Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 07, 2021

By Chris Fenske

Most major European equity indices closed higher, while US and APAC markets were mixed. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA credit indices were both flat across IG and high yield. Gold and silver closed higher, copper was flat, and the US dollar, oil, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Major US equity indices closed mixed; Russell 2000 +1.4%, Nasdaq +0.5%, S&P 500 -0.1%, and DJIA -0.4%.

2. 10yr US govt bonds closed +2bps/1.57% yield and 30yr bonds +2bps/2.25% yield.

3. CDX-NAIG closed flat/50bps and CDX-NAHY flat/283bps.

4. DXY US dollar index closed -0.2%/89.95.

5. Gold closed +0.4%/$1,899 per troy oz, silver +0.4%/$28.02 per troy oz, and copper flat/$4.53 per pound.

6. Crude oil closed -0.6%/$69.23 per barrel and natural gas closed -0.9%/$3.07 per mmbtu.

7. President Joe Biden's first budget request on May 28 furnished the US Department of Energy's (DOE) Office of Fossil Fuel Energy with a new and longer name that reflects a revised mission to decarbonize the nation's economy with technologies that promote greater use of hydrogen and carbon capture, use, and storage. The DOE fiscal year 2022 budget request renames it the Office of Fossil Energy and Carbon Management (FECM), and charges it with advancing Biden's goal to reach net-zero carbon levels by 2050 in alignment with the 2015 Paris Agreement. DOE is not just making cosmetic changes with a name change, nor is it stopping at taking newly developed technology to the point of deployment. It is creating an Office of Clean Energy Demonstrations (OCED), which, armed with a $400 million budget (subject to congressional approval), will serve as DOE's hub for demonstrating "near- and mid-term" technologies and systems with the goal of quicker commercial adoption and increased availability. (IHS Markit Climate and Sustainability News' Amena Saiyid)

8. The Securities and Exchange Commission is drafting a proposal that would restrict plans that corporate insiders use to avoid insider-trading claims when buying or selling their own company's stock. Speaking Monday at The Wall Street Journal's CFO Network event, SEC Chairman Gary Gensler said he is seeking to revise rules that govern the arrangements, known as 10b5-1 plans. Insiders set up plans ahead of time and use them to schedule future trades. The arrangement gives executives a defense against insider-trading claims that would stem from having undisclosed material nonpublic information at the time of a trade. (WSJ)

9. U.S. health regulators approved the first new Alzheimer's drug in nearly two decades, casting aside doubts about the therapy's effectiveness. The approval Monday of the therapy, which has the molecular name aducanumab and will be sold as Aduhelm, marked a watershed in Alzheimer's drug research after billions of dollars in investment. Maker Biogen Inc. developed the therapy to do what previously approved Alzheimer's medicines can't: slow the memory-robbing march of the disease. (WSJ)

10. Former shareholders of Celgene (US) have launched a USD6.4-billion lawsuit against Bristol Myers Squibb (BMS, US) alleging that the company delayed launching its gene therapy Breyanzi (lisocabtagene maraluecel; also known as liso-cel) in order to avoid making payments to them. The lawsuit, which was filed by UMB Bank NA on behalf of the shareholders at the United States District Court for the Southern District of New York, claimed that BMS broke its contractual obligations by failing to make appropriate efforts to secure US FDA approval for Breyanzi prior to a deadline of 31 December 2020. If the deadline had been met, then BMS would have had to make milestone payments of USD9 per share to Celgene shareholders. (IHS Markit Life Sciences' Milena Izmirlieva)

