Major APAC equity indices closed mixed, while most European and US indices were lower. US government bonds closed lower, while benchmark European bonds were higher on the day. CDX-NA closed wider across IG and high yield, iTraxx-Europe was flat, and iTraxx-Xover was tighter on the day. The US dollar closed higher, natural gas was flat, and oil, gold, copper, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for DJIA flat; S&P 500 -0.7%, Nasdaq -1.7%, and Russell 2000 -2.3%.

- 10yr US govt bonds closed +2bps/1.50% yield and 30yr bonds +7bps/1.87% yield.

- CDX-NAIG closed +1bp/55bps and CDX-NAHY +5bps/310bps.

- DXY US dollar index closed +0.4%/96.27.

- Gold closed -0.5%/$1,777 per troy oz, silver -1.9%/$22.01 per troy oz, and copper -1.4%/$4.33 per pound.

- Crude oil closed -2.0%/$70.94 per barrel and natural gas closed flat/$3.81 per mmbtu.

- By the end of 2022, the nameplate nominal capacity of operating US LNG facilities is expected to increase to processing 11.4 Bcf/d of natural gas, and peak capacity will increase to 13.9 Bcf/d, according to the US EIA. The peak capacity is greater than the capacities of the two largest LNG exporting nations today, Australia (peak 11.4 Bcf/d) and Qatar (10.4 Bcf/d). (IHS Markit PointLogic's Kevin Adler)

- At 11.4 Bcf/d of gas intake, US LNG production capacity is about 77 million metric tons/annum (Mtpa). At the peak of 13.9 Bcf/d of gs, that's about 90 Mtpa of LNG.

- The move to being possibly become the largest LNG producer and exporter in the world has been rapid, as the first global-scale train began service at Cheniere's Sabine Pass LNG in May 2016.

- US capacity this year has been increased with the startup of Train 3 at Corpus Christi LNG, and Train 6 at Sabine Pass could be at full commercial service this month. For 2022, the big impact is that Calcasieu Pass LNG will reach in-service. Its 18 liquefaction trains will have a total processing capacity of 1.6 Bcf/d of gas; commissioning at Calcasieu Pass has started, and the company has said all trains will be operating by the end of 2022.

- While the US could reach No. 1 status next year, Qatar is on target to become the world's largest producer by 2026, when new projects will be completed to bring the country to a total capacity of 110 Mtpa and possibly as high as 127 Mtpa, according to announcements it made in June.

- In 12 states and the nation's capital, the seven-day average of hospital admissions with confirmed COVID-19 has climbed at least 50% from two weeks earlier, according to U.S. Department of Health and Human Services data. The areas with the largest percentage upticks were Connecticut, New Jersey, Washington, D.C., Vermont and Rhode Island. (Bloomberg)

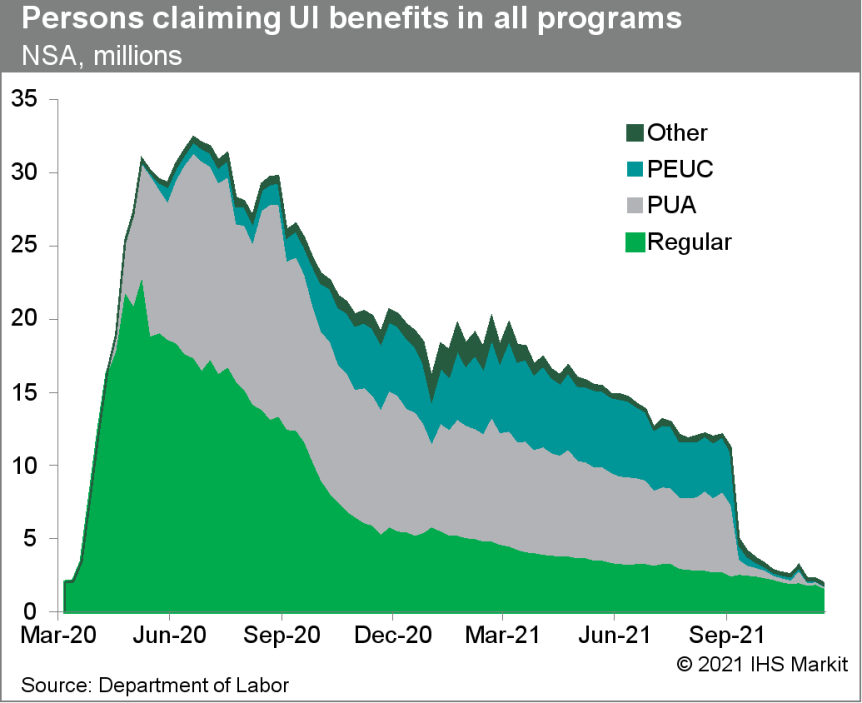

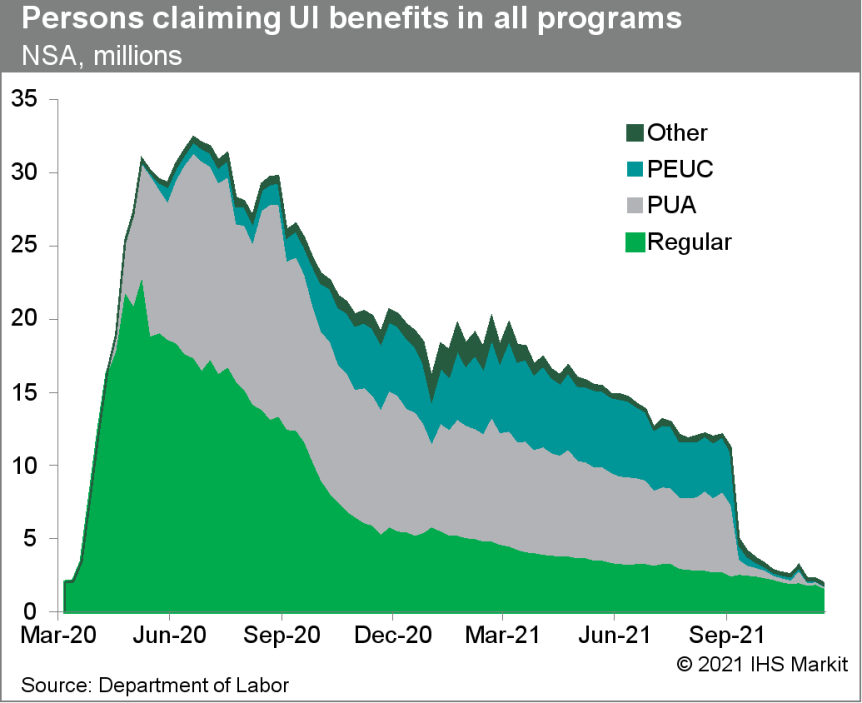

- US seasonally adjusted initial claims for unemployment insurance decreased by 43,000 to 184,000 in the week ended 4 December, falling to its lowest level since 15 November 1969. Given the tight labor market, employers are holding on to their existing employees—indeed, the layoffs and discharges rate is at a record low. Nevertheless, because of the difficulty of seasonal adjustment around the holidays, especially during the pandemic, we caution against reading too much into the large swings in the level of claims in the past few weeks. (IHS Markit Economist Akshat Goel)

