Major APAC equity markets closed mixed, while most major US and European indices were lower. US and benchmark European government bonds closed sharply lower. CDX-NAIG and European iTraxx closed almost unchanged, while iTraxx-Xover and CDX-NAHY were modestly wider on the day. The US dollar closed higher, while oil, natural gas, gold, copper, and silver closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq +0.1%; S&P 500 -0.3%, Russell 2000 -0.7%, and DJIA -0.8%.

- 10yr US govt bonds closed +4bps/1.37% yield and +4bps/1.99% yield.

- CDX-NAIG closed flat/47bps and CDX-NAHY +3bps/278bps.

- DXY US dollar index closed +0.5%/92.51.

- Gold closed -1.9%/$1,799 per troy oz, silver -1.7%/$24.37 per troy oz, and copper -1.2%/$4.28 per pound.

- Crude oil closed -1.4%/$68.35 per barrel and natural gas closed -3.1%/$4.57 per mmbtu.

- Averaged over the seven days ending Sunday, the count of seated diners on the OpenTable platform was 0.7% above the comparable period in 2019. While encouraging, this could reflect the timing of the Labor Day holiday. How this comparison evolves over the next week or so will shed light on the state of the recovery in dining out. Meanwhile, box-office revenues last week were 42.5% below the comparable week in 2019. This is close to recent readings and up from averages earlier in the summer. Still, the recovery in movie-theater activity has a long way to go. Finally, the Weekly Economic Index (WEI) stood at a value of 8.0 last week. If sustained through the end of this month, this would suggest about 8.3% GDP growth over the four quarters ending in the third quarter. We look for materially slower growth over this period (5.2%), so the WEI could suggest some upside risk to our forecast. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Tesla CEO Elon Musk has confirmed that production of the electric vehicle (EV) maker's much-anticipated Cybertruck is to be delayed until the end of 2022, according to a Bloomberg report. Tesla initially stated that customer deliveries of the battery electric vehicle (BEV) truck would begin in 2021. Later, Tesla said that the plan had been pushed back to 2022, when announcing its second-quarter 2021 financial results. However, in a company-wide phone call to Tesla workers Musk has confirmed that production of the futuristic-looking electric truck would be delayed to the end of 2022 and that significant levels of production would not occur until the latter months of 2023. IHS Markit's forecast currently has around 30,000 units of production of the Cybertruck allocated for 2022 at the company's new Texas Gigafactory. (IHS Markit AutoIntelligence's Tim Urquhart)

- PPG Industries now expects third-quarter sales will be $225-275 million lower than the company anticipated at the start of the quarter. The company cites increasing disruptions in commodity supplies; further reductions in customer production due to certain parts shortages, such as semiconductor chips; and continuing logistics and transportation challenges in many regions, including the US, Europe, and China. (IHS Markit Chemical Advisory)

- The company had previously expected supply chain disruptions to lower third-quarter sales by about $150 million. Raw material inflation for the third quarter is also trending higher than previously expected by about $60-70 million.

- PPG says coatings commodity supply disruptions have further deteriorated since its earnings announcement, due to several additional force majeure declarations and lower material allocations from certain suppliers. The company is also still assessing the full impact of Hurricane Ida, which made landfall along the Gulf Coast of Louisiana last week and could exacerbate supply chain effects even further. The company has withdrawn its financial guidance for the third quarter and full year 2021.

- PPG declined to comment on whether the supply chain issues were centered in the automotive and aerospace sectors, which are particularly impacted by the global semiconductor shortage. IHS Markit expects the semiconductor shortage to reduce 2021 light vehicle production by 7.1 million. It also expects semiconductor shortages across the automotive sector to extend into the first quarter of 2022 and possibly into the second quarter.

- Mercedes-Benz, at its 70th anniversary celebrations of the brand's presence in Argentina, has announced a planned investment of USD54 million in the country, reports NF News Center. With the investment, the automaker will align resources to expand its commercial network, developing a new regional training center, as well as develop a new engine for the Sprinter van. According to a statement by the automaker, "The commercial network is making investments of USD25 million in openings and remodeling of dealerships throughout the country. It is inaugurating a new Regional Training Center with the latest technology located in (the Buenos Aires district of) Malvinas Argentinas, for which an investment of USD10 million was made, and in this new center not only local dealers will receive training, but it will also be possible to train for other Latin American markets." The statement added, "Mercedes-Benz is adding USD19 million for the development of a new engine for this (Sprinter) commercial vehicle." (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- Most major European equity indices closed lower except for Spain +0.1%; France -0.3%, UK -0.5%, Germany -0.6%, and Italy -0.7%.

