Major US, European, and APAC equity indices closed mixed across each region. US and most benchmark European government bonds closed lower. European iTraxx closed wider across IG and high yield, while CDX-NA was almost flat on the day. Silver and gold closed higher, while the US dollar, oil, natural gas, and copper closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +0.5%, DJIA flat, S&P 500 -0.4%, and Nasdaq -0.6%.

- 10yr US govt bonds closed +1bp/1.92% yield and 30yr bonds +1bp/2.22% yield.

- CDX-NAIG closed flat/64bps and CDX-NAHY -1bp/354bps.

- DXY US dollar index closed -0.1%/95.40.

- Gold closed +0.8%/$1,822 per troy oz, silver +2.7%/$23.08 per troy oz, and copper -0.6%/$4.46 per pound.

- Crude oil closed -1.1%/$91.32 per barrel and natural gas closed -7.4%/$4.23 per mmbtu.

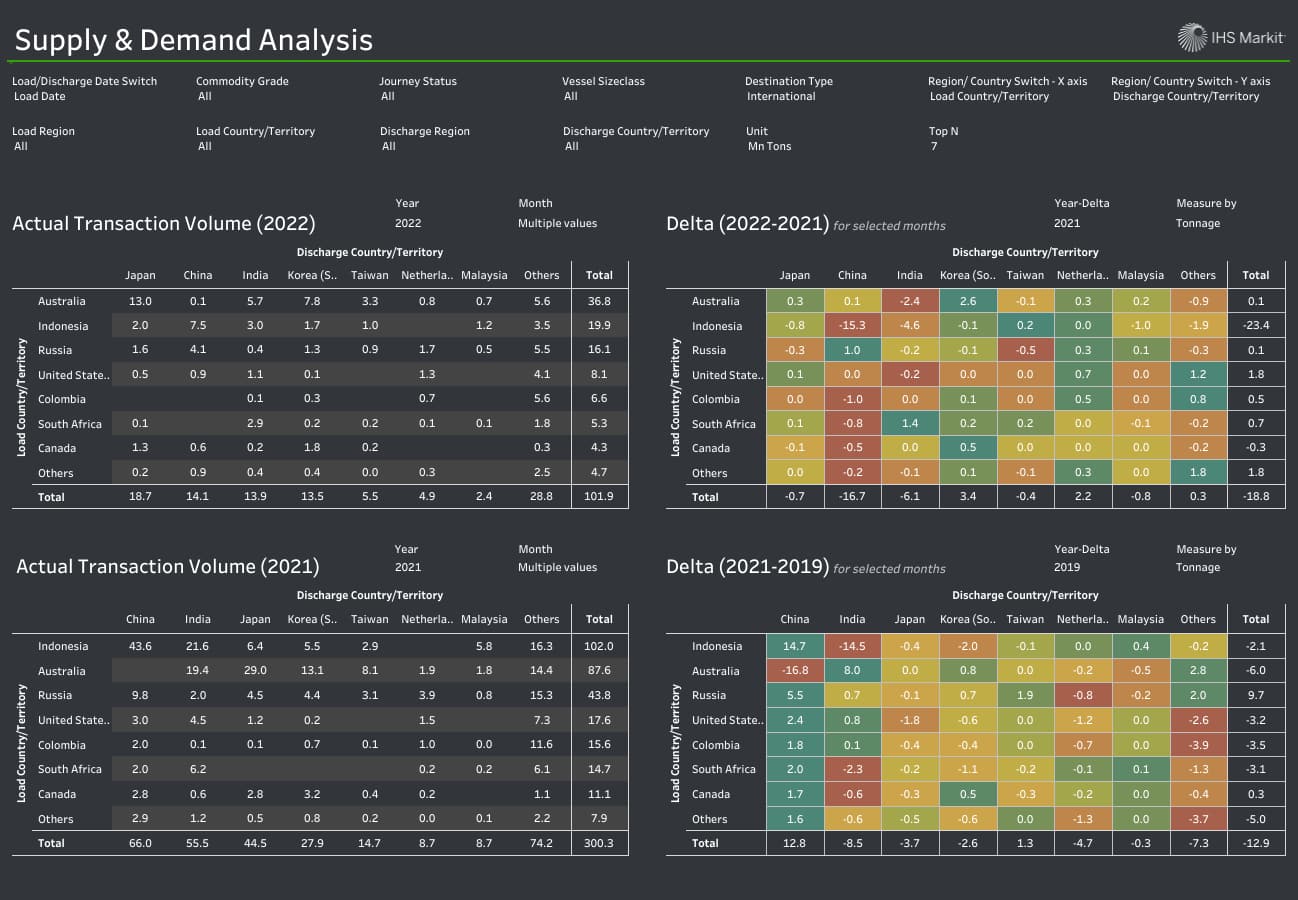

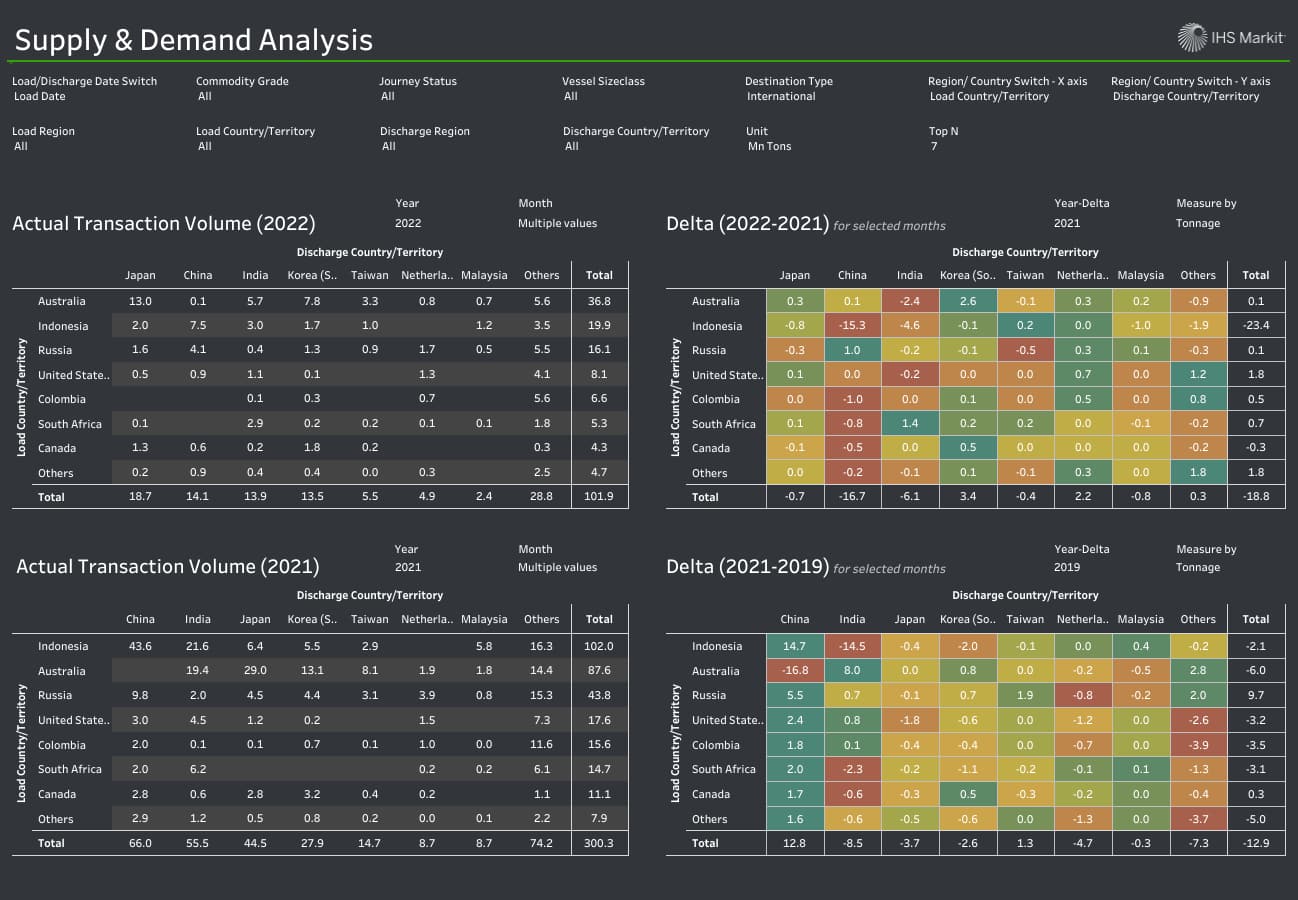

- As per IHS Markit's CAS Supply & Demand Analysis tab, there was a significant decline in coal supply during the Jan-Feb period (first 37 days of 2022) from Indonesia (19.9 metric tons(mt), down 23.4mt y/y), and marginally lower from Canada (4.3mt, down 0.3mt). While supply increased from the USA (8.1mt, up 1.8mt), marginally higher from Colombia (6.6mt, up 0.5mt), South Africa (5.3mt, up 0.7mt), and mostly stable from Australia (36.8mt, up 0.1mt y/y), and Russia (16.1mt, up 