Every major US, European, and APAC equity index closed higher for a second consecutive day. US and benchmark European government bonds closed sharply lower. CDX-NA and European iTraxx closed almost flat on the day across IG and high yield. Natural gas, oil, and copper closed higher, gold was flat, and the US dollar and silver closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +0.8%, Nasdaq +0.6%, S&P 500 +0.3%, and DJIA +0.1%.

- 10yr US govt bonds closed +5bps/1.52% yield and 30yr bonds +9bps/1.90% yield.

- CDX-NAIG closed flat/54bps and CDX-NAHY +2bps/306bps.

- DXY US dollar index closed -0.5%/95.89.

- Gold closed flat/$1,786 per troy oz, silver -0.4%/$22.43 per troy oz, and copper +1.2%/$4.39 per pound.

- Crude oil closed +0.4%/$72.36 per barrel and natural gas closed +2.9%/$3.82 per mmbtu.

- In the wake of surging oil and gas prices this year, reports are emerging that say that further high prices and volatility will continue for the rest of the decade if investments in new production do not increase. (IHS Markit PointLogic's Kevin Adler)

- The current situation reflects six years of low prices that discouraged investment, plus the uncertainty generated by rising environmental restrictions on fossil fuel development and use, said the reports. But if fossil fuels are to be a significant, perhaps the majority, source of energy for 10 to 30 more years, then investment must be increased quickly. Oil and gas accounted for about 84% of the world's energy needs in 2020, according to the International Energy Agency.

- "The next two years (2022-2023) are critical for sanctioning and allocating capital toward new projects to ensure adequate oil and gas supply comes online within the next 5-6 years," said a report released by the International Energy Forum (IEF), based on Saudi Arabia.

- The report, co-authored by IHS Markit, pegs the needs globally at $525 billion in those years, compared to $341 billion invested in 2021. "Oil and gas investment will need to return to pre-COVID levels and stay there through 2030 to restore market balance," the report states.

- Moody's this fall issued a similar recommendation, saying that global investment needs to be about $540 billion per year through 2025 to replace reserves and maintain production.

- The IEF-IHS Markit report does not project oil or gas prices going forward. But other sources, such as Goldman Sachs, have issued forecasts of high oil prices next year. In November, Goldman Sach said West Texas Intermediate, one of the global benchmarks, could be $90/bbl in 2022, as the economic recovery from COVID continues to outpace the ability of oil producers to expand production, given their investments. In October, Morgan Stanley and BNP Paribas forecast high prices as well for 2022, though less aggressively placing them at $70-80/bbl.

- On December 7, AES Corp. announced a completed purchase of Valcour Wind Energy, which controls wind farms in New York, from global investment firm Carlyle. Valcour's six wind farms represent the largest operating wind platform in New York and play an important role in helping the state meet its commitment to have 70% of its electricity come from renewable resources by 2030, AES said. The Valcour portfolio currently produces roughly 25% of the State of New York's wind power and includes three wind parks in Clinton County totaling 279 MW, two wind parks in Wyoming County totaling 227 MW, and one wind park in Franklin County totaling 106 MW. (IHS Markit PointLogic's Barry Cassell)

- Cogentrix Energy, a Carlyle portfolio company, operated, maintained, and managed the portfolio since Carlyle's acquisition of Valcour in 2018. AES has now assumed these responsibilities.

- Said Leo Moreno, AES Clean Energy President: "This wind portfolio complements our 1 GW solar pipeline in the state, allowing us to provide custom offerings such as our 24/7 product to realize a carbon-free energy grid. Thanks to the partnership between Carlyle, Cogentrix and Valcour, the Valcour portfolio also offers a strong platform upon which we can continue to build through repowering.".