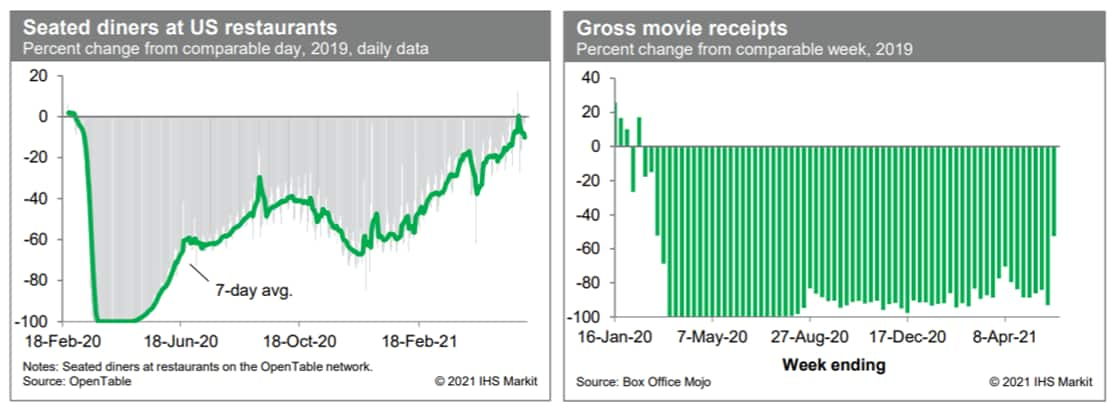

11. The trend in dining out is solid. Averaged over the week ending yesterday (6 June), the count of seated diners on the OpenTable platform was about 10% below the comparable period in 2019, as nice weather, easing restrictions on restaurants, and rising comfort levels are boosting restaurant activity. Meanwhile, there was a dramatic improvement in movie-theater activity last week. Relative to the comparable week in 2019, box-office revenues were down roughly 53%, up sharply from recent weeks. Relative to the week including Memorial Day 2019 (one week earlier), revenues were down about 58%; still a vast improvement from prior weeks. (IHS Markit Economists Ben Herzon and Joel Prakken)

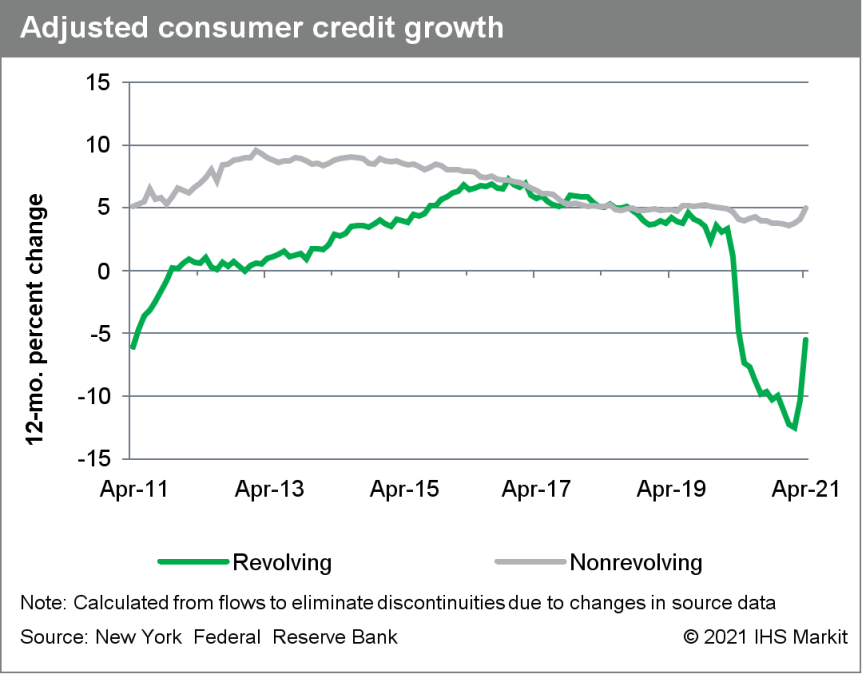

12. Outstanding US nonmortgage consumer credit rose $19 billion to $4.24 trillion in April after similar increases during February and March. The 12-month change in outstanding consumer credit was 2.4%, 2.0 percentage points higher than in March owing to "base effects"—i.e., comparison to a depressed level in April 2020, when widespread shutdowns in response to COVID-19 inhibited economic activity. (IHS Markit Economist David Deull)

a. Revolving credit fell by $2 billion, leaving the entirety of April's increase in the nonrevolving category of loan, which rose by $21 billion.

