Most major US and European equity indices closed lower, while APAC markets closed mixed. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed wider across IG and high yield. Natural gas, copper, silver, and gold closed higher, while the US dollar and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- US nonfarm payroll employment rose 199,000 in December, down from prior months' gains and well below expectations. Civilian employment, on the other hand, posted a solid gain (651,000), outpacing a more modest increase in the civilian labor force (168,000); the unemployment rate declined 0.3 percentage point to 3.9%. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The unemployment rate in December was below most estimates of the "natural rate" and only 0.4 percentage point above the pre-pandemic low of 3.5%, indicating that labor markets are, once again, tight and tightening.

- The current (tight) state of the labor market in large part reflects a continued depressed labor-force participation rate.

- While it has been moving unevenly higher in recent months, at 61.9%, the participation rate remains well below the February 2020 level of 63.4%. Were today's participation rate equal to that of February 2020, today's level of employment would imply an unemployment rate of 6.1%—a labor market with plenty of slack.

- Nevertheless, employers are competing for labor that is in short supply, and wage gains are firming. In December, average hourly earnings rose 0.6% and prior months' increases were revised higher. From March 2021 to December 2021, average hourly earnings rose at a 6.0% annual rate.

- The current rapid spread of the Omicron variant, moreover, has the potential to temporarily slow the recovery in labor-force participation and keep wage rates rising at rapid clip.

- Over the next few months, IHS Markit analysts assume that payroll gains firm only gradually while wage rates continue rising rapidly, implying solid growth of private wage-and-salary income.

- Most major US equity indices closed lower except DJIA flat; S&P 500 -0.4%, Nasdaq -1.0%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed +4bps/1.77% yield and 30yr bonds +4bps/2.12% yield.

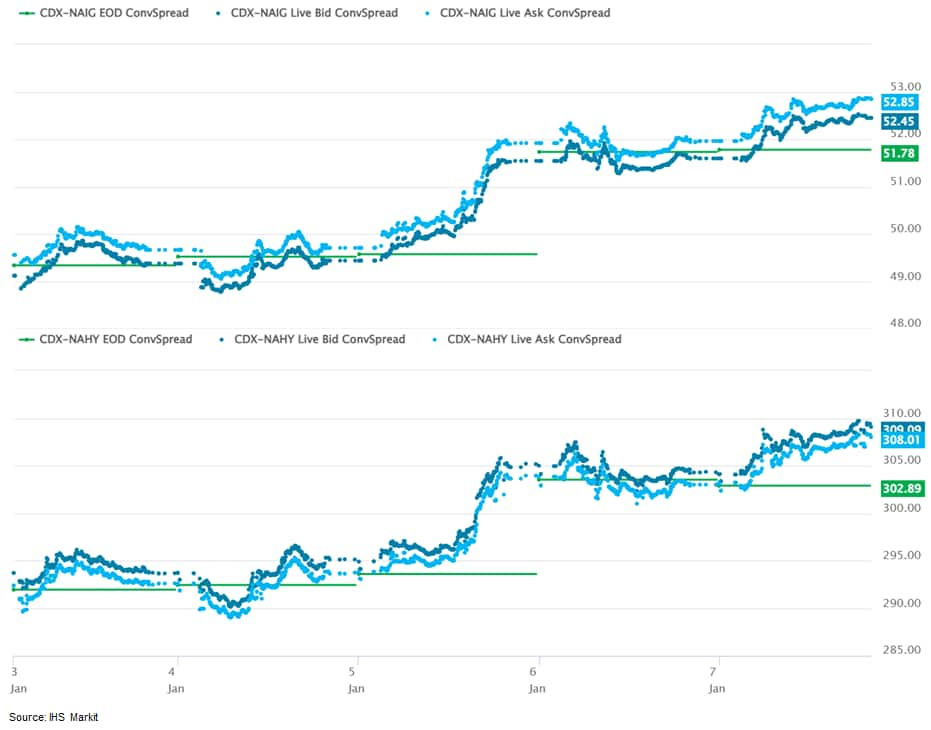

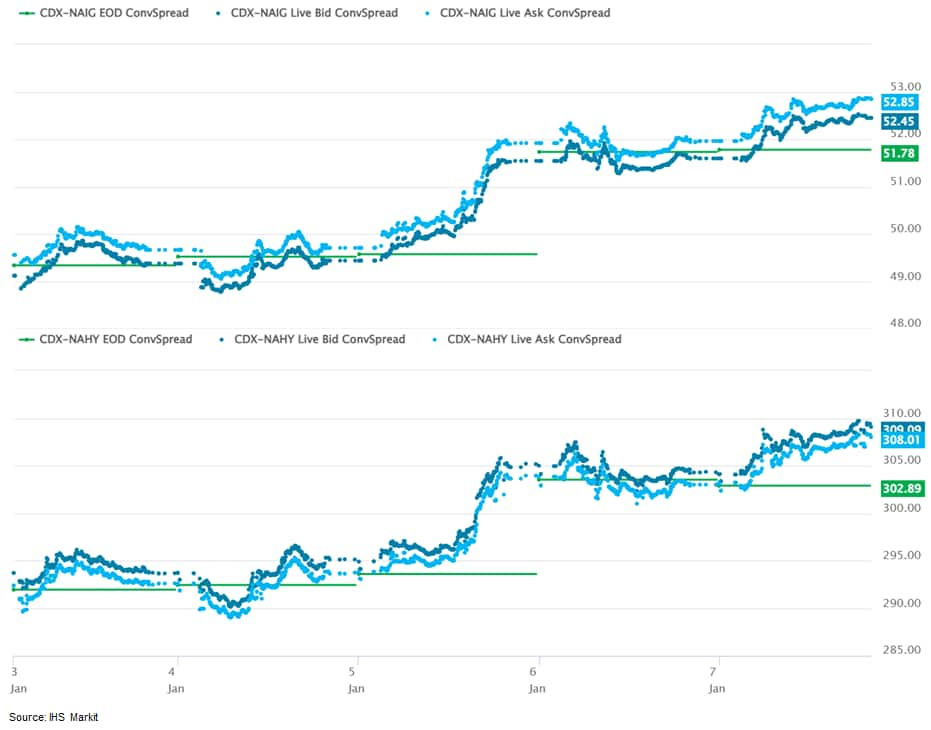

- CDX-NAIG closed +1bp/53bps and CDX-NAHY +6bps/309bps, which is +3bps and +17bps week-over-week, respectively.