0.1mt). The slump in Indonesian coal supply was due to the coal export ban implemented by the government during January 2022 amid critically low PLN stocks. The export ban has now been lifted. (IHS Markit Maritime and Trade's Chia Yee Koay and Pranay Shukla)

- Demand Side: In terms of recipient countries/territories, coal demand from Mainland China and India was quite weak at 14.1mt (down 16.7mt) and 13.9mt (down 6.1mt), resp. While slower from Japan, Taiwan, and Malaysia during the period, standing at 18.7mt (down 0.7mt), 5.5mt (down 0.4mt), and 2.4mt (down 0.8mt), respectively. On the other hand, strong coal demand was observed from South Korea (13.5mt, up 3.4mt) and NW Europe (8.0mt, up 3.3mt). The plunge in Mainland China coal import demand was due to a record high domestic coal production, and anticipated emissions restrictions during Winter Olympics.

- Supply/Demand Balance: Total seaborne flows during the first 37 days of 2022 were calculated at 101.9mt, down 18.8mt y/y. Although demand into Mainland China and India were lower still supply tightness prevailed and coal prices increased during the reported period. For week-05, thermal coal benchmark M42 and API2 price stood at $72.15/t (up 21% m/m and 81% y/y) and $178.06/t (up 27% m/m and 174% y/y), resp; while Australian mid-vol PHCC prices were assessed at $445.00/t (up 23% m/m and 188% y/y).

