Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 01, 2021

Eurozone manufacturing continued to grow at a rate unprecedented in almost 24 years of survey history in May, but also indicated record capacity constraints. While several indicators suggest output growth will remain very strong in coming months as firms reduce backlogs of work, these indicators also highlight growing price pressures, which are currently at a record high.

The IHS Markit headline PMI broke new records for a third month in a row during May to rise to a new high of 63.1. The surging manufacturing sector adds to signs that the eurozone economy is rebounding strongly in the second quarter, especially as the upturn in May was accompanied by signs from the flash PMI of the service sector also showing renewed signs of life.

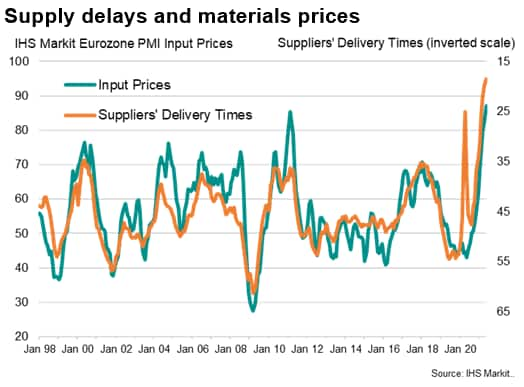

However, production growth would have been even stronger in May had it not been for record supply delays. Supply difficulties and widespread shortages of inputs are constraining output and leaving firms unable to meet demand to a degree not previously witnessed by the survey.

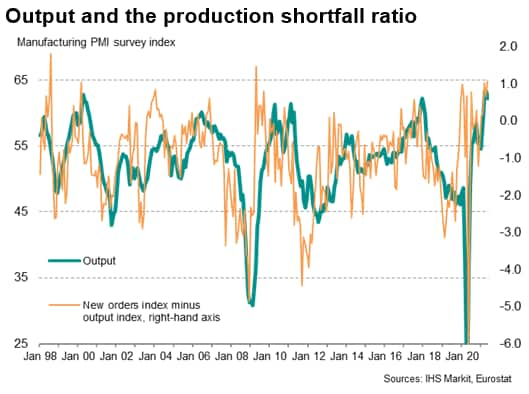

With new orders growing faster than output, the production shortfall relative to demand signalled in May was the largest for 12 years.

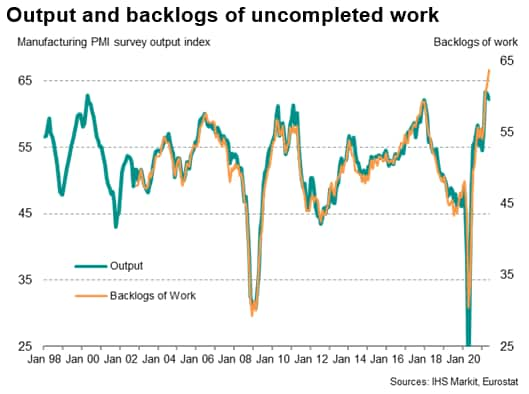

Backlogs of uncompleted work (orders received by manufacturers but not yet started or completed) have consequently accumulated at a record pace.

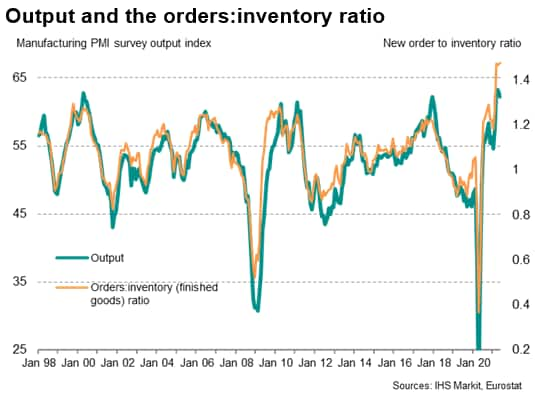

High sales volumes are consequently depleting warehouse stocks, resulting in a new order to inventory ratio far in excess of anything previously recorded by the survey.

While these forward-looking indicators bode well for production and employment gains to persist into coming months as firms seek to catch up with demand, the flip-side is higher prices. The combination of strong demand and deteriorating supply is pushing up prices to a degree unparalleled over the past 24 years.

The survey data therefore indicate that the economy looks set for strong growth over the summer, but will likely also see a sharp rise in inflation.

We expect price pressures to moderate as the disruptive effects of the pandemic ease further in coming months and global supply chains improve. We should also see demand shift from goods to services as economies continue to reopen, taking some pressure off prices but helping to sustain a solid pace of economic recovery. However, this assumes the impact of the pandemic continues to wane in the coming months, and further waves of COVID-19 infections would inevitably darken this improving picture. With signs already appearing of Asia-Pacific economies being hit by a renewed surge in cases, a smooth path to the restoration of global supply chains is by no means assured.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location