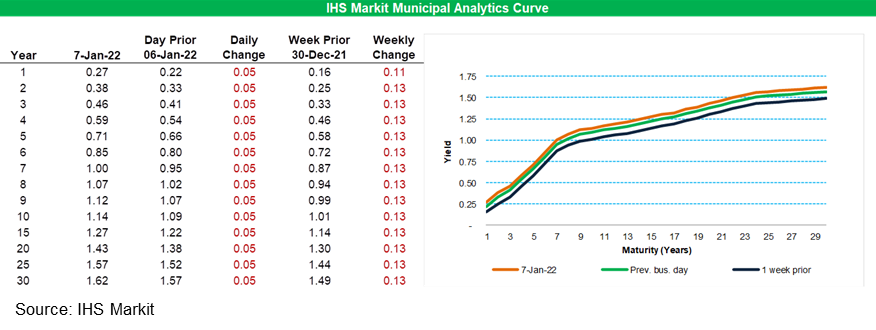

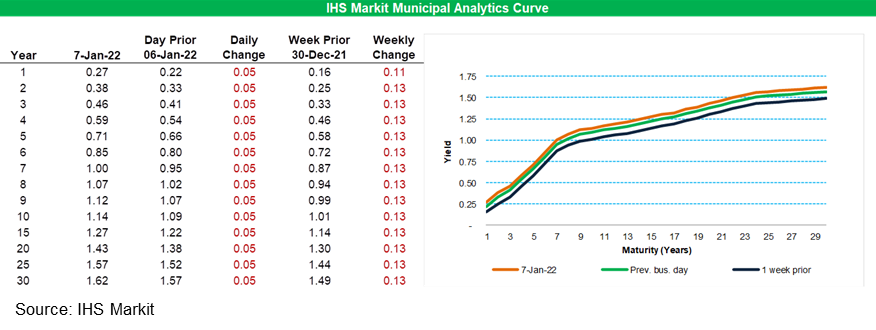

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) sold-off 5bps across the curve, with the curve 11-13bps worse week-over-week.

- DXY US dollar index closed -0.6%/95.72.

- Gold closed +0.5%/$1,797 per troy oz, silver +1.0%/$22.41 per troy oz, and copper +1.3%/$4.41 per pound.

- Crude oil closed -0.7%/$78.90 per barrel and natural gas closed +1.5%/$3.73 per mmbtu.

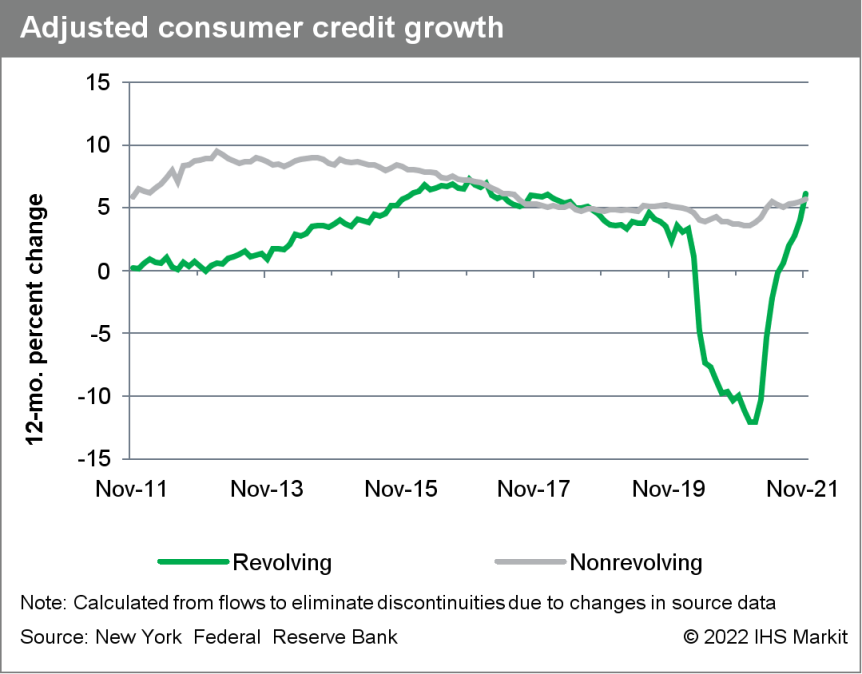

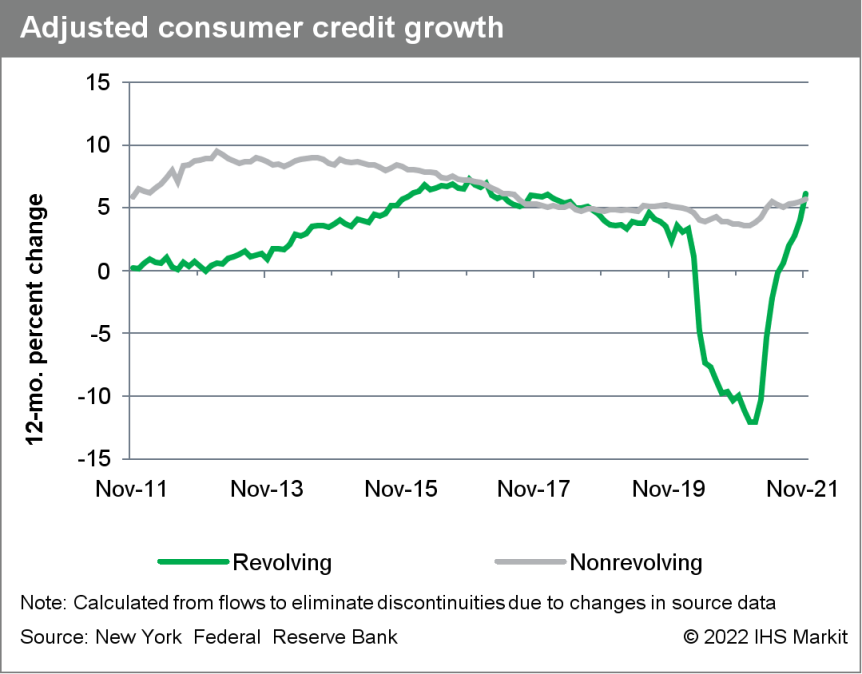

- Outstanding US nonmortgage consumer credit rose $40.0 billion to $4.41 trillion in November, with the increase nearly evenly split between revolving and nonrevolving credit. (IHS Markit Economist Michael Montgomery)

- The 12-month change in outstanding consumer credit was 5.8%, showing much faster growth.

- Revolving credit rose $19.8 billion, and nonrevolving increased by $20.2 billion. Both gains vastly exceed recent increases. There may, however, be a pandemic quirk to the November spurt as consumers pulled holiday shopping forward on fears of shortages. Given that risk, it would be premature to give the November surge an outsized significance.

- The ratio of nonmortgage consumer credit to disposable personal income was 24.3%, the same as a year earlier, but erratic stimulus measures make single-month ratios of little use. Still, ratios remain below pre-pandemic levels.

- The Omicron variant was only known for a few days in November, so its significance is mostly likely almost nil, but the November gain in debt is almost a sea-change from earlier this year and needs to be validated by future releases.

- The calorie disclosure mandate that went into effect for US chain restaurants in May 2018 has led to some positive changes, as it has caused restaurants to start offering more low-calorie menu items, according to a new study conducted by researchers at the Harvard T.H. Chan School of Public Health. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- But the study also suggests it may take time before the disclosure leads to more meaningful overall reductions in calories and that menu labeling may have to be coupled with additional interventions to provide restaurants with a greater incentive to reformulate dishes and make their overall menus healthier.

- Published December 30 in JAMA Network Open, the study looked for potential changes in calorie content for more than 35,000 menu items offered at 59 large chain restaurants — including Chipotle, Burger King, IHOP, Dunkin Donuts and KFC—between 2012 and 2019.

