Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 07, 2021

With August seeing a rise in COVID-19 case numbers globally due to the spread of the Delta variant, it was no surprise to see healthcare lead the PMI growth rankings and hospitality slump. Similarly, growing pandemic related shortages have increasingly hit many manufacturing sectors, such as autos and construction materials, with spill-overs to some service sectors such as IT services. Price pressures are most concentrated in those sectors reporting the greatest constraints.

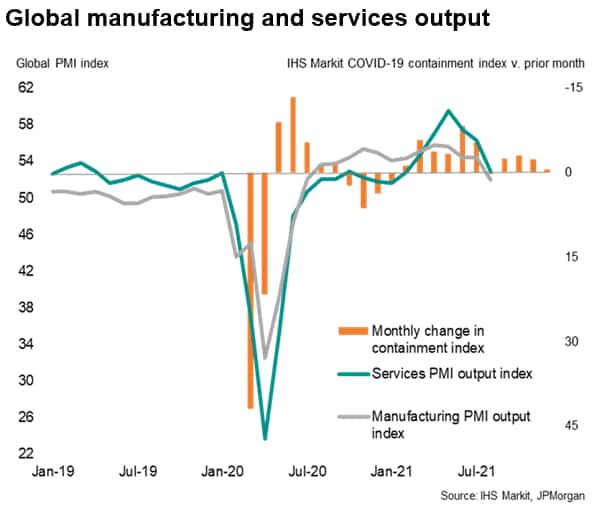

IHS Markit's global PMI data, based on information collected directly from over 28,000 companies around the world, showed the pace of global economic growth slipping in August to the lowest since January. The slowdown occurred alongside a further wave of COVID-19 infections as the more contagious Delta variant spread across increasing numbers of countries, notably in Asia but also in the US and parts of Europe.

Output consequently fell in China as well as a number of other smaller Asia-Pacific economies, and growth slowed in the US and Europe. Service sector output growth dropped worldwide to the lowest since February, led by the first fall in global services exports since March, and manufacturing grew at the lowest rate since the sector's recovery began in July of last year.

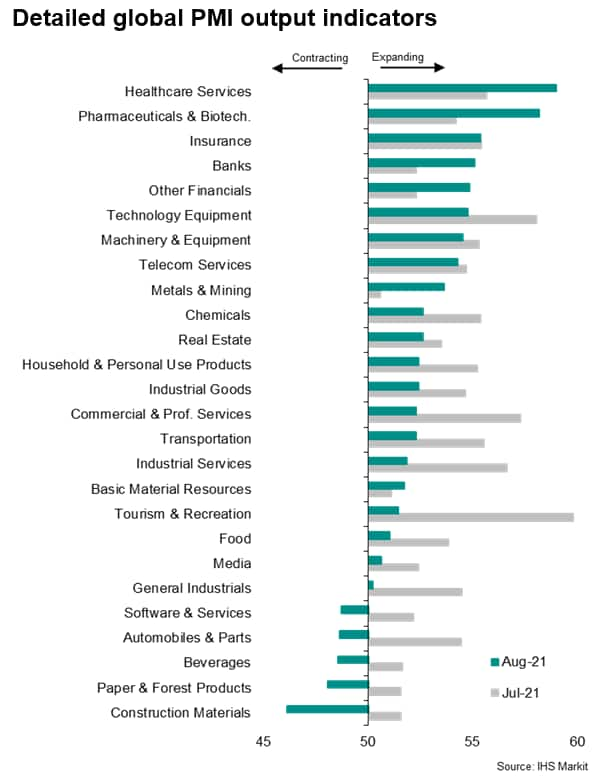

Looking deeper into the PMI data by detailed sector, the strongest expansion in August was recorded in healthcare services, reflecting the resurgence of the pandemic. Growth of business activity in this sector was among the highest ever recorded by the survey, albeit below prior peaks seen during the pandemic.

Growth also surged higher in the pharmaceuticals & biotech sector, resulting in the joint-third-fastest overall healthcare industry growth seen since data were first available in 2009.

In contrast, growth deteriorated to the greatest extent in the tourism & recreation sector, as many economies reimposed COVID-19 restrictions and concerns over the spread of the virus dampened demand for travel and other hospitality activities.

