Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Oct 06, 2021

Research Signals - September 2021

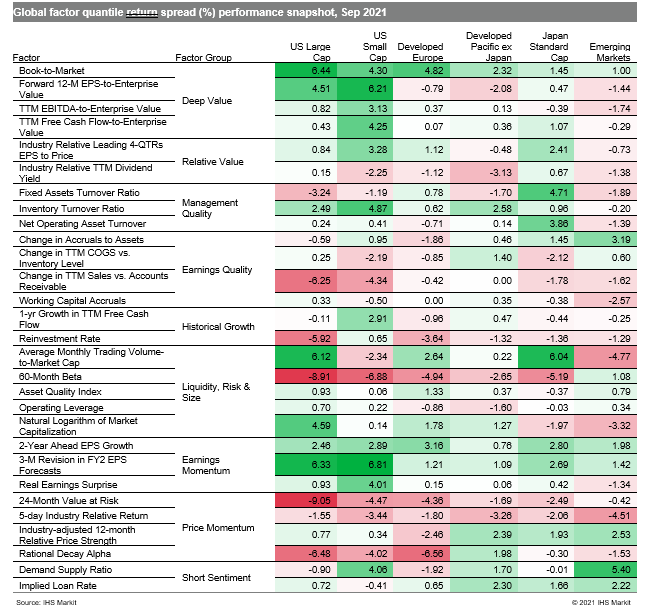

After rising steadily for most of the year while Asia Pacific markets remained unsettled, US and developed Europe equity markets finally succumbed to concerns over economic growth from factors such as the spread of the delta variant and rising inflation. Moreover, the global manufacturing upturn has remained constrained by supply chain disruptions and input shortages, according to the J.P.Morgan Global Manufacturing PMI. Yet, high risk shares outperformed in many developed markets, alongside undervalued stocks (Table 1).

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.