Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 24, 2022

The eurozone economy retained encouragingly resilient growth in May, as a beleaguered manufacturing sector was offset by a buoyant service sector. Although factories continue to report widespread supply constraints and diminished demand for goods amid elevated price pressures, the economy is being boosted by pent-up demand for services as pandemic-related restrictions are wound down.

However, it remains to be seen how long this service sector rebound can persist for, especially given the rising cost of living, and the weakness of manufacturing remains a concern, as the factory malaise is already showing signs of spilling over to some parts of the services economy.

Although there are signs that inflationary pressures could be peaking, with input cost inflation down for a second successive month and supply constraints starting to be less widely reported, inflationary pressures remained elevated at previously unprecedented levels.

Such high price pressures, accompanied by the reassuringly resilient GDP growth signalled by the surveys, looks set to tilt policymakers at the ECB towards a more hawkish stance.

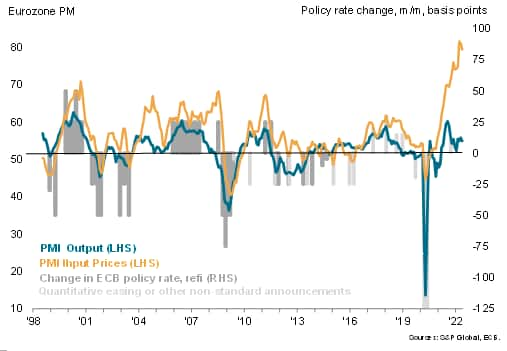

Eurozone PMI output and input cost inflation charted against ECB policy decisions

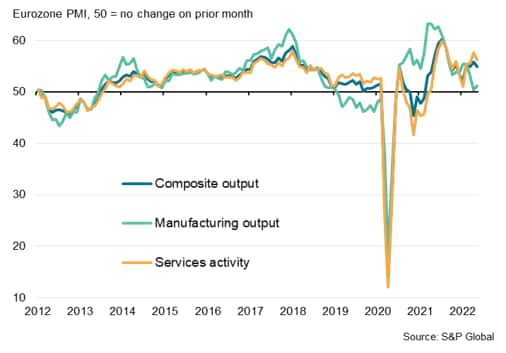

The seasonally adjusted S&P Global Eurozone PMI® Composite Output Index edged down from 55.8 in April to 54.9 in May, according to the preliminary 'flash' reading. The latest reading indicated an expansion of economic activity for the fifteenth successive month, with the rate of growth easing only modestly to remain well above the survey's long-run average.

The latest PMI data are consistent with the economy growing at a solid quarterly rate of 0.6% so far in the second quarter.

Eurozone PMI vs. GDP

Growth was led by the service sector, which recorded its second-strongest expansion in the past eight months. Many consumer-facing service sector businesses again reported strong demand due to the reopening of the economy after Omicron related restrictions, driving especially robust growth for tourism and recreation activities. However, the overall rate of service sector growth eased compared to April due in part to weaker expansions for financial services and industrial services, the latter in turn linked to a recent slowdown in manufacturing.

Although manufacturing output growth improved slightly in May, it remained very modest after production growth had slowed to a near stand-still in April. The second quarter so far has consequently seen the weakest manufacturing expansion since the pandemic-related shutdowns in the second quarter of 2020.

Eurozone PMI output indices

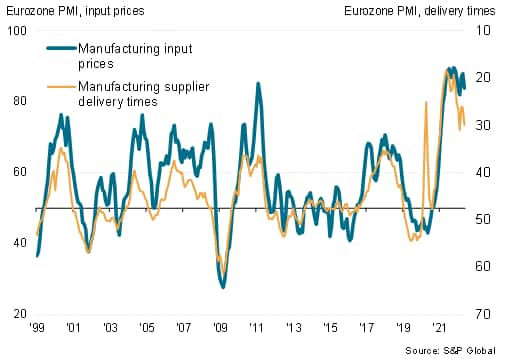

Factory output continued to be constrained by widespread supply shortages, with the Ukraine war and mainland China's lockdowns having exacerbated existing pandemic-related supply chain pressures. The lengthening of supplier delivery times in May continued to exceed anything recorded prior to the pandemic, albeit with the number of reported delays easing slightly compared to March and April, which in turn helped buoy growth in the autos sector. However, many other manufacturing industries reported that supply chain delays, combined with increased caution among customers and spending by households being diverted from goods to services, led to weaker output growth or even falling production.