- The not seasonally adjusted (NSA) tally of initial claims rose by 63,680 to 280,665. The fall in adjusted claims to a multi-decade low is in part explained by seasonal adjustment, which expected a much larger post-Thanksgiving spike of 106,047 in the level of unadjusted claims.

- Seasonally adjusted continuing claims (in regular state programs) rose by 38,000 to 1,992,000 in the week ended 27 November. The insured unemployment rate edged up 0.1 percentage point to 1.5%.

- In the week ended 20 November, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 33,721 to 112,728.

- In the week ended 20 November, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 45,764 to 124,536. The number of claims under PUA and PEUC should continue to decline in coming weeks as states work through retroactive claims.

- In the week ended 20 November, the unadjusted total of continuing claims for benefits in all programs fell by 350,527 to 1,947,598.

- Ford has reportedly stopped taking reservations for the upcoming F-150 Lightning, having confirmed in November that reservations were approaching 200,000. According to Automotive News, Ford is preparing to open its actual order banks in January 2022. Automotive News cites a Ford spokesperson as saying that the company is planning a "waved invitation approach" for converting the reservations to orders. "The number of waves will be adjusted throughout the process based on available commodities and customer order rates from each previous wave. Invitations to order a 22MY will continue to be sent to reservation holders until 22MY production is fulfilled. Remaining reservationists will be invited to order in subsequent model years," the Ford contact is quoted as saying via email. Given that Ford suggests the potential orders are approaching 200,000 units, it is likely that many will not get 2022 model year vehicles. Ford has not said how many it will produce in 2022 or 2023, although it has said it plans to ramp up to an annual run rate of 80,000 units in 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) technology startup Robotic Research has raised USD228 million in a Series A funding round, reports TechCrunch. The financing round was led by SoftBank Vision Fund 2 and Enlightenment Capital and included the participation of Crescent Cove Advisors, Henry Crown and Company, and Luminar. The company plans to use the infused capital to scale up its commercial division RR.AI's solutions for trucks, buses, and logistics vehicles. Alberto Lacaze, CEO of Robotic Research, said, "Most people think robotics is some magic piece of software. The reality is that robotics is more like a stamp collection. You have to collect all these different edge cases where you need to be able to run on slippery roads and with dust and without being able to see the lines and so forth. We have collected lots and lots of stamps. To a certain degree, a common day for a military application is the edge case for a commercial application." Robotics Research is an engineering and technology company, founded in 2002 to offer autonomy software and robotic technology. The company has a history of automating trucks for the US army and navy, operating in areas with no GPS, good communications, or lined roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US farmers are urging the Biden administration to investigate record high fertilizer prices and whether the highly-consolidated industry is manipulating the market. (IHS Markit Food and Agricultural Policy's JR Pegg)

- "The economic conditions of the fertilizer sector suggest market abuses are likely, and farmers are experiencing a price squeeze that is highly suspicious in its timing," the Family Farm Action Alliance said in a December 8 letter to the Department of Justice's Antitrust Division.

- "These corporations are using their monopoly power to raise and lower the price charged to farmers not based on basic supply and demand, but rather on the price the farmer is paid for their commodity crops," according to the ag group.

- The letter from the alliance—a non-profit advocacy organization with more than 6,000 members—comes as farmers are wrestling with prices for several fertilizers have risen more than 100% in the past year. Fertilizer companies blame the price increases on rising natural gas costs, export delays and production disruptions caused by severe weather in the US.

- But the alliance is unconvinced and contends the "alarming spike in prices … suspiciously coincides with an increase in income farmers are earning from commodity crops like soybeans and corn."

- The ag group points to industry consolidation, noting that since the 1980s the US fertilizer industry has shrunk from 46 companies to 13. The North American supply of potash is controlled by two companies—Nutrien Limited and the Mosaic Company—and four firms control 75% of the production and sale of nitrogen-based fertilizer in the US.