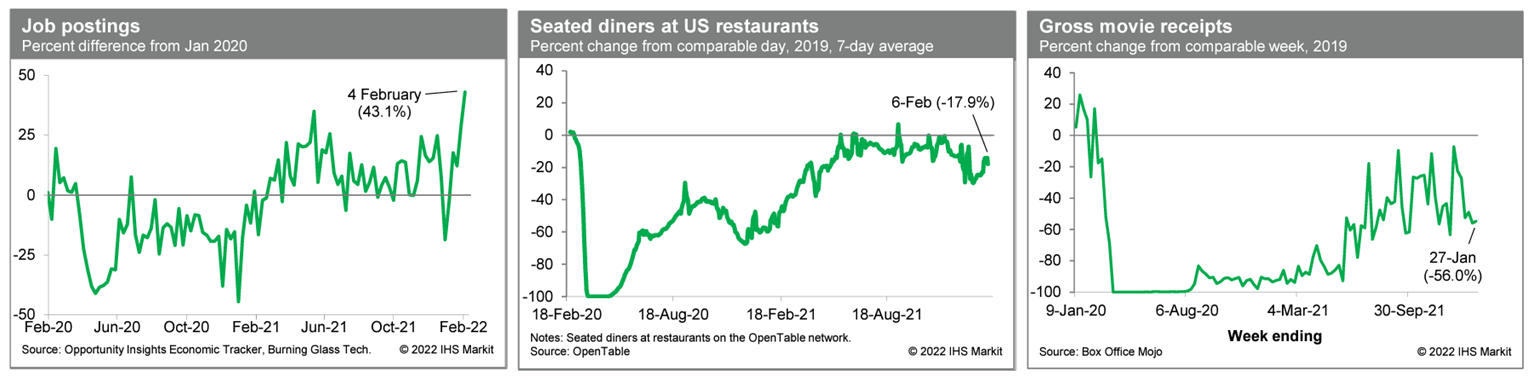

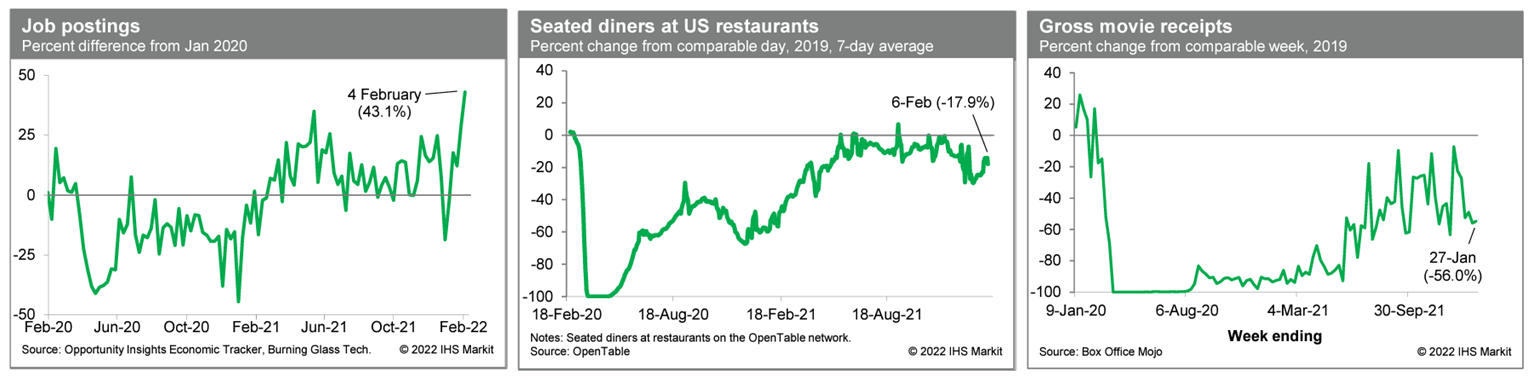

- US job postings rose last week to 43.1% above the January 2020 level, according to the Opportunity Insights Economic Tracker. This was materially above recent averages and, in fact, the strongest reading so far in the recovery, indicating robust labor demand. Meanwhile, averaged over the last seven days, the count of seated diners on the OpenTable platform was 17.9% below the comparable period in 2019. This is up from recent lows, perhaps indicating a rising comfort level associated with dining out as case counts decline. Box office revenues last week were 56% below the comparable week in 2019. This is close to recent readings and indicative of ongoing struggles in the movie-theater industry. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

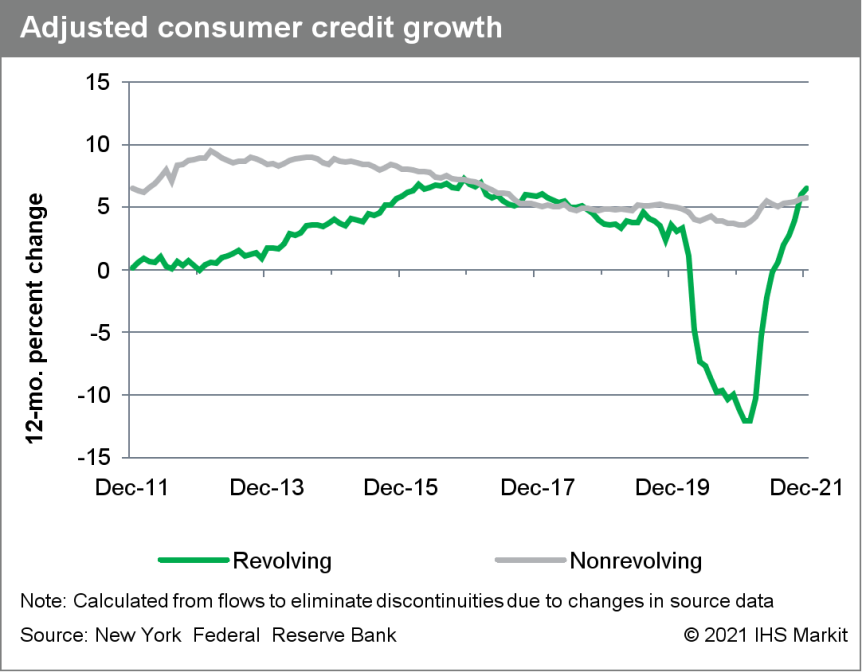

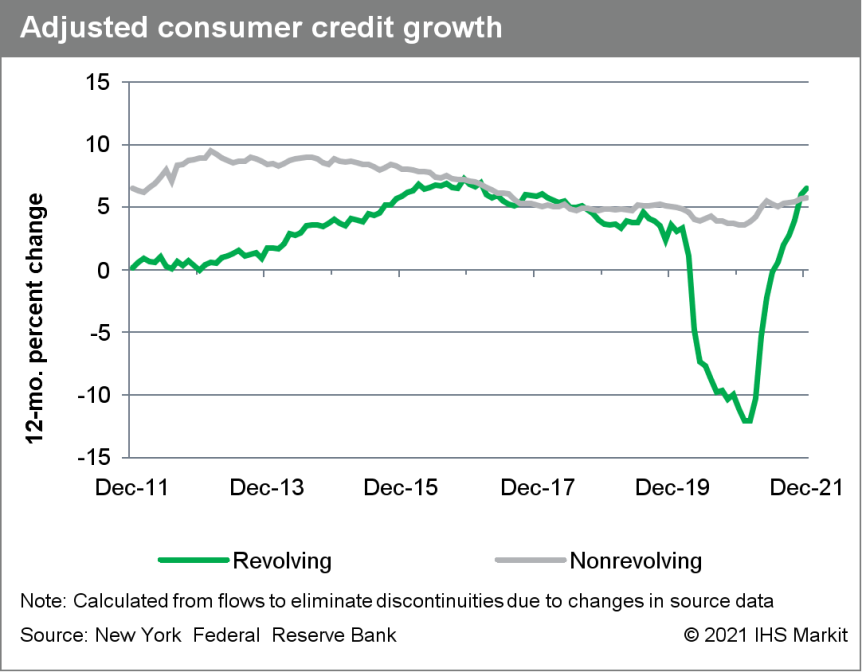

- US outstanding nonmortgage consumer credit rose $18.9 billion to $4.43 trillion in December 2021, less than half of the November increase of $38.8 billion. (IHS Markit Economist Michael Montgomery)

- The 12-month change in outstanding consumer credit was 5.9%, showing much faster growth than earlier in the year.

- Revolving credit rose $2.1 billion, and nonrevolving increased by $16.8 billion. Both fell below the November gain. Revolving credit had shot up by $19.3 billion in November for an extraordinarily large spike.

- The ratio of nonmortgage consumer credit to disposable personal income was 24.3%, the same as in November's original release but a tick higher than now reported for November. Erratic stimulus measures have made monthly comparisons awkward, but as stimulus transfers have wound down the distortion has faded.

- The Omicron variant was thriving in December but peaked in January. December retail sales were not great and the entire holiday season was warped by people shopping early and more likely to use credit cards because of shopping online. Still, the revolving credit surge of November is hard to fathom. The nonrevolving gain in the fourth quarter was largely from increased motor vehicle borrowing as student loans actually fell a token amount in the fourth quarter.