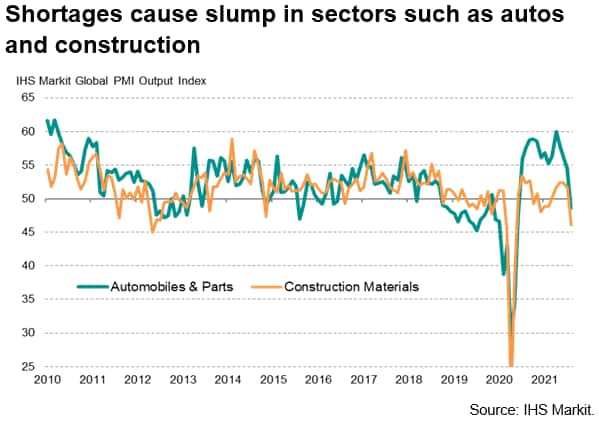

Steep slowdowns were also seen in many manufacturing sectors, most notably autos production and construction materials, linked in many cases to supply shortages curbing production capacity.

Of the 26 detailed sectors covered by the global PMI, falling output was in fact seen in five sectors, four of which were manufacturing oriented and a fifth - IT software and services - saw activity fall in part due to a lack of tech equipment.

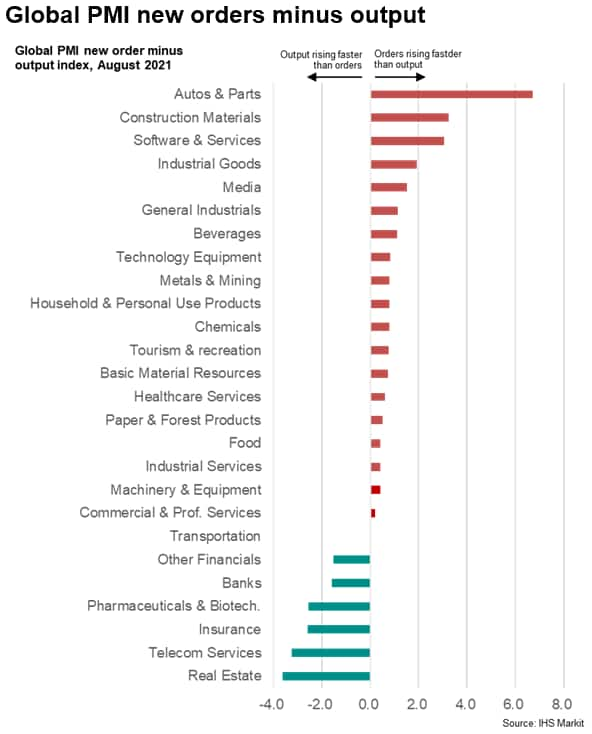

The constraints on production caused by a lack of inputs were further highlighted by certain sectors seeing output lag new orders growth. Autos and construction materials manufacturing, for example, reported that output had fallen short of new orders to the greatest extent of the sectors covered, followed bv software & services and industrial goods manufacturing.

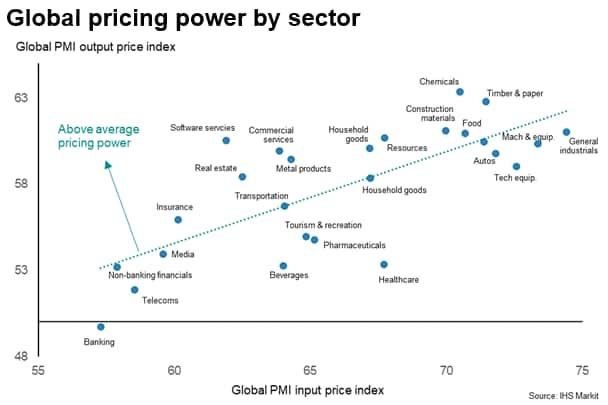

Price hikes were most prevalent in sectors reporting the greatest constraints and shortages relative to demand. The steepest rise in average selling prices globally in August was therefore recorded in the chemicals (including plastics) sector, followed closely by timber and paper producers.

Only banking services reported lower selling prices in August.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.