b. In spite of sharp declines a year ago, outstanding revolving credit was still 5.5% lower this April than last, as consumers have cut back sharply on credit card borrowing during the pandemic and paid down card balances.

c. However, nonrevolving debts, which include student and auto loans, have seen an accelerating increase amid towering demand for new and used vehicles. The 12-month change in nonrevolving debt in April 2021 was 4.9%, a return to rates of change seen in late 2019.

d. The ratio of nonmortgage consumer credit to disposable personal income rose, as expected, increasing 3.4 percentage points to 22.5%. This was a function of the sharply reduced rate of disbursement of stimulus checks in April relative to March.

e. Outstanding nonmortgage consumer credit rose $19 billion to $4.24 trillion in April after similar increases during February and March.

13. Albemarle has announced a set of sustainability goals, including aiming for net-zero carbon emissions by 2050. Goals also include a 35% reduction in carbon intensity for the company's catalysts and bromine business by 2030, and a commitment to "growing the lithium business in a carbon-intensity neutral manner by 2030." The company also announced initiatives around water use and resource efficiency. (IHS Markit Chemical Advisory)

a. The emission reductions will come in phases, with an early focus on building out infrastructure to measure and track progress, and on what CEO Kent Masters calls "low-hanging fruit" projects to cut emissions. "We've identified some projects and are working on them," Masters says. This includes water recycling projects in Australia and Jordan, and a $100 million investment in a thermal evaporator in Chile.

b. Albemarle is undertaking aggressive capacity expansion in lithium to meet growing demand from the electric vehicle (EV) market. Projects in Chile and Australia will, combined, increase the company's lithium conversion capacity by 175,000 metric tons/year of lithium carbonate equivalent (LCE), with commercial volumes expected to be available in 2022.

14. A coalition of 11 environmental, health, and consumer groups has petitioned FDA to ban all uses of PFAS in food and food contact applications. The petition says FDA should revoke all approvals of per and poly-fluorinated compounds (PFCs) in food contact materials unless companies can demonstrate the substances are safe. American Chemistry Council says the petition is "misguided and unnecessary," defends FDA process. While it's unclear if FDA would act on the petition, new legislation from Congress may force the agency's hand. Rep Rosa DeLauro (D-Conn.) introduces bill seeking to overhaul FDA's Generally Recognized as Safe (GRAS) process. Criticizing FDA for not taking a tougher stance on PFAS, the petition urges FDA to revoke all approvals for use of PFAS in food and food packaging and issue regulation that bans the use of both short-chain and long-chain PFAS in food packaging and food handling equipment. Moreover, the petition states FDA should take stronger action on all per and poly-fluorinated compounds (PFCs) - a broad category of chemicals that includes PFAS as well as cyclic chemicals. FDA should require industry to provide information demonstrating that all PFCs - including types of PFAS that fall outside the long-chain PFAS (LC-PFAS) and short-chain (SC-PFAS) categories - do not biopersist or do not cause cancer. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

15. Autonomous vehicle (AV) company Cruise LLC has received a permit that allows it to shuttle passengers in its driverless test vehicles in California, United States, reports TechCrunch. The permit, issued by the California Public Utilities Commission (CPUC) as part of its driverless pilot program, allows Cruise to offer passengers rides in its vehicles without a human safety operator behind the wheel, but it does not allow the company to charge passengers for any rides. Cruise must submit quarterly reports about the AV operation and outline a passenger safety plan to CPUC. (IHS Markit Automotive Mobility's Surabhi Rajpal)