- Electric vehicle (EV) battery startup Soelect has raised USD11 million in Series A funding round led by Lotte Ventures, an affiliate of Korea's Lotte Chemical, according to a company statement. Lotte Ventures teamed with General Motors' (GM) venture capital arm GM Ventures and KTB Network to make the investment, which is expected to propel development and commercialization of Soelect's EV technology. Wade Sheffer, managing director of GM Ventures, said, "GM is committed to investing in and implementing technologies that support the company's broader vision of a world with zero crashes, zero emissions, and zero congestion, and our collaboration with Soelect to advance lithium metal technology supports this effort". Soelect, founded in 2018, is developing lithium metal-based next-generation battery technology for EVs, consumer electronics, military and defense, and other applications. To date, the company has more than 20 customers, mostly in the automotive industry. Soelect considers lithium metal anodes as a key component in future battery systems as they have the potential to store more energy as well as the ability to charge much faster. GM's interest in Soelect is in line with its prior investment in and strategic co-operation with battery startup SES, which is expected to go public later this year. GM has announced plans to invest more in batteries and manufacturing for EVs in 2021 and early 2022 and expects to see North American capacity of 1 million EVs in 2025, with 600,000 of those full-size pick-up trucks. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In February 7 comments filed with the New York State Public Service Commission, New York City backed the two big transmission projects picked by state agencies to fulfill a need to wheel new power supply into the New York City region. (IHS Markit PointLogic's Barry Cassell)

- The New York State Energy Research and Development Authority (NYSERDA) has tentative contracts with H.Q. Energy Services (U.S.) Inc. and Clean Path New York LLC (CPNY) for the provision of Tier 4 renewable energy certificates that will facilitate New York State in achieving the goals of the Climate Leadership and Community Protection Act (CLPCA), the City noted.

- "Importantly, it will allow New York City to reduce its dependence on a fleet of old, inefficient, fossil-fueled power plants with high criterion pollutant and greenhouse gas ('GHG') emissions rates, which disproportionately impact disadvantaged communities," the City added. "NYSERDA's selected projects - HQ's Champlain Hudson Power Express ('CHPE') Project and the CPNY Project (collectively, the 'Tier 4 Projects' or 'Projects') - will improve air quality for millions of New Yorkers, accelerate the decarbonization of New York City's electric grid, and make the electric system serving one of the world's foremost economic and social centers more resilient."

- In October 2020, the Commission recognized that New York City's reliance predominantly on a fleet of fossil-fueled generating facilities was an impediment to achievement of the CLCPA's goals and that affirmative action is needed to reduce such reliance. That affirmative action took the form of a new component of the Clean Energy Standard - Tier 4 - focused on delivering clean power to New York City.

- The Commission directed NYSERDA to procure Tier 4 renewable energy certificates (RECs) via a competitive process, and it set a cap of 3,000 MW on the procurement. The Commission also set a non-binding limit of 1,500 MW on the first procurement, but it allowed NYSERDA to exceed this limit if warranted. In the petition, NYSERDA described the solicitation process it conducted and the rationale for entering into two contracts for a total of 2,550 MW. On November 30, 2021, New York Gov. Kathy Hochul announced that NYSERDA executed contracts with HQ and CPNY for the CHPE and CPNY Projects, respectively. That put them into this review process at the Commission.

- Volvo Trucks has announced new investment into its Brazilian operations through 2025, according to media reports and a Volvo Group Brazil press statement. Reuters reports that the funds will largely be dedicated to research and development of products and services. In a statement announcing the investment and summarizing 2021 performance, the Brazilian unit of Volvo Trucks reported record sales for 2021, despite conditions. Volvo Trucks president for Latin America, Wilson Lirmann, said in the statement, "Brazil maintained its position as Volvo's second largest truck market in the world, even at a time of limitations due to the pandemic and supply chain constraints…The exceptional result of 2021 fuels our confidence and commitment for the future. That is why we are renewing our investment cycle in Latin America with more BRL 1.5 billion (2022/2025 cycle). It will be a period of great transformations in the transport industry and Volvo will continue to bring many innovations in products and services, in all the segments in which we operate." Automotive Business reports that the funding will include investment into the dealer network and some of the resources will be used in 2022 to complete the Euro VI engine that is required for all Volvo Trucks in Brazil from January 2023. Funding is expected to support electrification developments, although no details on that element were available. Volvo Trucks confirmed testing electric bus chassis in Santiago (Chile) and Bogota (Colombia) began in January 2022, although a similar program in Brazil is not reportedly scheduled. The company reported its best year in Brazil in 2021, with 17,980 heavy vehicles sold and a total of 21,823 units, representing a 45.7% year-on-year (y/y) improvement. Volvo Trucks is the third-largest truck OEM in Brazil, behind Daimler Truck and its Mercedes-Benz truck business and Traton's Volkswagen brand. According to IHS Markit's January 2022 medium and heavy duty commercial vehicle (MHCV) forecast, Volvo Trucks is forecast to capture between 15% and 16% of the Brazilian MHCV market over the next several years. In 2021, the market exceeded 2019 volume, with about 135,600 units sold in 2021 versus about 115,000 units in 2019. Another gain is expected in 2022, though volumes beyond that are forecast to settle at about 126,000 units per year through 2026. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Major European equity markets closed mixed; France/UK +0.8%, Germany +0.7%, Spain -0.4%, and Italy -1.0%.

- Most 10yr European govt bonds closed lower except for UK flat; Germany/France +2bps, Spain +5bps, and Italy +7bps.

- iTraxx-Europe closed +1bp/66bps and iTraxx-Xover +6bps/321bps.

- Brent crude closed -0.6%/$92.69 per barrel.

- Ørsted is looking to sell off 50% stake in its 1.3GW Hornsea Two project off United Kingdom. The deal is expected to be valued at an estimated USD3.4 billion. Prior to this, Ørsted also sold its 50% stake in the 1.2GW Hornsea One project off United Kingdom, and its 50% stake in the 900MW Borkum Riffgrund 3 project off Germany. Transaction to farm down 50% of the Borkum Riffgrund 3 project is expected to close by end first quarter of 2022. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Siemens Gamesa and Ørsted have selected UK-based Specialist Marine Consultants (SMC) to get support on wind farms offshore projects of UK. Ørsted awarded SMC a framework agreement to provide statutory inspection and auxiliary services to its sites across the UK, which is the second multi-year framework agreement following the one in 2019. While Siemens Gamesa Renewable Energy (SGRE) has opted SMC to provide support with third-party offshore provision throughout their UK project portfolio. Ørsted's portfolio in the UK consists of twelve operational offshore wind farms and one currently under construction, Hornsea Two, with a combined capacity of over 6.3 GW. While SGRE's projects in the UK include London Array, Hornsea One, and Hornsea Two. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- The number of firms in the eurozone reporting labor shortages as a factor limiting production continued to increase during the three months to January. Labor shortages, as measured by the European Commission business and consumer survey, reached a record high in the industrial, construction, and services during the period. (IHS Markit Economist Diego Iscaro)

- The indices started to trend upwards in late 2020 (early 2021 for the construction sector) due to a combination of a recovering economy and a lower availability of workers as a result of the pandemic.

