Every major US, European, and APAC equity index closed higher today, with most indices not being in negative territory at any point of the trading day. US government bonds closed sharply lower, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed tighter across IG and high yield. Oil, natural gas, silver, and gold closed higher, while the US dollar and copper were flat on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +3.0%, Russell 2000 +2.3%, S&P 500 +2.1%, and DJIA +1.4%.

- 10yr US govt bonds closed +5bps/1.48% yield and 30yr bonds +14bps/1.81% yield.

- CDX-NAIG closed -2bps/54bps and CDX-NAHY -11bps/306bps.

- DXY US dollar index closed flat/96.37.

- Gold closed +0.3%/$1,785 per troy oz, silver +1.2%/$22.52 per troy oz, and copper flat/$4.34 per pound.

- Crude oil closed +3.7%/$72.05 per barrel and natural gas closed +1.4%/$3.71 per mmbtu.

- On December 7, Equinor announced the opening of its New York offshore wind project office, located in Sunset Park's Industry City neighborhood adjacent to the South Brooklyn Marine Terminal. (IHS Markit PointLogic's Barry Cassell)

- This office will serve as the hub for Equinor and bp's large-scale offshore wind operations in the region, including Empire Wind and Beacon Wind. Together, Empire Wind 1 and 2 and Beacon Wind 1 are poised to provide 3.3 GW to New York. Empire Wind and Beacon Wind are being developed by Equinor and bp through their 50/50 strategic partnership in the US.

- The opening of the project office was attended by officials including Doreen Harris, President and CEO of the New York State Energy Research and Development Authority (NYSERDA), Elizabeth Yeampierre.

- Said Equinor Wind US President, Siri Espedal Kindem, who presided over the ribbon-cutting ceremony: "The office is the cornerstone for our vision of developing an exciting new industry in New York, in the United States, and beyond."

- Harris added: "As New York solidifies its place as the nation's leader in offshore wind, we are pleased to see Equinor affirming its commitment to our state and its workforce. Equinor's investments and partnership are critical vehicles for advancing our climate and clean energy goals, and we look forward to continuing our shared efforts to seize this once in a generation opportunity to truly change the energy system and create thousands of family-sustaining jobs."

- The office will be built out by a local New York contractor and is set to open for day-to-day operations in 2022.

- US productivity (output per hour in the nonfarm business sector) declined at a 5.2% annual rate in the third quarter, revised down 0.2 percentage point. The third-quarter decline more than reversed a 2.4% increase in the second quarter. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Compensation per hour rose at a 3.9% annual rate in the third quarter, revised up 1.0 percentage point. This followed an 8.4% increase in the second quarter that was revised up 4.9 percentage points. Growth in compensation per hour has been elevated, on average, during the pandemic: since the fourth quarter of 2019, compensation per hour has risen at a 6.8% annual rate. Employment in lower-wage sectors has declined relative to employment in higher-wage sectors. Wage gains have increased in some lower-wage sectors.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs then slowed on average after the initial surge but quickened over the second and third quarters of 2021. Over the last two quarters, unit labor costs rose at an average annual rate of 7.7%, comprising rapid growth in compensation per hour (6.2%) alongside falling productivity (-1.5%). Upward revisions to unit labor costs in the second and third quarters were largely accounted for by revisions to compensation.

- Hours rose at a 7.4% rate in the third quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last five quarters, hours have risen 15.8% (not annualized), leaving them just 1.0% below the fourth-quarter 2019 level.

- US real goods exports grew 9.5% in October (11.0% nominal), with solid gains across the board; petroleum exports were up 14.8%, while nonpetroleum exports gained 8.8%; nominal goods exports to 14 of 16 markets listed in the trade report were up, with mainland China and Canada accounting for 39% of the increase in goods exports. The increase appears sustainable and related to stronger global growth—still, we are expecting some payback numbers in November. (IHS Markit Economist Patrick Newport)

- Real goods imports were about unchanged, remaining 9% above their pre-pandemic level; capital goods and consumer goods imports stand 15% and 20% above their last pre-pandemic reading—December 2019—hence, are still adding to port congestion.

- The services surplus edged up by $0.3 billion to $16.8 billion in October. Exports and imports of services stand 11% and 3% below their pre-pandemic level; excluding travel, exports and imports of services are 5% and 9% above their pre-pandemic level.

- Outstanding US nonmortgage consumer credit rose $16.9 billion to $4.38 trillion in October, very close to the average monthly $19.0 billion gain in the third quarter. (IHS Markit Economist Mike Montgomery)

- The 12-month change in outstanding consumer credit was 5.2%, continuing to show slow acceleration.

- Revolving credit rose $6.6 billion, much slower than June's $17.7 billion; revolving credit has risen 4.0% over the past 12 months, far below the 12.0% rise in personal consumption expenditures or the 6.2% rise in the CPI.

- The ratio of nonmortgage consumer credit to disposable personal income was 24.2%, but erratic stimulus measures make single-month ratios of little use. Still, ratios remain about a percentage point below pre-pandemic levels.

- Consumers have not taken to running up debt after using stimulus checks last year to reduce it. A portion of that restraint is an artifact of weak new vehicle sales due to supply constraints.

- A coalition of health and consumer groups—including the Environmental Defense Fund (EDF), the Center for Science in the Public Interest (CSPI) and the Center for Food Safety (CFS)—has sued FDA for failing to respond to a 2016 petition asking the agency to ban the use of certain ortho-phthalates in food packaging and food processing materials. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- Filed Tuesday (December 7) in the US District Court for the District of Columbia, the lawsuit alleged that by failing to respond to the petition FDA is ignoring a "robust" scientific evidence that links exposure to phthalates to serious health risks, including birth defects, infertility, miscarriage, and developmental damage.

- Noting that the petition to ban the substances was filed more than five and a half years ago, the plaintiffs argued the agency's "unreasonable delay" has put the health of Americans at risk and asked the court to force FDA to respond to the 2016 request within 60 days.

- "[E]vidence of phthalates' harmful effects on human health led Congress and the Consumer Product Safety Commission to ban eight of the phthalates addressed by the Food Safety Groups' petition from use in toys and childcare articles. Yet these chemicals remain FDA-approved for use in food packaging and processing materials from which they can leach into food and drinks," plaintiffs wrote in the complaint.

- Moreover, because the presence of phthalates is not disclosed on food labels or restaurant menus, "plaintiffs' members are left to guess based on incomplete information which foods may contain phthalates and the extent of phthalate contamination in various foods," the complaint stated.

- "The FDA had an obligation under the law to make a final decision on these petitions in 2018 at the latest," said Tom Neltner, chemicals policy director at EDF. "Every phthalate that has been studied for health effects has been found to pose a health risk. It's past time for the FDA to act on all phthalates as a class of chemicals that do not belong in our food."

- Other plaintiffs in the suit are the Learning Disabilities Association of America, the Center for Environmental Health (CEH), Breast Cancer Prevention Partners, Defend Our Health and Alaska Community Action on Toxics. All plaintiffs are represented by Earthjustice.