- Market appetite for muni bonds remains robust, with investor demand suppressing yields despite an influx in new issue activity after last week's calendar supplied $15.2 billion outpacing the 2021 weekly average of $9.4 billion, led by various large scale issuers who priced deals in the remaining month of the year. The Black Belt Energy Gas District (A2/-/-) led last week's negotiated calendar with $1 billion of gas project revenue bonds spanning across two series with maturities ranging from 12/2022-12/2026 with investor interest driving lower yields by 4-7bps with the largest bump noted in the 2022 maturity falling +21bps off the interpolated MAC. The Illinois State Toll Highway Authority (Aa3/AA-/AA-) also tapped into the primary arena with $700 million of toll highway senior revenue bonds across 01/2039- 01/2046 with bumps of 1-4bps spread throughout the scale, providing longer-date focused investors yields of 1.72-2.00%. This week's calendar is set to draw $18.7 billion, marking the largest weekly calendar of the year and will span across 219 new issues with The Golden State Tobacco Securitization Corporation offering a combined $4.2 billion of tobacco settlement asset-backed bonds across two separate tranches with maturities ranging from 2022-2052, with the greatest par size noted in the 30YR tenor; senior managed by Jefferies. The San Joaquin Hills Transportation Corridor Agency (-/A/BBB/-) will also price on a negotiated basis, supplying $1.2 billion of senior lien toll road revenue refunding bonds across two series pricing on Wednesday 12/08 and senior managed by Goldman Sachs. This week's competitive calendar will span across 99 new issues for a total of $4.6 billion, led by the Dormitory Authority of the State of New York (-/AA+/AA+/-) auctioning $2.5 billion of state personal income tax revenue bonds across six individual tranches with maturities spanning 2023-2046, selling throughout Thursday, December 9. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- Initial data from a small trial in South Africa suggest that the Pfizer (US) / BioNTech (Germany) vaccine conferred a reduced antibody response to the Omicron variant of COVID-19, although escape from protection was not complete, and appeared to be more robust in individuals who had also had previous COVID-19 infection as well as vaccination. Although the data were only from 12 patients and not peer-reviewed, they may provide some initial reassurance that this new variant, while appearing more highly transmissible than previous strains, may well continue to respond to current vaccines, albeit at a reduced level - and that previous infections and/or booster doses appear likely to enhance protection. This was echoed by World Health Organization (WHO) official Michael Ryan, who claimed that the Omicron variant currently appeared "no worse" overall than existing strains, with little indication so far of increased severity or complete escape from vaccine protection. However, these preliminary findings, if backed up by further data, would suggest that the ramping up of booster programs could be advisable to help minimize the global impact of the next wave of infection, and/or the emergence of further more dangerous variants. In addition, there has been growing support for the use of heterologous boosters, with the European Medicines Agency (EMA) endorsing their use and the WHO making moves towards a similar verdict. (Life Sciences by GlobalData's Janet Beal)