- Labor shortages can also be seen in the eurozone vacancy rates, which measure the proportion of job openings that are currently vacant. The eurozone vacancy rate stood at 2.7% during the third quarter of 2021, which is highest level since the figures started to be collected in 2014 (it had averaged 2.3% in 2019).

- The increase in unfilled vacancies has been particularly acute in Belgium, the Netherlands, and Austria. On the other hand, vacancy rates remain substantially lower in Southern European countries.

- The breakdown of vacancy rates by sector suggests that labor conditions have significantly tightened in the administrative and support services, construction, and hospitality sectors. Vacancy rates in other sectors are not too dissimilar to where they were in late 2019.

- Labor shortages are being reported despite the recovery of labor market participation rates. The eurozone participation rate declined from 57.5% during the fourth quarter of 2019 to 55.6% in early 2020, but it returned to its pre-COVID-19 level during the third quarter of 2021.

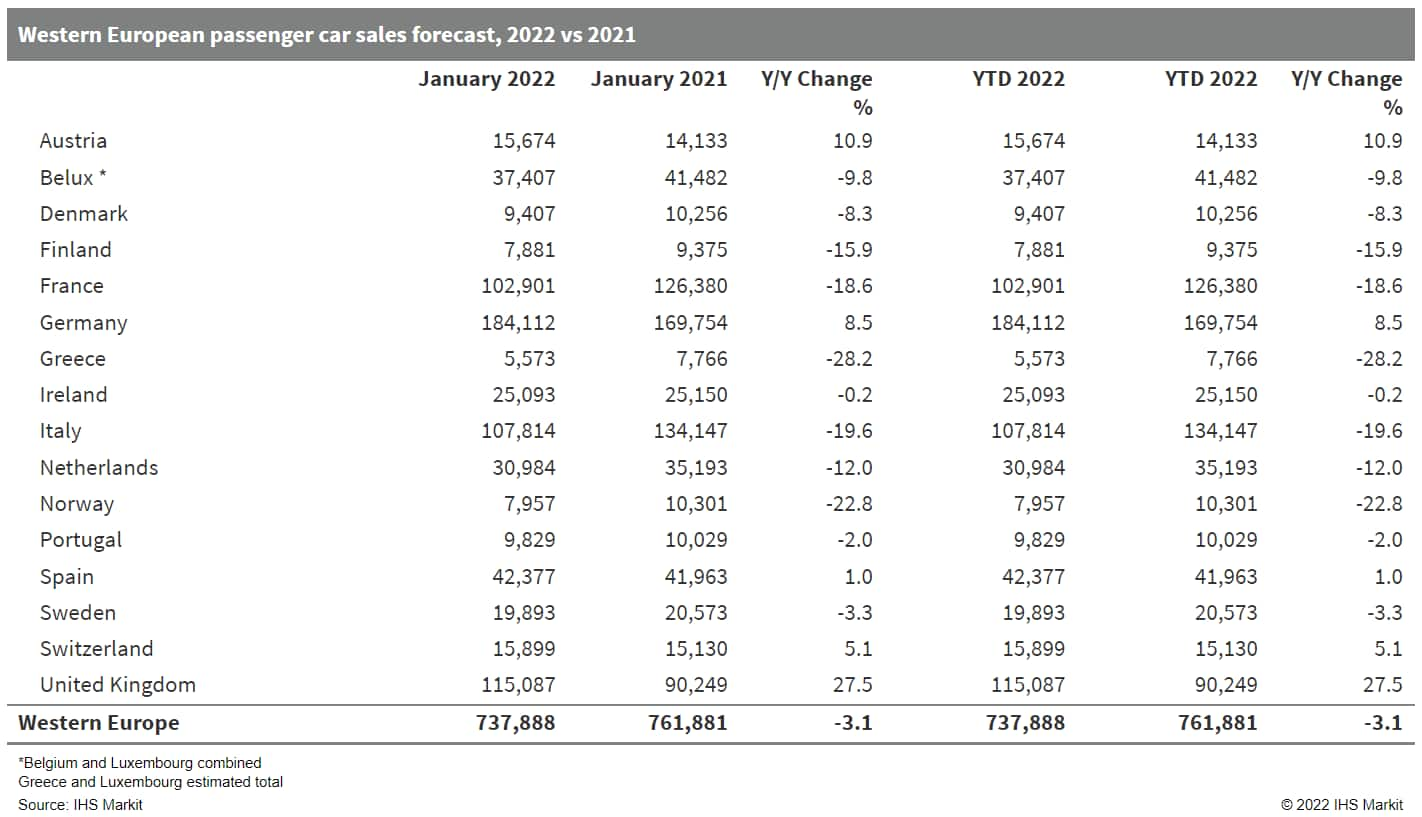

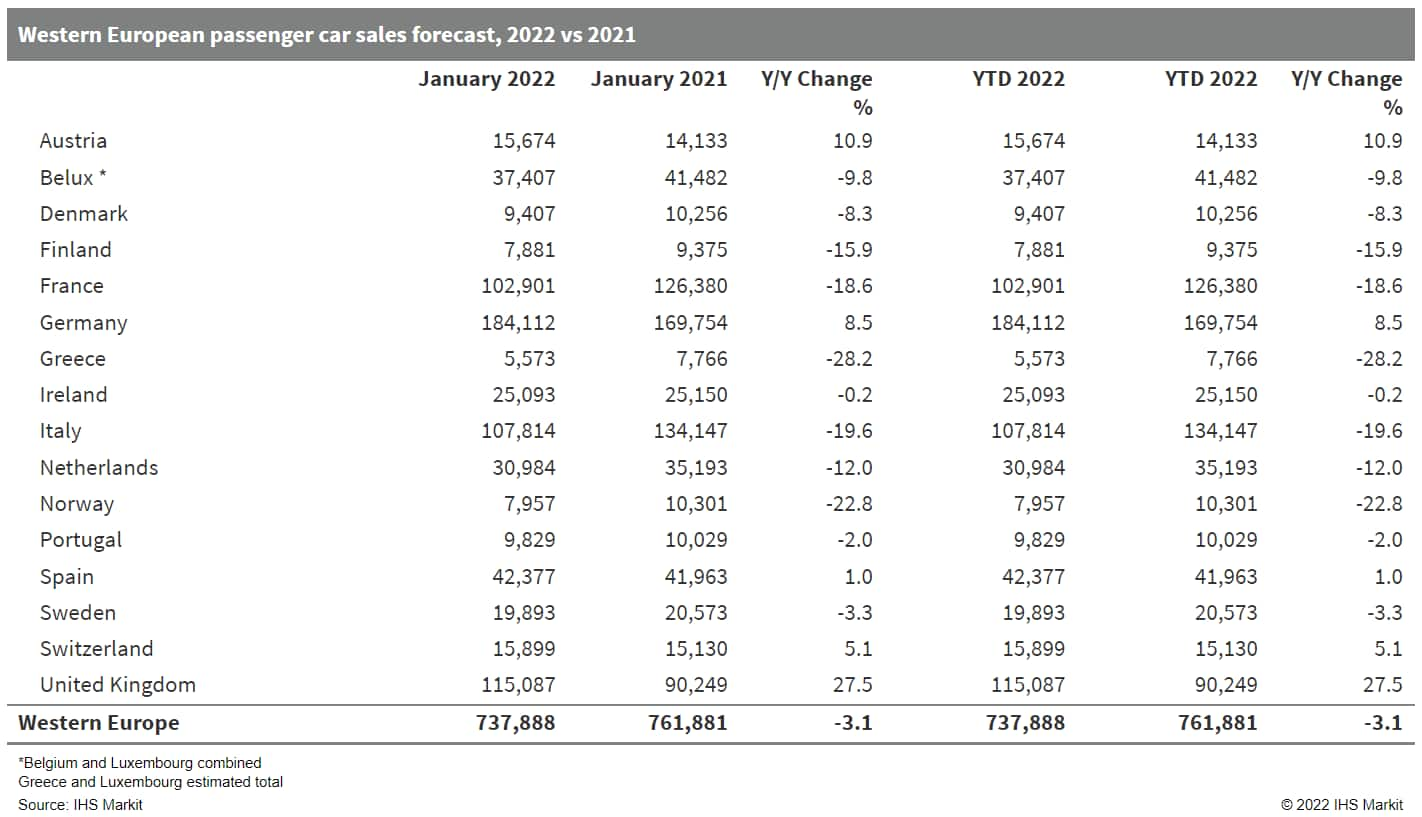

- Western European passenger car registrations have slipped by 3.1% year on year (y/y) in January despite an already very weak January 2021 caused by coronavirus disease 2019 (COVID-19) virus measures in some markets as semiconductor shortages continue to hurt vehicle availability. According to IHS Markit's latest forecast, registrations in the region dropped to 737,888 units from 761,881 units in January 2021. While the decline in January is relatively modest compared to some that were seen during the second half of 2021, this is against a 25.7% y/y fall recorded in January 2021 thanks to a combination of COVID-19 virus-related lockdown restrictions, uncertainty over the impact of the pandemic prior to vaccination programs being accelerated, and more localized factors. There was also a negative calendar effect. The main factor that will be hitting their performance now will again be the shortage of semiconductors. This hit the majority of OEMs' production from early 2021, but the impact on sales accelerated in the second half of that year as production disruptions and stoppages worsened, and this could not be compensated for through inventory which had already been depleted, and not been restocked. Looking forward to 2022, IHS Markit currently expects semiconductor lead times will stabilize in the first half of 2022, but lead times will continue to be 26 weeks and longer. There are some uncertainties attached to this though. This comes from the impact from flooding in Malaysia during December 2021 and the potential for a rise in COVID-19 cases in the Philippines to hit supplies of semiconductors early in 2022. We also currently forecast that lead times will improve during the second half of 2022, but will still be longer than what is considered normal. We anticipate that passenger car registrations in the wider Western European region will improve by 9.2% y/y during 2022 to around 11.7 million units. However, this will be around 16.7% below the five-year pre-COVID-19 virus pandemic average between 2015 and 2019. We also expect the market to continue to grow over the coming years, peaking at around 13.9 million units in 2024. (IHS Markit AutoIntelligence's Ian Fletcher)