- 10yr European govt bonds closed sharply lower; Germany/UK +4bps, Spain +5bps, France +6bps, and Italy +8bps.

- iTraxx-Europe closed +1bp/45bps and iTraxx-Xover +3bps/229bps.

- Brent crude closed -0.7%/$71.69 per barrel.

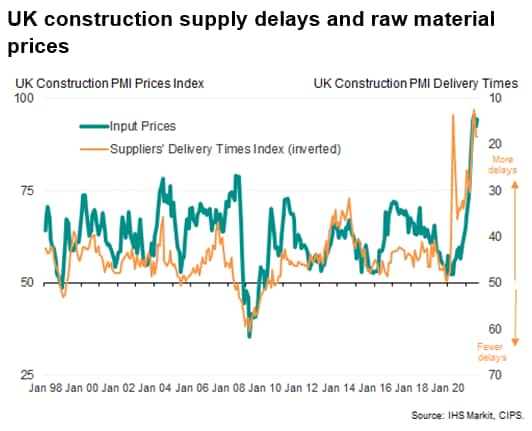

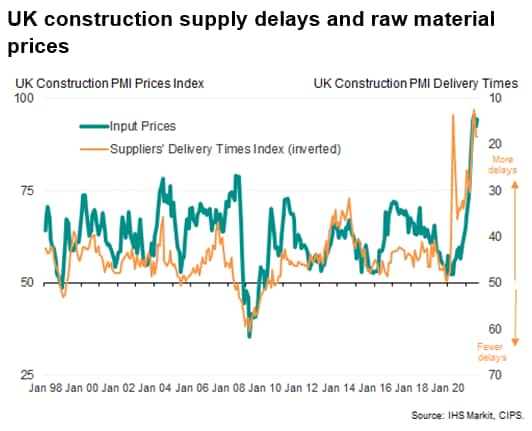

- The UK construction industry is being hit by unprecedented shortages of raw materials and labour, the costs of which are also rising at rates far in excess of anything previously recorded in over two decades of PMI survey history. UK PMI data showed construction activity slowing sharply in August. The headline IHS Markit/CIPS PMI slumped form 58.7 in July to 55.2, its lowest since February. While the index remained above 50.0 to indicate ongoing growth in total construction activity, the current reading compares with an historical average of 53.8. Given the amount of stimulus and relatively early stage in the recovery, to be slowing so close to the long-term trend is disappointing. (IHS Markit Economist Chris Williamson)

- Part of the slowdown can be linked to weaker growth of new orders for construction work, with the survey's New Orders Index slowing for a third consecutive month to register a further cooling of demand growth from May's record high.

- However, the New Orders Index remains far higher than the Total Activity Index, reading at 59.4 in August. Thus, activity has slowed much more sharply than demand for new work, meaning there must be other factors at play in explaining the sharp output slowdown.

- The slowdown can also be partly attributed to ongoing and near-record shortages of raw materials, as measured by suppliers' delivery times, which have in turn led to unprecedented price hikes for building materials in recent months.

- UK authorities have allowed the cultivation of wheat created with a controversial gene-editing technique for the first time in Europe. On 24 August, the UK's Department of Environment, Food and Rural Affairs (DEFRA) approved a series of field trials using wheat created through the gene-editing tool CRISPR-CAS9. Rothamsted Research institute will conduct the tests and said these would be the first field trials of CRISPR-edited wheat "anywhere in the UK or Europe". The CRISPR technique aims to facilitate crop breeding by introducing small changes to plant genes and has been praised by industry as a game-changer, but the technology has been controversial among other groups such as environmental NGOs. The trials are planned to run for the next five years and will end in 2026, with plants sown in September and October and harvested the following year. The researchers said they hope the project will lead to new GMO rules in the UK and allow genome edited food to be sold to consumers. The UK tests also represent another step away from the EU's GMO rules after the British government sought advice on how gene-editing could unlock "substantial benefits" for the agri-food sector and environment. The EU currently still treats CRISPR-edit plants as GMOs and subjects them to the same strict regulations, which essentially blocks the use of the technology across the bloc. However, the bloc's policymakers could change their stance after the European Commission concluded in April that the current GMOs rules are "not fit for purpose" and could prevent farmers and food producers from supporting the bloc's sustainability goals. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Eurostat's third estimate of second-quarter GDP for the eurozone has resulted in an upward revision to the quarter-on-quarter (q/q) growth rate, from 2.0% to 2.2%, taking it further above the initial market consensus expectation (of 1.5% q/q). The prior quarter's 0.3% q/q decline was unrevised. (IHS Markit Economist Ken Wattret)