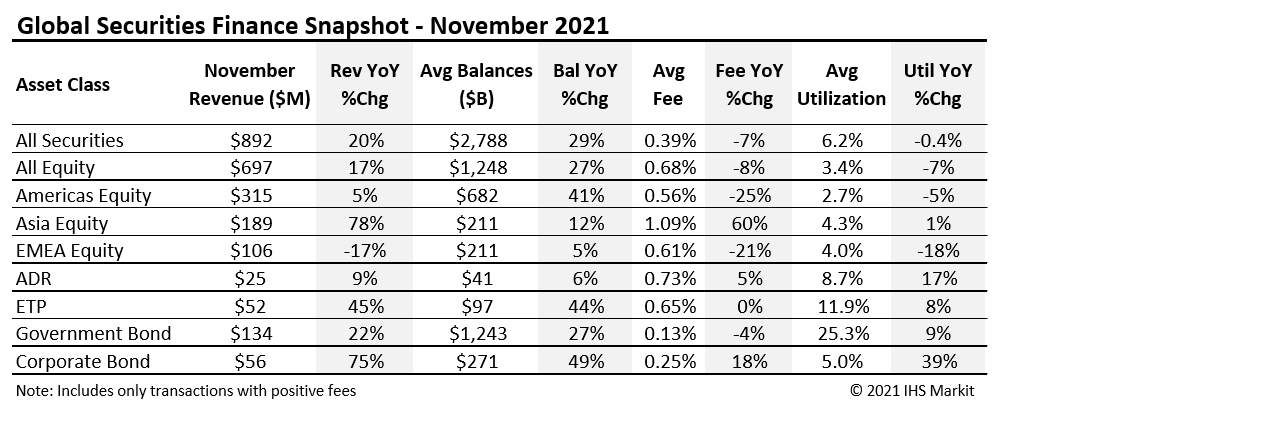

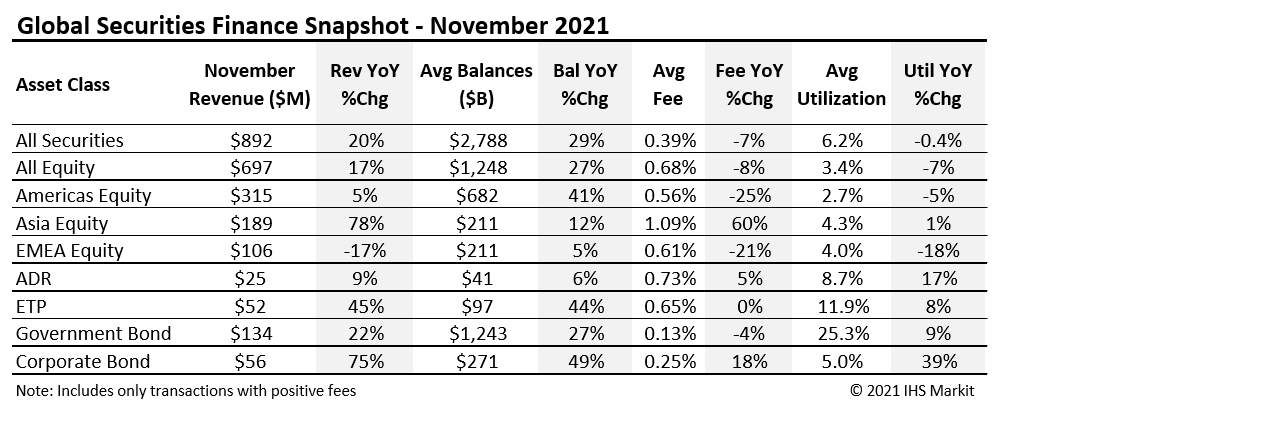

- Global securities finance revenues totaled $892 million in November, a 20% YoY increase. ETPs saw YoY increases in revenues and loan balances. All asset classes showed YoY increases, except for European equities where a lack of new specials dented revenue opportunities. In this note we'll discuss some of the highlights of the November equity finance revenue. (IHS Markit Securities Finance's Paul Wilson)