- Tesla CEO Elon Musk has stated on Twitter that the electric vehicle (EV) maker is changing the specifications of the upcoming Cybertruck to include a version with four motors and four-wheel steering, media reports state. According to a Motor Authority report, Musk's tweet said, "Initial production [of the Cybertruck] will be 4 motor variant, with independent, ultra fast response torque control of each wheel." Musk wrote the post in response to a post by another Twitter user, which said, "Rumor has it that the Cybertruck is no longer configurable on the Tesla site because they're debating getting rid of the single motor version and having only 2, 3, and 4 motor variants." Tesla has delayed the introduction of the Cybertruck until late 2022, partly because of the semiconductor shortage. However, it is also due to Tesla's decision not to begin production of the Cybertruck at the company's all-new Texas plant until after production of the Model Y is up and running at volume. The plant is due to be completed by the end of 2021. However, the change regarding the Cybertruck over whether to launch it with one motor or more could be interpreted as a response to the specifications of the just-launched Rivian R1T and GMC Hummer EV, both of which have multiple motors. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Intel has announced its plans to take its autonomous vehicle (AV) unit Mobileye public in the United States in mid-2022, according to a company statement. Intel said that it will remain the majority owner after the transaction, which involves an initial public offering (IPO) of newly issued Mobileye stock. Mobileye CEO Amnon Shashua will continue to lead the same executive team. Intel also said that it has no intention to divest or spin off its majority ownership in Mobileye, adding that both the companies will continue collaborating on projects to further their interests in the automotive tech market. Shashua said, "Our alignment with Intel continues to provide Mobileye with valuable technical resources and support that has yielded strong revenue along with free cash flow that allows us to fund our AV development work from current revenue. Intel and Mobileye's ongoing technology co-development will continue to deliver great platform solutions for our customers." Mobileye was acquired by Intel in 2017 for USD15 billion. It is making rapid advancements in developing cameras and a custom-made processor chip to support automated vehicle operations. Mobileye recently shipped its 100 millionth EyeQ system-on-chip and expects to deliver over 40% more revenue in 2021 compared with 2020. It has revealed its electric AV, which will be deployed for commercial ride-hailing services (see Israel-Germany: 8 September 2021: IAA Mobility 2021: Mobileye unveils autonomous vehicle for commercial ride-hailing service, partners with Sixt). The company launched its first autonomous test fleet in Jerusalem (Israel) in 2018 and has now scaled it up to multiple cities around the world covering the US, Europe, and Asia. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota has announced the site selection for its first battery plant in the United States. The automaker says the plant is due on line in 2025 in the US state of North Carolina. Toyota says the factory will have the capacity to produce enough battery packs for 1.2 million electrified vehicles per year. Toyota says it is investing USD1.29 billion in the Toyota Battery Manufacturing North Carolina (TBMNC) facility, which will have four production lines, with each line capable of producing enough lithium-ion batteries for 200,000 vehicles. Toyota also states that it intends to expand the facility to at least six production lines, although it has not disclosed when it plans that expansion. The investment in the facility is being made by Toyota Motor North America (TMNA) and Toyota Tsusho, with part of the funding to come from the USD3.4 billion that TMNA announced for its US battery production in October. The company states it expects to create 1,750 jobs at the plant. In a company statement, Toyota said it selected the North Carolina site based on several criteria. Among these were that the site is near an extensive and well-maintained highway system for overland logistics and four international and two seaports are nearby. In addition, the company said there is onsite rail and renewable energy availability, the area has a diverse workforce, and there is a "strong government partnership" at state and local level. Toyota aims to use 100% renewable energy at the site. The Wall Street Journal reports that the government partnership includes a USD435-million, 20-year incentive package if the project meets certain investment benchmarks. In addition, the Journal reports sources as indicating that jobs at the plant will have wages of approximately USD62,000 per year, on average. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US states dominate the list of the most attractive jurisdictions for North America oil and gas producers, according to Canadian economic think tank Fraser Institute. (IHS Markit PointLogic's Kevin Adler)

- "According to this year's survey, Texas is the most attractive jurisdiction for oil and gas investment followed by Oklahoma (2nd) and Wyoming (3rd). Seven other US jurisdictions also ranked in the top 10 this year: North Dakota (4th), Kansas (5th), Mississippi (6th), Utah (7th), Montana (8th), Pennsylvania (9th), and Louisiana (10th)," Fraser Institute said in releasing its annual survey in November.

- The highest-ranking Canadian province was Saskatchewan at No. 11, followed by Alberta in the 12th position, Newfoundland & Labrador (16th), British Columbia (18th), and the Northwest Territories (20th).

- The 71 investors who responded to the survey pointed to costly, changing regulatory factors as "a defining issue hampering Canada's energy competitiveness," Fraser Institute said. "This year's respondents pointed to the uncertainty concerning environmental regulations, regulatory duplication and inconsistencies, and the cost of regulatory compliance as key areas of concern in Canada compared to the United States."

- On average, 76% of respondents for Canada are deterred by environmental regulations, compared to 49% for the US.

- Canada's purchasing managers' spending growth slightly accelerated in November compared with the previous month. The supplier deliveries time marginally improved, but it remained at a historically low level, indicating that there has not been much relief in terms of intense supply chain disruptions. The employment index declined for a third consecutive month to the lowest level since the beginning of 2021, indicating a slower pace of job growth, which defied November's robust Labour Force Survey's 153,700 increase in net employment. Posting the biggest monthly drop since May 2017, the prices index, which shows strong inflation pressures, may be signaling that October was an inflation peak. (IHS Markit Economist Chul-Woo Hong)

- The Ivey Purchasing Managers' Index (PMI) increased 1.9 points to 61.2.

- The supplier deliveries index inched up 2.1 points while the inventories index was unchanged.

- The employment index and prices index fell sharply, down 7.5 and 9.6 points, respectively.

- Regional purchasing managers' spending will be affected by the damaged highways and rail lines from British Columbia's severe flooding, which will contribute to ongoing supply chain challenges in the short term.

