Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 12, 2025

By Nathan Stovall and Zain Tariq

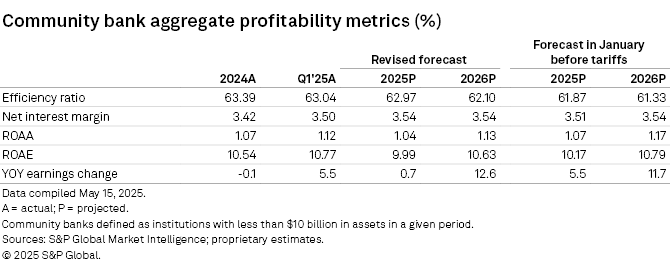

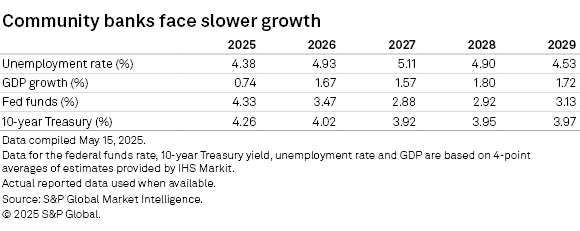

US community banks’ net interest margins are poised to expand as funding costs move lower, while earning assets mature and are replaced with higher-yielding loans and securities. But the Trump administration’s broad suite of tariffs and uncertainty created by the protectionist policies will weigh on loan growth and credit quality and threaten earnings growth in 2025.

Community bank earnings failed to grow in 2024 as net interest margins contracted, while credit quality remained stable. Earnings were expected to grow even more rapidly in 2025 due to declining funding costs and the maturation of lower-yielding pandemic-era assets, allowing for margin expansion. Margins are still expected to expand, but strained consumer sentiment and heightened tariff-related anxiety in the business community are likely to reduce investment activity and loan growth and lead to higher levels of charge-offs. Economic uncertainty should also prompt community banks to build loan loss reserves, making it difficult to grow earnings in 2025. Despite the headwinds, we expect US community banks to report stronger returns than current market valuations suggest.

Click here to access the US Community Bank Market Report.

Click here to access data exhibits and the US community bank aggregate's projections template.

Deposit growth holds, but outlook cloudy for loan growth

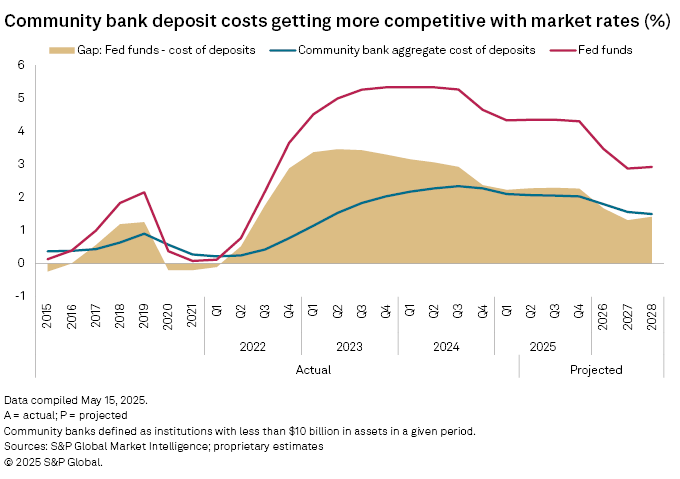

Deposit costs declined over the last few quarters as higher-cost CDs matured and community banks were able to reprice those deposits at lower rates.

As short-term rates moved lower, community banks became far more competitive with alternatives in the Treasury and money markets. The difference between the average fed funds rate and community banks’ cost of deposits narrowed further in the first quarter of 2025 to the smallest gap recorded since the third quarter of 2022, when the Fed was still early in its tightening campaign. That spread should hold in 2025 as community banks seek to lower their deposit costs while staying competitive with higher-yielding alternatives to grow their deposit base.