- Researchers found that menu offerings introduced after the calorie disclosure mandate did have fewer calories than new items introduced before the mandatory calorie disclosure. Specifically, the study noted that a menu item introduced after the mandate had a mean of 113 fewer calories, a reduction of about 25%, compared to new items that debuted on menus before the start of the calorie disclosure.

- "The nationwide rollout of these calorie labels appeared to prompt restaurants to introduce lower-calorie items to their menus," said lead scientist Anna Grummon, a research fellow in nutrition at the Harvard T.H. Chan School of Public Health.

- On the flip side, however, researchers found that one year after the mandate, there was no significant reduction in calories in the menu items that restaurants were already offering before the calorie disclosure took effect. In addition, authors of the study discovered no evidence that the mandate was leading restaurants to remove higher-calorie items from their menus and there was no difference in the caloric content of items that were dropped from menus before and after the mandatory disclosure took effect.

- Free2Move is expanding its monthly Car on Demand subscription service in select cities across California (United States). According to a company statement, the Car on Demand service, which provides access to vehicles on a monthly basis, will now be available in San Francisco, San Diego, San Jose, and Sacramento. Free2Move aims to "simplify and guarantee mobility for everyone" by offering a full range of mobility services for individuals and professionals. These mobility services include taxi rides, as well as rentals and car sharing. The company has served more than 2 million customers globally and has a presence in more than 170 countries. It has also formed Free2Move eSolutions, a new e-mobility joint venture (JV) between Stellantis and Engie EPS. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On January 7, the Southwest Power Pool lodged with FERC the Generator Interconnection Agreements for three big wind projects in Oklahoma of Invenergy Wind Development LLC. The agreements, filed individually, cover (IHS Markit PointLogic's Barry Cassell):

- States Edge Wind I LLC (Docket ER22-783) - Agreement is with transmission owner AEP Oklahoma Transmission Co. Inc. for a project consisting of two hundred-eighty General Electric 2.5-MW wind turbine generators for a total nameplate capacity of 700 MW. The project's Point of Interconnection will be where the 345-kV circuit from the wind farm is attached to AEP's Riverside 345-kV Substation. The project's targeted commercial operation date is December 31, 2025.

- States Edge Wind I LLC (Docket ER22-782) - Deal is also with AEP Oklahoma Transmission. It covers a project consisting of one hundred-eighty General Electric 2.5-MW wind turbine generators for a total nameplate capacity of 450 MW. The Point of Interconnection will be at AEP's Riverside 345 kV Substation. Commercial operation is targeted for December 31, 2025.

- States Edge Wind I LLC (Docket ER22-781) - Agreement is with AEP Oklahoma Transmission for a project that will consist of three-hundred General Electric 2.5-MW wind turbine generators for a total nameplate capacity of 750 MW. The Point of Interconnection will be at AEP's Riverside 345-kV Substation. Commercial operation is targeted for December 31, 2025.

- After expanding for the past 10 months, Canada's purchasing managers' spending declined in December mainly because of the negative impact of the Omicron variant and partly owing to British Columbia's flood damage that negatively affected transportation infrastructure. The Ivey Purchasing Managers' Index (PMI) plummeted 16.2 points to 45.0 in December, as purchasing managers pulled back spending for the first time since January 2021. (IHS Markit Economist Chul-Woo Hong)

- Although the employment index continued to decrease for four consecutive months, down 4.5 points to 50.0, indicating no change in monthly employment, December's Labor Force Survey showed a solid net job gain of 54,700, led by the public sector.

- The inventories index fell 5.4 points to 49.6, showing a modest first decline in inventory spending since last December. Reflecting the intensified supply disruption, the supplier deliveries index dropped to 27.7, remaining at the second-lowest level following the massive plunge in the first month of the pandemic.

- After the sharp decline in the previous month, the price index slightly rebounded, partly because of the low exchange rate, putting modest upward pressure on inflation.

- All subindexes fell except the price index, which increased 2.6 points to 77.6.

- Given the reimposed regional restrictions, more affecting the service sector, ongoing supply disruption will likely weigh on purchasing managers' spending activity in the short term.

- Canada's labor-market results, while positive, were not as solid as the headline figure may suggest. The net employment gains were concentrated in a few industries, namely construction (up 27,100), education (up 17,300), and manufacturing (up 10,500). On an upbeat note, employment was up in each goods-producing industry, totaling 44,100. However, employment tumbled in 6 of 11 services industries, with the 10,700 loss in finance, insurance, real estate, and leasing being the largest. The smaller losses, like the 4,000 decline in healthcare, can be at least partially attributed to implemented proof-of-vaccination policies that resulted in job losses. (IHS Markit Economist Arlene Kish)

- Net employment gained 54,700 in December, which was much better than IHS Markit expectations.

- Full-time positions were up sharply, at 122,500, and part-time work fell 67,700. On net, the gains in the private sector and the number of self-employed workers were low.

- The jobless rate dipped 0.1 percentage point to 5.9%.

- The labor force participation rate was unchanged at 65.3% for a third straight month and the total number of hours worked increased 0.3% from the prior month.

- Labor-market conditions are about to take a turn for the worse with the reintroduction of public health measures thanks to Omicron.