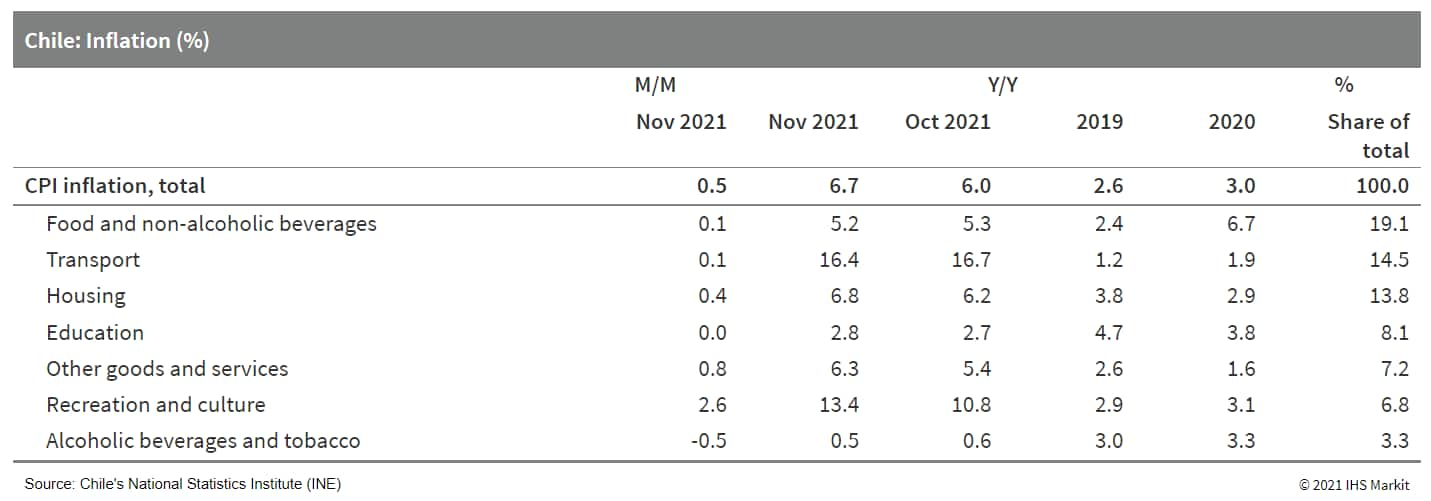

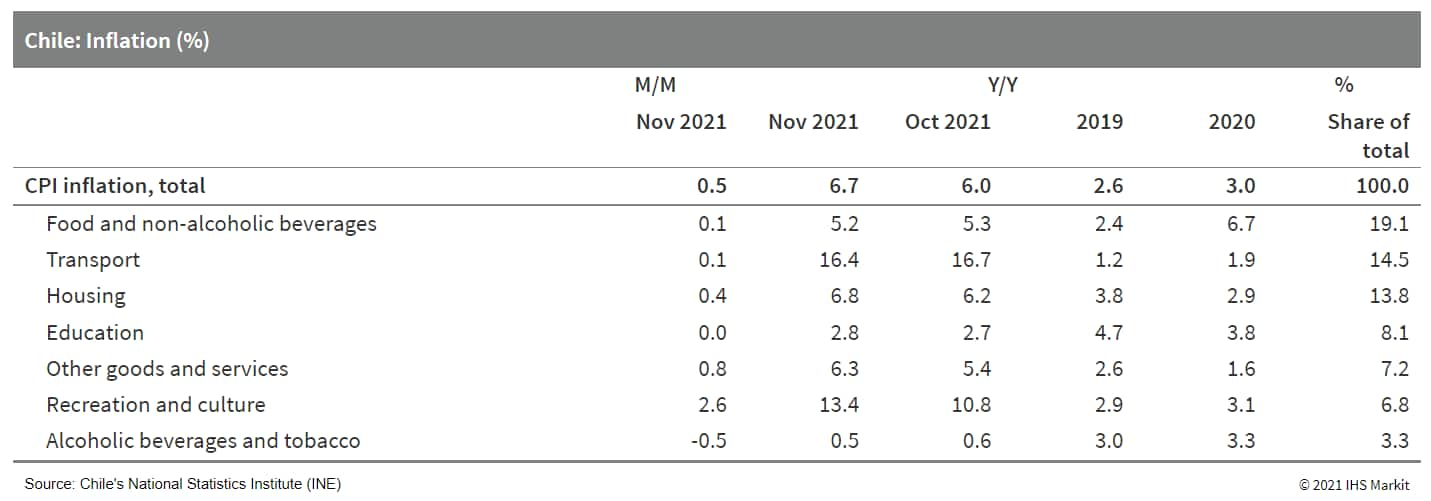

- Chile's consumer price inflation rate stood at 0.5% m/m in November, slowing from 1.34% m/m in the prior month, mainly because of increases in the costs of recreation and culture and clothing and shoes. Prices rose in 8 of the 12 basket components. (IHS Markit Economist Claudia Wehbe)

- Prices in the recreation and culture category rose because of increases in tour package prices, although they slowed in comparison with the prior month's reading. The rise in the clothing and shoes category was driven by increases in costs in its five components; however, the overall result in this category is negative for the year. Meanwhile, a drop in the alcoholic beverages and tobacco category partially offset the overall monthly cost increase.

- On an annual basis, all of the consumption basket components showed rising prices, led by transportation. Annual inflation hit 6.7% in November - a 12-year high and remaining well above the 4% upper bound of the inflation target range since July. IHS Markit's current year-end 2022 inflation forecast is 5.32%, slowing from this year's higher inflation reading amid the withdrawal of extraordinary pandemic-related fiscal stimulus, which will help cool demand.

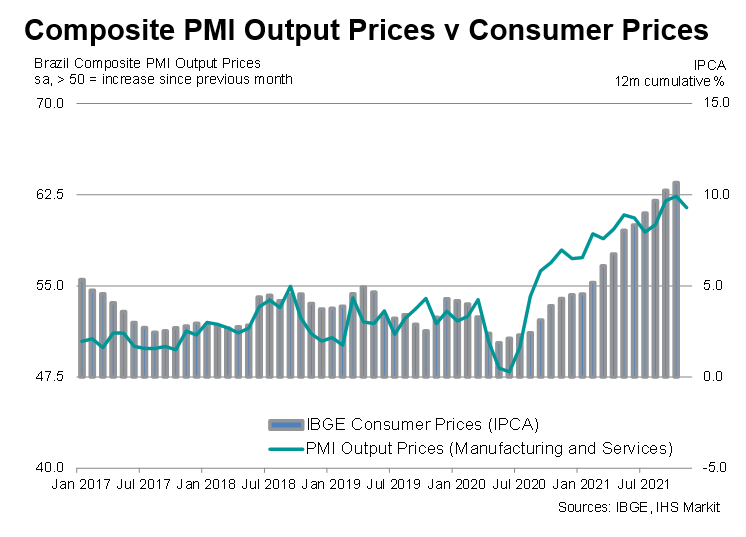

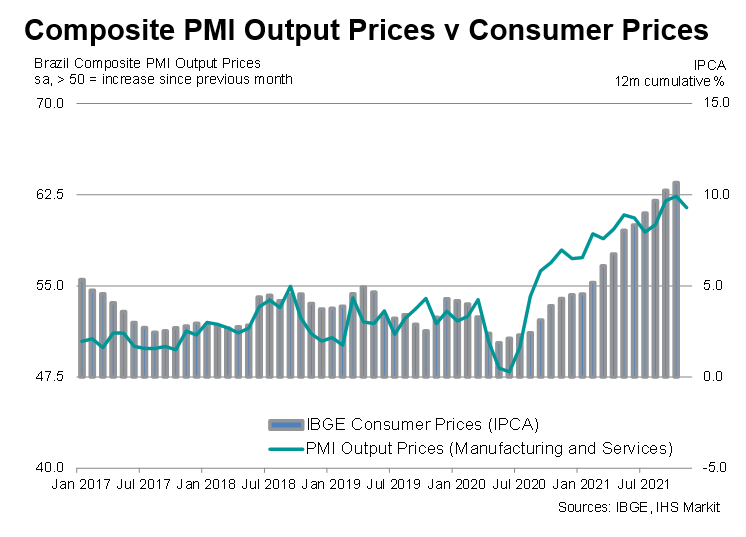

- Brazil dipped back into recession in the third quarter of 2021 as a severe drought hugely impacted farmers. PMI data for the fourth quarter so far showed a resilient service sector, but factory production contracted to a greater extent as demand was stymied by rising interest rates and price pressures. With inflation mounting, the central bank hiked the policy rate for the seventh time running, a factor that could hurt consumption and investment in coming months. (IHS Markit Economist Pollyanna DeLima)