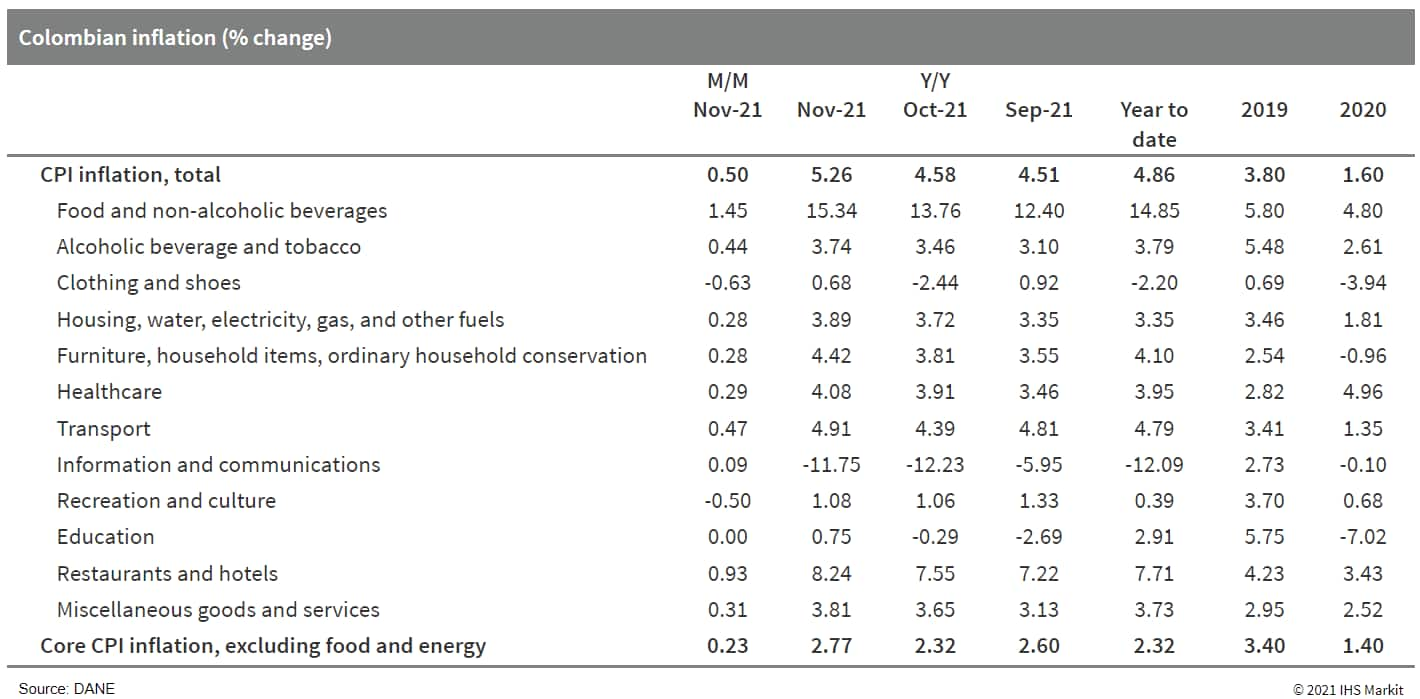

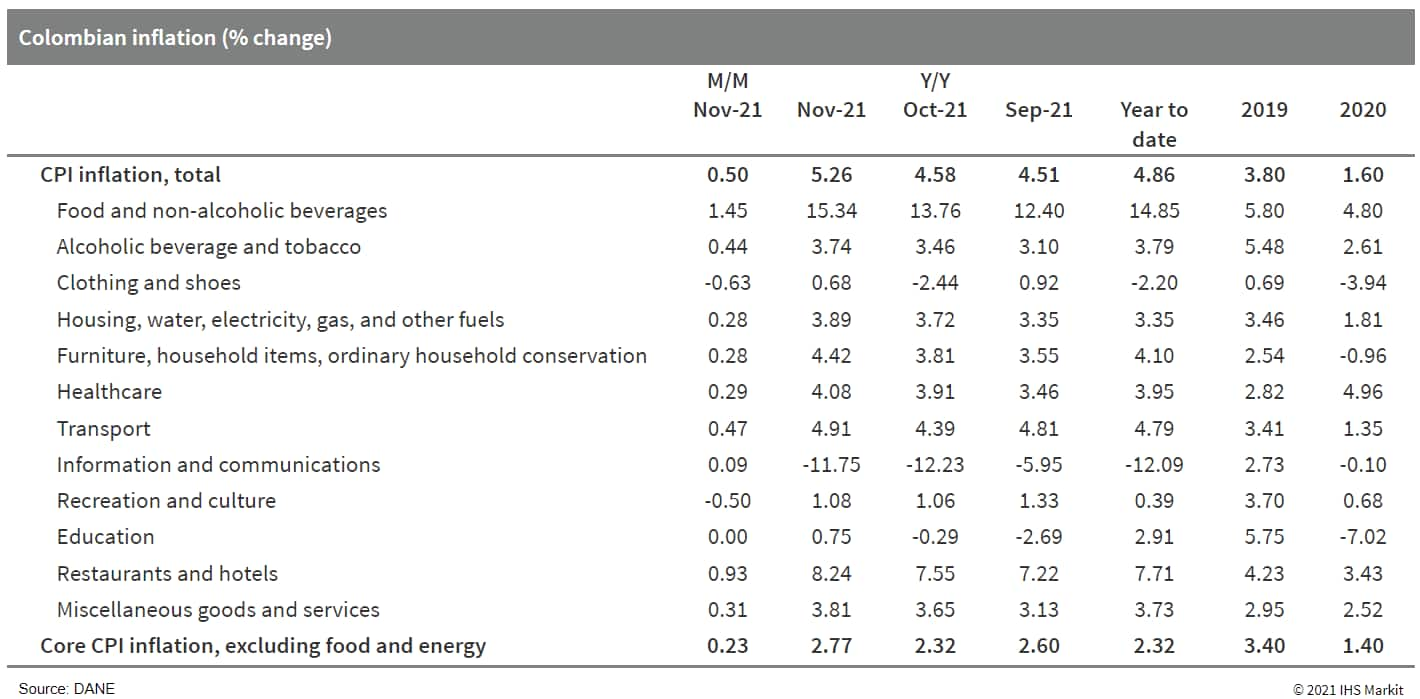

- According to the National Administrative Department of Statistics (DANE), Colombia's inflation rose from 4.58% year on year (y/y) in October to 5.26% y/y in November, taking the year-to-date inflation rate to 4.86%. November's results were above our expectations (4.89%) and marked the highest inflation rate since January 2017. Meanwhile, core inflation, as measured by the Consumer Price Index (CPI) that excludes food and energy prices, increased from 2.32% y/y in October to 2.77% y/y, accelerating by 0.45 percentage points. (IHS Markit Economist Dariana Tani)

- In m/m terms, the CPI rose by 0.5% m/m in November, following an increase of just 0.01% m/m in the previous month as a value-added tax (VAT)-free day provided temporary relief to Colombia's consumer prices in October. This was the fifth month in a row that the index has posted a monthly increase, and it was slightly above our own forecast for November (0.39%), although much higher than the Central Bank of Colombia (Banco de la República: Banrep)'s monthly survey of economic analyst expectations of 0.21%.

- The breakdown of the monthly data showed that food and non-alcoholic beverages and restaurants and hotels once again registered the largest price increases, followed by transport and alcoholic beverage and tobacco, reflecting higher global food and energy prices and the continued effects of the economic reopening. On the other hand, clothing and shoes categories posted another decline, benefiting mainly from the second no-VAT day that took place during November.

Europe/Middle East/Africa

- All major European equity indices closed higher; France +2.9%, Germany +2.8%, Italy +2.4%, UK +1.5%, and Spain +1.4%.

- 10yr European govt bonds closed mixed; France/Spain/UK flat, Germany +1bp, US +2bps, and Italy +3bps.

- iTraxx-Europe closed -3bps/54bps and iTraxx-Xover -16bps/264bps.

- Brent crude closed +3.2%/$75.44 per barrel.

- The UK essential oil and flavor processor Treatt has reported that its revenues have risen by 14% y/y to £123.4 million ($161.0 million) in the FY2021 (October-September) thanks to purchases from the global beverage industry in the US, the EU, the UK and China. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Operating profit rose by 43% y/y to £20 million.

- Citrus oils were the driver of growth, accounting for 44% of the total revenues. Other important product categories were tea (11%), health & wellness (8%), fruit & vegetables (10%), herbs and spices (9%) and synthetic aroma (18%).

- The company has reached its potential production in the US after completing its second factory in Florida in 2019. Currently, it is developing a new plant in the UK, which will be developed between 2022-2023.