16. Ineos is looking to enter the US market in early 2023, as well as Canada and Mexico, after first launching its Grenadier sport utility vehicle (SUV) in Europe. The company has appointed Greg Clark to the post of vice-president of Americas. Clark is tasked with selecting a location for US headquarters, deciding how to get dealers in all 50 states, and hiring all staff of US arm (marketing, compliance managers, warranty administrators, zone managers, parts and service personnel, and so on). In an interview with Automotive News, Clark said of the headquarters location, "We have to make the right decision. Being in an area where we can attract good talent and attract talent from other places of the country and that has the appropriate infrastructure is a big driver." Clark says the ideal location would be within reasonable driving distance of punishing off-road driving, and he is looking at locations on the US Eastern Seaboard, near ports and areas with transportation in place to move parts and vehicles. Clark is reportedly aiming to have between 30 and 50 dealers open at launch, with about 70% US market coverage. Once its North American operations are fully up, Ineos is aiming to sell about 30,000 units per year. The Grenadier reportedly could be followed by a pick-up truck and a hydrogen-powered version. (IHS Markit AutoIntelligence's Stephanie Brinley)

17. Autonomous vehicle (AV) startup Aurora Innovation is close to finalising a merger deal with Reinvent Technology Partners Y, a special-purpose acquisition company (SPAC), reports Reuters. This deal's targeted valuation, which had been as high as USD20 billion, is now closer to USD12 billion. According to the report, the companies are expected to announce the deal as early as next week. In a separate statement, Aurora has formed a committee of experts to provide guidance and recommendations on safety matters related to driverless operations. The Safety Advisory Board includes outside professionals from fields such as aviation safety, insurance, medicine, and automotive. The company has also detailed its own safety efforts by publishing a voluntary safety self-assessment report. The report discussed Aurora's use of LiDAR, a virtual testing suite, and how vehicle operators are trained. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

1. Most major European equity indices closed higher except for Germany -0.1%; Italy +1.0%, Spain +0.8%, France +0.4%, and UK +0.1%.

2. 10yr European govt bonds closed lower; Italy +4bps, France/Germany +2bps, and Spain/UK +1bp.

3. iTraxx-Europe closed flat/49bps and iTraxx-Xover flat/244bps.

4. Brent crude closed -0.6%/$71.49 per barrel.

5. In 2020, the UK had a total area of 489,000 hectares of land farmed organically (combined the fully converted area and area under conversion), an increase of 0.8% compared with 2019, according to the UK Department for Environment, Food & Rural Affairs (Defra). This increase was entirely driven by a 12% rise in the area of in-conversion land compared with the preceding year. The organically farmed area represents about 3% of the total farmed area on agricultural holdings in the UK. The area in-conversion gives an indication of the potential growth in the organic sector. The three main crop types grown organically are cereals, vegetables including potatoes and other arable crops. About 62% of UK organic land is accounted for by permanent grassland; 9% of the total UK organic area is used to grow cereals. This echoes the performance across Europe, where the number of producers and amount of organic land continue to rise to achieve the EU's ambition for 25% of all agricultural land to be organic by 2030. (IHS Markit Food and Agricultural Commodities' Hope Lee)

6. Transport for West Midlands (TfWM) is working with Vodafone, Nokia, and Chordant to trial a new "mobility cloud" platform on open roads in the UK. The platform uses 5G-based vehicle-to-everything (V2X) technology to connect with road users in the West Midlands and provide them with live updates about local lane closures, speed restrictions, and traffic incidents. Vodafone will integrate its 4G and 5G network and multi-access edge computing (MEC) technology into the platform, which will serve as "a new type of information superhighway". The platform will offer real-time road information that will be displayed initially on users' smartphones, and in the future, on in-car infotainment systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