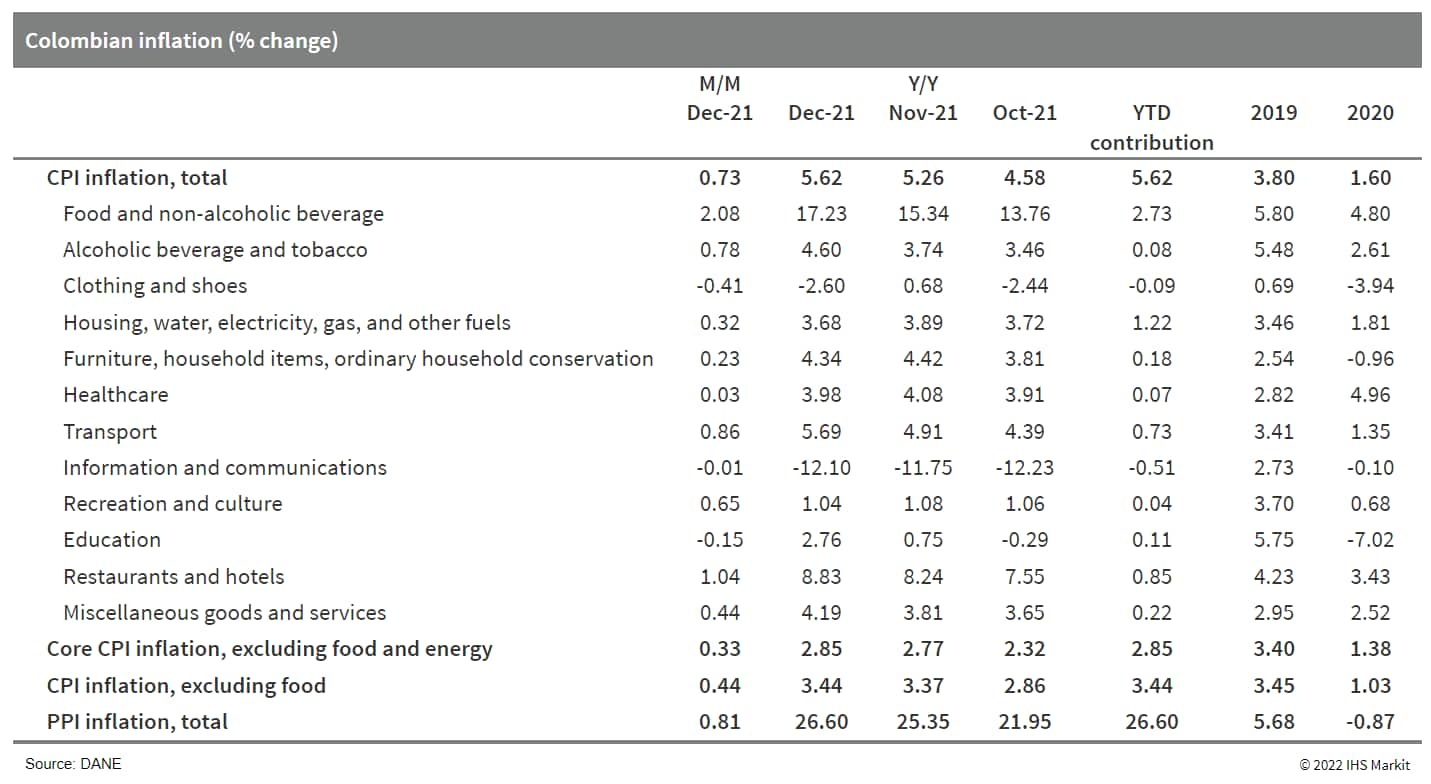

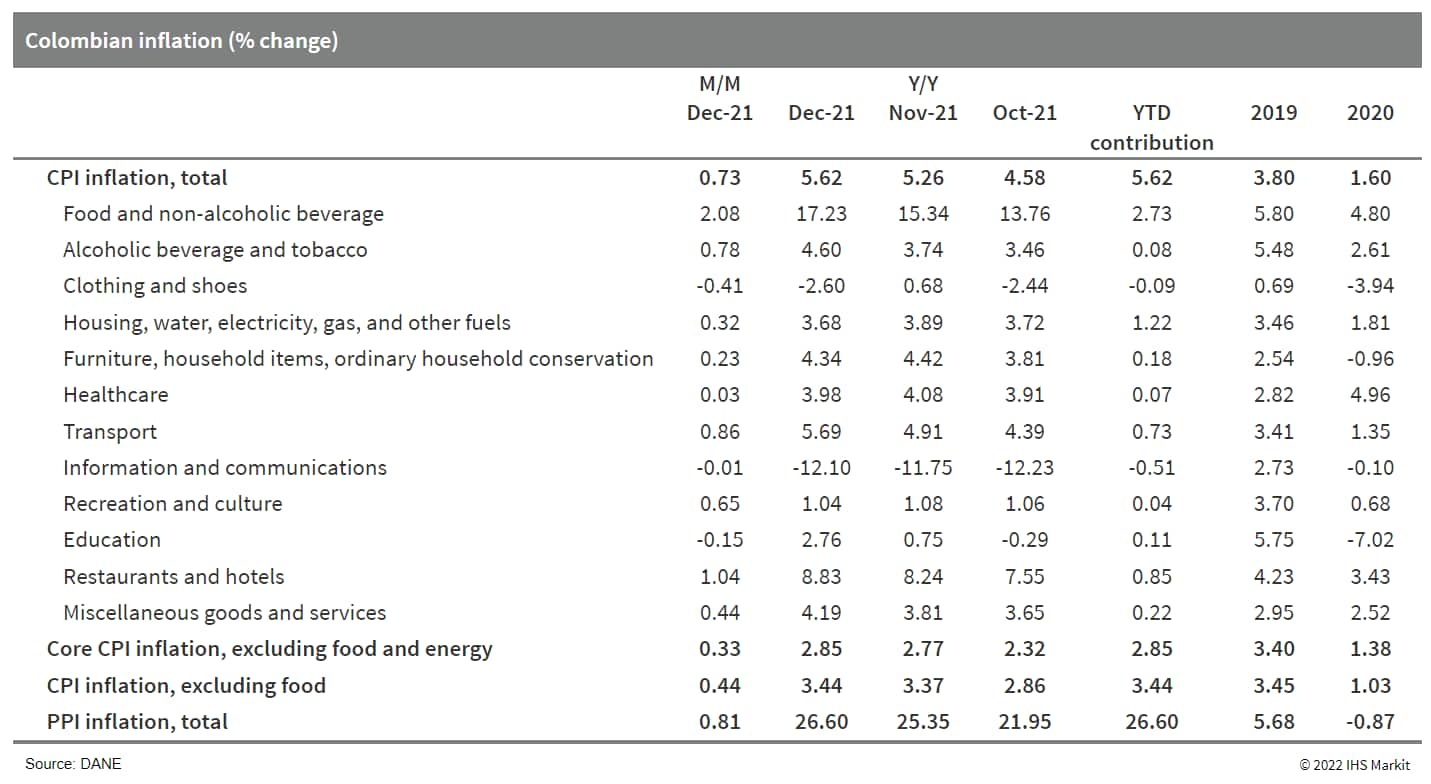

- Colombia closed 2021 with a five-year-high annual inflation rate of 5.62% in December, led by the rise in food prices. This, together with higher inflationary expectations and prospects of a more restrictive US Federal Reserves, will add pressure on the Central Bank of Colombia (Banco de la República: Banrep) to keep raising interest rates this year. (IHS Markit Economist Dariana Tani)

- According to the National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística: DANE), Colombia's consumer price index (CPI) rose to 5.62% year on year (y/y) in December 2021, from 5.26% in November, bringing the annual average rate of inflation to 3.49% in 2021. December's rate of price inflation was the highest since 2016 and stronger than IHS Markit's forecast and the market consensus expectation (5.32% y/y and 5.33% y/y, respectively). In 2020, inflation ended the year at 1.61%.

- Core inflation, measured by the CPI that excludes food and energy prices, also continued to show an upward trend by rising to 2.85% in December 2021, the highest rate since December 2019, following readings of 2.77% y/y in November 2021 and 2.32% y/y in October 2021. In month-on-month (m/m) terms, the headline CPI rose by 0.73% m/m in December, up from 0.50% m/m in the previous month.

- As in November, the breakdown of the monthly data showed that the largest contribution to inflation in December came from food and non-alcoholic beverages, followed by restaurants and hotels, transport, and alcoholic beverages and tobacco. Prices of recreational and cultural services and miscellaneous goods and services also showed large increases. Meanwhile, clothing and shoes, education, and information and communications were the only three categories offsetting part of the rise in inflation last month.

- In addition, separate data from DANE showed that producer prices as measured by the producer price index (PPI) rose from 25.8% y/y in November 2021 to 26.6% y/y in December 2021, driven by rising costs in mining and agriculture. While the index rose by just 0.80% from the previous month, it still showed the highest producer prices on record, and we expect that rising input costs related to raw material shortages and other ongoing supply chain issues will continue to put upward pressure on producer prices during the first half of the year.

Europe/Middle East/Africa

- Most major European equity markets closed lower except for UK +0.5%; Italy -0.1%, France -0.4%, Spain -0.4%, and Germany -0.7%.