- Official statistics data for the third quarter of 2021 highlighted another quarterly contraction in GDP as the agriculture and livestock sector posted its worst performance (-8.0%) in nine-and-a-half years due to a severe drought. Industrial production stabilized (0.0%), with companies in this segment negatively impacted by supply-side issues and mounting inflationary pressures. Services activity expanded (+1.1%) in what appears to be a shift in demand from goods to services as COVID-19 restrictions recede. Encouragingly, domestic consumption rose (+0.9%), but exports decreased sharply (-9.8%).

- Industrial production figures from IBGE showed another monthly reduction in output during October, the fifth in successive months. Timely PMI data indicated that the manufacturing sector remained stuck in contraction, with the downturn gathering pace during November. Companies indicated that order book volumes were down markedly, owing to higher interest rates and inflationary pressures. Elevated prices for inputs also restricted input buying and job creation as companies focused on cost-reduction measures.

- Price pressures in Brazil remained elevated, as global shortages of inputs and supply-chain disruptions were exacerbated by an unprecedented drought and associated increases in energy prices. Official inflation climbed to 10.7% in October, the highest since January 2016 and more than double the central bank's upper-limit goal (5.25%) for 2021.

- PMI data showed that input costs continued to rise at a stronger rate in manufacturing than in services midway through the final quarter of 2021, the latter registered a survey record increase (data collection started in March 2007). Subsequently, the aggregate rate of input cost inflation climbed to a series peak.

- Indeed, a large proportion of purchases in Brazil are attained on credit and indebtedness is on the rise. Preliminary data from the central bank showed an increase in household debt to 59.9% of national income. Excluding mortgages, household debt amounted to 37.0% of GDP. This is particularly concerning as the cost of borrowing is rising. In August, the annual interest rate on a credit card for households averaged 63.8% and that for overdrafts stood at 125.1%.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for the Italy +0.2%; France -0.1%, UK -0.2%, Germany -0.3%, and Spain -0.9%.

- 10yr European govt bonds closed higher; Germany/France/Spain -4bps, Italy -3bps, and UK -2bps.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover -3bps/261bps.

- Brent crude closed -1.8%/$74.42 per barrel.

- The UK government this week announced a design for a hydrogen-fueled airplane, lining up with its plans to subsidize both zero-carbon flight and hydrogen production. The proposed plane, which uses hydrogen from renewable energy rather than the fossil fuels from which 96% of hydrogen is currently sourced, was designed by the FlyZero project, part of the government-funded public-private £3.9 billion Aerospace Technology Institute Program. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- The research program works with NATEP, an industry-led incubator on zero-carbon aviation, and H2GEAR, an industry project aiming to create liquid hydrogen fuel cells for planes. The government said the projects could bring a £114 billion boost to the UK economy by 2035.

- UK Prime Minister Boris Johnson flew back to London from the Glasgow COP26 climate summit last month, provoking tough questions from the media. At the summit, the UK had joined over 20 countries in making tentative plans to reduce aviation emissions.

- The UK is eager to carve out a path to low-carbon aviation. The government-backed HyFlyer project completed the first hydrogen fuel cell passenger flight in September 2020, although the first liquid hydrogen aircraft, the Soviet Tu-155, flew in 1988.

- Meanwhile, the UK is also investigating other types of low-carbon aviation fuel, known as sustainable aviation fuel (SAF), created for example from waste cooking oil.

- Federal Statistical Office (FSO) data gleaned from a quarterly earnings survey show that labor costs per hour - in the producing sectors (manufacturing, construction, mining, energy/water) and the whole service sector - rebounded by 0.5% quarter on quarter (q/q) in the third quarter (seasonally and calendar adjusted). This followed stagnation in the second quarter and an equally moderate increase of 0.4% q/q in the first quarter. The second-quarter stagnation primarily reflected the rebound in hours worked enabled by a loosening of pandemic-related restrictions. (IHS Markit Economist Timo Klein)

- With base effects also playing a role, owing to an even stronger impact from increasing hours worked in the third quarter of 2020, the year-on-year (y/y) rate of hourly labor costs rebounded from just 0.2% in the second quarter to 2.6% in the third. This compares with a cyclical and also all-time peak of 4.5% y/y in the first quarter of 2020 in the 25-year history of this series (since 1996). It also exceeds the long-run average of 2.1%.

- It is important to note that fluctuations in short-time work do not affect this labor cost statistic directly as employers' payroll also adjusts along with the number of hours worked. The difference in net pay for employees is much smaller because of the public-sector subsidies provided for short-time workers that partially replace the lost income, but these payments do not represent labor costs for the firm.

- The third-quarter breakdown between gross wages and non-wage labor costs, i.e., social security contributions, reveals little difference between the two. This contrasts with the evidence for the two preceding quarters, as a tightening of restrictions as in the first quarter partly depresses hours worked due to more people either having to take sick leave or to quarantine.

- Federal Statistical Office - FSO - external trade data (customs methodology, seasonally and calendar adjusted, nominal) reveal that exports increased by 4.1% month on month (m/m) in October, more than offsetting August-September declines and reaching a level that exceeds that of February 2020 (just before the pandemic), also by about 4%. Imports surged even more (5.0% m/m), although this is entirely due to import prices rising more strongly than export prices lately. Indeed, volume data show that exports outperformed imports at 2.6% versus 1.1% m/m in October. (IHS Markit Economist Timo Klein)

- Based on the seasonal and calendar adjusted series, year-on-year (y/y) rates for export and import values both rebounded to 11.4% and 19.7%, respectively, having been on a declining trajectory since May owing to large base effects linked to the recovery from the first pandemic wave in March-April 2020.

- The seasonally adjusted trade surplus, which had peaked at EUR21.7 billion in January in the wake of the initial recovery from the COVID-19 virus pandemic, has been narrowing since. It fell further from EUR12.9 billion in September to EUR12.5 billion in October. Recent levels are much lower than the monthly average in 2019 (EUR18.9 billion) and even that of 2020 (EUR14.8 billion), although the latter had been hit hard by the pandemic already.

- BMW Group has reported that it has now sold a combined total of one million electrified vehicles, as its accelerates its pure battery electric vehicle (BEV) launches with the recent market release of the iX and the i4 models. According to a company press release, the one-millionth electrified vehicle that BMW handed over to a customer was a BMW iX xDrive40, which took place at BMW Welt on 6 December. Commenting on the event, Pieter Nota, BMW AG board of management member responsible for customers, brands and sales, said, "The delivery of our one-millionth electrified vehicle marks a milestone in our transformation - and we already have the next one in our sights: We aim to break through the two-million mark in just two years. Thanks to our steadily growing product range, we are setting ourselves ambitious sales targets, in particular for fully-electric vehicles: In 2022, we aim to double this year's sales." (IHS Markit AutoIntelligence's Tim Urquhart)

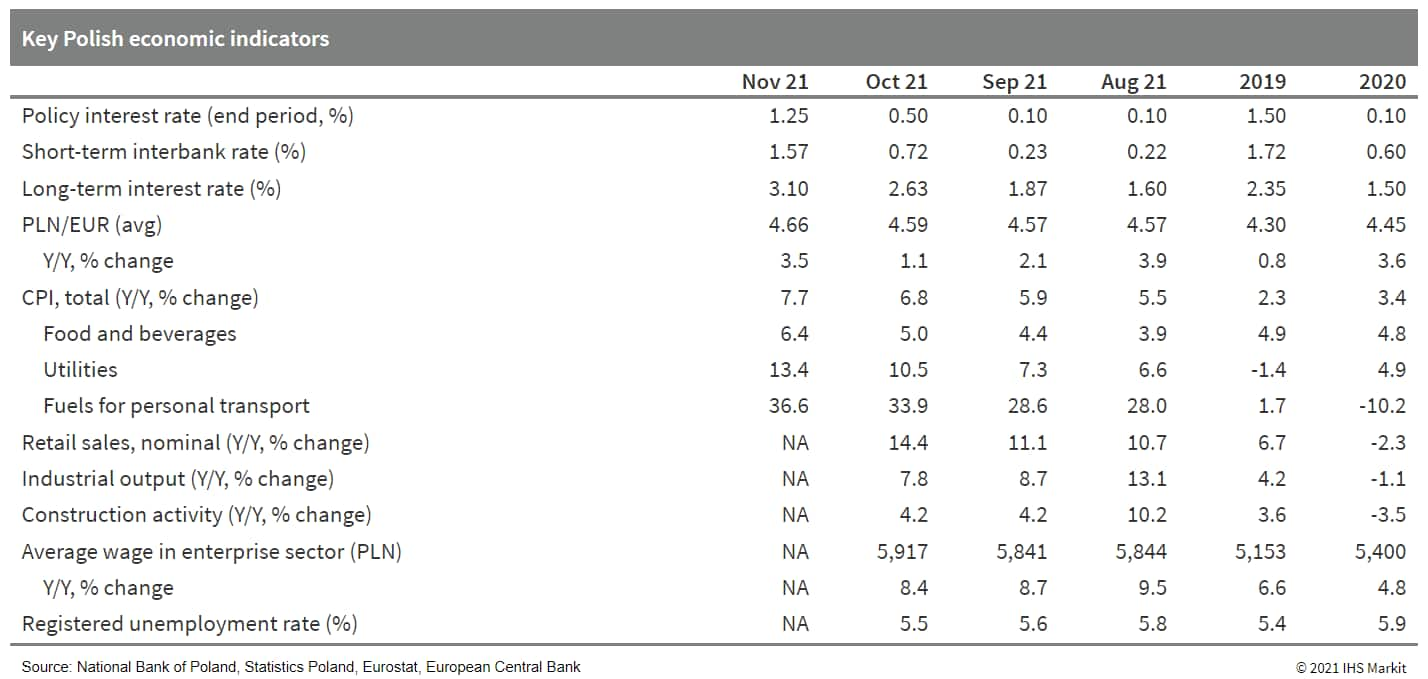

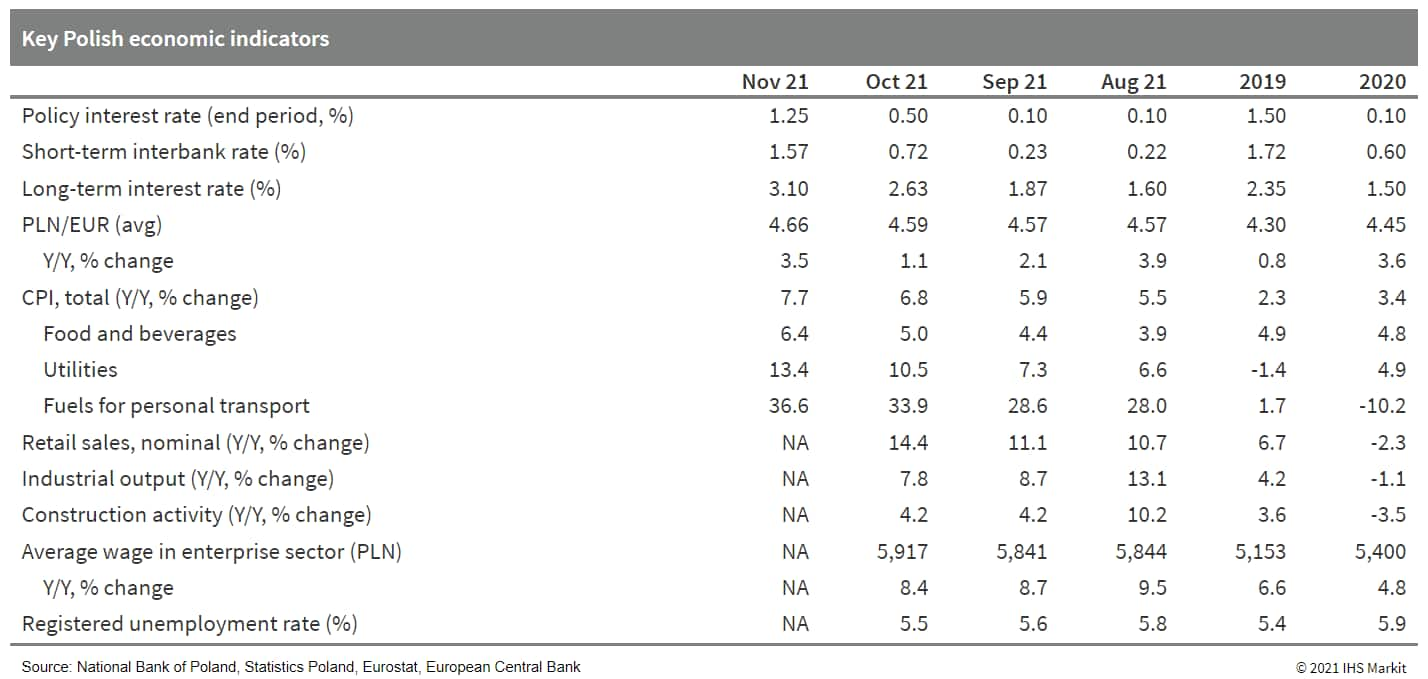

- At its session on 8 December, Poland's Monetary Policy Council (MPC) raised the base interest rate for the third consecutive month to 1.75%, a slightly smaller increase than IHS Markit analysts were projecting in the November forecast round. Meanwhile, the remaining interest rates were set at the following levels: Lombard (2.25%), deposit (1.25%), rediscount (1.80%), and discount (1.85%). (IHS Markit Economist Sharon Fisher)

- The December rate rise was moderate despite a surge in November inflation to a preliminary 1.0% month on month (m/m) and 7.7% year on year (y/y), amid soaring growth in fuel and utilities prices. The MPC continued to argue that inflation has stemmed largely from external factors that are beyond the control of domestic monetary policy, including higher energy and agricultural costs as well as rising prices of goods that have been impacted by supply-chain disruptions.

- Although external factors are viewed as the main driver, the MPC has also acknowledged that the ongoing economic recovery is contributing to price growth. Indeed, demand pressures remain strong, fueled by a tight labor market and pent-up demand.

- Poland's average monthly nominal wage jumped 9.4% y/y during the third quarter, contributing to robust growth in private consumption (up 4.7% y/y in real terms). Into the fourth quarter, October retail sales (including the automotive sector) rose 14.4% y/y in nominal terms and 6.9% y/y in real terms.