- Transatlantic trade in bivalve molluscan shellfish, such as mussels, clams, oysters and scallops, is to resume following more than a decade's suspension, after both the EU and US took the final steps to recognize the equivalence of each other's food safety systems last week. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Trade starts with exports to Europe from two states - Massachusetts and Washington - and to the US from the same number of EU countries - Spain and the Netherlands - according to 4 February statements from the European Commission and United States Trade Representative (USTR).

- Differences in regulatory standards meant trade in live molluscan shellfish has not been possible between the EU and the US since 2011, a situation that the Commission and US Food and Drug Administration (FDA) worked hard to resolve.

- In 2015, both sides carried out on-the-spot audits and, following years of discussions, the Commission and FDA recommended that the food safety systems for the production of raw bivalve mollusks in the two US states (Massachusetts and Washington) and the two EU member states can be considered equivalent.

- US Agriculture Secretary Tom Vilsack said the announcement "demonstrates an exciting opportunity for U.S. seafood producers to deliver world-leading products to consumers in the EU and furthers the U.S. Department of Agriculture's mission to provide U.S. stakeholders opportunities to better compete in the global marketplace."

- At 1.1% month on month (m/m), seasonally and calendar-adjusted German industrial production excluding construction posted their third consecutive increase in December, thus broadly returning to average levels of the first half of 2021 ahead of the mid-year slump. The latest output level still is about 6% below its February 2020 pre-pandemic high, however. (IHS Markit Economist Timo Klein)

- Total production including construction (see table below for a breakdown of recent history) posted only -0.3% m/m owing to a major drag from construction output (-7.3%). Construction was a key supportive force for overall production between mid-2018 and mid-2021, but this was no longer the case during the second half of 2021.

- The split by type of good (see table) reveals that the production of investment goods was the driving force during the fourth quarter of 2021. Admittedly, this only compensated for net declines during the second and third quarters, but this is nonetheless encouraging in view of persisting uncertainty in late 2021 about the duration of pandemic-related disruptions to both supply and demand. Intermediate goods displayed a similar pattern during 2021, though with less m/m volatility. Finally, consumer goods production has been moving sideways since September 2021.

- December's breakdown by industrial branch reveals that motor vehicle production - as has been the case since September 2021 - greatly outperforms all other branches, increasing another 12.1% m/m in December. This reflects their particularly sharp decline during January-August 2021, however, mainly owing to the global scarcity of semiconductors. Even in December, motor vehicle output was approximately 21% below pre-pandemic levels. In other sectors, December production of electronic and electric equipment did quite well too (2.3% m/m), whereas there were declines in the machinery & equipment sector (-3.7% m/m) and the food and beverage sector (-3.1%). Output slipped just slightly in the chemicals/pharmaceuticals and metals sectors.