- 10yr European govt bonds closed lower; Spain/UK +2bps, France +3bps, Italy +5bps, and Germany +6bps.

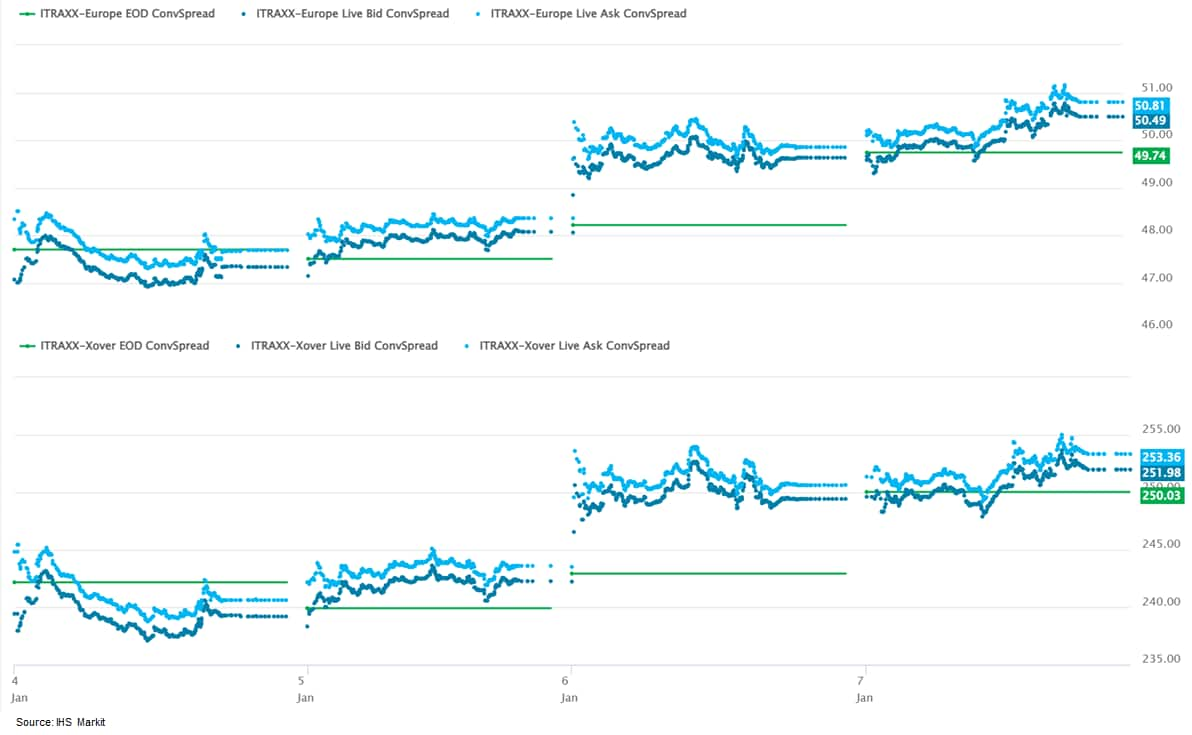

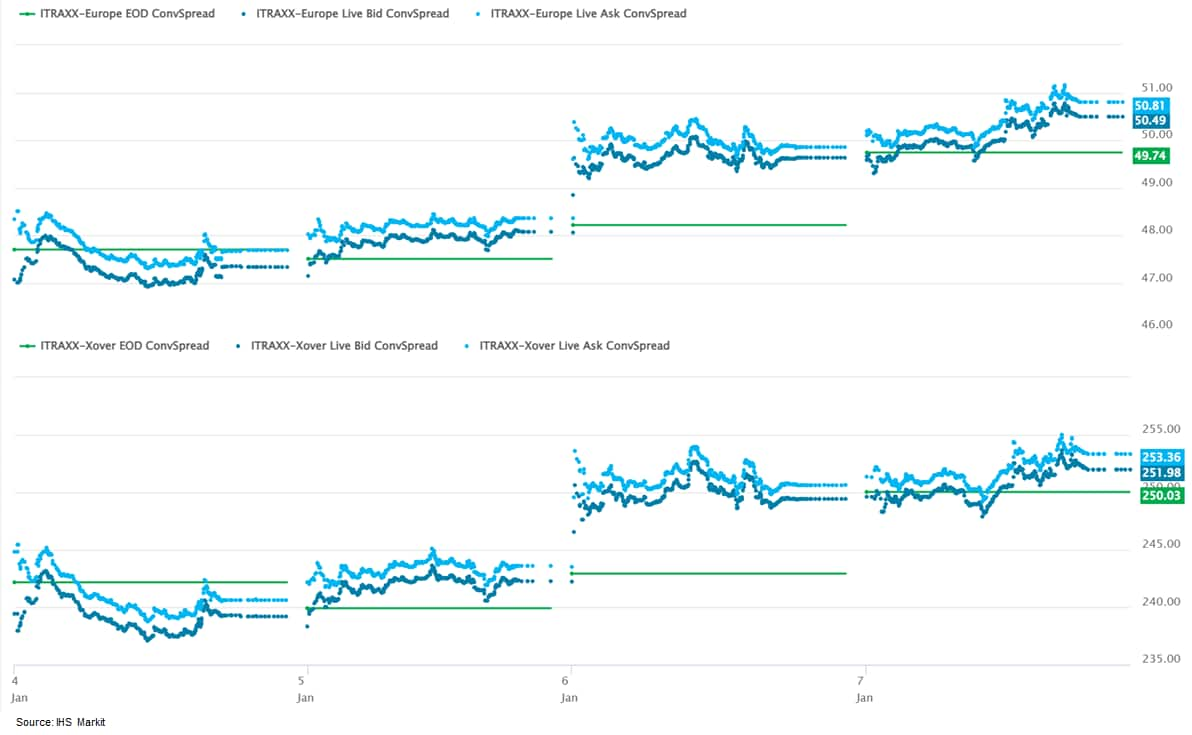

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +3bps/253bps, which is +3bps and +11bps week-over-week, respectively.

- Brent crude closed -0.3%/$81.75 per barrel.

- Over 100 local authorities in the UK are pursuing legal action against European medium- and heavy commercial vehicle (MHCV) manufacturers involved in price fixing for losses that they allegedly incurred, reports The Times. According to the newspaper, the case includes councils that purchased vehicles, as well as 22 fire and rescue services. The authorities claim that as a consequence of the truck-makers' actions, costs related to the purchase and ownership were "materially higher than they would otherwise have been" for at least the period between January 1997 and January 2011. Lawyers representing the claimants estimate that the authorities were overcharged almost GBP240 million, and are seeking to claim a further GBP155 million for estimated additional charges from other companies not involved in price fixing, due to the cartel's effects on the wider market. They also estimate that almost GBP60 million was lost due to inflated prices following the end of the cartel period due to the "delayed onset of the effects of full competition", which "would not have been charged but for the cartel". The list of truck-makers defending the claims include Daimler, which told The Times, "We thoroughly assess all customer claims and will vigorously defend ourselves against unjustified claims". It added, "The European Commission has not made any findings in its decision with respect to possible damage to customers. This also illustrates the high hurdles that exist for plaintiffs. Plaintiffs must demonstrate in detail that the exchange of information in fact led to a concrete damage. Considerable internal time and effort will be required to furnish that proof and customers will ultimately not be in the position to meet that threshold." A spokesperson for Volvo told The Times that the company does not comment on legal proceedings, and Iveco, DAF and MAN did not respond to the newspaper's requests for comment. This is the latest case to emerge in relation to a ruling by the European Commission that fined the four truck-makers EUR2.9 billion for colluding on truck pricing in the European Union (EU) over a 14-year period between 1997 and 2011. This was subsequently followed by the European Court of Justice ruling that owners can sue the manufacturers in domestic courts arising from the findings of the case. It also follows the European Commission publishing its final settlement decision during 2020. (IHS Markit AutoIntelligence's Ian Fletcher)