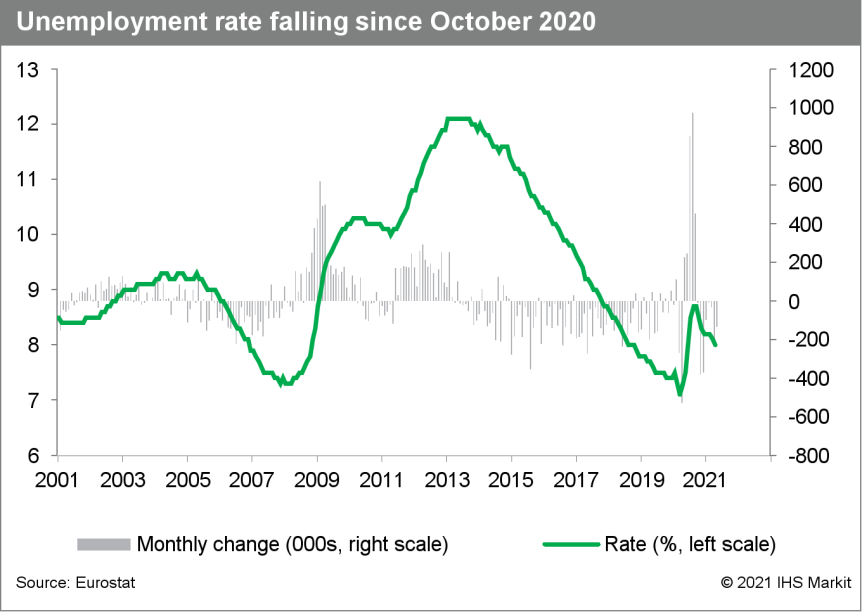

7. The eurozone's harmonized unemployment rate showed another modest decline in April, the fifth in seven months, from 8.1% to 8.0%. The unemployment rate is now 0.7 percentage point below its post-pandemic peak in October 2020. (IHS Markit Economist Ken Wattret)

a. The level of unemployment fell by 134,000 in April compared with March, the eighth consecutive month-on-month (m/m) decline. April's three-month moving average rate of decline accelerated sharply to 125,000, roughly three times the equivalent rate of a decline in February.

b. Since the initial wave of COVID-19 in March 2020, the eurozone unemployment rate has risen by just 0.9 percentage point net, a remarkably small increase given the large output and expenditure losses over the same period. As of the first quarter of 2021, the latest data available, eurozone GDP was still 5.5% below its pre-pandemic level in real terms.

c. A comparison with the post-Global Financial Crisis (GFC) period highlights the remarkable recent resilience of eurozone labor markets. Between early 2008 and mid-2010, during a less severe recession, the eurozone unemployment rate rose by three percentage points (from a similar trough of 7.3% up to 10.3%).

d. The divergence in the unemployment rate over the two periods reflects three key differences.

i. First, while the initial COVID-19-driven recession in early 2020 was much deeper, it was also much shorter, with the subsequent second dip in late 2020 and early 2021 much less severe than the first.

ii. Second, and related to the point above, policy-makers introduced a variety of labour market support schemes to bridge the gap to the post-COVID-19 recovery, which is now gathering momentum.

iii. Third, participation rates declined markedly in some member states during the COVID-19 shock, partly related to the closures of schools.

e. Eurozone employment data are released quarterly, and the latest figures, for the first quarter of 2021, showed a quarter-on-quarter (q/q) decline of 0.3%. This was the first q/q fall for three quarters, reflecting the second leg of the COVID-19-driven recession in the eurozone.

8. Majors BP and Shell, utilities like Vattenfall and RWE, and chemical refiners like BASF, Linde, and Dow all are likely to benefit from promised German state funding for 62 hydrogen projects. Their projects are due a share of over €8 billion ($9.73 billion) in German state and federal funds announced jointly by Germany's Federal Ministry of Economics and Federal Ministry of Transport on 28 May. An additional €20 billion ($24 billion) in backing for projects is set to come from private investors and other sources so that funding levels reach an expected €33 billion ($40 billion). Germany's funding for the projects is contingent on the outcome of an application for EU State Aid law exemptions under the EU's Important Project of Common European Interest (IPCEI) program. The EU put out a call for proposals to regional companies to join a hydrogen IPCEI in December. (IHS Markit Climate and Sustainability News' Cristina Brooks)