- Volkswagen (VW) Group is to decide whether to manufacture motors for electric vehicles (EVs) at SEAT-run facilities before the end of February, reports Cinco Días. According to the news website, the SEAT Components facility in El Prat de Llobregat in Barcelona (Spain) is in the running. However, the site is said to be competing with the Györ (Hungary) facility. The two sites that are thought to be in the running to manufacture this key component for battery electric vehicles (BEVs) would enable them to secure their future, as traditional internal combustion engine (ICE) powertrains are phased out. The El Prat de Llobregat site currently assembles manual transmissions, while the Györ site manufactures a range of diesel and gasoline (petrol) ICEs used by all VW Group brands. However, while there would be a strong rationale to manufacture electric motors in Spain given that both SEAT's Martorell (Spain) and VW's Pamplona (Spain) facilities are expected to benefit from BEV models in due course, the General Union of Workers (Unión General de Trabajadores: UGT) fears that the El Prat de Llobregat facility will ultimately lose out. Indeed, the report suggests that production of these motors would save salary costs, although it also notes that this would bring with it greater logistics costs. The decision may ultimately depend on the availability of government support measures. (IHS Markit AutoIntelligence's Ian Fletcher)

- Russian contract automaker Sollers and Chinese OEM Chery are in discussions over a major joint production arrangement to build Chery's cars in Russia, according to a Interfax news agency report. Russia is now Chery's biggest marketplace outside China, and it is an obvious next step to establish volume production in the country. Chery vehicles are sold in Russia by official distributor Chery Automobiles Rus. The company is the leading Chinese brand on the Russian auto market, with rapidly growing sales. Last year Chery overtook rivals Haval and Geely on the Russian market by sales volumes. Chery sold 40,874 units in Russia in 2021, 250% more than in 2020, according to the AEB. The company's market share grew by 1.8 percentage points to 2.2 percentage points. The company sells the Tiggo 4, Tiggo 7 Pro, Tiggo 8, Tiggo 8 Pro crossovers and high-end Exeed TXL and Exeed VX SUVs in Russia. Chery Rus's revenue more than tripled to RUB15.6 billion in 2020, but its net loss grew by 250% to RUB1 billion. (IHS Markit AutoIntelligence's Tim Urquhart)

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China +2.0%, Hong Kong flat, Australia -0.1%, South Korea -0.2%, Japan -0.7%, and India -1.8%.

- Japan's Mitsui & Co. has invested in Canada's Ekona Power Inc. to commercialize Ekona's clean hydrogen technology, both companies announced last week. The Japanese company is one of several partners including energy companies and venture funds injecting CAD $79 million ($61.93 million) in equity investments to the project, Ekona said. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Funding was led by US-based industrial company Baker Hughes, participated by industrial investors such as the US's ConocoPhillips, Continental Resources, Japan's Mitsui, Russia's Severstal, and Canada's TransAlta. Venture capital firms such as Canada's NGIF Cleantech Ventures, BDC Capital, were also investors, Ekona said.

- Using combustion and high-speed gas dynamics, Ekona believes its process is low-cost, scalable, and can be flexibly sited wherever natural gas infrastructure exists.

- Ekona's investor Mitsui said that hydrogen will play a key role in industrial decarbonization, agreeing on its potential as a clean energy source as hydrogen emits no CO2 when burned, and can be used in power generation, mobility, and other industries.

- However, technical and economic challenges in clean hydrogen production include CO2 capture and storage (CCS) needed for abating CO2 emitted from hydrogen production, Mitsui explained. Mitsui believes that EKONA's technology not only offers lower CO2 emissions, but also lower production costs comparable to other conventional hydrogen production technologies, such as steam methane reforming.

- Ekona's technology generates a majority of carbon in solid form, eliminating the need for CCS, said Mitsui.

- As part of its aim to provide clean hydrogen, fuel ammonia, CCS, and carbon capture, usage and storage (CCUS), Mitsui said it will use Ekona's technology to explore clean hydrogen opportunities in Japan.

- Mitsui said that Ekona produces clean hydrogen by decomposing methane into hydrogen and solid carbon under high temperatures, with a proprietary pyrolysis method that does not require any catalysts.

- According to Mitsui, producing hydrogen by burning fossil fuels into gas and extracting hydrogen from the gas (reforming), particularly steam reforming using methane as a feedstock, is widespread in the industry and relatively low cost. However, the accompanying CO2 emission is challenging.

- Joby Aviation, in partnership with SK Telecom, is planning to offer an air taxi service in South Korea, according to a company statement. The partners intend to leverage the T Map mobility platform, a spinoff of SK Telecom, which provides subscription-based mobility-as-a-service. Joby's piloted aircraft is designed to offer emissions-free air travel with a maximum range of 150 miles, a top speed of 200 mph, and a low noise profile. SK Telecom is using its expertise in telecommunications, autonomous vehicles, precise positioning, and security to develop urban air mobility (UAM) services. JoeBen Bevirt, founder and CEO of Joby, said, "We are thrilled to be partnering with the team at SK Telecom who bring a wealth of relevant experience and technology to the table. With more than 42 million people living in urban areas, South Korea offers a remarkable opportunity for Joby to make air travel a part of daily life, helping people to save time while reducing their carbon footprint". Joby, which recently went public through a merger agreement with a special-purpose acquisition company (SPAC), plans to launch a passenger service using its electric vertical takeoff and landing (eVTOL) aircraft in 2024. Joby has completed over 1,000 test flights and is the first eVTOL company to receive a G-1 (stage 4) Certification Basis for its aircraft with the Federal Aviation Administration (FAA). Joby's partnership with SK Telecom on introducing air taxi service is in line with South Korean Ministry of Land, Infrastructure, and Transport's "K-UAM" (Korean Urban Air Mobility) Roadmap, first announced in 2020. SK Telecom is also a member of UAM Team Korea and is working with major South Korean companies to enhance the nation's competitiveness in the field. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Doosan Heavy Industries & Construction has installed the 8MW offshore wind turbine prototype at the Korea Wind Power Demonstration Center in Baeksu, Yeonggwang, South Jeolla Province, South Korea. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Final preparation for commercialization is expected by end June 2022 following the receipt of international certification for the turbine.

- The 8MW offshore wind turbine, which is South Korea's largest to date, was developed as an industry-academia-research sector cooperation project led by the Korea Institute of Energy Technology Evaluation and Planning since 2018. The 232.5m turbine, featuring a 130m tower and 100m blades, is designed for use in South Korea's typhoon-prone environment where average wind speed is comparatively lower than Europe.

- Doosan Heavy Industries & Construction is building a second wind turbine shop at its Changwon headquarters and securing additional manpower in preparation for increased domestic offshore wind turbine orders. The company has plans to increase the percentage of locally manufactured parts from the current 70% range.