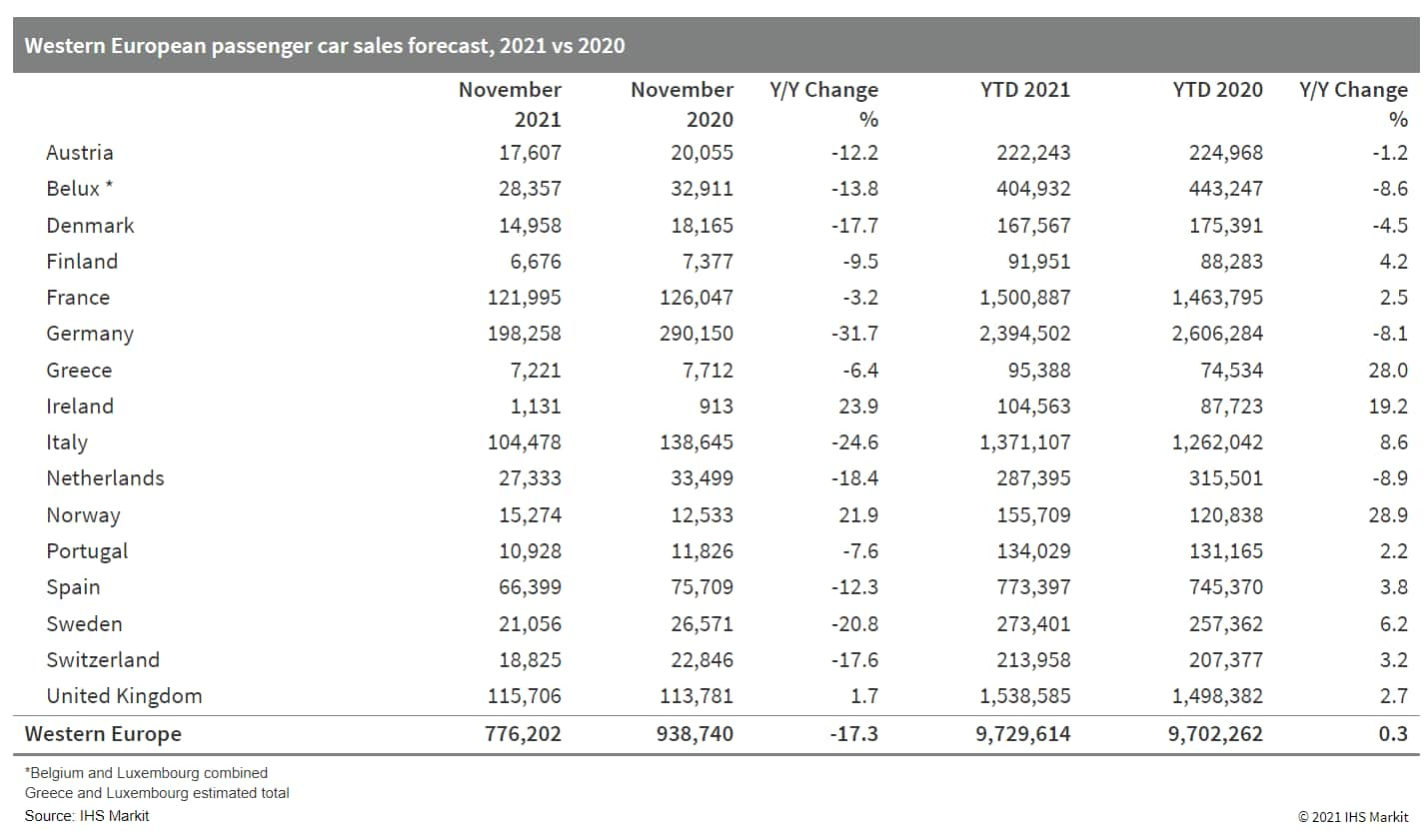

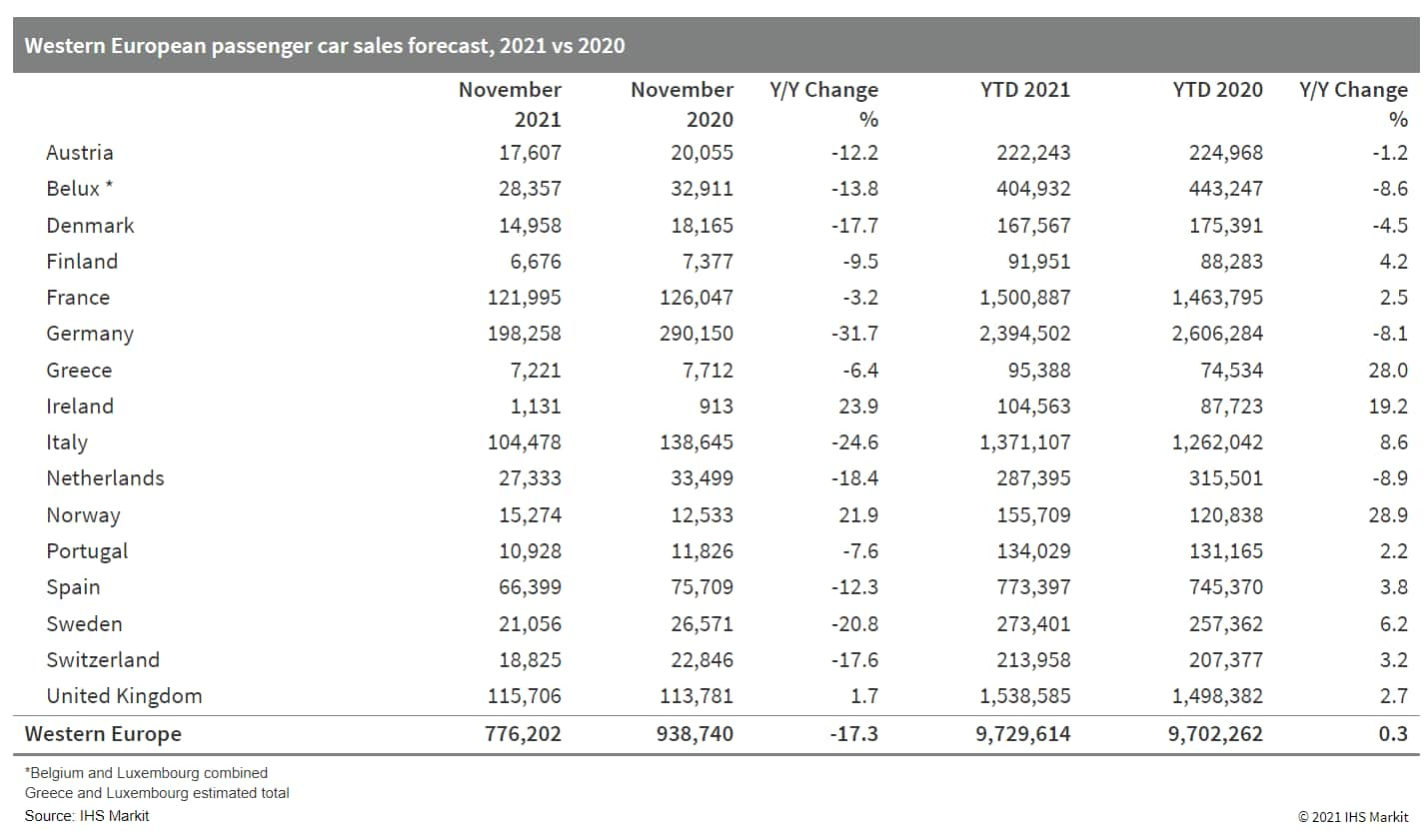

- Western European passenger car registrations have retreated again during November. According to IHS Markit's latest forecast, registrations in the region dropped by 17.3% year on year (y/y) to 776,202 units. Nevertheless, substantial earlier gains due to the low base caused by coronavirus disease 2019 (COVID-19) virus pandemic measures during the first half of 2020 have helped to keep volumes just about in positive territory in the year to date (YTD). For the first 11 months of 2021, registrations are up 0.3% y/y at around 9.7230 million units. The fall this month was despite an already low base of comparison as some markets in the region reintroduced COVID-19-related restrictions during the final quarter of 2020. The drag was caused by a shortage of vehicles as OEMs and suppliers have struggled to source enough semiconductors. IHS Markit currently expects 2021 volumes to be below 2020's, but there should be some improvement in 2022. (IHS Markit AutoIntelligence's Ian Fletcher)