- There was another stronger-than-expected increase in eurozone HICP inflation in December 2021. According to Eurostat's flash estimate, it edged up from 4.9% to 5.0%, a new record high and above the market consensus expectation (of 4.7%, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- That is the highest headline inflation rate since the eurozone's inception in 1999 by some distance - the prior peak in 2008 was 4.1%. The cumulative increase during 2021 was 5.3 percentage points, a record one-year rise, again by a large margin.

- Energy inflation moderated in December for the first time in seven months, although at 26.0% year on year (y/y) it still increased by more than 30 percentage points during 2021. Energy inflation contributed half (2.5 percentage points) of December's HICP inflation rate, down marginally from November's record 2.6-percentage-point contribution.

- Food inflation increased sharply to 3.2%, the highest rate since June 2020. This was driven mainly by unprocessed food inflation (up from 1.9% to 4.6%), which can be very volatile in winter months due to weather effects.

- The eurozone's core HICP inflation rate excluding energy, food, alcohol, and tobacco prices was stable in December at 2.6%, slightly above the market consensus expectation of 2.5%, and a record high. As expected, the two constituent parts of the core inflation rate diverged in December.

- Non-energy industrial goods (NEIG) inflation jumped from 2.4% to 2.9%, a record high. The strong upward trend during 2021 reflected various influences, including supply-side bottlenecks, and has further to go. The pre-pandemic rate of NEIG inflation back in February 2020 was just 0.5%.

- In contrast, services inflation slipped back from 2.7% to 2.4% in December, although it remained well above its pre-pandemic rate of 1.6%. The areas of services inflation most sensitive to the coronavirus disease 2019 (COVID-19) pandemic, such as restaurants and hotels, fell markedly in 2020 but rebounded during 2021 as economies reopened and consumer demand recovered strongly.

- Vietnamese OEM VinFast is looking for a production location in Germany as it looks to establish a European base for the rollout of its new range of electric cars and buses, according to a company statement. The factory will build both electric passenger cars and buses, although there was no timeframe given for when the new facility will open. In its statement, VinFast said, "VinFast wants to offer high-quality e-vehicles and a special customer experience at affordable prices. We are confident we can find a place in the European market, especially since the shift to e-vehicles in Europe is crystal clear." VinFast is an interesting and ambitious company, although it suffered a setback last month when its CEO, and former head of Opel, Michael Lohscheller stepped down for personal reasons. Lohscheller had already created a shortlist of locations for VinFast to establish a German production location, which initially had five potentials sites but which have been whittled down to two, according to an interview Lohscheller gave with Automobilwoche prior to his departure. (IHS Markit AutoIntelligence's Tim Urquhart)

- A sharp fall in production of motor vehicles led to a decline in French industrial output in November, and leading indicators point to more weakness ahead as the sector deals with material shortages, supply chain disruption, and higher costs. (IHS Markit Economist Diego Iscaro)

- French industrial production declined by 0.4% month on month (m/m) in November, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Production had risen by 0.9% m/m in October.

- Industrial output fell by 0.5% year on year (y/y) in November. Quarterly figures show industrial production declining by 0.4% during the three months to November.

- Output was still 5.0% below its level right before the pandemic in February 2020.

- The manufacture of transport equipment fell particularly sharply in November (-4.6% m/m), following a rise of 8.0% m/m in October (-3.0% on a quarterly basis). Production of transport equipment was still 27.4% below that in February 2020.

- The breakdown by main industrial grouping shows capital goods (-3.8% m/m) being the main drag on production. On the other hand, production of intermediate (+1.2% m/m) and consumer durable and non-durables goods (+0.9% m/m and +0.6% m/m) rose in November.

- Energy production also increased by 1.2% m/m in November, following two months of virtually flat production.

- French consumption of goods rose by 0.8% month on month (m/m) in November 2021, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- Consumption of goods represent around 45% of total consumption. However, this share has been very volatile since the start of the pandemic, affected by COVID-19 restrictions.

- Consumption of goods had fallen by 0.6% m/m in October 2021. Quarterly figures, which remove some of the volatility found in monthly data, show it declining by 0.2% during the three months to November 2021.

- The breakdown shows a particularly strong rebound in household durables (+6.1% m/m), while sales of transport equipment also increased (+1.8% m/m, following a fall of 3.4% m/m in October 2021).

- Energy consumption also rose by 0.5% m/m (+1.0% m/m in October 2021), despite the sharp increase in electricity and gas prices.

- Italy-based Repower Renewables has announced plans to build a 495 MW offshore wind farm around 70 kilometers off the eastern coast of Calabria, Italy. The project will feature 33 wind turbines, with an estimated capacity of 15 MW each. The company has submitted plans to the Ministry of Infrastructure and Transport Port Authority of Crotone for a 30-year concession to build and operate the wind farm. The wind turbines will be connected via 66 kV array cables and the electricity generated will be transported to shore through a 380 kV export cable. Repower is one of 64 developers who noted their expression of interest to build floating wind farms in Italy. The survey was carried out last year by Italy's Ministry of Ecological Transition. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- In an extraordinary session held on 21 December 2021, the Board of Directors of Banco Nacional de Angola (BNA) approved the recapitalization and restructuring plan submitted by Banco Economico (BE). In an announcement on its website, the central bank noted that it will continue to monitor BE's progress in meeting the steps outlined in the recapitalization plan and would take additional action to protect the stability of the financial system and depositors of the bank, if needed. The bank's major shareholders are Sonangol, Angola's state-owned oil company, which owns 70% of BE's shares through various holding companies and subsidiaries, Geni Novas Tecnologias (19.9%) and Portugal's Novo Banco (9.7%), according to BE's website. (IHS Markit Banking Risk's Alyssa Grzelak)

- BE, Angola's sixth-largest bank by assets (7% of assets), was formed out of the failed subsidiary of Portugal's Banco Espírito Santo in 2014. Since its relaunch, the bank has struggled with poor asset quality and low capital buffers.

- In March 2020, the BNA announced that BE would need to raise capital after its asset quality review revealed shortfalls.

- BE has not released any financial statements since the third quarter of 2019 and no details a timeline of its recapitalization plan were released by the BNA or published on BE's website.

- In October 2021, the BNA had publicly threatened to liquidate BE if its shareholders did not submit a credible recapitalization plan. At that time, local news sources suggested that the bank would need AOA1.1 billion (USD2 million) of fresh capital from shareholders, plus issue convertible 10-year bonds of about AOA50 billion. At that time, it was also suggested that the BNA had propose converting a loan made by Novo Banco to BE in 2014 into share capital as well as large depositors' holding accounts worth over AOA3 billion into shares to prevent Sonangol from having to inject more capital.

