Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Jun, 2017 | 15:00

Highlights

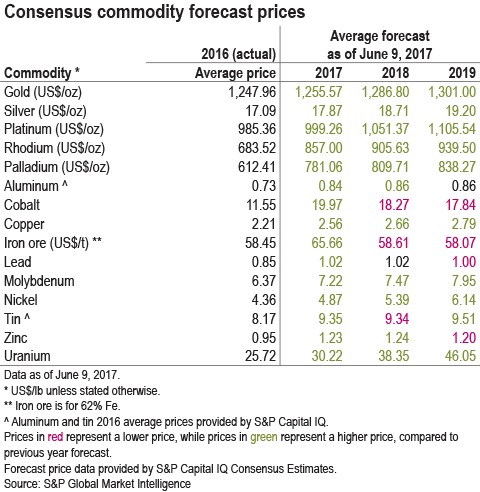

Analysts remain optimistic for commodity markets, with most metals showing higher consensus price forecasts.

Commodity markets have enjoyed a strong first half, and all of the S&P Capital IQ consensus price forecasts as of June 9 are for higher average values in calendar year 2017, compared with the 2016 average prices. Forecasts for most metals also increased in May compared to the previous month's forecasts.

Riding on price increases in the past week, precious metals are expected to continue an upward trend for the next two years, according to consensus price forecasts.

Consensus forecasts for the copper price also sustained an upward trend. This is greatly affected by global copper supply currently at risk due to wage negotiations for mines located in Chile, such as BHP Billiton Group's Escondida mine, Glencore Plc's Collahuasi mine, Orion Resource Partners' Mantos Blancos mine, and Codelco's Radomiro Tomic mine. Another factor is disrupted copper production at several Chilean mines due to recent rain and snow storms.

Iron ore forecast prices remain positive for 2017 despite a decrease in the metal's price over the past two weeks. However, analysts expect the iron ore price to plummet in 2018 and to remain low in 2019. Reports of oversupply continue, and China's consumption of the metal is no longer reported to be the key component in driving demand.

Cobalt also shows a large jump in price for 2017, as supply remains tight despite the increase in demand. The following years show a decline in anticipated prices. Consensus cobalt price forecasts rose again in May compared with the previous month.

The price forecasts for aluminum, lead, tin, and zinc in 2017 show notable increases, to US$0.84/lb, US$1.02/lb, US$9.35, and US$1.23/lb respectively, compared with the previous year's average prices.

Following the same movement, molybdenum, nickel, and uranium continue to show significant increases for 2018 and 2019.

Learn more about our global metals and mining solutions.