9. Greece's GDP rose by 4.4% quarter on quarter (q/q) during the first quarter of 2021. This follows revised increases of 3.4% q/q (previously estimated as a rise of 3.1%) and 3.8% q/q (up from 2.7% q/q) during the third and fourth quarters of 2020, respectively. (IHS Markit Economist Diego Iscaro)

a. On a year-on-year (y/y) basis, GDP still declined by 2.3%, following a drop of 6.9% during the previous quarter. The economy is now estimated to have declined by 7.8% in 2020, as opposed to 8.0%.

b. Exports continued to rebound during the first quarter, boosted by a recovery in exports of services, growing by 4.0% q/q. Imports of goods and services rebounded from their 2.8% q/q decline in the fourth quarter, rising by 2.0% q/q.

c. The tightening of COVID-19 pandemic-related restrictions led to a 1.2% q/q decline in private consumption (-4.9% y/y). Household spending was still 6.0% below its level during the fourth quarter of 2019.

10. The Russian government has said that the country is gearing up to provide the framework to produce 150,000 battery electric vehicles (BEVs) a year by 2030, according to a Prime-Tass news agency report. The directive was communicated by the Russian Economic Development Ministry's department director, Maksim Kolesnikov. He said, "We believe that the implementation of the concept [for the development of production and use of electric transport in Russia - Tass] will allow [the creation of] a new technological sector in the country and [production of] electric cars [will have a] share of at least 10% of the total production of transport vehicles by 2030." Given the rapid ramping up of BEV production in other major economies, the 150,000 BEV production target is a modest one, albeit necessarily so given the equally modest program that the Russian government is currently talking about to accelerate BEV take-up in the country. (IHS Markit AutoIntelligence's Tim Urquhart)

11. Car-sharing service provider Delimobil has received a USD75-million investment from Russia's second-largest lender, VTB Bank, reports Reuters. In return, VTB Bank has bought a 15% stake in Delimobil, which runs a fleet of cars that can be hired by the minute in Russia. The company intends to use the proceeds for further development and to strengthen its position in the Russian car-sharing market. Delimobil was established in 2015, and currently has a fleet of over 15,000 vehicles with more than 1 million members. (IHS Markit Automotive Mobility's Surabhi Rajpal)

12. The Economic Community of West African States (ECOWAS) and the African Union announced decisions on 30 May and 1 June respectively, to suspend Mali's membership and participation in the organizations' bodies. On 3 June, France announced the suspension of joint military operations and training activities with Mali and the World Bank, which is currently financing projects amounting to USD1.8 billion in Mali, on 4 June suspended its financial operations there until further notice. (IHS Markit Economists Jihane Boudiaf and Anton Casteleijn)

a. After six years of robust real GDP growth averaging 7.5%, Mali's growth declined by 2% in 2020 due to the impact of the COVID-19 virus pandemic, the worsening political climate and the eventual imposition of ECOWAS sanctions for several weeks, following the removal of President Keïta in a military coup on 18 August 2020.

b. To cover the financing gaps that resulted from the impact of the COVID-19 pandemic, the International Monetary Fund (IMF) approved a USD200-million Rapid Credit Facility disbursement to Mali on 30 April 2020. The government announced a pandemic response plan amounting to 5% of GDP in May 2020, to support businesses and households.

Asia-Pacific

1. APAC equity markets closed mixed; India +0.4%, South Korea +0.4%, Japan +0.3%, Mainland China +0.2%, Australia -0.2%, and Hong Kong -0.5%.