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.8%, Australia +1.3%, South Korea +1.2%, India +0.2%, Japan flat, and Mainland China -0.2%.

- The People's Bank of China (PBOC) has started to provide low-cost loans to fund decarbonization activities via a scheme that financial experts say could play a key role in helping the country reach its climate goals. (IHS Markit Net-Zero Business Daily's Max Lin)

- Under the carbon emissions reduction facility (CERF) launched 8 November, Chinese financial institutions licensed to operate nationwide can apply for PBOC funds to support their loans to clean energy, energy conservation, and environmental protection projects.

- Sun Guofeng, head of the Chinese central bank's monetary policy department, said 30 December that the first batch of funds totaling CNY 85.5 billion ($13.4 billion) were already distributed to lenders to back decarbonization projects that can cut CO2 emissions by 28.8 million metric tons. "The PBOC will continue … to help China reach the goals of reaching peak CO2 emissions by 2030 and carbon neutrality by 2060," Sun said during a press conference, citing the country's national targets.

- The central bank has not indicated an upper limit for the CERF funds. Based on the amount of domestic green loans, CCB Futures, a brokerage owned by state-controlled China Construction Bank, estimates that the PBOC could distribute CNY 1.26 trillion per year via the facility. Anhui-based Huaan Securities estimates the figure at CNY 1.8 trillion.

- In a research note published last September, the International Energy Agency said China—the world's largest GHG emitter—needs an annual investment of CNY 4 trillion in its energy sector alone to reach the 2030 climate target.

- Baidu-backed smart electric vehicle (EV) company JiDU Auto said its next-generation Level 4 autonomous vehicle (AV) will be powered by NVIDIA DRIVE Orin SoC (system-on-chip). NVIDIA DRIVE Orin has more than 250 TOPS (trillion operations per second) of computing performance and can support functions such as automated vehicle operation and infotainment. The JiDU intelligent driving system is powered by Baidu's AV computing platform using NVIDIA DRIVE Orin. According to JiDU, the vehicle will be showcased at the Beijing Auto Show in April, and mass production and delivery will start in 2023. Robin Li, Baidu co-founder and CEO, said, "The JiDU vehicle has been designed to operate under the concepts of free movement, natural communication, and self-improvement". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's Wanhua Chemical Group has ramped up the operating rate at its new 650,000 mt/yr propylene oxide/styrene monomer (PO/SM) plant to about 80% of capacity after attaining on-specification output last month, said a source with knowledge of the matter. Daily output at the plant, located in Yantai, Shandong province, has reached around 1,500 mt, said the source, adding that the unit's operating rate will be further increased gradually to ensure stable operations. Wanhua attained on-specification styrene output on Dec. 23, the source said. (IHS Markit Chemical Market Advisory Service's Trisha Huang)

- The unit is the first among three similar-sized plants slated for commissioning in China in early 2022.

- Also in late December, Ningbo ZRCC Lyondell Chemical Co. started feeding raw material into its 600,000 mt/yr PO/SM plant in Zhejiang province. On-specification output is expected in the coming week, according to IHS Markit chemicals.

- Lihuayi Lijin Refining & Chemical has also begun feeding raw material into its 720,000 mt/yr styrene plant and start-up is slated for mid-January, according to IHS Markit chemicals.

- Ahead of a wave of new supplies, the spot CFR China styrene price spread against spot FOB Korea benzene shrank by 34.2% on month to $158/mt in December, the smallest monthly spread in 2021, OPIS data show.

- For comparison, the styrene/benzene spread averaged $296/mt in the first six months of 2021, the data show.

- About 5 million mt/yr of new styrene capacities are scheduled to be onstream in China this year, following the commissioning of six plants with a combined capacity of 2.46 million mt/yr last year, according to IHS Markit chemicals.