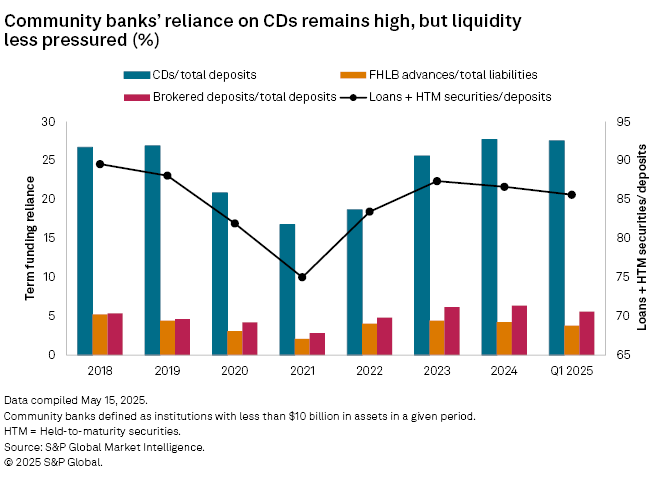

A key driver of deposit costs will be the maturity schedule of certificates of deposits. Community banks have significantly increased their reliance on CDs for funding since the Fed started raising short-term rates early in 2022. CDs represented 27.6% of deposits at the end of the first quarter of 2025, down slightly from 27.7% at the end of the fourth quarter but up notably from 18.7% at year-end 2022 and 16.8% at year-end 2021.

Many CDs carry one-year terms, which allowed a number of community banks to record some relief in the first quarter as the highest-rate CDs originated before the Fed pivot in September matured. At the end of the first quarter, the bulk of CDs were set to mature in the next year, with 33.6% of all CDs maturing or repricing in the next three months, while 85.0% of CDs were set to mature in the next 12 months.

When those CDs mature, most banks will have to meet market rates to retain the deposits. CD rates began declining late in the third quarter, and far fewer institutions are offering the products at rates over 4%, but there has been less movement around the 3.5% level. The number of banks marketing one-year CDs over 3.5% included 1,055 institutions as of May 9, 2025, down slightly from 1,079 institutions as of March 28, 1,134 as of Dec. 27, 2024, 1,266 as of Sept. 27, 2024, and 1,286 as of Sept. 6, 2024.

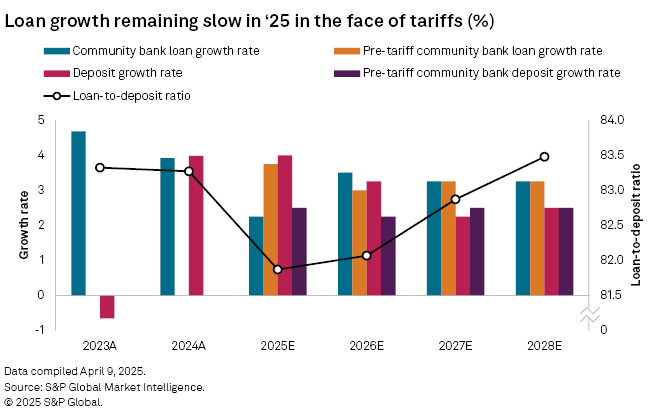

We expect deposit costs to decline in 2025 as higher-cost CDs roll off banks' books. Weaker loan growth should also reduce banks' funding needs and let them keep moving deposit costs incrementally lower. Deposits should grow further, but interest-bearing funds will continue to grow at a quicker clip than non-interest-bearing deposits — banks' most prized source of funding.

As deposit pricing remains competitive with alternatives in the Treasury and money markets, we anticipate healthy deposit growth in 2025. Growth should prove even stronger than previously expected as protectionist trade policies continue to weigh on consumer and business sentiment, potentially driving a flight to banks' safety. Loan growth, meanwhile, should remain relatively weak as fears of tariffs slowing economic growth negatively impact sentiment and cause borrowers to become more risk-averse. Banks reported far stronger loan pipelines early in 2025, but that appetite has yet to turn into reality. While we expect some of those plans to come to fruition, the emergence of tariffs not seen in 100 years is likely to have a chilling effect on business activity in the near term, even if the trade policies do not remain in place for a prolonged period.

Credit trends continue to normalize but tariffs could spur higher losses

Community banks' credit quality remained benign in 2024 even as some members of the investment community feared potential stress in their commercial real estate portfolios. The worst fears of potential bank credit quality deterioration eased heading into 2025, but protectionist trade policies have spurred recessionary fears and brought concerns over credit deterioration back to the forefront. Many economists warn that broader tariffs could cause price increases for consumers and businesses, potentially leading to a recession.

Our baseline scenario does not include that possibility but assumes that, at least in the near term, trade tensions will slow economic growth, reduce corporate investment and put additional strain on consumers, particularly lower-income households that spend a disproportionate amount of their income on goods impacted by tariffs. Consumer delinquencies have steadily risen from pandemic-era lows. Consumer savings rates jumped during the pandemic due to stimulus payments and expanded unemployment benefits that allowed consumers to accumulate more than $2 trillion in excess savings. Despite lasting longer than many economists expected, those savings were finally exhausted in the late summer of 2024. Savings served as a buffer against the impact of rate hikes, but their absence likely will be felt over the coming quarters.