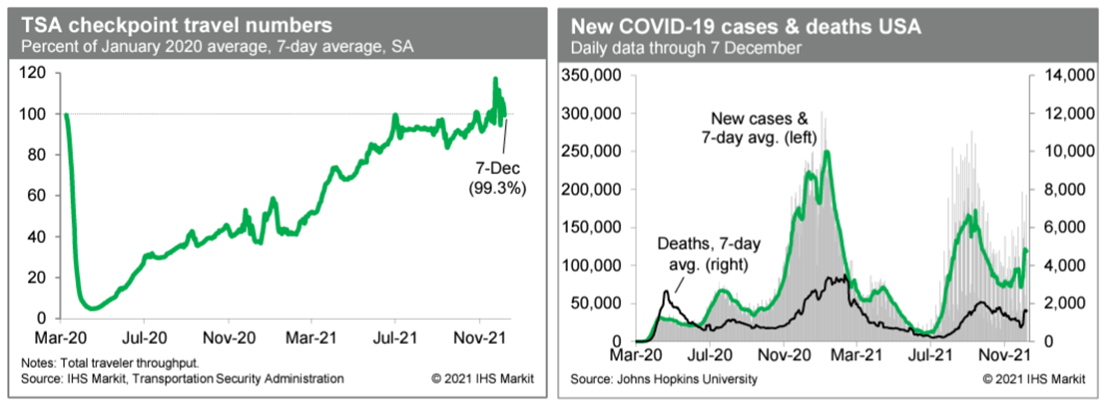

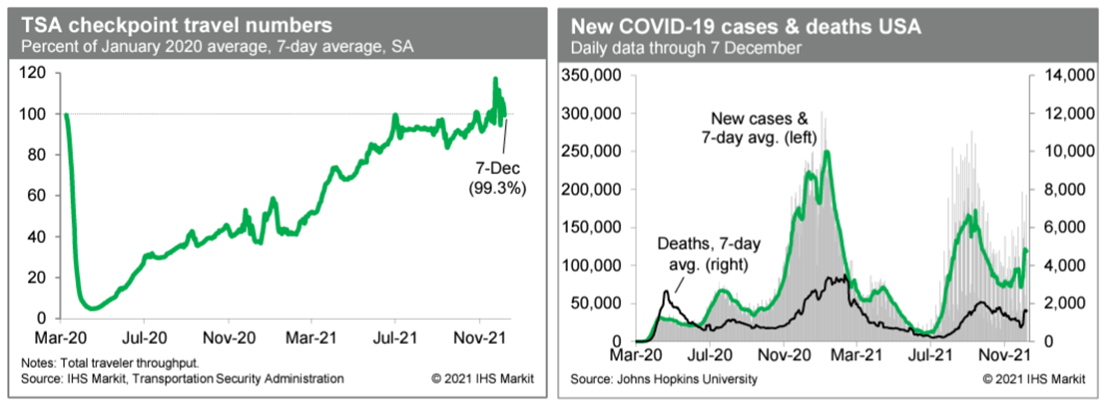

- Averaged over the last seven days, and after seasonal adjustment, passenger throughput at US airports was 99.3% of the January 2020 level (our estimate based on daily data from the Transportation Security Administration). Recent readings on this indicator suggest that air travel has made a full recovery. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Deeproute.ai has unveiled its new production-ready Level 4 (L4) autonomous vehicle (AV) system, which costs USD10,000, reports TechCrunch. The package, named DeepRoute-Driver 2.0, consists of five solid-state LiDAR sensors, eight cameras, a proprietary computing system, and an optional millimeter-wave radar. The company said, "DeepRoute-Driver 2.0 offers differentiation from existing L4 pioneers like Waymo and Cruise, which boast sophisticated and efficient L4 algorithms but with a hefty price tag, and from advanced driver-assistance systems (ADAS) such as Tesla, that are affordable but have limited capabilities in terms of fully automated driving." DeepRoute.ai offers solutions that focus on Level 4 autonomous operations and has research centers in Shenzhen and Beijing (China) and Silicon Valley (United States). The company's long-term strategy involves developing medium-duty trucks for urban logistics, enhancing transit for shipments and freight delivery. Earlier this year, DeepRoute.ai opened its robotaxi pilot service to the public in Shenzhen. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- As anticipated, the Bank of Canada left interest rates unchanged, maintained extraordinary guidance, and continued its reinvestment phase—keeping its holdings of Government of Canada bonds roughly constant. (IHS Markit Economist Arlene Kish)

- The underlying factors determining the forward guidance were as expected, with improved foreign growth momentum, elevated inflation, and the recent drop in energy prices while supply chain bottlenecks, the new Omicron COVID-19 variant, and extreme weather events in British Columbia dampen the real GDP growth outlook.

- The combination of the latest Canadian third-quarter real GDP results and solid current economic indicators, especially labor market data, points to a full recovery for real GDP in the fourth quarter.

- Yet, as expected, uncertainty surrounding the outlook has cranked higher with the new Omicron COVID-19 coronavirus variant and any pandemic policy responses, domestically and globally, as new COVID-19 cases climb.

- The inflation outlook remains the same, with high rates persisting through the first half of 2022.

- Against this backdrop, the Bank of Canada's forward guidance is unchanged as the overnight rate of 0.25% will be maintained until the inflation rate hits 2.00% on a sustainable basis, which is anticipated in the middle quarters of 2022. We maintain that the Bank of Canada will begin raising interest rates in July 2022 as the most recent improvement in labour market data is offset by the growing uncertainty related to the new Omicron variant and regional supply chain disruptions.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for the UK flat; France -0.7%, Germany -0.8%, Spain -1.0%, and Italy -1.4%.

- 10yr European govt bonds closed sharply lower; UK +4bps, Germany +6bps, Spain +7bps, France +8bps, and Italy +12bps.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover +1bp/264bps.

- Brent crude closed +0.5%/$75.82 per barrel.

- Uber Technologies has lost a UK court ruling over its business model in London, reports Bloomberg. The judges ruled that it should enter into a direct contract with the user when delivering vehicle rides, assuming greater responsibility for each trip booked through its app. They also said London's transport regulator will have to reassess its current guidance to reflect the ruling. Uber said it will comply with the ruling, but that the judgment should apply to every private hire operator in London. While the decision only affects London, it has implications for other UK cities and the instructions that each city's transport authority offers private-hire vehicle operators. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Lab-grown meat companies have created a new coalition to defend their interests in the EU policy-making circle. 'Cellular Agriculture Europe' was formally launched on 3 December and consists of 13 companies - including Bluu Biosciences, Vital Meat, Mosa Meat, SuperMeat, Aleph Farms and Higher Steaks. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- The companies will start lobbying EU policymakers in early 2022 and said they are "making the same food Europeans love in a new way", using just a small sample of animal cells to grow meat, fish, and oils.

