Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 29, 2025

By Ravina Choudhary

US biotech group Exelixis Inc. (NASDAQ: EXEL) has taken a major step forward in its cancer drug pipeline, reporting positive Phase III trial results in June for its experimental therapy zanzalintinib (XL092). When used in combination with Roche Holding AG (SWX: ROG) immunotherapy Tecentriq (atezolizumab), the drug significantly improved overall survival in patients with advanced colorectal cancer, outperforming Bayer AG (FWB: BAYN) Stivarga in the same setting.

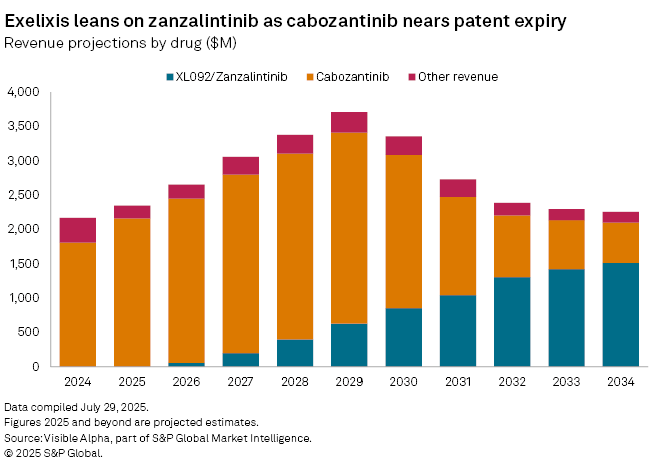

Pending regulatory approval, Zanzalintinib is projected to generate $14 million in risk-adjusted sales from colorectal cancer in 2025, according to Visible Alpha consensus, with analysts assigning a 61% probability of approval in this indication. Broader commercial potential lies ahead, with peak global risk-adjusted sales estimated at $518 million by 2035.

The drug is also being tested across other cancers, including renal cell carcinoma and castration-resistant prostate cancer. However, development for head and neck squamous cell carcinoma has been discontinued after zanzalintinib failed to meet its primary endpoint in a Phase II study, a setback that weighed on Exelixis’s shares.

If successful across indications, zanzalintinib could reach blockbuster status with risk-adjusted global sales of $1 billion by 2031 and peak sales of $1.6 billion by 2035.

Exelixis is hoping the drug will succeed cabozantinib —its current blockbuster sold under the brand names Cabometyx and Cometriq —which generated $1.8 billion in 2024. Sales are projected to rise to $2.2 billion in 2025 and peak at $2.8 billion by 2029, before generic competition begins to erode revenues following patent expiry in 2026. Analysts expect Exelixis’s top line to begin declining from 2030, exposing a gap that zanzalintinib alone is unlikely to close.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment