Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 24, 2021

Flash Eurozone PMI at 52.5 in March signals return to growth

Manufacturing expands at record pace, helping offset service sector weakness

Factory input cost inflation highest since March 2011, as supplier delivery times lengthen to the greatest extent in the survey's 23-year history

Rising infection rates threaten outlook

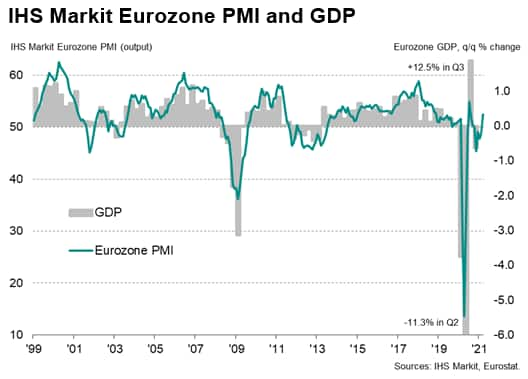

The eurozone economy beat expectations in March, showing a much better than anticipated expansion thanks mainly to a record surge in manufacturing output.

The headline IHS Markit Eurozone Composite PMI® rose from 48.8 in February to 52.5 in March, according to the preliminary 'flash' reading. By rising above 50.0, the latest reading indicated the first increase in business activity since last September, with the current expansion the largest recorded since last July and the second-steepest seen over the past 28 months.

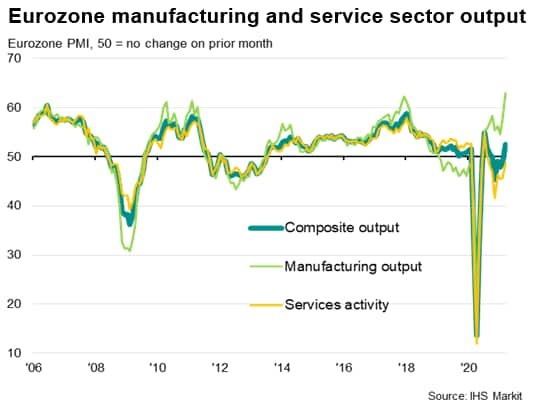

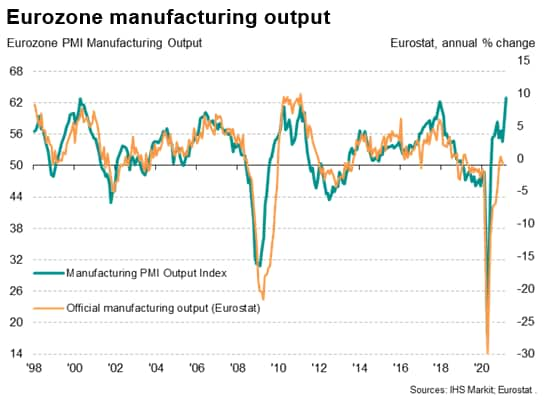

Manufacturing surges but services struggle

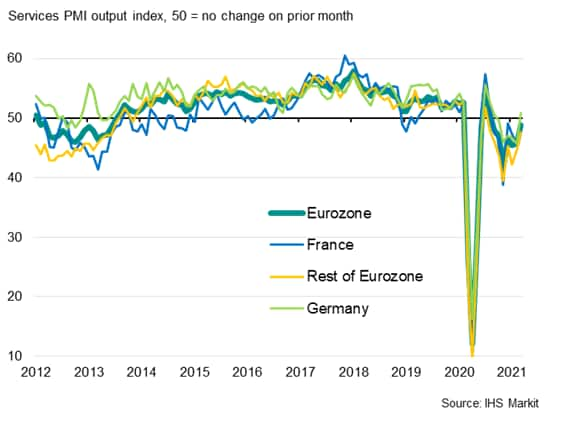

Divergent trends were seen by sector. While manufacturing output growth accelerated sharply to the highest since data were first available in 1997, the service sector continued to be constrained by the coronavirus disease 2019 (COVID-19) pandemic, with social distancing restrictions leading to a seventh successive monthly fall in business activity.

The service sector therefore remained the economy's weak spot, but even here the rate of decline moderated in March as companies benefited from the manufacturing sector's upturn, customers adapted to life during a pandemic and prospects remained relatively upbeat.

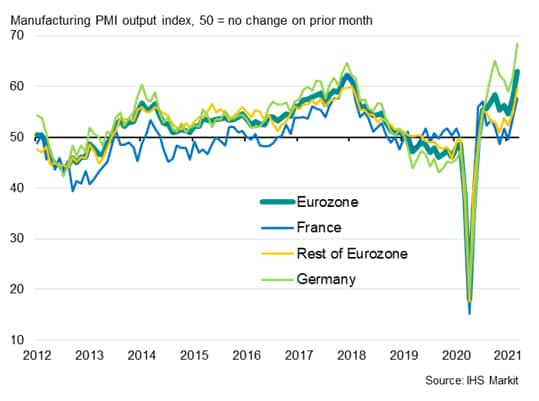

Germany leads the upturn

The manufacturing upturn was led by a record surge of factory production in Germany, accompanied by the fastest production growth since January 2018 in both France and the rest of the region as a whole.

Germany also outshone in terms of service sector performance, recording the first (albeit modest) expansion of activity for six months while France and the rest of the euro area merely saw rates of contraction moderate.

Looking at growth over both sectors combined, Germany's resulting upturn was the strongest for just over three years (the composite PMI rising from 51.1 to 56.8), contrasting with a decline in France for the seventh successive month (albeit with the index at 49.5, up from 47.0 in February). The rest of the region saw a modest return to growth for the first time since last July (composite index at 50.6 versus 48.2 in February).

Higher inflation

The return to growth was accompanied by a further increase in price pressures. Average prices charged for goods and services rose to a degree not seen since January 2019, with goods prices rising particularly steeply, posting the largest gain for almost a decade. Prices rose far more modestly in the service sector, yet the increase was notable in being the first since the pandemic began.

Higher charges often reflected rising costs. Average input prices across both manufacturing and services rose in March at the sharpest rate for a decade. Factory input cost inflation struck the highest since March 2011, often linked to supply shortages. March saw supplier delivery times lengthen to the greatest extent in the survey's 23-year history.

However, service sector input costs also grew sharply, rising at the fastest pace since February of last year, reflecting higher materials, food, PPE and fuel prices, plus rising wage pressures.

Higher costs were observed across the board, with Germany reporting the steepest increases (and also the most widespread supply chain delays).

Outlook clouded by further COVID-19 waves

The outlook has deteriorated, however, amid rising COVID-19 infection rates and new lockdown measures, notably in Germany.

The two-speed nature of the economy will therefore likely persist for some time to come, as manufacturers benefit from a recovery in global demand but consumer-facing service companies remain constrained by social distancing restrictions.

While March's rise in the PMI is encouraging, especially in relation to how the economy has become somewhat resilient to COVID-19 lockdown measures and social distancing restrictions, the slow roll-out of vaccines and third waves of infections suggest that the latest reading may represent a short-term peak.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Book Time with or Ask Chris a Question

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location