- The coalition argued that their industry can therefore be a "powerful new tool" to help realize the EU's environmental ambitions of the Farm to Fork (F2F) strategy because it can "trigger a shift away from intensive animal agriculture".

- They added that a transition towards alternative protein sources is needed to achieve the bloc's climate targets and highlighted that the EU's research program Horizon Europe recognized this by allocating millions in funding to the development of more sustainable proteins, including cultivated meat.

- Robert Jones, President of the Board of Cellular Agriculture Europe and Head of Public Affairs at Mosa Meat, said: "We believe in a future where cellular agriculture, in combination with sustainability reforms to conventional agricultural practices, helps Europe meet its growing demand for protein while giving consumers the opportunity to choose delicious and safe meat and seafood products".

- The new coalition could nevertheless face some competition from other groups that also promote cultivated and plant-based meat alternatives in Europe, such as the Good Food Institute and ProVeg. At the same time, cooperation between these groups could see them achieve their joint goals of realizing more favorable EU legislation for lab-grown meat and their widespread consumption in the bloc.

- Currently, food produced with cells derived from animals falls under the bloc's Novel Foods Regulation and requires pre-market authorization as well as approval by the European Food Safety Authority (EFSA). These stringent steps have effectively blocked the sales of lab-grown meat in the bloc.

- The Volkswagen (VW) Group has signed a deal with three more companies that will help improve its future electric vehicle (EV) battery technology offering, according to a company statement. The new partnerships should 'further strengthen its battery technology know-how and cost management, driving vertical integration of the battery value chain'. The first of the new alliances is a planned joint venture (JV) with Umicore to jointly produce key materials for battery cells. Its core aim will be to jointly build up precursor and cathode material production capacities in Europe, as well as sustainably securing responsibly sourced raw material capacities at competitive prices. The second deal involves investment in 24M, which gives the company access to an innovative dry coating process in battery cell production, while the third has seen VW sign a long-term agreement with Vulcan Energy Resources Ltd. for the supply of zero carbon lithium. (IHS Markit AutoIntelligence's Tim Urquhart)

- Siemens Gamesa and Strohm have signed a memorandum of understanding to explore the use of thermoplastic composite pipe (TCP) to transfer hydrogen produced at its offshore wind turbines. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Instead of transmitting the electricity produced from the offshore wind turbines onshore, the concept of the decentralized solution integrates an electrolyzer into the offshore wind turbine, using the electricity generated to produce green hydrogen. Subsea electrical cabling will therefore not be required.

- The TCP solution is described to be more cost effective as it is corrosion-resistant, does not suffer from fatigue issues associated with steel pipe, does not require any maintenance, and has a field life of over 30 years. Further, TCP is more flexible and can be manufactured in long spoolable lengths, allowing it to be readily installed. The companies believe that this will help to bring down the levelized cost of electricity (LCOE).

- Stellantis hosted a Software Day on 7 December to communicate its new strategy for evolving its vehicles to software-based products, offering connected vehicle services and features it expects can be as important as vehicle propulsion, safety and design for connecting with consumers and generating revenue. Along with the Software Day presentation, Stellantis announced an agreement with Foxconn to develop (and sell) a new generation of automotive semiconductor chip. Key points include that Stellantis expects there to be 34 million monetizable connected cars on the road by 2030, beginning with most of its products to have ability for full over-the-air updates by 2024, compared with 12 million today and an expected 26 million in 2026. By comparison, Ford has said it will have 33 million connected vehicles on the road by 2028. Stellantis also noted that it defines monetizable as the first five years of the vehicle's life. Also not unlike other automakers investing heavily in the arena, Stellantis says it will expand its roster of software engineers (hiring 4,500 by 2024) for a dedicated Software Academy. The company software and data academy will retrain more than 1,000 internal engineers in multiple roles, as well as hiring top software and artificial intelligence (AI) talent from technology and other industries globally. The 4,500 software engineers in 2024 will work from talent hubs globally, Stellantis said. (IHS Markit AutoIntelligence's Stephanie Brinley and Ian Fletcher)