Commercial real estate (CRE) delinquencies have also risen off historically low bases, increasing for 10 straight quarters to the highest level in nearly a decade. That deterioration has drawn considerable attention, as some CRE borrowers face a double whammy of lower cash flows due to the rise of hybrid work and higher debt service stemming from increases in interest rates over the last few years. Banks’ CRE portfolios have faced considerable scrutiny in the investment and regulatory community, but fewer institutions count themselves among those deemed to have an elevated exposure to the asset class as they slowed loan growth and built capital.

While not all CRE credits are equally affected, loans tied to office properties are the most threatened. The subcategories of that asset class also show distinctions, with premier office buildings — defined as the 7% of highest-quality buildings based on CBRE research — considerably outperforming other office properties. CRE borrowers’ mettle will be tested as they seek to refinance maturing credits. Given the increase in interest rates, borrowers may find it harder to access credit or at least face a significantly higher debt service. But CRE losses are likely to be spread out over time. Rates are unlikely to decline enough to leave borrowers with the same debt servicing costs as before the Fed’s tightening cycle. Given the shift to hybrid work, some properties associated with those credits are also producing weaker cash flows.

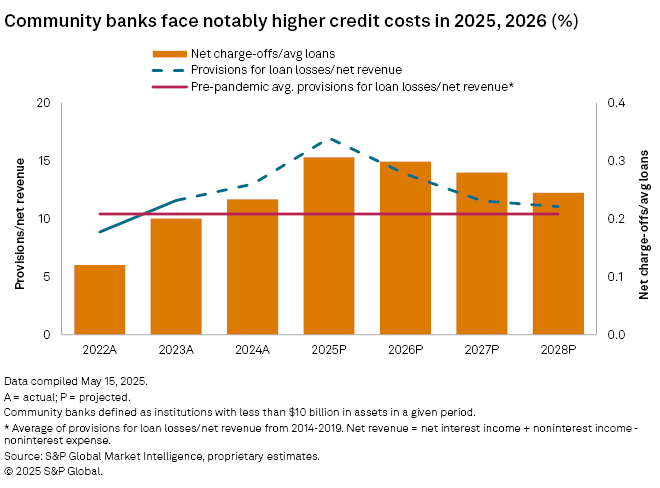

We expect related refinancing challenges to result in defaults and higher loss content in 2025, with net charge-offs continuing to rise from benign levels. We expect loss content to linger as banks provide borrowers with extensions in the face of some maturity walls. Some extensions might let borrowers or their lenders mitigate losses over time, but other properties — especially Class B and Class C office buildings in central urban areas — are likely to incur significant losses.

More banks have shared stories of a handful of commercial borrowers quickly moving from performing status to default or, even worse, succumbing to bankruptcy. While those reports are anecdotal and could prove to represent isolated events, such surprising losses often occur as the credit cycle begins to turn.

Community banks have assumed that greater stress lies ahead and have set aside considerable reserves for the most troubled projects. At the end of the first quarter of 2025, reserves held steady at 1.29% of loans for the third quarter in a row, but we expect them to rise in 2025 as economic uncertainty pushes banks to prepare for trouble ahead. While we expect net charge-offs to rise significantly in 2025, losses and the reserves required to fund them should serve as a modest headwind to earnings rather than a severe downturn.

We expect provisions to rise to 17% of net revenue in 2025, up from 13.0% in 2024 and 11.6% in 2023. On average, from 2013 to 2019, banks’ provisions equated to 10.8% of net revenue.

Looking ahead

The fundamental environment heading into 2025 was close to optimal for US community banks, with improving net interest margins, stronger loan growth, benign credit quality, a friendlier regulatory environment and stronger valuations providing the group with wind at its back and the option to pursue strategic initiatives, including through M&A.

Some of those positives remain in place. Community banks continue to benefit from the remixing of balance sheets as lower-yielding assets roll off and are replaced with higher-yielding new loans or securities. Funding costs have peaked and are declining. Community banks are also expected to feel a lighter touch during regular examinations in the coming quarters. Institutions should also face less regulatory scrutiny over expansion activities, including fintech partnerships.

But economic uncertainty clouds the outlook for community banks. For now, it seems that many strategic actions are on hold until valuations fully recover or at least stabilize. We expect US community bank earnings to hold steady in 2025, resulting in stronger returns than current market valuations suggest. We likely would adopt a more negative stance if the current trade framework were to hold for a prolonged period. If agreements are reached quickly and the US economy can return to business as usual, though, our outlook could be closer to the forecast shared earlier in 2025. It will be difficult to put the genie back in the bottle, and uncertainty will likely negatively impact some expansion plans, but US community banks are well-positioned to navigate, with ample capital, liquidity and reserves to weather potential challenges.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.