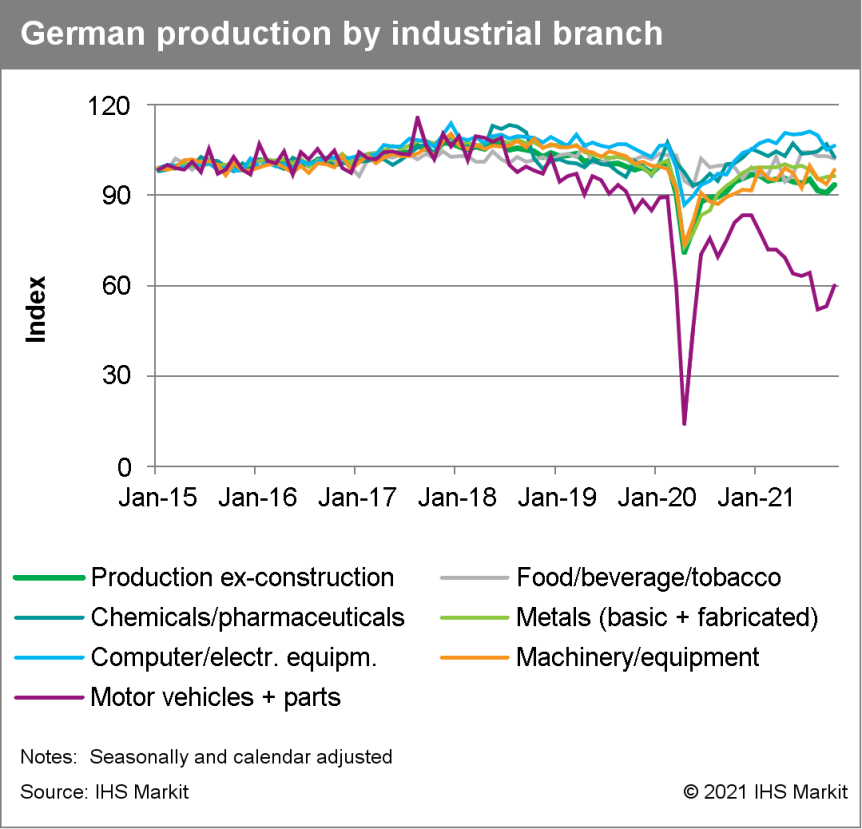

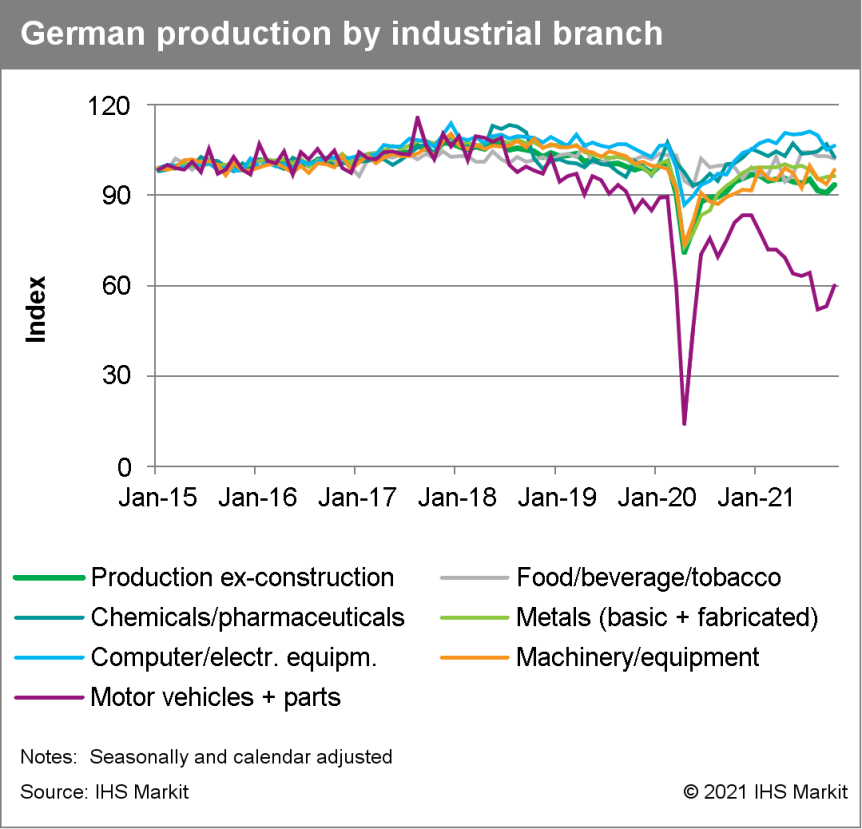

- Seasonally and calendar-adjusted German industrial production excluding construction unexpectedly rebounded by a large 3.0% month on month (m/m) in October, recouping much of the combined -4.6% setback during August-September. Nevertheless, the latest output level remains almost 8% below its February 2020 pre-pandemic high. (IHS Markit Economist Timo Klein)

- Total production including construction posted a slightly lower 2.8% m/m in October, as construction output only increased by 1.2% m/m. The latter had performed much better than the production excluding construction measure in September, however (2.2% vs -1.0% m/m), as generally has been the case since mid-2018 and especially during the pandemic. Meanwhile, energy output continued to increase at 0.9% in October, following a cumulative rebound of 7.4% already during August-September that had recouped a decline of roughly the same size in May-July.

- The split by type of goods reveals that investment goods output rebounded sharply, largely unwinding its August-September declines, whereas production of intermediate and consumer goods broadly stagnated. In the case of intermediate goods, this represents stabilization after a four-month decline, whereas consumer goods production has been levelling off since August already. The loosening of COVID-19 restrictions since May thus provided for a recovery around mid-2021 that only lasted for about three months.

- The October breakdown by industrial branch reveals even greater divergences. Motor vehicle production, which had suffered a huge drop in August (-18.9% m/m) before stabilizing in September (2.1%), bounced back sharply by 12.6% m/m in October. This remains about one-third below the pre-pandemic level, however, as a shortage of semiconductors continues to restrain achievable output. October production was also boosted by the machinery and equipment (5.0% m/m) and electronics and electric equipment sectors (1.2%), both of which had been particularly weak during August-September. In contrast, the chemicals/pharmaceuticals sector, which had outperformed industry as a whole during August-September, suffered a setback of -3.9% m/m in October.

- Meanwhile, manufacturing orders have shown a very different and even more volatile pattern in recent months. October's renewed plunge of -6.9% m/m follows September's stabilization (1.8%) after an even larger fall of -8.8% m/m in August. In turn, much of this needs to be seen as a correction to a combined June-July increase of nearly 10%, with the net result being that both orders and production were roughly 1% below their respective year-ago levels in October.

- Greece's GDP rose by 2.7% quarter on quarter (q/q) during the third quarter of 2021, according to seasonally adjusted figures. Its GDP is now estimated to have risen by 2.1% q/q during the second quarter (revised down from 3.4% q/q). The statistical office has also made substantial revisions to historical data alongside the publication of the third quarter. Real GDP is now estimated to have declined by 8.8% in 2020, as opposed to 7.8%. (IHS Markit Economist Diego Iscaro)

- On a year-on-year (y/y) basis, real GDP grew by 13.4% during the third quarter. GDP is now 1.2% above its pre-pandemic level.

- The quarterly increase in activity during the third quarter was driven by a sharp rise in exports (+12.6% q/q). While exports of goods rose by 1.4% q/q, tourism led to a 29% q/q increase in exports of services (-13.3% q/q during the second quarter).