- The Transportation Ministry of Israel has unveiled a draft law that would allow 400 autonomous electric-powered taxis to operate around the country by early 2022. The proposed law, which was presented to parliament's Economic Affairs Committee, would arrange, supervise, and develop the autonomous vehicle (AV) sector in Israel, initially confined to taxis. A ministry official, Avner Flor, said that 640 Israeli startups are already working in the AV sector, with the objective of zero traffic accidents, lower emissions, and reduced congestion, reports Reuters. Israel is progressing its efforts towards AV operations and this law, if approved, would place the country alongside other leading nations in the field. It would also expedite AV testing, encourage technology companies to establish research and development (R&D) centers, and accelerate the economic activity of smart transportation in the country. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Africa's real GDP contracted by 1.5% q/q during the third quarter, reports Statistics South Africa (StatsSA), more than the market consensus of closer to -1.2% q/q but better than the 2.0 q/q fall expected by IHS Markit. The third-quarter GDP slowdown leaves GDP up by 5.8% year on year (y/y) during the first three quarters of 2021. (IHS Markit Economist Thea Fourie)

- Sectors showing the largest contribution to third-quarter output included the financial sector (adding 0.3 percentage point), followed by personal services (0.1 percentage point). Negative contributions during the third quarter were made by the trade sector (-0.7 percentage point), followed by manufacturing (-0.5% percentage point) and agricultural production (-0.4 percentage point). A fall in production of field crops and animal products was primarily responsible for the slowdown in overall agricultural output. StatsSA reported that eight of the 10 manufacturing divisions reported negative output in the third quarter, of which motor vehicles, parts and accessories, and other transport equipment division made the largest contribution to the overall manufacturing slowdown.

- A fall in durable and non-durable consumer spending left overall household spending down by 2.4% q/q during the third quarter. Total fixed investment spending was flat between the second and third quarter, while government consumption expenditure increased marginally by 0.1% q/q as compensation of employees accelerated. Net trade made a positive contribution to overall economic output during the third quarter. A 5.9% q/q fall in exports of goods and services was matched by a 2.8% q/q slowdown in imports of goods and services. A drawdown in inventories, to the amount of ZAR915 million (USD58 million), was recorded during the third quarter.

Asia-Pacific

- All major APAC equity indices closed higher for a second consecutive day; India +1.8%, Japan +1.4%, Australia +1.3%, Mainland China +1.2%, South Korea +0.3%, and Hong Kong +0.1%.

- China has approved and expanded the list of frozen fruit imports from Central and eastern European countries. The new rule will be effective from 1 February 2022. Frozen fruit are raw material for a wide range of beverages and dairy products. The industry is positive about the news and the current domestic supplies cannot meet the huge demand. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Previously, only six countries from the region including Poland and Latvia are allowed to export five types of frozen fruits (i.e. frozen bilberries and strawberries) to China.

- Overall, approved frozen fruits to enter China from some specific origins include strawberries (the US, Mexico, Argentina, Poland etc.), currant (New Zealand, France etc.), blackberries (Chile and Mexico), mulberries (Mexico etc.), raspberries, durians, lemons, figs, cherries, blueberries, bilberries, cranberries, bananas, mangoes, pineapples and avocado.

- Domestic demand exceeds supplies for frozen fruits as the applications are rapidly widening and increasing in the beverage café and tea rooms. Frozen fruits are added in flavoured yoghurts, raw materials for dried and dehydrated fruits and making wine. Chinese media says: "The demand for frozen fruits is explosive."

- A local source told IHS Markit that: "Frozen puree applications in yoghurt are a huge growth area. All major brands such as Mengniu and Yili have many types of fruit flavor yoghurt."

- In some beverage café/tea rooms, fresh mango is blended with frozen mango puree to make artisanal mango flavored beverages such as fruit flavored milk tea. China has about 500,000 beverage café/tea rooms despite the pandemic-related closure.

- Another local vendor told IHS Markit that there is a notable price increase for these frozen fruits: strawberries, apricots, blackberries, yellow peaches, mangos, kiwifruits, sour cherries, blueberries and cranberries.

- In April, frozen blackberry factory gate price was CNY5,000 per ton ($785/ton); in November, the price jumped up to CNY30,000/ton.

- China's Ningbo City locked down its Zhenhai District unexpectedly on Tuesday to organize large scale Covid-19 testing, sources told OPIS Wednesday. The Zhenhai lockdown commenced 0200 hrs on Dec. 7, while the wider Ningbo city declared a "Level 1" emergency at the same time, said the source from neighboring Hangzhou City. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Zhenhai District had set up multiple testing points by 0500 hrs Dec. 7, including one at Zhongjin Petrochemical, according to the source.

- There was no information about the origin and the severity of this outbreak at press time.