Measured overall, manufacturing new orders fell for the first time since June 2020, contrasting with further solid growth of new business inflows into the service sector, albeit the latter seeing demand growth wane slightly compared to April's eight-month high.

Eurozone PMI new orders

Similar sector divergences were seen in terms of backlogs of work: while levels of outstanding business rose in manufacturing at the slowest rate since August 2020, hinting at weaker production needs in coming months, growth of service sector backlogs hit the highest since July 2021, rising at a rate rarely exceeded in the survey's history to suggest service providers may need to expand capacity to meet current demand growth.

Identical rates of solid and improving employment growth were recorded in manufacturing and services, the latter notably representing the strongest payroll gain since July 2007, as firms sought to boost operating capacity.

Eurozone PMI employment

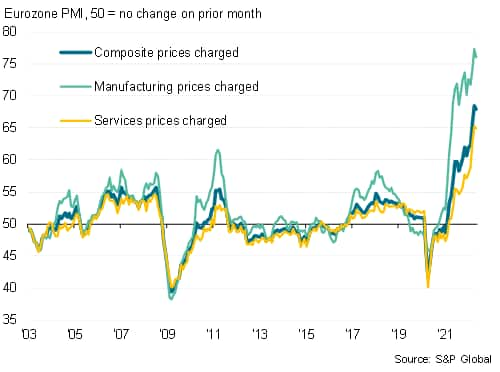

Average prices charged for goods and services meanwhile rose sharply, increasing at a rate below April's all-time high but still registering the second-steepest increase yet recorded by the survey. Slightly slower rates of inflation were seen for both goods and services, principally reflecting the slower growth of costs recorded during the month.

Eurozone PMI prices charged

Input cost inflation eased slightly for a second successive month, albeit the rise was still the third-largest recorded since comparable data were first available in 1998 due to soaring energy prices, rising transport costs, broader supplier-driven input price increases and rising wage pressures. Rates of increase eased in both manufacturing and services to the lowest since February, the factory sector reporting an especially marked cooling in raw material price inflation. However, the recent easing of supply chain delays hints at industrial price pressures beginning to cool.

Eurozone supplier delivery times and prices

Eurozone inflation: elevated, but peaking?

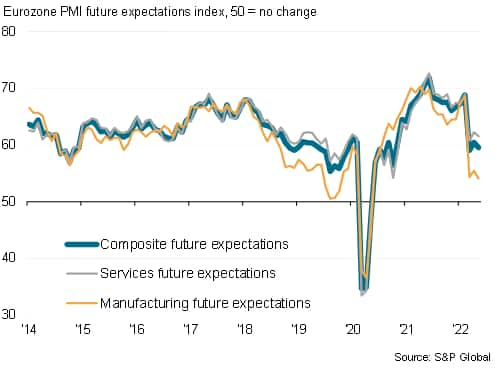

Looking ahead, business optimism about the next 12 months deteriorated slightly to run at the second-lowest recorded over the past year-and-a-half. Confidence has moved sharply lower since the outbreak of the Ukraine war, with the uncertainty and supply constraints caused by Russia's invasion continuing to be accompanied by wider global supply chain worries linked to China, as well as broader gloom regarding economic prospects and high inflation. Confidence fell to the lowest since the first wave of the pandemic in manufacturing during May but remained more resilient in services.

Eurozone business confidence

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.