- Imports of goods and services rose by a softer 7.3% q/q during the third quarter.

- Investment spending also grew by 3.9% q/q, following a rise of 4.7% q/q. Investment in dwellings (+23.3% q/q) was particularly strong during the third quarter, while investment in transport equipment (+14.1% q/q) and 'other machinery' (+7.1% q/q) was also robust.

- Private consumption rose for a fifth consecutive quarter, although its growth decelerated from 1.8% q/q in the second quarter to 1.1% q/q.

- Uber Technologies is reportedly in talks with the management of its Middle East unit Careem to raise capital from outside investors into the business. The proceeds will support Careem in rolling out its Super App, which offers services other than its core ride-hailing business, reports Reuters. Careem was established in 2012 and operates in more than 100 cities in 13 countries in the Middle East, North Africa, and South Asia. In 2019, Uber acquired Careem for USD3.1 billion (see United States-United Arab Emirates: 26 March 2019: Uber confirms buying Middle Eastern rival Careem for USD3.1 bil.) This was ahead of Uber's initial public offering (IPO) in the same year that raised USD8.1 billion from investors and valued the company at USD82.4 billion. In 2020, Careem launched a "Super App" to bring all of its offerings into one place so that users can gain access to services such as ride hailing, bike rentals, food delivery, item delivery, and the delivery of goods from local shops and pharmacies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

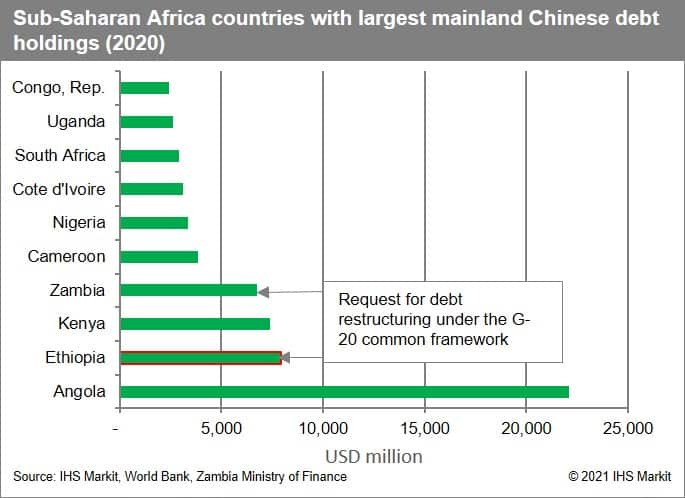

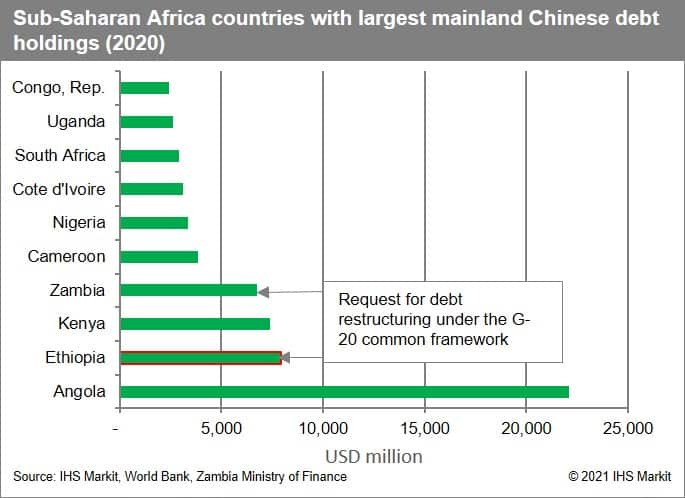

- The triennial Forum on China-Africa Cooperation (FOCAC) took place in Dakar, Senegal, on 29-30 November. At the summit, China pledged to facilitate USD40 billion in overall funding and investment for African countries over the next three years. (IHS Markit Country Risk's William Farmer, David Li, Nezo Sobekwa, and Chris Suckling)

- The Chinese government pledges do not represent direct state investment and instead prioritize channels involving the International Monetary Fund (IMF), the African Development Bank (AfDB), and private Chinese firms. None of the total USD40 billion pledged is projected to take the form of direct government investment. Rather, USD10 billion each is to be provided through trade financing, credit to African official institutions, and the reallocation of part of China's Special Drawing Rights (SDRs) allocation of SDR29.22 billion from the IMF in August 2021, with the remainder to come from private Chinese investment into Africa. As yet, there has been no announcement on how the commitment from China's SDR new allocation is to be distributed among the African continent's 55 states.

- The reduction in China's financial pledges versus 2018, and their narrower scope, indicate increased caution in committing financial resources to African development. China reduced its three-year pledge to USD40 billion in 2021, from a headline USD60 billion between 2018 and 2021, and narrowed its scope (we have not identified an official statement on the actual amount previously disbursed). The absence of large-scale infrastructure projects and the reduction in development finance pledges were expected, aligning with indications given by Chinese policymakers prior to the FOCAC ministerial meeting.

- Private-sector development has replaced infrastructure investment as the cornerstone of China's African strategy. Half of China's USD40-billion pledge is designated as trade credit for African exports or to encourage Chinese companies to invest in Africa. This approach is a clear move away from the prior focus on large projects carried out by Chinese state-owned enterprises in areas such as power generation and transport infrastructure, generally without a BOT or PPP contract. Areas of focus now include agriculture, the digital economy, and healthcare, including the provision of Chinese-made vaccines. For the first time, China and African countries jointly signed the Declaration on Climate Change Cooperation, highlighting Chinese support for environmental initiatives, biodiversity protection, and climate-sensitive development in the region.

Asia-Pacific

- All major APAC equity indices closed higher; Hong Kong +2.7%, Japan +1.9%, India +1.6%, Australia +1.0%, South Korea +0.6%, and Mainland China +0.2%.

