although the rate cooled in the eurozone, it remained well above the pre-pandemic decade average.

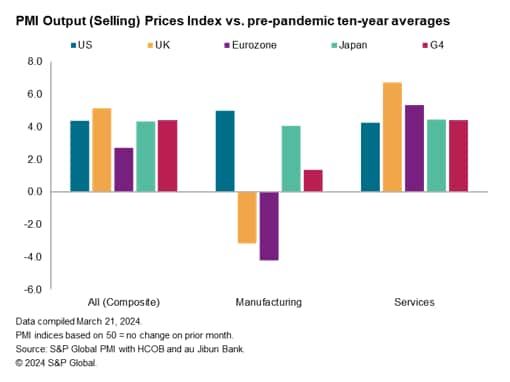

Composite PMI selling price indices exceeded their pre-pandemic ten-year averages by 5.1, 4.4 and 4.3 points respectively in the UK, US and Japan, and by 2.7 points in the eurozone, underscoring the sustained elevated nature of inflation in these economies.

The elevated inflation picture is primarily driven by services (reflecting above pre-pandemic average growth of input costs) but it is notable that manufacturing selling prices are now also rising at rates in excess of pre-pandemic ten-year averages in both the US and Japan, where rates of increase hit 13- and three-month highs respectively in March, according to the flash PMI data.

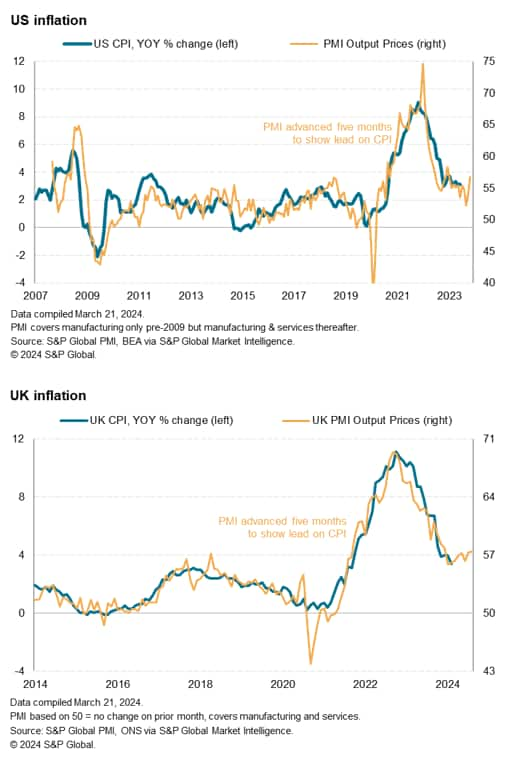

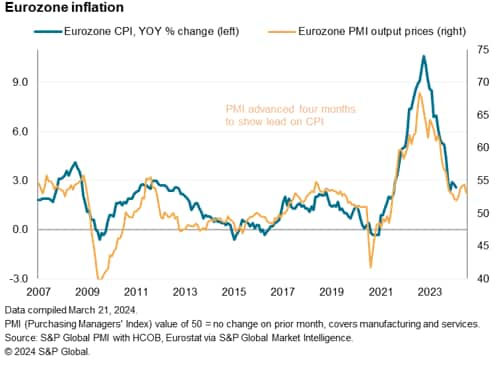

Historical comparisons of the PMI selling price data against consumer price inflation rates in the major economies therefore suggest that underlying price pressures have picked up slightly in the US and UK to degrees which may keep inflation above central bank 2% targets, albeit with some favorable base effects likely to dampen annual rates of inflation in the near term (notably in the UK). Eurozone inflation on the other hand looks more likely to sustainably hit the 2% level given the recent PMI signals.

While recent months have seen financial markets roll back their expectations of the degrees to which interest rates may be cut in the US and Europe, when falling inflation rates had been accompanied by recession worries, central banks have maintained the view that rates should still start falling from around the middle of the year, data permitting. The latest policy meetings at the US Federal Open Market Committee (FOMC), Bank of England and European Central Bank (ECB), for example, have been characterised by a guarded optimism that interest rates will start to fall in 2024, the questions focused on 'when' not 'if' it might be appropriate to start loosening monetary policy.

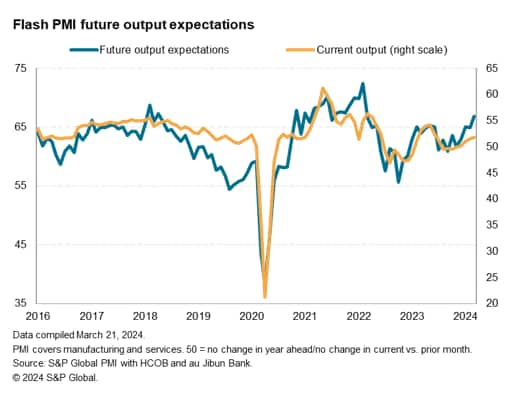

Encouragingly, the reduced rate cut expectations have not dented business confidence. In contrast, the PMI data on business expectations for the year ahead have risen in the US and Europe compared to late last year, and continued to run at a relatively encouraging level in Japan.

From a low point last September, overall business optimism in the outlook across the G4 economies has now risen to its highest since March 2022, according to the March flash PMI data, boding well for the economic upturn to gather further momentum as we head into the second quarter.

In short, the survey data suggest that the US and European economies are showing signs of reduced recession risks while inflationary pressures remain elevated, and in some instances have gathered intensity again. As such, the data support the view that central banks have time to monitor the data follow over the spring to assess the inflation trend.

A widely held expectation among policymakers is that lower headline inflation readings will eventually erode wage bargaining power, helping moderate service sector inflation rates and present a more convincing picture of inflation not just hitting targets but also remaining sufficiently close to target in the medium term. PMI services input cost data, and Comment Tracker data which look at the driving forces behind price changes, will be useful to monitor in this respect.

Access the US, UK, eurozone and Japan Flash PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.