- Another factor driving up inflation has been the depreciating zloty, which slumped a monthly average of PLN4.66/EUR1.00 in November (down 3.6% y/y), the weakest level since 2004. Despite the weakening of the zloty in November, the NBP stated that it may still intervene in the foreign exchange market and use other instruments envisaged in the monetary policy guidelines.

- Emirates Global Motor Electric, Hitachi Energy, and Yinlong Energy have said that electric buses that will be assembled in Abu Dhabi (United Arab Emirates) will be available for purchase at the end of 2022, reports the Khaleej Times. The buses, which include a Dolphin series 12-metre, 34-seater bus for public transportation, as well as a vintage series 10.5-metre, 30-seater bus for shuttle service usage manufactured at Yinlong Energy's headquarters in China's Zhuhai, have been carrying out trial runs in the country since 2020. The buses can travel a distance of 95 kilometers (km) on a single charge. According to the source, the electric bus can be charged in less than 10 seconds using a flash charging facility available at bus stops using Hitachi Energy's pioneering Grid-eMotion smart charging solution. (IHS Markit AutoIntelligence's Tarun Thakur)

- Nelson Gaichuhie, the Treasury Chief Administrative Secretary, announced to parliament that the Treasury had stopped plans by the state-owned enterprise (SOE) agency Kenya Roads Board (KRB) to issue a 10-year, USD1.33-billion, domestic infrastructure bond. The Treasury is concerned that the bond would contravene Kenya's effort to lower public-sector debt to 55% of GDP, as recommended by the International Monetary Fund (IMF), jeopardizing ongoing IMF disbursements to Kenya under an Extended Credit Facility (ECF) and Extended Fund Facility (EFF) totaling USD2.3 billion approved in April 2021. Kenya raised its debt ceiling to KES9,000 billion (USD79.7 billion) in late 2019, which was equivalent to 92% of nominal GDP in 2019. Kenya is now close to breaching the KES9,000 ceiling. Kenya's debt burden, currently around 73% of GDP, is already at levels indicating potential debt stress. Reducing the debt stock and fiscal deficit are key aims of the IMF program, with reform of heavily indebted SOEs a particular focus, providing clear justification to block the proposed bond sale. However, this exacerbates the already high likelihood of project delays and government non-payment in the road construction sector KRB will have fewer resources to clear existing arrears to contractors and suppliers, and to complete ongoing road construction projects (many of which have stalled) and rehabilitate poorly maintained roads, the stated aims of the bond. (IHS Markit Country Risk's William Farmer and Ronel Oberholzer)

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.1%, Mainland China +1.0%, South Korea +0.9%, India +0.3%, Australia -0.3%, and Japan -0.5%.