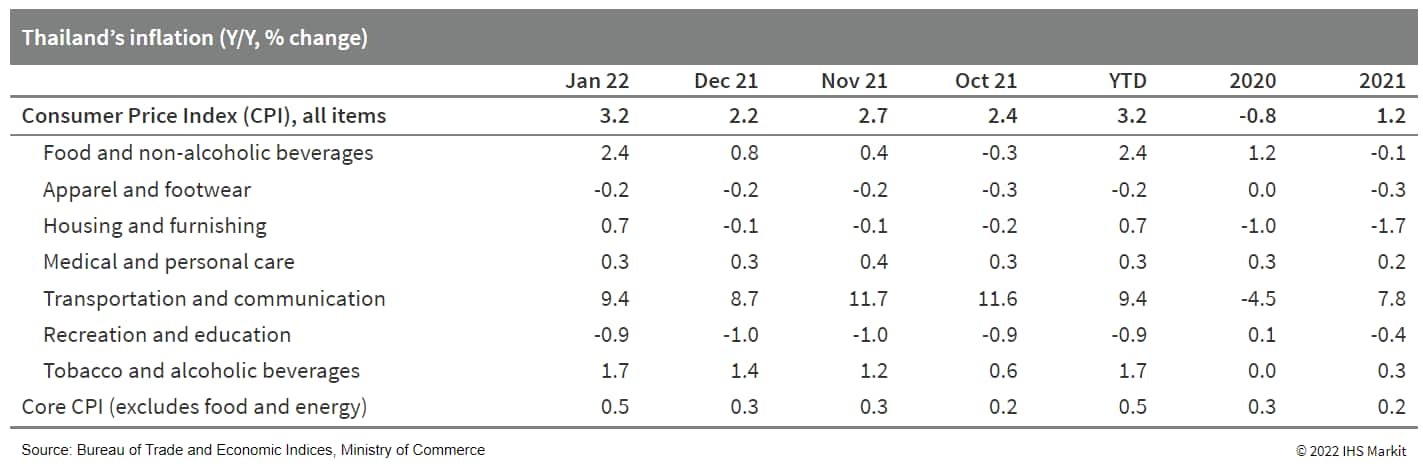

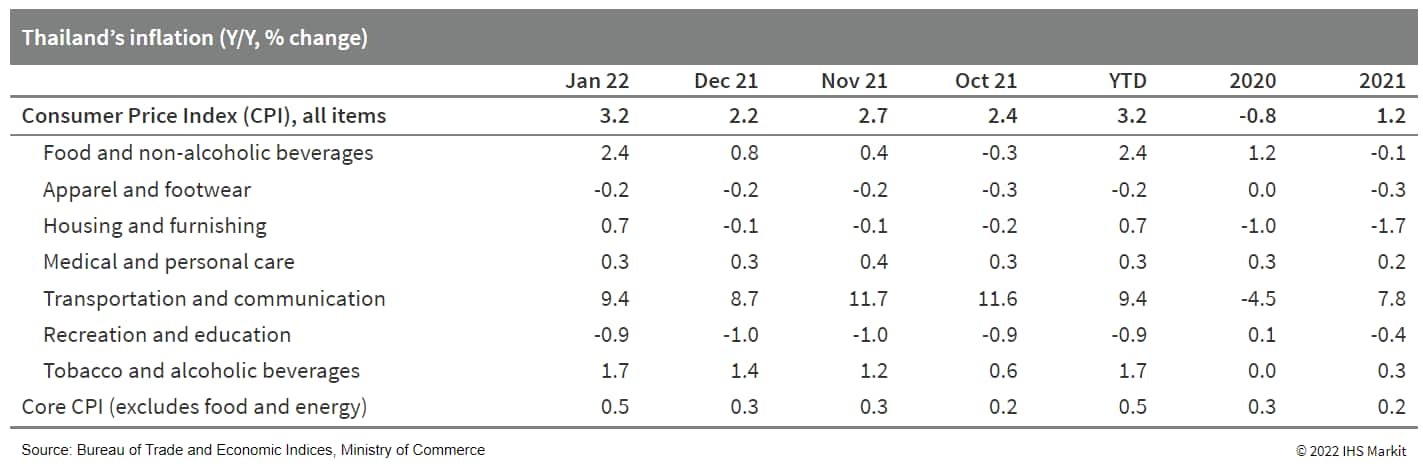

- Thailand's consumer prices kicked off 2022 with a strong year-on-year (y/y) uptick, and a similar trend is expected to follow through at least the first quarter of 2022. (IHS Markit Economist Jola Pasku)

- Thailand's consumer prices jumped by 3.2% y/y in January, the fastest y/y uptick in the latest nine months. Higher fresh food prices and rising global oil prices were the major drivers behind the latest uptick. Core inflation, which excluded volatile food and energy prices, rose by 0.5% y/y.

- Inflationary pressures have started building up since the last quarter of 2021 mainly because of supply side factors. Another major supporting driver was the government's withdrawal of electrical and water subsidies. Despite these factors, the cost pass-through to consumer prices has been limited because of the subdued economic recovery and weak employment and labor income. Annual average inflation settled at 1.2% y/y for 2021.

- A consortium between Saipem, Petrofac, and Samsung has won a USD4.0 billion contract to expand Thai Oil Public Company Limited's (ThaiOil) Sriracha refinery in Chonburi province. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Saipem states its share of the project is worth approximately USD1.4 billion. Its scope includes engineering, procurement, construction, and start-up of new production units, as well as upgrading of some existing ones.

- Petrofac has disclosed its share is also around USD1.4 billion. Its scope covers engineering, procurement, construction, and commissioning services, including improvements and expansion at the existing facility, and adding new complex processing units. Petrofac expects to complete its scope over a period of four years.

- Samsung Engineering's share is estimated to be worth USD1.2 billion.

- The project will ultimately increase the refinery's production capacity from 275,000 bpd to 400,000 bpd. The expansion is part of ThaiOil's Clean Fuel Project (CFP) which aims to produce higher quality transportation fuels. ThaiOil is a subsidiary of the Petroleum Authority of Thailand (PTT), Thailand's national oil an gas company.

- Avass Group, an Australia-based company that offers the manufacturing, research, and development of electric transportation buses, has announced the signing of a memorandum of understanding (MOU) with His Royal Highness Prince Abdulaziz Bin Abdullah Bin Saud of Saudi Arabia to manufacture electric vehicles (EVs) and lithium batteries, reports Green Car Congress. As part of the agreement, Avass Group will mass manufacture full electric buses and lithium batteries in Saudi Arabia. Dr Allen Saylav, group CEO at Avass, said, "At a time when more and more countries are trying to reduce their carbon footprint, it's imperative to boost manufacturing of EVs to meet this goal. Saudi Arabia stands at a central point between Asia and Europe which gives it a strategic location advantage as a production hub." He added, "The agreement will also greatly assist the trade relationship between Saudi Arabia and India and help Avass to provide an integrated solution for batteries, EVs." (IHS Markit AutoIntelligence's Tarun Thakur)

Posted 07 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.