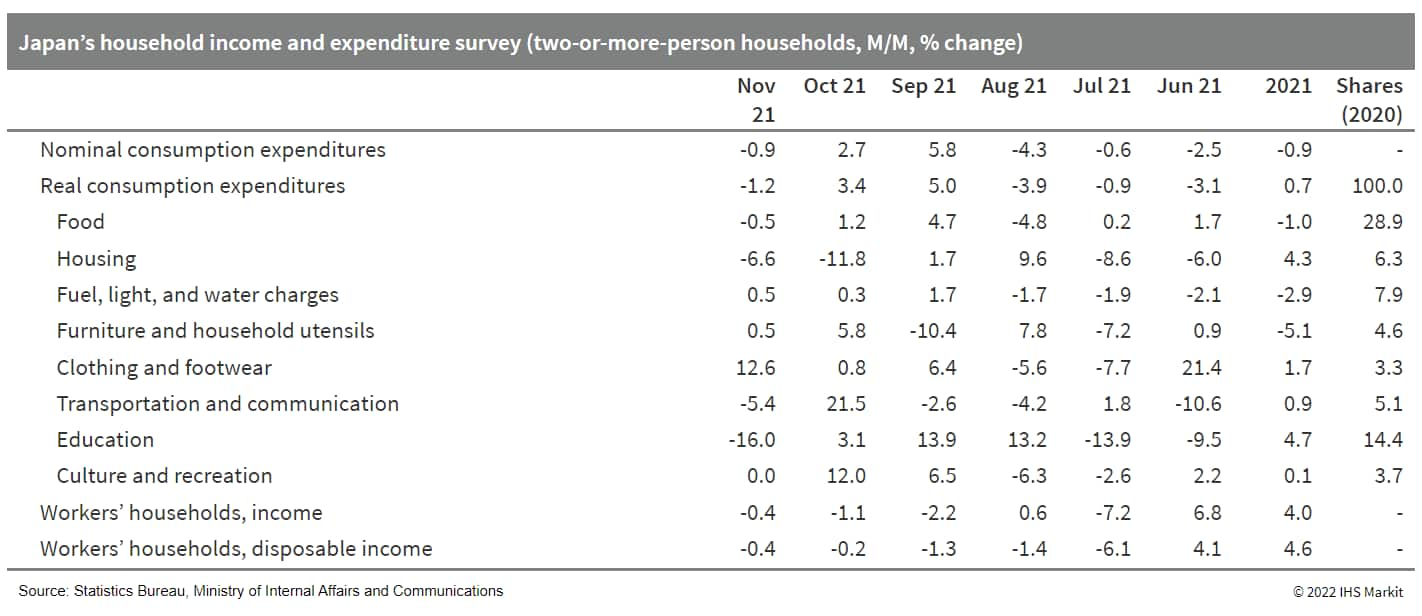

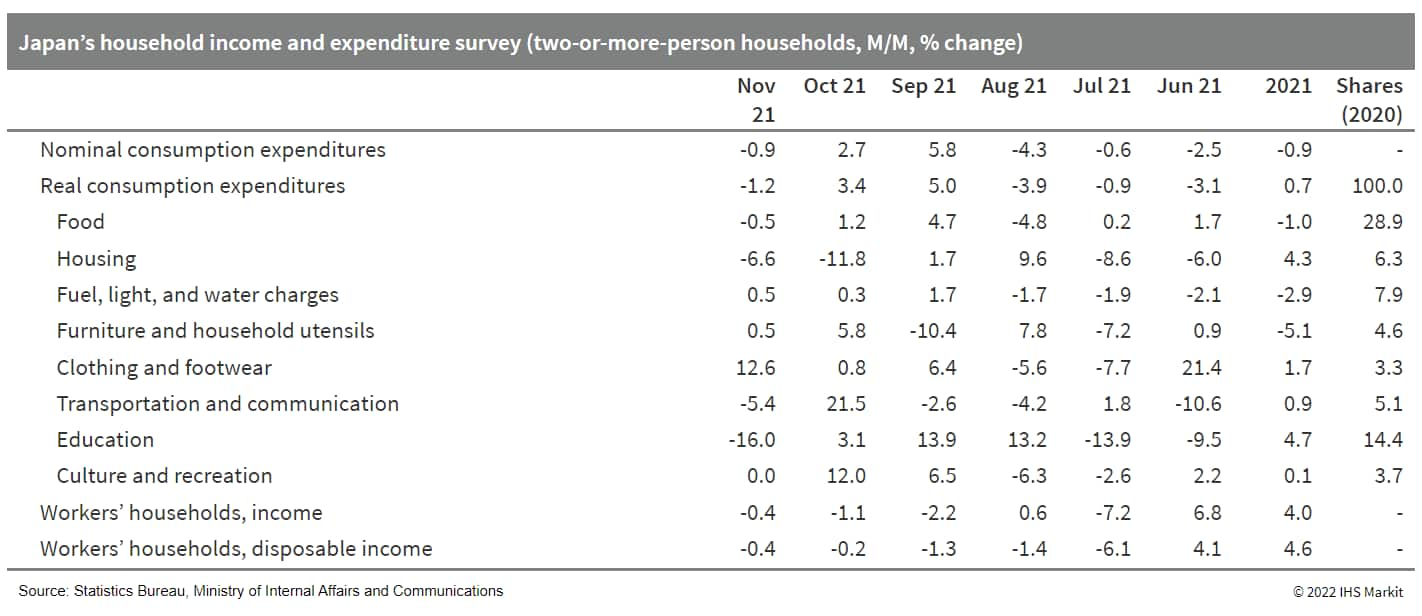

- Japan's real household expenditures fell by 1.2% month on month (m/m) in November following two consecutive months of increases, while the year-on-year (y/y) figure continued to fall (down 1.3%). The m/m weakness largely reflected a shortfall after a surge in spending on transportation and communication and a sharp drop in spending on education. The weakness was partially offset by a solid rise in spending on clothing and footwear. (IHS Markit Economist Harumi Taguchi)

- Nominal cash earnings held at the year-earlier level, but real cash earnings fell by 1.6% y/y for the third consecutive month of decline, according to the monthly labor survey for November. Contractual cash earnings rose by 0.5% y/y, reflecting increases in hours worked. However, this was offset partly by a 7.9% y/y drop in special earnings (mainly seasonal bonuses). A faster increase in the number of part-timers with softer growth in part-timers' earnings per hour also weighed on the growth of cash earnings.

- November's household expenditures were weaker than IHS Markit expected. Although the weakness was due partially to constrained auto supply and lower communication charges, the figures suggest that consumers remain cautious about resuming activity despite easing COVID-19 containment measures. Reportedly, restaurant reservation rates moved up towards the end of the year and New Year's Day sales drove solid growth for sales at major department stores.

- Due to higher dairy product finishing stocks in 2021, Japan expects to see flat to lower butter and SMP imports in 2022. According to the USDA´s Foreign Agricultural Service (FAS), Japan's fluid milk production in 2022 will increase about 1% from 2021's estimated 7.5 million tons on a greater number of new cows. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Despite both rising feed prices and stagnating prices on milk for further processing, the experts anticipate that with the support of compensation programs, the impact on dairy farm management in 2021 and 2022 will be limited.

- The latest customs data, available until November 2021, reveals that total imports fell 6% in volume in the first 11 months of the year, led by a 45% y/y slump in SMP imports to 19,400 tons. Similarly, butter supplies also plunged, but to a slightly lesser extent, by 38% y/y to 10,500 tons.

- FAS expects this export trend to continue in 2022. In the end of 2021, Japan was left with surplus stocks of butter as the milk production accumulated from closure of schools and foodservice in 2020 was diverted into butter and SMP.

- The situation with producing shelf-stable products from surplus milk has continued through August 2021. As large butter stocks remain, FAS projects that Japan's butter imports in 2022 will remain flat y/y, and the imports will be mostly product imported through the TRQ operated by ALIC as well as certain niche products traded outside of the TRQ.

- Ending stocks of SMP have hit their historical high in late-2021, at around 90,000 tons, and are likely to o higher in 2022, despite MAFF's lowered TRQ for SMP in the past two years. FAS projects that Japan's SMP imports in 2022 will decrease y/y because of reduced TRQs for ALIC tenders and large stocks; the imports in the first eight months in 2021 were only half of 2020.

- Industry sources report strong household consumption has held demand for dairy products made of SMP, such as yogurts (down 1% y/y) and ice cream (up 3% y/y), in 2021. However, industry use of these products has only half-recovered.

- LG Electronics has developed new biometric recognition technology that enables car owners to turn on the ignition without using a key, according to a press release by Digi Times Asia. The technology identifies facial expressions along with finger movements leveraging the use of multiple in-car cameras. LG's authentication system, with the help of a first camera, identifies the user's specific body parts, and through a second camera automatically resets its viewing angles based on the data points of the first camera to capture the user's iris and other biometric features. This allows the user to start up the vehicles as well as adjust or control the vehicle through facial expressions and hand gestures. The technology also helps to detect whether a driver is drowsy or has a sudden illness by monitoring eyelids and facial movements. The press release adds that LG and its subsidiaries are working to ensure that more emphasis is placed on development through various patented technologies, including autonomous driving devices, automotive in-cabin foldable displays, and vehicle-to-everything (V2X) communications technologies. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai has signed a memorandum of understanding (MOU) with Singapore-based real-time 3D content developer and platform operator Unity to jointly design and build a new metaverse roadmap and platform for a meta-factory, according to a company press release. Under the MOU, the two parties aim to build a meta-factory concept, a digital twin of an actual factory supported by a metaverse platform. Hyundai will be able to virtually test-run a factory in order to compute the optimal plant operation, and plant managers will be able to handle problems without having to physically visit the plant, thanks to the advent of a meta-factory. The collaboration will also result in a real-time 3D and virtual platform that will reach a large number of Hyundai consumers, providing them with a more comprehensive range of services across sales, marketing, and customer experience, according to the automaker. Hyundai intends to implement the meta-factory concept first at the Hyundai Motor Global Innovation Center in Singapore (HMGICS), currently under construction. After construction of the physical center is completed by the end of this year, the automaker plans to open the virtual factory by 2025. Hyundai and Unity's collaboration at HMGICS will accelerate intelligent manufacturing innovation by merging artificial intelligence, 5G, and other advanced technologies into a next-generation smart factory platform. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 07 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.