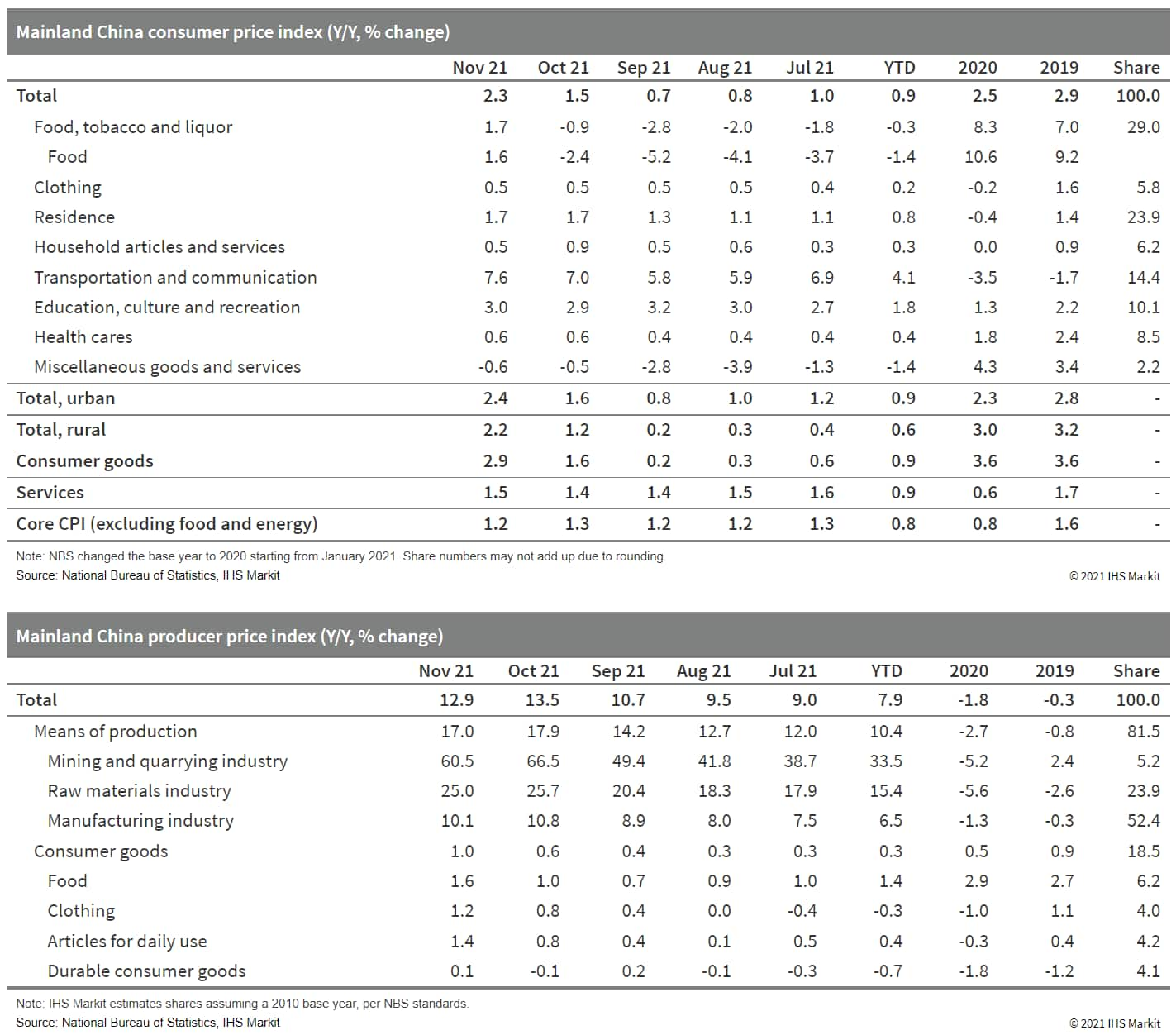

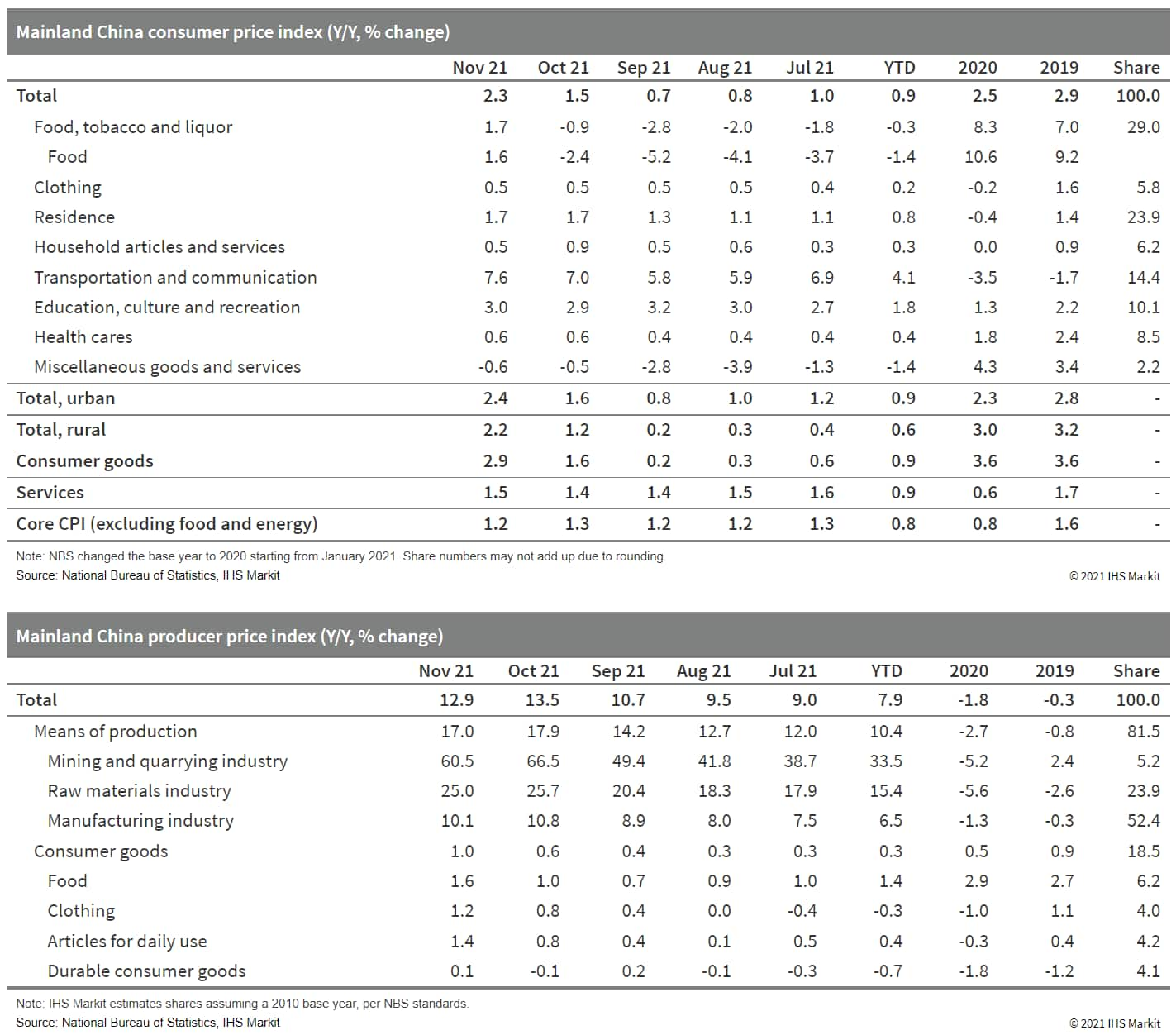

- Mainland China's consumer price index (CPI) increased by 2.3% year on year (y/y) in November, up by 0.8 percentage point from the October reading, according to the National Bureau of Statistics (NBS). Month-on-month (m/m) CPI inflation edged down however, by 0.3 percentage point to reach 0.4% m/m in November.