2. China's merchandise exports rose 27.9% year on year (y/y) in May in US dollar terms, down from 32.3% y/y in April, according to the General Administration of Customs. Merchandise imports growth continued to accelerate to 51.1% y/y in May from 43.1% y/y in the previous month. On a two-year (2020-21) average basis, exports growth slowed from 16.8% in April to 11.1% in May and imports growth accelerated from 10.7% to 12.4%. (IHS Markit Economist Yating Xu)

a. The headline exports slowdown was driven by double-digit declines in growth of exports to the United States and European Union. However, exports to Hong Kong, Association of Southeast Asian Nations (ASEAN) member states, South Korea, and Japan accelerated. By product, export growth decelerated across high-tech manufacturing goods, mechanical goods, and labor-intensive goods.

b. Notably, exports of pandemic-prevention supplies declined year on year as the global vaccination progress continues to advance and the pandemic situation in Southeast Asia gradually stabilized. Meanwhile, exports of consumption goods such as clothes, home appliances, furniture, and automobiles moderated. On the other hand, with the production recovery in the United States and European Union, exports of investment goods and materials such as general-purpose equipment and plastic accelerated.

c. The acceleration in imports growth was largely driven by a low base - as imports dropped to contraction in April 2020 - and rising commodity prices. To illustrate, the import value of crude oil rose by 105% y/y, while the import volume dropped by 14.6% y/y; the situation was similar for copper, coal, and iron ore imports. By product, imports of agricultural products, mechanical goods, and high-tech manufacturing goods accelerated.

d. Trade surplus continued to increase to USD45.5 billion in May, while the cumulative surplus increase was down from 174%y/y in April to 26.5% y/y decline compared to a year ago, expanding from a 4.7% y/y decline in April to 70.2% y/y.

3. Japan's government is debating its future strategy for the pharmaceutical sector, amid rising concerns within the industry that the country's drug pricing regulations are increasingly hampering innovation. The debates over the pharmaceutical sector come as Japan finalizes its 2021 Basic Policy for Economic and Fiscal Management and Reform (honebuto in Japanese). Among the leading drug-pricing topics debated is the long-established 2% adjustment rate (or adjustment range), also known as the reasonable zone (R-zone). The adjustment rate, which was set at 2% in April 2000, is added to a drug's market price and is intended to offer a "cushion" following market price-based revisions of a drug's National Health Insurance (NHI) price. The overall aim of the addition of the adjustment rate is to maintain stable drug distribution in Japan. The debate over the potential revision of the 2% adjustment rate follows a year of extraordinary pricing reforms, due in part to the off-year FY 2021 NHI revision cycle, as well as the impact of the COVID-19 virus pandemic. In addition, the policies of the 2016 four-minister accord have now also been carried out, opening the door to a new round of drug pricing reforms. (IHS Markit Life Sciences' Sophie Cairns)

4. Toyota Motor is rebranding its corporate investment arm as Toyota Ventures, which was formerly known as Toyota AI Ventures, according to a company statement. The new brand has added two USD150-million early-stage funds - the Toyota Ventures Frontier Fund and the Toyota Ventures Climate Fund - bringing Toyota Ventures' total assets under management to more than USD500 million. The Frontier Fund will continue to invest in such areas as artificial intelligence, automated vehicles, cloud computing, and robotics, while expanding its range to include smart cities, digital health, fintech, materials, and energy. The Climate Fund will be focused on finding and funding early-stage startups that develop solutions for carbon dioxide reduction. (IHS Markit Automotive Mobility's Surabhi Rajpal)

5. The Australian Securities and Investments Commission, the Australian Prudential Regulation Authority (which supervises banks and insurance companies) and the Reserve Bank of Australia issued a joint statement on 4 June which urges rapid migration from LIBOR use and requests no new LIBOR-based contracts to be issued from end-2021. Australian regulators thus have reacted rapidly to apply the Financial Stability Board (FSB) recommendations on LIBOR transition. The joint statement warned that continued use of LIBOR would present "significant risks and disruptions" to financial stability and integrity, with individual financial groups facing "financial, conduct, litigation and operational risks" from inadequate preparation for migration. (IHS Markit Economist Brian Lawson)

Posted 07 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.