Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Sep, 2018

Technology, Media & Telecom

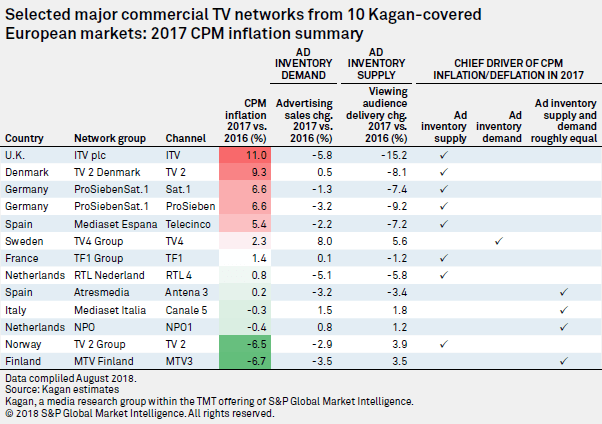

A lack of major international televised sports events and continued decline in viewing were key contributors to rising CPMs on the flagship channels of Europe's major commercial TV networks in 2017, according to Kagan estimates.

Tougher conditions compared to 2016 coupled with the continuing factors of viewing fragmentation and over-the-top growth contributed to the decline in linear viewing in 2017. In 2016, the Rio Summer Olympics and the UEFA European Championship, commonly referred to as Euro 2016, drove viewing on most of the 10 European TV networks covered by Kagan. As a result, 2017 was, in general, a year defined by CPM inflation as the overall lower viewing relative to 2016 led to a decrease in ad inventory, which fueled year-over-year price increases.

Ad sales were down year over year for most of the flagship channels of the Kagan-covered European commercial networks, though in most cases any decline in advertiser demand was not sufficient to bring CPMs down.

CPM inflation: Impact on TV networks and their advertisers

Advertisers are clearly averse to sustained increases in the cost of advertising, yet moderate CPM inflation is neither necessarily bad for advertisers nor good for networks. CPM inflation is a gauge for the cost-effectiveness of advertising, making it more than just a metric for annual price comparison.

Although many networks publish fixed rate cards, CPMs mostly "float" under market conditions and are a function of inventory supply and demand. Networks must constantly monitor this delicate balancing act, and much depends on whether inflation is primarily driven by ad inventory supply, i.e., viewing audience, or ad inventory demand, i.e., ad sales.

For example, if annual viewing audiences fall and annual ad sales remain flat, the CPM will increase year over year. In such a case of supply-driven inflation, it is tougher for networks to justify the increased cost to advertisers. On the other hand, an annual increase in ad sales coupled with flat year-over-year viewing is an example of demand-driven CPM inflation for a channel, which might suggest a healthy trading environment in which advertisers are willing to spend, thus creating significant demand for networks to command a higher CPM. This is typically the case when a network sells inventory in major sports tournaments or during a period of high consumer spending, such as the weeks preceding Christmas.