- "Logistics at factories and docks are affected, with timing restrictions. Negotiations to clear these bottlenecks are underway," another source from Shanghai added.

- Ningbo hosts petrochemical capacities of about 11.35 million mt/yr of paraxylene (PX), 10.35 million mt/yr of purified terephthalic acid (PTA), 1.15 million mt/yr of monoethylene glycol (MEG), and 1.77 million mt/year of polyester. Most of these plants have not been affected, except for a single PTA unit heard lowering rates, said the source.

- Yisheng Petrochemical's 3.6 million mt/yr PTA plant in Zhenhai was heard to be affected, lowering its production rates to an undisclosed level.

- Zhenhai district is home to two PX plants, Zhongjin Petrochemical with its 1.6 million mt/yr capacity, and Sinopec Zhenhai with 750,000 mt/yr.

- Japan's real GDP growth for the third quarter of 2021 was revised down to -0.9% quarter on quarter (q/q), or -3.6% q/q annualized, from -0.8% q/q, or -3.0% q/q annualized, following a 0.1% q/q rise (revised down from a 0.5% q/q increase) in the second quarter. Reflecting annual revision, full-year real GDP figures were revised down to a 0.2% year on year (y/y) decline from 0% for 2019, and up from a 4.6% y/y drop to a 4.5% y/y drop in 2020. (IHS Markit Economist Harumi Taguchi)

- The downward revision largely reflects weaker external demand, highlighting a narrower decline in imports (revised up from a 2.7% q/q decline to a 1.0% q/q decline), relative to exports (revised up from a 2.1% q/q drop to 0.9% q/q drop). While domestic demand remained weak, declining by 0.9% q/q, upward revisions to private capital expenditure (capex) and residential investment were offset by a downward revision in private consumption and changes in private inventory.

- The third-quarter revision reflects the review of seasonal adjustments in addition to regular revisions factoring in additional information after the release of preliminary figures. According to the source, non-seasonally adjusted capex was revised down, just as expected by IHS Markit. However, the revision to seasonal adjustments led to an upward revision of the quarter-on-quarter figure, from a 3.8% q/q decline to a 2.3% q/q decline.

- Despite the upward revision to capex, sluggish business conditions under states of emergency and supply chain disruption led to declines in all types of capex. Investment in transport equipment fell by 8.4% q/q for a third consecutive quarter while investment in other buildings and structures fell by 1.8% q/q for the fourth consecutive quarter. Investment in other machinery and equipment fell by 1.2% q/q, marking the first decline in five quarters. Investment in intellectual properties slid by 0.3% q/q.

- Mazda has unveiled autonomous vehicle technology that guides a vehicle to a safe place and then brings it to a halt if any sudden change in the driver's physical condition is detected, reports Jiji Press. The system, called Mazda Co-Pilot, is expected to be introduced in vehicles in stages from 2022. The first stage will incorporate a system that can autonomously steer the vehicle to a hard shoulder when travelling on a motorway. Subsequently, starting from 2025, Mazda aims to introduce technology that will enable a vehicle to change lanes autonomously on local streets. The automaker has reportedly already conducted trials with this technology on a Tokyo street. The trial vehicle enabled with the technology started to slow down while indicating danger with a warning tone and hazard lights after the driver pushed an emergency button and took their hands off the steering wheel. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Ford has announced a USD900-million investment in Thai manufacturing for the next-generation Ranger and Everest. The investment will cover upgrades to its two plants in the country and the creation of 1,250 jobs for a second shift at one of the facilities. The funding will support advanced technologies and new systems at both Ford's joint-venture (JV) plant (AutoAlliance Thailand; AAT) and its wholly owned facility (Ford Thailand Manufacturing; FTM) in Thailand; more than USD400 million of the figure will support the supply chain network, with 250 jobs expected to be created. The supply chain investment is intended to localize and enhance the quality of vehicle parts and design-related tools. Ford says that it is the largest single outlay in the country. The number of robots at both plants will double, with 356 state-of-the-art robots planned for the body shop and the paint shop. Automation at the body shop will increase from 34% to 80% at FTM and 69% at AAT, Ford says. Production capability at FTM for multi-variant production is also being improved so that multiple cab styles can be produced on the same line. The plants are also increasing their efforts to use renewable energy, reduce carbon dioxide (CO2) emissions, and ensure zero waste to landfill. (IHS Markit AutoIntelligence's Stephanie Brinley)

Posted 08 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.