- As expected, the key driver of the second quarter's GDP increase was a strong rebound in private consumption due to reduced COVID-19 restrictions. The rise of 3.7% q/q followed two large declines and contributed the bulk (1.9 percentage points) of the 2.2% q/q increase in GDP.

- Investment rose by 1.1% q/q in the second quarter, following a (downwardly revised) 0.2% q/q decline in the first quarter. Exports rose by 2.2% q/q, the fourth successive increase. Imports rose by a slightly larger 2.3% q/q, also the fourth straight increase, resulting in a zero contribution to GDP growth from net trade.

- Inventories subtracted by 0.2 percentage point from the q/q GDP growth rate in the second quarter, following back-to-back strong contributions in the prior two quarters.

- As year-on-year (y/y) rates of change are hugely distorted by base effects currently, we continue to favor looking at levels of expenditure. Despite the second quarter's strong rise, eurozone GDP was still 2.5% below its pre-pandemic level in the fourth quarter of 2019, with wide variations in performance across expenditure components.

- Seasonally and calendar-adjusted German industrial production excluding construction increased by 1.0% month on month (m/m) in July, unwinding part of the cumulative decline by 1.6% in April-June. July's output level is 6.2% higher than a year ago, but conversely still about 6% below its February 2020 pre-pandemic high. (IHS Markit Economist Timo Klein)

- Total production including construction equally posted 1.0% m/m in July given the similar 1.1% m/m increase of construction output. In contrast, energy output declined by 3.2% m/m, its third successive dip.

- The split by type of goods reveals that the first truly robust increase in the investment goods sector since October 2020 was the driving force in July. Consumer goods production expanded only modestly after their combined 6.3% surge during May-June (then driven by loosened COVID-19 restrictions), and intermediate goods production slipped for the second consecutive month.

- The breakdown by industrial branch is dominated by a sharp rebound of the recently suffering machinery and equipment sector (6.9% m/m), followed by a much more limited improvement of motor vehicle production (1.9% m/m). The latter is still hampered by the ongoing shortage of semiconductors - car production in July remained about 23% lower than at its interim peak in December 2020. The monthly change in the other key industrial sectors ranged between -0.9% and 1.1%, averaging out to be almost unchanged.

- The headline increase of manufacturing orders by 3.4% m/m after June's even stronger 4.6% m/m, lifting the orders volume to 16% above its pre-pandemic level in February 2020, is heavily qualified by recent big-ticket items. In June, this had pertained to domestic investment goods, while the July surge was propelled by their foreign counterpart, specifically ship-building orders from Asia. The measure excluding big-ticket items only increased by 1.5% in June-July, which compares with 8.1% in headline terms.

- Automotive and industrial supplier Schaeffler has partnered with Intel's Mobileye to advance industrialization of autonomous shuttles, according to a company statement. Under this partnership, the rolling chassis from Schaeffler is to be combined with Mobileye's autonomous system Mobileye Drive, to develop a platform of Level 4 automation. The platform will enable autonomous transport solutions from 2023. Matthias Zink, CEO automotive technologies at Schaeffler, said, "Rapid regulatory and technological change, increasing urbanization and growing social awareness of mobility are increasing the need for alternative, novel concepts such as autonomous people or logistics movers. They play a crucial role in sustainable mobility and are a future field in our Roadmap 2025. With the partnership with Mobileye, we want to develop autonomous shuttles to series production." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen (VW) Group's CEO Herbert Diess has said that the company will aim to retain its ownership of battery electric vehicles (BEVs) through used-car vehicle leases so that it can utilize the batteries for 'second-life' purposes. According to an Automotive News Europe report, Diess has been outlining how the plan would work at this week's IAA Mobility Show. He said, "In Europe, we are trying to get a second lease and even a third lease, and keep the car in our hands" and added, "Battery life, we think today is about 1,000 charging cycles and around 350,000 kilometers [about 215,000 miles], something like that. So, the battery would probably live longer than the car, and we want to get hold of the battery. We don't want to give the battery away." It has long been anticipated that the battery packs in BEV passenger cars have the potential to outlast the vehicle they initially power and be used in a secondary role; this would even take into account the deterioration in performance that will occur over time in terms of charge retention. (IHS Markit AutoIntelligence)