- GAC Group (GAC) has announced the restructuring of GAC AION, its wholly owned subsidiary that focuses on electric vehicle (EV) production. The internal restructuring will pave the way for GAC AION to make full use of the capital market and actively seek listing at an opportune time. GAC AION will take over research and development (R&D) personnel in the field of EVs from the group's research arm, Guangzhou Automobile Group Company Automotive Engineering Institute (GAEI), and implement internal asset restructuring by way of capital injection and asset injection. Specifically, GAC will inject capital of CNY7.407 billion (USD1,16 billion) into GAC AION in cash. GAC Motor Company (GAMC), GAC's passenger car subsidiary, will inject capital into GAC AION in the form of production equipment and other tangible assets amounting to CNY3.557 billion in value; and GAC AION will purchase intangible assets and fixed assets related to the field of EVs from GAEI, GAMC and other entities by paying CNY4.975 billion in cash and assuming liabilities. After the above internal asset restructuring, GAC AION's registered capital will be increased to CNY6 billion, and it will have greater R&D capabilities, and a more complete business and asset structure focusing on EVs. GAC will still hold 100% shareholding in GAC AION after the transaction. The implementation of the transaction has no significant impact on the company's operating results for this year, according to GAC. Subsequently, GAC AION will promote employee stock ownership and the introduction of strategic investors. The internal restructuring is GAC's latest move to build up the AION brand as its leading brand in the EV market. The automaker separated AION from its Chuanqi vehicle series last November, to help AION build its own brand identity and sales network (see China: 24 November 2020: GAC launches AION as standalone EV brand). Since the spin-off, the AION brand has been under the management of GAC AION, which was previously known as GAC New Energy (GAC NE). GAC said that since the launch of the AION brand in 2019, GAC has mainly been represented by the AION brand in the EV market; it already has four models on sale. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Pony.ai has started testing its Level 4 autonomous trucks on open highways in China, reports Gasgoo. Its autonomous truck business brand dedicated for the logistics market, PonyTron, has started testing Level 4 autonomous functions on busy highways and expressways. PonyTron trucks are deployed with two LiDARs, millimeter-wave radars, high-precision cameras, and high-accuracy locating systems, supporting them in achieving a 360-degree perception without blind spots. Pony.ai is conducting autonomous car tests on public roads in five Chinese cities as well as the United States, with the combined mileage totaling 5 million km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Teras Offshore (TOPL), Ezion Holding's wholly-owned subsidiary informed that the wind turbine transportation and installation (T&I) contract for Taiwan Power Company's (Taipower) 300 MW Changhua Phase 2 offshore wind farm (OWF) in Taiwan, has been terminated by Foxwell Energy, a subsidiary of Shinfox Energy. TOPL is presently exploring its legal options to seek legal action, if required, in relation to the unilateral termination. TOPL's T&I contract work scope comprises the installation of 31 wind turbines due to start in September 2024 for a year. In addition, TOPL's appointment as the Foundation Scope Contractor with Foxwell Energy for the OWF, has been simultaneously affected. Therefore, TOPL signed the turbine T&I contract for the OWF with Foxwell Energy in December 2020 but however was unsuccessful to meet one of the conditions that TOPL has to cater its externally audited financial statement to Foxwell Energy within 90 days from 30 Jun 2021 or as of any later date to be mutually agreed between the two parties, in order to show TOPL is in a positive net asset. The Taipower's 300 MW Changhua Phase 2 OWF features 31 units of 9.5 MW wind turbines and an offshore substation, is anticipated to be grid-connected by the end of September 2025. (IHS Markit Upstream Costs and Technology's Lopamudra De)