- The divergence in Mainland China's year-on-year and month-on-month CPI inflation change was largely to do with the November pandemic impact outweighed by the year-ago low-base effect (Headline CPI recorded 0.5% y/y deflation in November 2020). Widespread outbreak affecting two-thirds of mainland China provinces notably hampered services demand in November on top of the seasonal effect, which resulted in a 0.3% m/m decrease in service price, compared with a 0.1% m/m increase in October. Prices of air tickets and hotel accommodation fell by 14.8% m/m and 3.7% m/m, respectively in November. Excluding the volatile food and energy components, core CPI slid into deflation territory of 0.2% m/m, the lowest so far in 2021. (IHS Markit Economist Lei Yi)

- On a year-on-year basis, recovering food prices again became the main driver for the uptick in November headline CPI inflation. Owing to the further narrowed pork price deflation from 44.0% y/y to 32.7% y/y and widened fresh vegetable price inflation from 15.9% y/y to 30.6% y/y, food price inflation came in at 1.6% y/y in November, higher by 4.0 percentage points from October and ending the five-month-long deflation since June. As vehicle fuel price inflation expanded by 4.3 percentage points to 35.7% y/y in November, non-food price inflation inched up by 0.1 percentage point to 2.5% y/y. Core CPI came in at 1.2% y/y, lower by 0.1 percentage point from the month before.

- The producer price index (PPI) continued to report year-on-year gains of 12.9% y/y in November. Still, this has come down from the October high by 0.6 percentage point thanks to authorities' interventions to tame commodity rally and tackle power crunch. Month-on-month PPI inflation moved in the same direction, down by 2.5 percentage points to reach 0.0% m/m in November.

- With the ramped-up coal production and imports, prices of coal mining and dressing registered a 4.9% m/m drop in November compared with a 20.1% m/m gain in October; energy-intensive sectors like non-ferrous and ferrous metal smelting and pressing also saw output prices falling month on month. However, oil and gas-related sectors continued to log price increases due to persistent rally in the global market.

- The People's Bank of China (PBOC) lowered the interest rates on relending facilities by 25 basis points starting from 7 December as an incentive to encourage commercial banks to lend to small businesses and rural sectors, according to an announcement on the central bank's website. Following this cut, the one-year relending rate was lowered by 25 basis points to 2%, the six-month rate to 1.9%, and the three-month rate to 1.7%. (IHS Markit Economist Yating Xu)

- Small and medium-sized banks that issue loans to small businesses and rural sectors can apply for the relending funds from the PBOC.

- This move came just one day after the PBOC announced the cut of reserve requirement ratio (RRR) on 6 December, reflecting the government's policy rebalancing toward risk prevention and economic stabilization.

- Japan's Business Survey Index (BSI) for large enterprises rose by 6.3 points to 9.6 in the Business Outlook Survey for the fourth quarter of 2021. The positive figure largely reflected improvement in non-manufacturing. The BSI for large manufacturing enterprises improved marginally because of supply chain disruption and higher input prices. (IHS Markit Economist Harumi Taguchi)

- The improvement of current business conditions was thanks largely to a recovery in domestic conditions in line with easing COVID-19 containment measures. The upward momentum of business conditions for large enterprises is expected to wane over the next two quarters as activity normalizes. The contractions of BSIs for small enterprises narrowed but figures remained slack, although small enterprises expect business to start expanding from the second quarter of 2022.

- Projected sales and ordinary profits for all industries in fiscal year (FY) 2021/22 (ending March 2022) were revised up to a 4.0% year-on-year (y/y) rise from a 3.5% y/y increase and to a 17.5% y/y rise from an 11.2% y/y increase, respectively.

- The BSI on fixed investment suggests all sized enterprises are experiencing capacity shortages. However, fixed investment plans (including software and excluding land) in FY 2021/22 for all industries were revised down to 5.3% y/y from 6.6% y/y because of lower outlooks for manufacturing, which moved down to 5.4% y/y from 10.6% y/y. Fixed investment plans for non-manufacturing were revised up from 4.7% y/y to 5.3% y/y, largely reflecting upbeat plans in services (such as amusement and life-related services).

- South Korean car-sharing company SoCar plans to introduce an integrated mobility service next year that will connect various modes of transportation under one app. The envisioned 'super app' will allow users to find multiple modes of transit, such as car-sharing, buses, trains, and electric bikes, to reach their destinations in the fastest and most effective manner. The company said, "The super app users can book an electric bike to reach a SoCar zone, a SoCar vehicle to reach a train station, and another SoCar vehicle to reach their destinations from the train station. Many other combinations are possible depending on the users' demands," reports Yonhap News Agency. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tata Motors has announced plans to invest INR75 billion (USD993 million) in the next four to five years to rebuild its road map for the commercial vehicle (CV) business, with a focus on electric vehicle (EV) powertrains, reports the Economic Times. Girish Wagh, executive director of the CV business at Tata Motors, said, "Electrification in CVs will happen through gaseous fuel first. One has seen a significant shift towards CNG [compressed natural gas]; the improved distribution [of CNG] is expected to accelerate further. We have re-looked at the whole range and applications, which we need to work on and prioritize at the back end with a reworked modularity strategy." He added, "A lot of work is happening on delivering solutions with real-world experiences." According to the executive, total cost of ownership (TCO) parity between electric and diesel is expected sooner than TCO parity between EVs and CNG vehicles. (IHS Markit AutoIntelligence's Tarun Thakur)

- Indian ride-hailing giant Ola has raised USD139 million in a Series J funding round led by Edelweiss, reports the Economic Times. The round was also backed by family offices, ultra-high net-worth individuals, and corporations. According to the report, Ola has reached a post-money valuation of USD7.3 billion after this latest financing round. Ola is planning to go public in the first half of 2022 and is expected to raise up to USD1 billion through an IPO. Ola operates in more than 100 cities in India and has expanded to several international markets, including Australia, New Zealand, and the United Kingdom, in a bid to improve its valuation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 09 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.