- Bladt Industries and Steelwind Nordenham have signed monopile foundation supply contracts with Ørsted for the Gode Wind 3 (242MW) and Borkum Riffgrund 3 (900MW) offshore wind farms in Germany. In addition, Ørsted has also secured call-off rights with Bladt and Steelwind for other projects, if needed. The two suppliers will deliver a total of 107 XXL monopile foundations of which 106 are for wind turbines and one is for the Gode Wind 3 offshore substation. According to Ørsted, each monopile will be up to 100 meters long with diameter of approximately 10 meters and will weigh upwards of 1,200 tons. Installation of Gode Wind 3 is expected to begin in 2023 with commissioning completed in 2024. Construction of Borkum Riffgrund 3 will be carried out in parallel with commissioning planned for 2025. Both projects will be powered by Siemens Gamesa's 11MW offshore wind turbines with the topside to be built by Atlantique Offshore Energy in Saint Nazaire, France. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- French car leasing group ALD Automotive has invested an undisclosed amount in Belgian mobility startup Skipr, according to a company statement. In return, ALD has acquired a 17% stake in the mobility startup in a shareholder agreement with two existing investors Belgian bank Belfius and Lab Box. The capital infused will enable the companies to take advantage of growth opportunities by integrating consultancy services for mobility transformation with digital access to multimodal mobility solutions for employees. ALD is a full-service leasing and fleet management group. It has a presence in 41 countries and manages around 1.5 million vehicles. Skipr, founded in 2018, is an all-in-one solution for corporate mobility. It helps companies organise transport and mobility for employees in Belgium and France through its platform. This deal will allow Skipr's expertise to complement ALD Move, ALD's mobility-as-a-service (MaaS) solution in the Netherlands. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Leading chemicals distributor Azelis (Antwerp, Belgium) has announced plans to launch an initial public offering (IPO) aimed at raising gross proceeds of €880 million ($1.04 billion), with the company to list its shares on the Euronext Brussels exchange. A schedule for the IPO process has not been disclosed. (IHS Markit Chemical Advisory)

- Azelis, acquired by private equity firm EQT (Stockholm, Sweden) in 2018, says the IPO will consist of a primary offering of new shares from a capital increase, as well as a secondary component from existing shareholders. The offering will consist of private placements to qualified investors in Belgium, qualified institutional buyers in the US, and certain other qualified and/or institutional investors in the rest of the world, it says.

- Proceeds from the planned IPO, in addition to borrowings under new credit facilities, will be used to "significantly strengthen" Azelis's financial position by repaying current outstanding debt of approximately €1.6 billion and providing the group with "increased financial flexibility that is more consistent with its current profile and maturity," according to Azelis. The IPO is also expected to support the company's growth strategy and future acquisitions by providing funding and giving it access to capital markets.

- The specialty chemicals and food ingredients distribution market was valued at €117 billion in 2019, with the top-four companies together holding a 10% market share, according to Azelis. "The industry is expected to consolidate as principals and customers look to streamline their distributor relationships. Acquisitions will enable Azelis to expand its product portfolio and its geographic and product segment market coverage," it says.

- Vattenfall has officially opened its 604 MW Kriegers Flak offshore wind farm in an inauguration ceremony presided by the Crown Prince of Denmark and the Danish Minister for Industry, Business and Financial Affairs. Comprising 72 Siemens Gamesa 8.4 MW offshore wind turbines, Kriegers Flak has surpassed the 407 MW Horns Rev 3 to become the largest wind farm in the country. Construction of the wind farm began in May 2020 with the foundation works, with wind turbine installation taking place at the beginning of 2021 and lasting until June. First power was delivered in February. Kriegers Flak is located in the Baltic Sea, around 15 to 50 kilometers off the coast of Denmark in water depths of up to 25 meters. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China +1.5%, Japan +0.9%, Hong Kong +0.7%, Australia/India flat, and South Korea -0.5%.