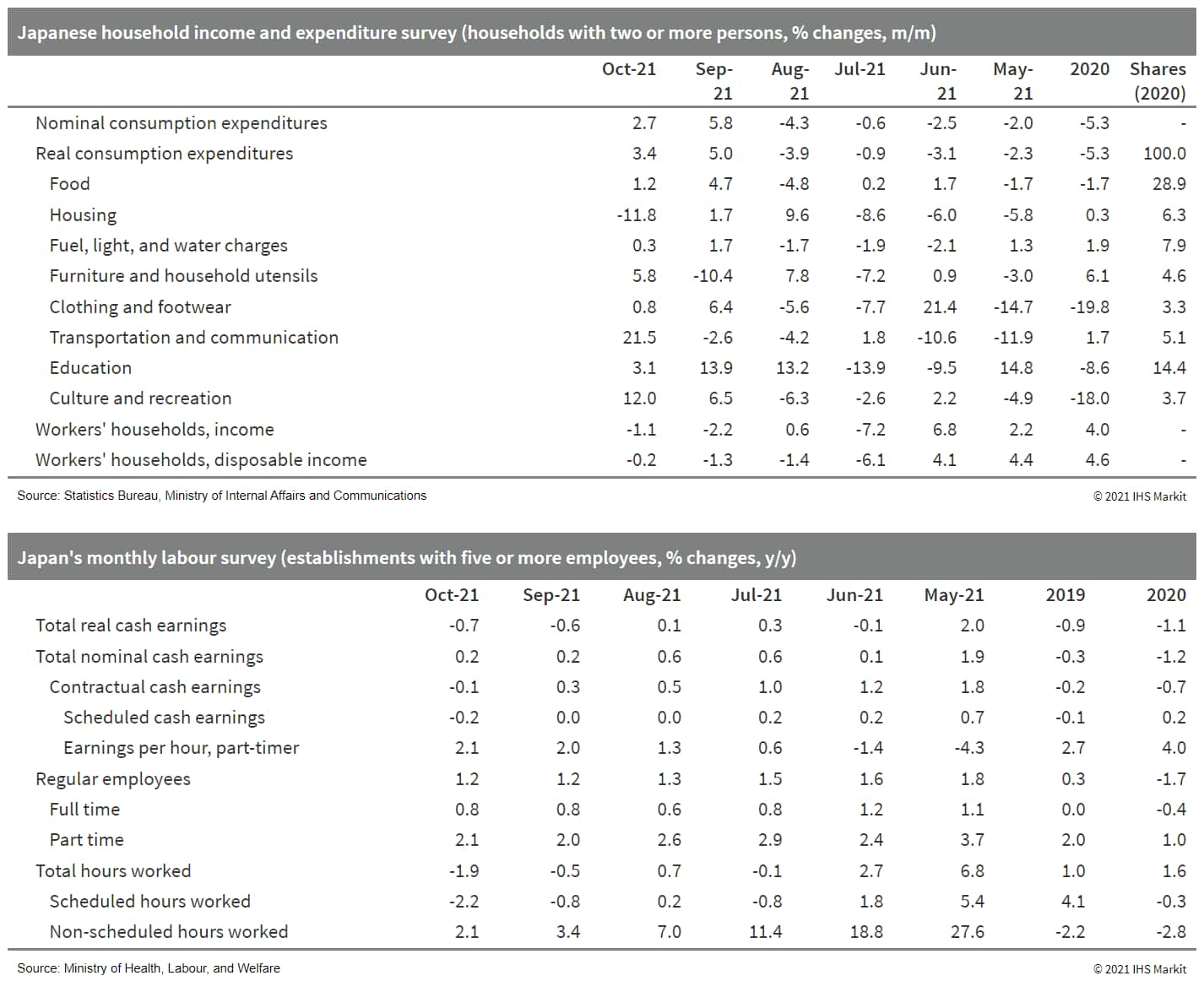

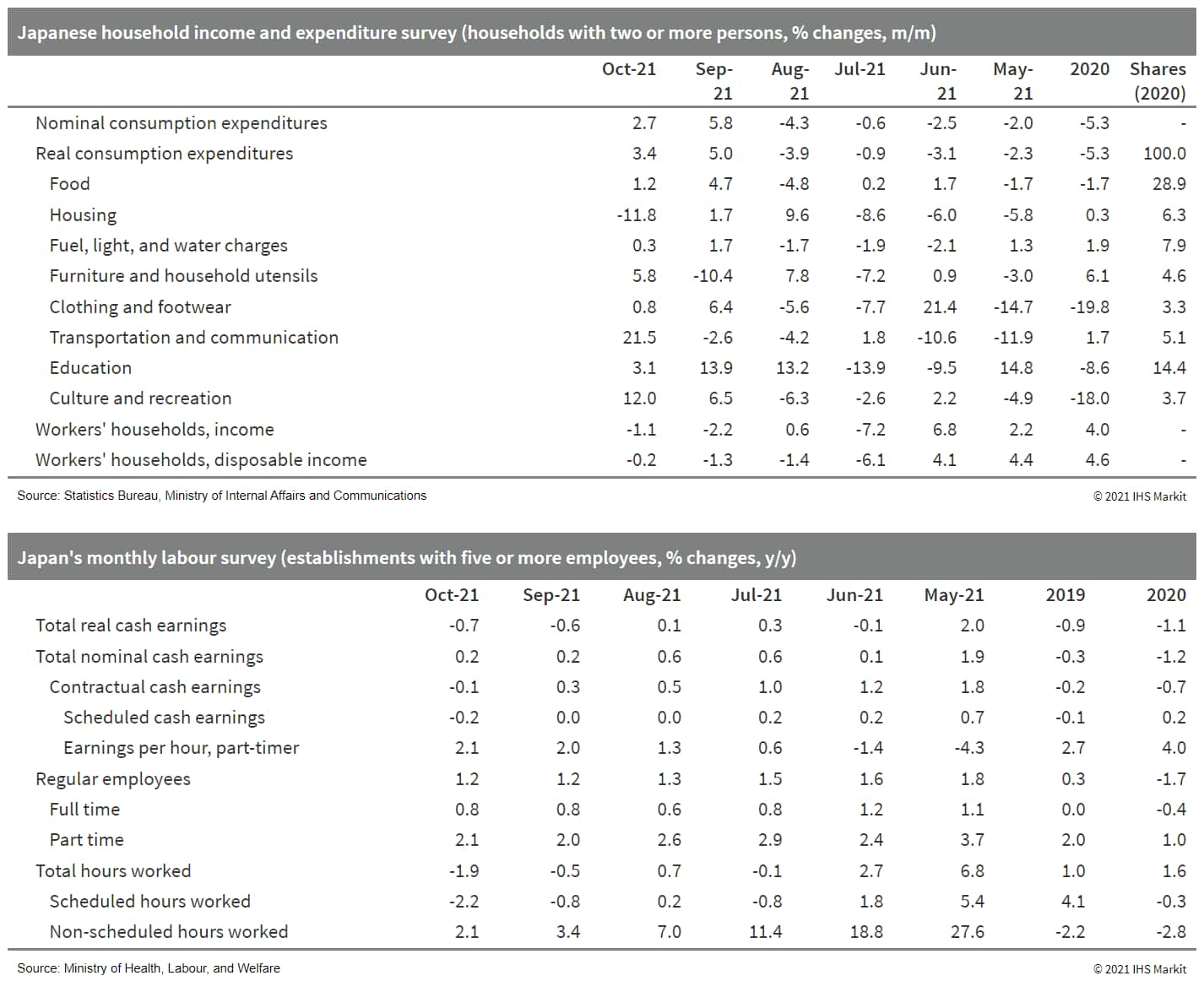

- Japan's real household expenditure increased by 3.4% month on month (m/m) in October following a 5.8% rise in the previous month, but the year-on-year (y/y) figure continued to fall, decreasing by 0.6%. (IHS Markit Economist Harumi Taguchi)

- The continued month-on-month improvement largely reflected solid increases in spending on transportation and communication and culture and recreation; this is as a result of increased mobility caused by the easing of COVID-19-related containment measures. Improvements in auto supply led to a rise in auto purchases. However, the increases were partially offset by weaker spending in housing and medical care.

- According to the monthly labor survey for October, year-on-year growth for nominal cash earnings remained at 0.2%, but real cash earnings fell by 0.7% y/y following a 0.6% y/y decline in September. The year-on-year rise was caused by fast increases in special and non-scheduled earnings. The rise was largely offset by weak scheduled cash earnings (down by 0.2% y/y), mainly because of declines in part-timers' cash earnings as a result of fewer workdays.

- Toyota Motor has announced that it is happy to accept scratched or disfigured parts from suppliers in a bid to cut down costs amid rising material costs and production cuts due to the global chip shortage, reports Reuters. Toyota's chief project leader for vehicle development, Takefumi Shiga, said, "We are careful about the outside of our vehicles, the parts you can easily see. But there are plenty of places that people don't notice unless they really take a good look." As per the report, Shiga along with other Toyota engineers are expanding a program that began in 2019 to meet component suppliers to assure them that scratches or blemishes are acceptable as long as they do not affect vehicle safety and performance, and are unlikely to be noticed by car buyers. The move is a good strategy especially for parts such as brackets and other panels that are used in the exterior, which are hidden and are not categorized as safety critical parts. However, this may have a negative impact on the brand perception of Toyota, which is known for quality products. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tata Motors has announced in a filing to the Bombay Stock Exchange (BSE) that it will hike the prices of its commercial vehicle (CV) range from January 2022 by around 2.5%. The automaker said, "The increase in the prices of commodities such as steel, aluminum and other precious metals, in addition to higher costs of other raw materials has incited this price hike commercial vehicles. While the company is absorbing a significant portion of the increased costs at various levels of manufacturing, the steep rise in overall input costs makes it imperative to pass on some residual proportion via a minimal price hike." The price hike will affect all segments, including medium and heavy commercial vehicles (MHCVs), intermediate and light commercial vehicles (I&LCVs), small commercial vehicles (SCVs), and buses, but will vary depending on model and variant. The automaker is also mulling to increase the price of its passenger vehicles owing to rising input costs. (IHS Markit AutoIntelligence's Isha Sharma)

- Ho Chi Minh City's Department of Transport plans to pilot five electric bus routes in the first quarter of 2022 to connect residential areas and diversify public transport, reports The Saigon Times Daily. The pilot is expected to be conducted in two years and the city will provide a subsidy of 44% for the operator of these bus routes. The five routes will connect the Vinhome Grand Park Urban Area in Thu Duc City to the Emart trade center in Go Vap District, the Tan Son Nhat International Airport in Tan Binh District, the Saigon bus station in District 1, the new Mien Dong Coach Station in Thu Duc City, and the Vietnam National University HCMC urban area in Thu Duc City. From 5 AM to 9 PM, 77 buses will run on these routes. Tickets will cost VND3,000 (USD0.13) per student, while other commuters' tickets will cost VND5,000-7,000 each, with monthly tickets costing VND112,500-157,500. In addition, the investor of the five electric bus routes, Vinbus Ecology Transport Services LLC, will build nine more bus stations, a car park of approximately 12,200 square meters in the Vinhome Grand Park Urban Area, and charging stations. VinBus was established by Vingroup, VinFast's parent company, in 2019 with registered capital of VND1 trillion. (IHS Markit AutoIntelligence's Jamal Amir)

- Australia's Woodside Energy has proposed its first overseas clean hydrogen plant as the natural gas producer seeks to add low-carbon products to its business mix. Woodside, which expects a hydrogen business to play a major role in its path to net zero, announced 7 December its third project in the space this quarter to underscore its decarbonization ambitions. (IHS Markit Net-Zero Business Daily's Max Lin)

- The ASX-listed company said it had secured a lease and purchase option for 38 hectares of vacant land to develop the H2OK facility at the Westport Industrial Park in Ardmore, Oklahoma, targeting the heavy transportation sector.

- Initially, the plant will produce up to 90 metric tons (mt) of hydrogen per day based on a 290-MW electrolysis capacity. Woodside said the location allows the plant to expand its production to 180 mt per day with a 550-MW electrolysis capacity.

- "H2OK would be located in a highly prospective part of the US market, close to national highways and the supply chain infrastructure of major companies that have signaled their interest in securing reliable, affordable, and lower carbon energy," she added.

- Woodside plans to source power for the project from Oklahoma's existing grid, a large portion of which is wind powered, and acquire Renewable Energy Certificates to abate any remaining emissions.

- Wind power accounted for more than one-third of the state's net electricity generation of 82.3 million TWh in 2020, according to the US Energy Information Administration. Overall, 40% of Oklahoma's electricity came from renewable sources last year.

- Woodside has completed the preliminary design for the modular, scalable production facility for H2OK and may issue tenders for front-end engineering design before the end of this year. The project is due for a final investment decision (FID) in the second half of 2022 and would begin production in 2025.

- The facility will aim to meet hydrogen demand from heavy-duty trucks and equipment, warehouse forklifts, ground-handling equipment, and fuel-cell microgrids for warehouses and data centers, according to Woodside.

Posted 07 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.