Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 01, 2022

The S&P Global Eurozone Manufacturing PMI® indicated a sixth successive monthly decline in factory production in November. Although the rate of contraction cooled, it remained among the steepest recorded since the global financial crisis.

The survey sub-indices reveal that demand had slumped to such an extent that production is likely to fall further in coming months, especially as the downturn in final demand looks set to be exacerbated by stock reduction policies.

A by-product of the collapse in demand has been improved supply availability, in turn pulling price pressures lower. As such the data suggest that concerns will start to move away from inflation towards the growing risks of a recession in Europe.

Eurozone manufacturing output

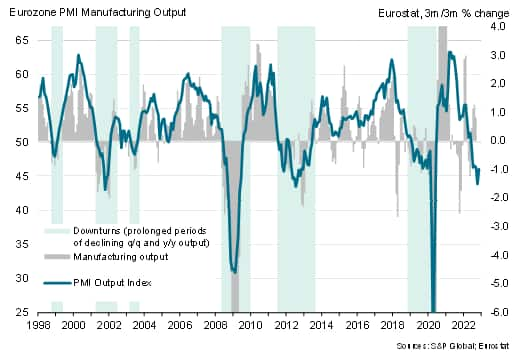

The S&P Global Eurozone Manufacturing PMI moved slightly higher in November to 47.1, from 46.4 in October. While the rise in the index signals some welcome moderation in the intensity of the eurozone manufacturing downturn in November, which will in turn support hopes that the region may not be facing a winter downturn as severe as previously anticipated by many, the survey's production index nevertheless continues to run at one of the lowest levels recorded over the past decade, indicating a sixth successive monthly contraction of factory output.

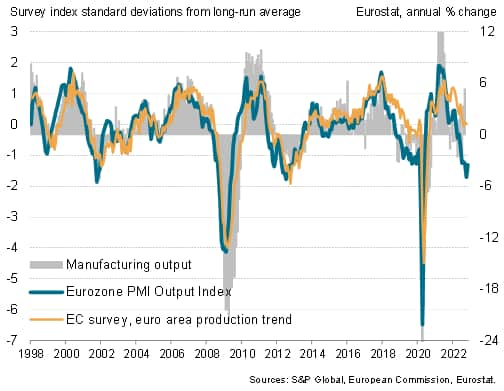

At these levels the survey is indicative of a marked annualised rate of contraction of approximately 4%. While official manufacturing data have been more buoyant - and more volatile - in recent months, such weak PMI readings have always been followed by commensurate steep declines in the official statistics.

Similarly, while the European Commission's business surveys have not yet indicated a downturn of the intensity signalled by the PMI in recent months, it should be noted that the EC survey tends to lag the PMI. The EC survey has also tended to overstate the manufacturing production trend, notably in the two years leading up to the pandemic.

Eurozone manufacturing survey comparisons

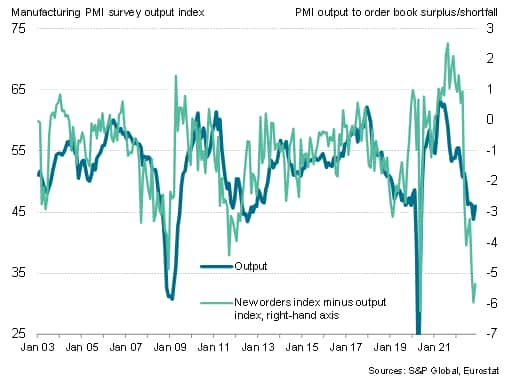

There also seems to be no immediate respite in sight for the plight of manufacturers, given that order books continue to deteriorate at a worryingly steep pace, contracting at a far faster rate than firms are cutting production.

Eurozone manufacturing output vs order books

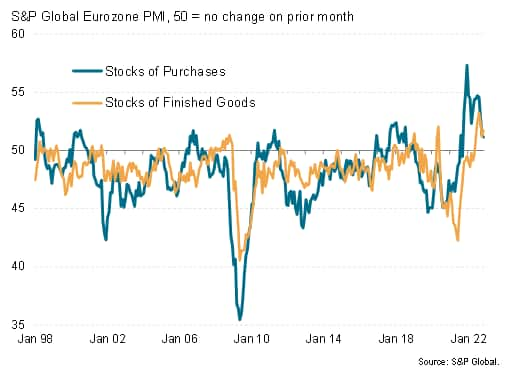

Inventories of unsold stock are therefore rising further and follow on from the largest build-up of finished goods inventories in the quarter century history of the survey in recent months. Such a stock build-up will inevitably be followed by further production capacity cuts, absent a revival in demand.

Inventories of raw material inputs have also climbed sharply in recent months, largely in response to lower than anticipated production requirements.

Eurozone manufacturing inventories

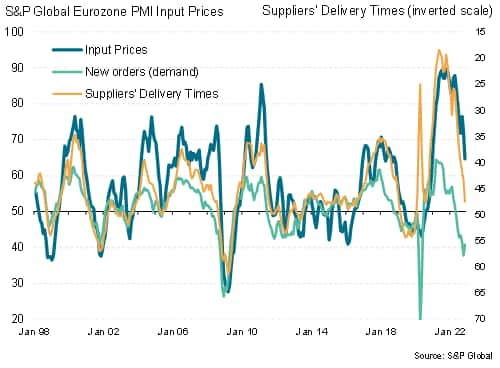

A consequence of the recent inventory build-up and softening of demand has been a major pull-back in purchases of inputs by manufacturers, which has in turn taken pressure off supply chains. Supplier delivery times lengthened in November to the smallest extent since August 2020, and are now even improving in Germany. This improvement in supply is an important signal of a shift from a sellers' to a buyers' market, and is hence being accompanied by a significant cooling of industrial price pressures.

Eurozone manufacturing demand, supply and prices

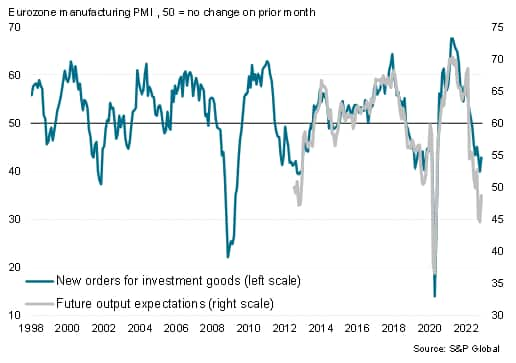

Looking ahead, future output expectations picked up slightly on improved supply chain and energy market signals, the latter buoyed by warmer than usual autumn weather, but confidence remained amongst the lowest seen over the past decade. Demand for investment goods such as plant and machinery slumped alongside the downturn in business confidence, in a disappointing signal of further cost-cutting-led retrenchment by manufacturers.

Eurozone manufacturing confidence and demand for investment goods

How manufacturers fare over the winter months will of course be conditional to a large extent on the weather, with any cold snaps likely to fuel concerns over energy resources and potentially hitting production and supply chains further.

Read the accompanying press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.