- Geely-backed ride-hailing platform Caocao Mobility has raised CNY3.8 billion (USD589 million) in a Series B funding round, reports Gasgoo. This financing round attracted five investors, most of which were state-owned companies in Suzhou (China). The company plans to use the infused capital to develop technology, expand its business, improve service quality, and strengthen safeguards for drivers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen Group (VW) plans to co-operate with Chinese companies to offer autonomous vehicle (AV) solutions in China. Stephan Woellenstein, CEO of VW China, said, "The approach in China is somewhat different from what we see in Europe and the US. We believe we need a strong Chinese partner or two on our side in order to comply with the forthcoming frame (of autonomous driving) in China. We try to keep the global synergies but in a China-specific way. We cannot do it alone." Woellenstein did not reveal the names of potential Chinese candidates but he said they are in intense talks and VW is "coming to conclusion very soon who this partner will be", reports the China Daily. VW is already working with Chinese drone maker DJI to develop advanced driving assist functions to be deployed in vehicles manufactured in China. In the United States and Europe, VW is working with AV startup Argo AI. VW and Argo are debuting their all-electric test vehicle, the ID. Buzz AD (Autonomous Driving), this week at the Munich auto show. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's real household expenditure fell by 0.9% month on month (m/m) in July for the third consecutive month of decline, although the year-on-year (y/y) figure turned positive with an increase of 0.7%. The main reasons behind the m/m decline were lower spending on a broad range of categories, particularly for education and housing, which were partially offset by rebounds in spending on miscellaneous items and transportation and communication. The weakness suggests that continued containment measures are having a negative impact. (IHS Markit Economist Harumi Taguchi)

- Nominal monthly average cash earnings rose by 1.0% y/y in July following a 0.1% y/y drop in the previous month. The improvement reflected a 0.7% y/y rise in special earnings (mainly seasonal bonuses) following a 1.8% y/y drop in June.

- Scheduled cash earnings as well as non-scheduled cash earnings also rose by 0.4% y/y and 12.2% y/y, respectively.

- Despite overall improvement, nominal monthly average cash earnings declined from a year ago in medical and healthcare, information and communication, finance and insurance, life-related services, education services, and some other industry groupings.

- Wilson Engineering was awarded a contract to build a hydrogen manufacturing unit (HMU-2) for IRPC Public Company, a Thai refiner. The HMU-2 project is part of the Ultra Clean Fuel Diesel Euro V project (UCF project) located in IRPC Industrial Estate at Rayong province of Thailand. The scope includes detailed engineering, supply of all equipment and materials, construction and installation, as well as pre-commissioning, commissioning and performance test. Upon completion, the HMU-2 project will provide hydrogen (40,000Nm3/h) to the UCF project. Detailed engineering and procurement of the project is in progress and construction is expected to commence in 2022. Completion of the HMU-2 is scheduled by third quarter 2023. IRPC is a leading integrated petroleum and petrochemical complex with fully managed infrastructure including ports, tanks and power plants. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Mobilink Microfinance Bank Limited (MMBL), Pakistan's digital bank that offers digital wallet payments, has signed a memorandum of understanding (MOU) with Universal Motors Private Limited, an importer, exporter, as well as manufacturer of commercial vehicles (CVs) in Pakistan, reports Business Recorder. President and CEO of MMBL Ghazanfar Azzam said, "MMBL's expansive product portfolio has witnessed a significant growth trajectory over the past few years with the introduction of more and more customer-centric products that are aimed at facilitating maximum convenience for empowering our borrowers in true sense." The collaboration will help MMBL customers purchase CVs from Universal Motors under convenient terms and on priority financing. The MOU will also help in a hassle-free purchase, which will be backed by the provision of 1S/2S/3S dealership or retailer services by Universal Motors near the bank's branches across the country. (IHS Markit AutoIntelligence's Tarun Thakur)

Posted 07 September 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.